Time for a retrospective on how the various surveys are doing on forecasting year-on-year CPI inflation.

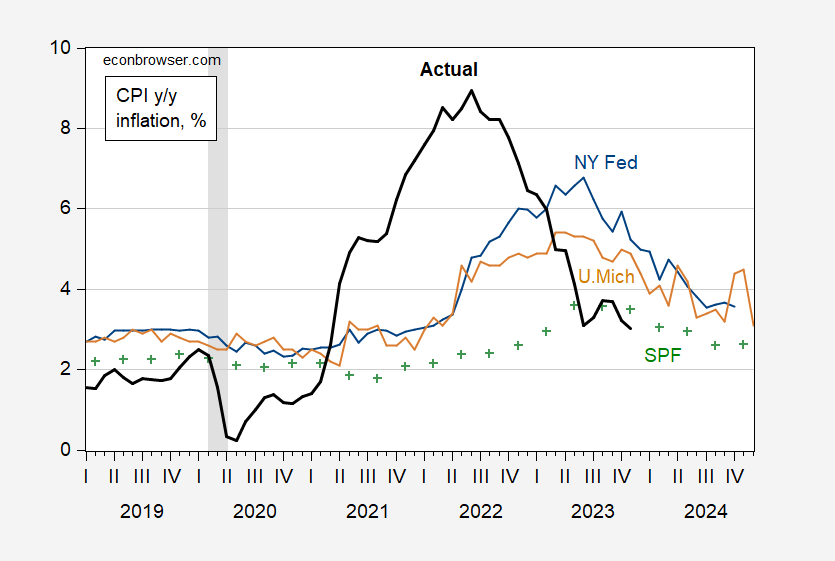

Figure 1: Actual CPI y/y inflation (bold black), U.Michigan survey (tan), NY Fed survey (blue), and Survey of Professional Forecasters (green +), all in %. November CPI is Cleveland Fed nowcast of 12/8. December U.Michigan observation is preliminary. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, U.Michigan via FRED, NY Fed, Philadelphia Fed, NBER and author’s calculations.

Several interesting points.

- SPF as of August was spot on.

- NY Fed diverged substantially from Michigan.

- Michigan evidenced some wild variability over the last four months.

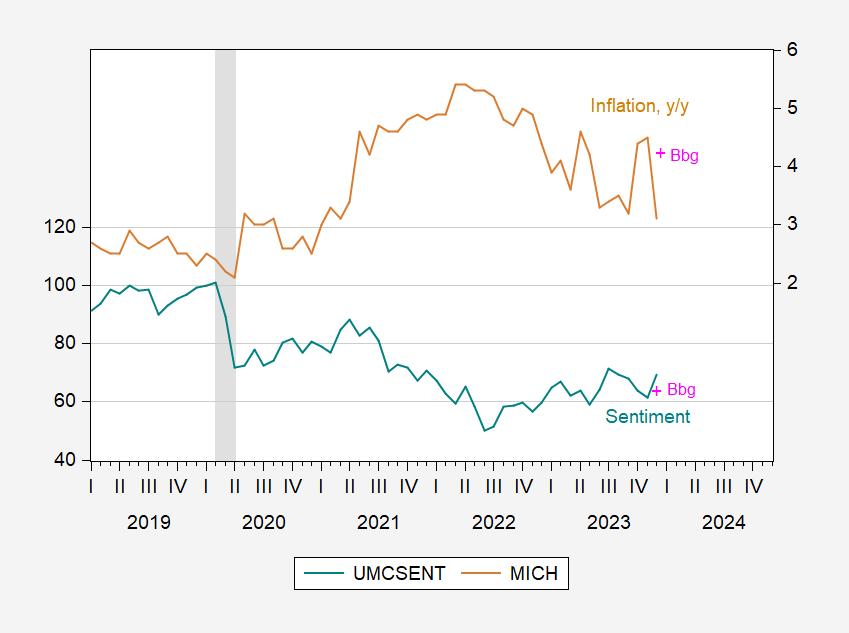

Note that the downside surprise on inflation expectations was matched by upside surprise in consumer sentiment in the Michigan survey.

Figure 2: Michigan survey on inflation y/y (tan), on sentiment (teal). Bloomberg consensus (pink +) December figures are preliminary. NBER defined peak-to-trough recession dates shaded gray. U.Michigan via FRED, NBER, and Bloomberg.

