In early 2001 (April or May) I was on staff at CEA, and recall a conversation where I was assured there’d be no recession, given the latest data available. So, with all the data I’ve recapped, remember, the data will be revised (and GDP in particular will be revised, over and over again).

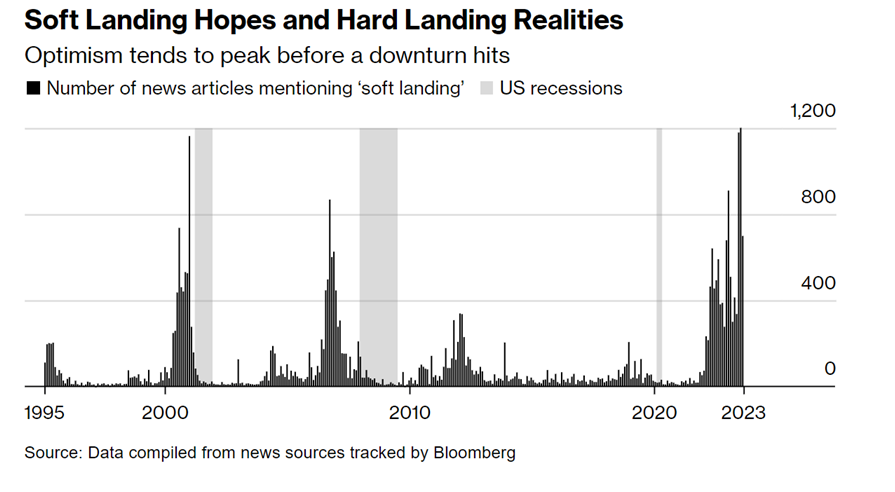

As Wang and Orlick point out, before each of the most recent recessions, a considerable number or analysts think we have dodged a bullet.

Source: Wang, Orlick, Bloomberg, Oct 1, 2023.