It’s once again time to take out some of JohnH’s trash. The troll is saying Krugman contradicted himself in a recent oped but of course this liar cannot bother to read his entire oped. Oh no – Jonny boy lets Scott Sumner cherry pick what Krugman actually wrote in this hit job:

https://www.econlib.org/krugman-on-the-effects-of-a-hot-economy/

Scott begins with:

People often suggest that a fast growing economy is inflationary. I would argue that exactly the opposite is true. Consider this data for Venezuela and Singapore from an old Robert Barro textbook:

Venezuela (1950-90): Average RGDP growth = 4.4% Average inflation = 8.0%

Singapore (1963-89): Average RGDP growth = 8.1% Average inflation = 3.6%

Singapore grew much faster and had much lower inflation.

On the other hand, you might argue that I’m not holding “other things equal”. Actually, I did:

Venezuela (1950-90): Average money (base) growth rate = 10.7%

Singapore (1963-89): Average money (base) growth rate = 10.8%

Most sane people would have stopped reading such a stupid blog post right there. Yea Jonny boy loves to dig the bottom of the barrel to smear Krugman.

The Krugman oped in full. Forget the misrepresentations of Scott Sumner and JohnH and read what he wrote for yourselves:

It’s a fact universally acknowledged — properly, anyway, a fact acknowledged by everybody I do know who thinks concerning the topic — {that a} scorching financial system results in greater wages and costs. When demand for labor is powerful, employees can and do demand wage hikes; when demand for items and providers is powerful, companies have “pricing energy,” or the flexibility to boost costs with out dropping clients.

However does a scorching financial system result in the next degree of costs? Or does it result in the next fee of change in costs, i.e., ongoing inflation? Or possibly even to accelerating inflation, the next fee of change within the fee of change?

These could sound like abstruse questions, however they aren’t. Quite the opposite, they’ve ceaselessly been on the coronary heart of debates over financial coverage; they’re, actually, central to present debate. But I’m undecided everybody writing on economics proper now understands these distinctions. Nor am I even certain that every one educational macroeconomists are absolutely conscious both of the historical past or the significance of those questions: A lot of contemporary educational macroeconomics (versus coverage evaluation) is wrapped up within the research of dynamic stochastic general equilibrium models (don’t ask), which in a manner assume away the entire concern.

So I believed I’d use as we speak’s publication to speak about what a scorching financial system does to inflation — specifically, about how each the proof and extensively held views about that relationship have modified over time. It’s a narrative that’s, frankly, not very encouraging for many who need to consider economics as a science.

A notice to skilled colleagues: This article just isn’t supposed as a analysis paper. I current some information, however just for illustrative functions, not as a part of a severe empirical evaluation. If you’d like a state-of-the-art take a look at the empirical proof, I like to recommend you begin with this highly influential paper by Emi Nakamura, Jón Steinsson and associates. Or in order for you detailed evaluation of what the present inflation information appear to be saying, you may need to learn Matthew Klein and this Brookings discussion.

However in order for you a fast and soiled take a look at what the actual points appear to be, learn on.

To start with was the combination provide curve — a putative upward-sloping relationship between output and the general worth degree, or kind of equivalently a downward-sloping relationship between unemployment and costs. And I do imply to start with: It’s proper there in John Maynard Keynes. It’s additionally clearly seen in Despair-era information. Total costs slumped when the U.S. financial system plunged into despair, rose again up because the financial system recovered, then fell once more because the financial system relapsed in 1937. Right here’s what the scatterplot for these years seems like:

In 1958, nevertheless, the economist A.W. Phillips pointed out that there had traditionally been a relationship between unemployment and the fee of change in wages (versus their degree). This was quickly reinterpreted extra typically as what we now name the Phillips curve, a relationship between unemployment and inflation, which appeared to work fairly properly within the Sixties:

So, how do you get from “a scorching financial system causes excessive costs” to “a scorching financial system causes ongoing inflation”? It’s truly a bit awkward, one thing that turns into particularly obvious whenever you co-write an economics textbook. There’s, nevertheless, an insightful dialogue of that transition in a traditional 1968 paper by Edmund S. Phelps, which I want I might advocate to readers. Sadly, I can’t, at the very least not in good conscience: It’s amazingly exhausting to decipher, even for skilled economists. And that’s a disgrace, as a result of Phelps’s evaluation of inflation was, I’d argue, significantly extra practical than that of Milton Friedman, who concurrently and independently arrived at kind of the identical conclusion: that the Phillips curve wouldn’t show to be a secure relationship.

What each economists argued was that sustained inflation would get “in-built” to wage- and price-setting, in order that making an attempt to maintain unemployment low would require not simply excessive however ever-accelerating inflation. And this declare, made at a time when the normal Phillips curve nonetheless gave the impression to be working fairly properly, gave the impression to be vindicated by the period of stagflation. From 1970 till someday within the Eighties, it regarded as if unemployment decided not the speed of inflation however the fee of change within the inflation fee, a relationship typically described as an “accelerationist” Phillips curve.

The thought of an accelerationist Phillips curve is what underlies the idea of the nonaccelerating inflation fee of unemployment, or NAIRU — that’s, the unemployment fee at which inflation might be secure, neither rising nor falling. This idea is a staple of sensible coverage evaluation, a lot in order that the Congressional Price range Workplace recurrently publishes estimates of the NAIRU, though today it calls it the noncyclical rate of unemployment.

However a humorous factor occurred to the Phillips curve after inflation receded within the Eighties: It stopped trying accelerationist. The truth is, within the twenty years earlier than the pandemic, the U.S. financial system exhibited one thing that regarded like a (weak) model of the previous Phillips curve, with a correlation between unemployment and the inflation fee, not the change within the inflation fee:

What occurred? The most typical clarification out there’s that after a protracted interval of low inflation, expectations turned “anchored”: Folks setting wages and costs did so within the perception that future inflation would run at round 2 %, and didn’t replace that perception within the face of the newest inflation numbers.

Which brings us to present coverage debate. Pessimists who insist that we’re doomed to years of excessive unemployment are principally asserting that we’re again to the inflation atmosphere of the Nineteen Seventies and early Eighties, that expectations have gotten unanchored and that to cut back inflation we’ll have to undergo an prolonged interval of unemployment properly above the NAIRU.

I don’t agree; after I take a look at varied measures of medium-term inflation expectations, they nonetheless look fairly anchored to me. However I might, after all, be improper — the transient historical past of inflation theorizing I’ve simply recounted doesn’t encourage a lot confidence that any of us has a extremely strong grip on the connection between financial hotness (or coldness) and costs.

The purpose I need to make, nevertheless, is that you just do want a concept. The proof is pretty overwhelming that the U.S. financial system is presently working too scorching and desires to chill off. However how a lot cooling it wants isn’t a query that may be settled with out deciding what sort of inflation course of you suppose is presently working.

Where exactly does Krugman contradict his introductory statement that “It’s a fact universally acknowledged — properly, anyway, a fact acknowledged by everybody I do know who thinks concerning the topic — {that a} scorching financial system results in greater wages and costs. When demand for labor is powerful, employees can and do demand wage hikes?”

Where is the evidence that the vast majority of workers have sufficient agency to DEMAND wage increases?

Why is monopsony not being factored in? “How prevalent is labor market monopsony in the United States?” In short, we find that most labor markets (as defined by occupation and geography) are very concentrated, and that that concentration has a robust negative impact on posted wages for job openings.”

https://rooseveltinstitute.org/2017/12/18/how-widespread-is-labor-monopsony-some-new-results-suggest-its-pervasive/

It seems to me that the impact of widespread monopsony is not being factored into discussions of the wage-price spiral for precisely the same reason that mainstream economists have largely ignored Corporate America’s role in driving inflation

Anything that “seems” to you, Johnny, can safely be ignored. You really shown neither much knowledge of the practical working of economies nor of the state of economic research. Everything from you is “Johnny thinks this” or “Johnny has been instructed by his masters to say that”. There is no reason to credit you view of things.

So here’s an idea. Why don’t you tell us what you’ve done to reach the conclusion that “the impact of widespread monopsony is not being factored into discussions of the wage-price spiral”. What literature searchs have you done? What survey papers have you read? What data have you reviewed? Why would your impression of things matter?

Want an example of someone who has paid attention to monoposony? How about Jerad Bernstein, who President Biden appointed to the Council of Economic Advisors? Or Robert Reich, who President Clinton appointed to be Secretary of Labor? Or Paul Krugman, whom you malign on a regular basis, though you aren’t fit to polish his shoes?

Please tell us, Johnny, why should anyone care what “seems” to you.

Ducky, instead of railing against what seems to me, you could simply provide evidence to refute it…but you didn’t. It seems to me that you have no evidence that monopsony is not being factored in.

So tell me: how exactly does you square the notion of labor DEMANDING and getting wage increases with the fact of widespread monopsony?

He has to do your homework? I have to provide evidence to back up you lies? Damn dude – you belong in an insane asylum.

Bernstein, Riech, Krugman. You want me to hold your hand?

Folks, this is one of Johnny’s standard tricks. He simply claims that th other guy uas offered no evidence, ignoring the evidenc that’s been offered. When he’s caught lying, he calls the other guy a liar. When his claim is refuted with evidence, he simply waits a day or two then repeats his claim as if it’s true.

Johnny isn’t just a liar, he’s a calculated liar, circling back to the same old lies over an over. The lowest of the low.

JohnH says he’s both anti war and pro-Russian invasion. He loves the phrase “ pointless, futile, wasteful war “ but has no problem with Russian invaders massacring civilians. He believes the war should end—not with a withdrawal by the invading Russians—but by negotiated settlement that rewards Russia for its war crimes.

His pants have been in flames so often , his local fire department has likely deemed him a public hazard #1.

His understanding of economics equals mine; I.e., like me, he has little to none, but given his ego he continually babbles about the same limited topics.

Unlike CoRev, he isn’t a fool, just a boor who thinks there’s someone here who appreciates his repetitive deceits.

JohnH: Monopsony is typically thought of as affecting the level of the wage relative to the wage determined in perfect competition (or for a given level of monopoly power). By the way, the topic has been discussed on this blog here, and here. I don’t recall you commenting on either post.

Funny. Johnny made a claim. I challenged it. Now, Johnny says the durden o proof is all on my side. I have, in fact, named economists an policy makers who take monopsony seriously, and Johnny simply pretends I haven’t.

As to squaring monopsony with supply and demand, I will merely note that theories of monopsony do not suggest the laws of economics are suspended by market power. Merely warped. Supply and demand are still in effect. Johnny’s demand that I explain this is more evidence of either his ignorance, his bad faith, or both.

And really, Johnny, how long are you goin to keep acting like everyone except you has to provide evidence (which you ignore anyway) while you don’t. That’s just lazy, boy. That’s why you don’t actually know any economics.

“how exactly does you square the notion of labor DEMANDING and getting wage increases with the fact of widespread monopsony?”

Poor little Jonny boy does not know what any of this means. Yes firms that hire non-union labor that also have monopsony power pay wages below the value of marginal product. But that is why we have unions and wage floors which actually increase employment as wages are forced up.

So much basic economic that our mentally retarded troll never grasped.

“Why don’t you tell us what you’ve done to reach the conclusion that “the impact of widespread monopsony is not being factored into discussions of the wage-price spiral”. What literature searchs have you done? What survey papers have you read? What data have you reviewed? Why would your impression of things matter?”

This very blog has featured this research. So did the blog of Mark Thoma. Jonny boy was so busy polluting both blogs I guess he forgot to read those excellent posts.

“Where exactly does Krugman contradict his introductory statement”

He does not contradict himself. You kept saying he did but you never said how. And now you are asking ME this question? Dude – you are one pathetic moron.

Here’s a link to a major benefits and compensation company that tracks and forecasts pay raises. Other, similar companies provide forecasts with similar results.

If you read the link, you get an idea of how Corporate America handles wage increases. The company notes that “Inflationary pressures (55%) and concerns over a tight labor market (52%) are the primary influencing factors behind salary increase budgets, both cited by over half of employers surveyed.” In setting their budgets for wage increases, companies consider various factors and then budget pay increases. Nowhere is there any mention of bargaining, negotiating, acting on employees demands or any participation of labor in the process of setting wages. https://www.wtwco.com/en-us/news/2023/12/as-economic-uncertainty-looms-pay-rises-remain-high

This is consistent with my own experience working at a Fortune 200. For the most part employees took whatever pay raise the employer offered. Only if you were a superstar or had a critical skill in short supply could you ask for more. As I show in past links, most did not. In fact, most did not even ask for increases. They just took whatever crumbs the company deigned to bestow them with.

If you look at their data, increases are forecast to be 4.0% in 2024. Past average wage increases amounted to 3.1% in 2021, 4.2% in 2022, and are expected to be 4.4% in 2023. Overall these increases are well below inflation for the same period. Even the seemingly high increase for 2024 will not close the gap. This is also consistent with my experience. During the budgeting process, employers set the wage budget to increase at a rate slightly below inflation and their pricing plans are set to increase slightly above. This helps satisfy investor demand for record revenues and record profits every year.

The bottom line here is that employers are in the drivers seat. The idea of employees bargaining, negotiating, or successfullly demanding wage increases is simply wrong, except in some unusual circumstances, such as the autoworkers strike.

If economists want to understand and forecast wage increases, they need to understand corporate behavior and the factors influencing it. Labor’s demands are simply not a direct part of the equation.

Uh, oh. Johnny is one again pretending that he has found a link that explains everything. He’s claiming that because something isn’t mentioned, it doesn’t matter. The famous aphorism here is “the absence of evidence is not evidence of absence.” Johnny has made a fundamental logical error. Again.

But really, it’s worse than that. What might the mechanism be for transmitting inflationary pressures and the effect of a tight labor market to corporate decisions about wage increases? Magic? Corporate virtue? Johnny lectures economists about how they ought to try to understand wage increases, but apparently understand very little.

Johnny’s claim to understanding is that he has held a job. OK, well I have also held a job, so I guess I am also qualified to potificate about stuff. Here goes…

Employee behavior drives wage decisions, contrary to what Johnny may or may not be trying to say – it’s often hard to tell. Johnny is eager to point out that most employees don’t negotiate for wage increases. (I have, but that’s beside the point. My experience is a datum, not “data”.) The low rate of union representation in the U.S. accounts for the low rate of negotiated wage increases – and that’s a feature, not a bug. Ask Elon Musk.

In the U.S., instead of negotiating for wage increases, most workers look for higher paying jobs. Here’s the picture, truncated because the Covid recession messes up the scale:

https://fred.stlouisfed.org/graph/?g=1cDES

A high rate of job quits generates a faster rate of hourly earnings gain. Workers do have the ability to drive wage gains in a tight labor market, even if they don’t negotiate with their current employer; they negotiate with their next employer.

And, by the way, you can check for yourself here:

https://www.atlantafed.org/chcs/wage-growth-tracker

Just click on “job switcher” to see the data. Those who switch jobs increase their pay at a faster rate than those who don’t.

The threat of high worker turnover is how worker behavior becomes part of the two things Johnny found in an article to explain – something or other. And he’s sure that economists don’t understand whatever it is that he thinks he has discovered, even though economists created the data series on quits, hourly earnings, job switchers and stayers I’ve cite here.

So, here’s a simple rule. If Johnny claims to explain something, assume he’s wrong. A corollary to that rule is, if Johnny claims to know more about something than a specialist does, he doesn’t. Heck, if Johnny claims to know more than just about anybody, you can safely assume he doesn’t, even though he once held a job.

“In the U.S., instead of negotiating for wage increases, most workers look for higher paying jobs. ”

Johnny plays games with wage increases, bouncing between real and nominal as he sees fit, even if it is apples to oranges. it is the same thing with this idea of negotiation of wages. it is not sufficient that a worker ends the year at a higher wage. if that wage was not with the same company and the result of a direct negotiation, then in johnny’s world is simply does not count. for the rest of us, an increased wage counts as a negotiation, because we do not have a narrow definition of what negotiation is defined by.

personally, I have dealt with the attrition issue over the past couple of years. we have lost good people to higher wage positions. and we have had to pay more for the workers we have hired. and the applicant pool is small, so higher wages are even going to less qualified people. that has been the case until about 6 months ago. have not followed the market since then.

another item at play is that companies are doing internal salary adjustments to retain workers. this also results in higher wages. Johnny would not call that a negotiation, but that is what is effectively occurring. I personally received a significant wage correction this year, because of institutional concerns about attrition due to competitive salary. I did not go in and negotiate. but the wage increase is effectively that result. a good company should keep good workers happy without having them reach the point of negotiating. because once they do that, the worker is likely to leave. a friend in another department is leaving because of that situation. if he had not negotiated, he would not have left. but that put him in search mode, and higher offers came along. would have been cheaper and easier to proactively offer a wage increase.

EPI: “There is an inherent imbalance of bargaining power between employers and employees. There is, however, a pervasive assumption in ECONOMICS, POLITICAL SCIENCE, LAW, and PHILOSOPHY that this is a relationship of equal power. This wrong assumption diminishes our freedoms in and out of the workplace and undermines our legal protections in the workplace. It generates wage stagnation and inequality. And it undercuts civic engagement and representative.” Here, this pervasive, wrong assumption leads economists to the belief that labor can drive a wage-price spiral.

https://www.epi.org/unequalpower/home/

Tricky Ducky and baffling say that job quits translate into higher wages. That is true…to a limited extent. However, a majority of workers do NOT quite their jobs in any given year. And the majority of those who quit do NOT ask for higher wages. “A little over a quarter of women (28%) asked for higher pay the last time they were hired for a new job, according to new research released Wednesday by Pew Research Center. But men were only slightly more likely (32%) to have requested more pay when last hired.” The net effect, as documented by WTW, is that wages given closely mirror the wage budget established at the end of the preceding year. https://fortune.com/2023/04/05/pay-gap-men-versus-women-asking-for-raises-pew/

Those numbers also help explain why WTW’s number show that wages have not kept pace with inflation over the past three years–workers accept the wage that Corporate America bestows upon them. It also helps explain why average real hourly wages have risen by a mere 0.56% since before the pandemic, despite one of the tightest labor markets in the last 75 years.

Ducky, baffling and pgl should try actually reading the links I provide.

Fact is, Corporate America is infirmly in the driver’s seat when it comes to setting wages. Most workers are in NO position to negotiate, bargain, or successfully DEMAND higher wages. That notion is a figment of the imagination of Krugman and other economists like him…and Ducky, pgl, and baffling can find no evidence, other than economics dogma, that workers do have the power to drive inflation.

Curious, isn’t it that economists want to blame labor for inflation but shield Corporate America’s for seller’s inflation?

“Ducky, baffling and pgl should try actually reading the links I provide.”

Jonny boy actually wrote this? I certainly read them and I fall on the floor laughing how they contradict what Jonny boy said routinely. No little Jonny boy – you are the one who needs to READ your own damn links.

I’m sorry but Jonny boy is truly the most mentally retarded troll eve.

Jonny boy tries to school you with an EPI piece called Unequal Power. Well if a monospony does not face a labor union or some other form of wages floors – then yea. But Jonny boy has also quggested we should not rely on unions. Now that is idiotic.

“Here’s a link to a major benefits and compensation company that tracks and forecasts pay raises.”

Damn it – another link you provided but failed to read. READ it moron as it talks about wage increases that will clearly be higher than general inflation. Come on Jonny boy – we know your reading skills suck. Is that why your Fortune 200 company you never identify went bankrupt.

Things in Jonny’s link he never read:

The title:

US pay raises to remain high in 2024, WTW survey

Concerns over economic uncertainty not deterring employers from increasing pay

The very first paragraph:

U.S. employers are planning an overall average salary increase of 4.0% for 2024. That’s according to the latest Salary Budget Planning Survey by WTW (NASDAQ: WTW), a leading global advisory, broking and solutions company. Though down from the actual average increase of 4.4% in 2023, the numbers remain well above the 3.1% salary increase budget in 2021 and years prior.

Oh wait – Jonny boy thinks these increases are below current inflation. Yea – Jonny boy is that damn dumb.

“Overall these increases are well below inflation for the same period.”

Inflation for 2023 is far above 4.4%? Damn – you are the dumbest troll ever.

https://fred.stlouisfed.org/series/CPIAUCSL

CPI over the past 12 months has risen by 3.1%. But here’s Jonnny after noting wages rose by 4.4%.

‘Overall these increases are well below inflation for the same period.’

Jonny boy actually thinks 3.1 is far greater than 4.4. Yea – he is one dumb troll.

“The bottom line here is that employers are in the drivers seat. The idea of employees bargaining, negotiating, or successfullly demanding wage increases is simply wrong, except in some unusual circumstances, such as the autoworkers strike.”

I guess those successful strikes in Hollywood do not count. Jonny boy is basically telling unions to not even try. Hey Starbucks workers – get off the picket line and make Jonny boy his coffee. Hey nurses – get back into the hospitals working for low pay. That is Jonny boy’s message here.

Yea – Jonny boy is actually shilling for those monopsonist in the shadows.

How Widespread Is Labor Monopsony? Some New Results Suggest It’s Pervasive.

DECEMBER 18, 2017

New results six years ago little Jonny. Come on dude – try actually reading the posts here as Dr. Chinn has noted more recent papers. Or did you once again not read the entire title?

That has to be a translation using an automatic translator from Chinese or some distant-from-English language. “The purpose I need to make, nevertheless, is that you just do want a concept.” ? “However I might, after all, be improper” ? “However in order for you a fast and soiled take a look at what the actual points appear to be, learn on.”?

Possibly translated to another language and back again – “fast and soiled” instead of “quick and dirty”, for example, but the grammar and diction are both horrendous.

Hi Menzie – I found this discussion with Claudia Sahm “it’s clear now who was right” on inflation instructive. Unfortunately – can’t find a version that is not behind a paywall: https://www.ft.com/content/33f9dbb0-c620-4cd7-a7dc-02e47fe28c11?sharetype=blocked Here is some more from her substack: https://stayathomemacro.substack.com/p/i-was-right

https://www.ft.com/content/33f9dbb0-c620-4cd7-a7dc-02e47fe28c11

Not an unprecedented pattern after high inflation.

https://fred.stlouisfed.org/series/FPCPITOTLZGUSA

Bruce Hall: Annual data is a pretty blunt series to assess for instance persistence. Using monthly data, the AR(1) coefficient for 1976-84 is 0.75. The AR(1) coefficient 2021-2023 is 0.38.

Yes, annual data has its limitations, but it can be useful when looking at longer term patterns. Regardless, the point was that it’s not unexpected to see inflation abate after a spike caused by disruptions, especially supply disruptions.

Merry Christmas.

Damn are you dumb. Our host has been making his point for a long time ala many posts. And yet little Brucie never got the point. Go figure.

BTW – your little graph shows that inflation averaged more than 2.1% during Trump’s first three years … above the FED’s target of 2%. Oh wait – his rear end got saved by 2020 when he let Covid run wild. What a brilliant anti-inflation policy – kill the economic boom with a Covid led recession!

https://fred.stlouisfed.org/series/CPIAUCSL

Here is CPI on a monthly basis ala FRED. Brucie boy choose not to present this data. I wonder why. Oh yea prices have risen a lot more slowly ever since June 2022. I guess Brucie boy could not tolerate JohnH getting all that attention for blatant liar so he had to join the circus.

Dude – we get inflation was high for a short time. No it was not over 13% as you claimed. And recently? Oh yea – our host has taken down your latest stupidity.

“Several interesting points.

SPF as of August was spot on.”

Of course ubertroll JohnH claimed their forecasts were awful. He also claimed they do not track their forecast record even though his own link noted that they do.

Oh well Jonny boy’s track record is getting one thing right out of a thousand bogus claims.

Even a broken clock is right twice a day. Given overall poor forecasting of the past few years, caveat emptor.

But you can count on pgl to cherry pick a couple good results and then claim they are representative.

Where does pgl “cherry pick a couple good results and then claim they are representative.” Come on, Johnny, you’ve made the claim. Just show us where it happened. Give us the quote. You wouldn’t just pretend pgl said something he didn’t say,would you?

Give us the quote.

Dear casual readers, here’s a brief explanation of what’s good on. JohnH is a supporter of Russia’s invasion of Ukraine and, as a sort of side hustle, also denigrates nearly everything associated with the United States. pgl (pro-growth liberal), on the other hand, is an academic economist with a a professional interest in transfer pricing issues. pgl has taken umbrage, as I have, at JohnH’s dishonest characterization of Russia’s war on Ukraine, the U.S. economy, and any number of other things. JohnH pretends to support progressive causes, but in fact only uses progressive rhetoric to bad-mouth Democrats – the nearest thing to a progressive party in mainstream U.S. politics. Recall that the most recent Republcan president is an admirer of Putin, a critic of NATO and an opponent of aid to Ukraine. You can see why JohnH might want to pretend that the U.S. is worse than it is and that Democrats are the root of any problem under consideration.

Tricky Ducky is Peppa Piggly’s döppelganger yet again! Peppa Piggly’s attempt to use the current SPF forecast as proof of their stellar forecast record is the only example you need to show exactly how he “cherry picks a couple good results and then claims they are representative…unless like Ducky you can’t be bothered with looking at their recent historical record.

Lord – you are worse than a two year old retarded child. No – I happen to sometimes taken a different position than Macroduck. The difference is however he presents informed discussions and you present moronic dishonesty.

Give us the quote in which pgl cherry picked. Simpe request if he did an un fact, cherry pick data. But no, you resort to word salad aimed at diverting attention from your lie. Same old Johnny.

“JohnH pretends to support progressive causes”

As in his continuing defense of Cameron’s fiscal austerity when the UK was well below full employment? Jonny boy may be even worse than Lawrence Kudlow in this respect.

“Even a broken clock is right twice a day.”

Which is twice a day more than you are ever correct.

How dumb is James Comer. He wants us to believe that the indictment of Hunter Biden is a coverup for … something or the other:

https://www.msn.com/en-us/news/politics/maddow-blog-james-comer-s-anti-biden-theories-take-a-literally-laughable-turn/ar-AA1lkpye?ocid=msedgdhp&pc=U531&cvid=1e75547472704e8a938d45e77e61b220&ei=25

Its a cover up for the fact that Hunter is innocent of any serious crime. The right wing persecutor has been unable to find anything real and his friends are demanding that at least there has to be a scandal they can pump up until Hunter is declared innocent in a court of law.

Jeez, pgl. What the heck was the source of that Krugman op ed you posted? I reads as gobbledygook like it was filtered through ChatGPT. Or translated from French to German to English. It bears only passing resemblance to what was published by the NYT.

Have Jonny boy provide you the NYTimes link which he so misrepresented? Me – I cannot get past their damn paywall so I find some other way of providing the text. Not that I agree with every thing Krugman said there.

Here’s the quote and its source: “It is a truth universally acknowledged — well, anyway, a truth acknowledged by everyone I know who thinks about the subject — that a hot economy leads to higher wages and prices. When demand for labor is strong, workers can and do demand wage hikes.”

https://www.nytimes.com/2023/04/28/opinion/inflation-wages-unemployment.html

Where is the evidence that workers demand higher wages? Sure, some do…but workers overall do not.

I hate to bore the adult readers of this blog but it seems JohnH never understood labor economics especially the role of unions facing a monopsonist. Yea – little Jonny boy has been chirping that unions should just basically give it up when facing a monopsonist. Now our host has provided us with a lot of good economists on this matter but it seems all that went over little Jonny boy’s little brain. So forgive me for presenting a version that even freshmen in college get:

https://www.economicshelp.org/labour-markets/trades-unions/

Initially, a monopsony can pay a wage of W2 and employ just Q2. Note this profit maximising level is a lower wage and lower employment level than a competitive equilibrium of Q1, W1. In this situation, if a trade union bargains for W3, it does not create unemployment, but employment stays at Q2. We can say that a trade union is counter-balancing the monopsony power of employers.

This came with a very clear set of graphs but yea – it is still all way over little Jonny boy’s little brain.

BTW – JohnH’s latest stupid ranting on a topic he never understood – labor economics – suggested economists do not factor in monopsony power. I used this cite’s search engine and all sorts of discussions of this issue as well as the effects of wage floors. One in particular that lying little Jonny boy suggested never existed:

https://econbrowser.com/archives/2022/01/employer-power-in-labor-markets-measured

Of course little Jonny boy won’t read this either.

https://www.bls.gov/news.release/realer.nr0.htm

Real Earnings Summary

REAL EARNINGS – NOVEMBER 2023

All employees

Real average hourly earnings for all employees increased 0.2 percent from October to November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from an increase of 0.4 percent in average hourly earnings combined with an increase of 0.1 percent in the Consumer Price Index for All Urban Consumers (CPI-U).

Real earnings rose? Wait, wait – this is the opposite of what JohnH has been chirping. BLS breaks this down into the increase in nominal earnings which they think is greater than the increase in CPI. Wait 0.1% is much greater than 0.4% according to the Nobel Prize winning JohnH. BLS must be lying to us!

https://www.statista.com/statistics/216259/monthly-real-average-hourly-earnings-for-all-employees-in-the-us/

Real average hourly earnings for all employees in the United States from November 2010 to November 2023

Over the past 12 months, real earnings have risen as nominal earnings growth has exceed CPI growth. Anyone who says otherwise is either stupid or a liar. JohnH is both.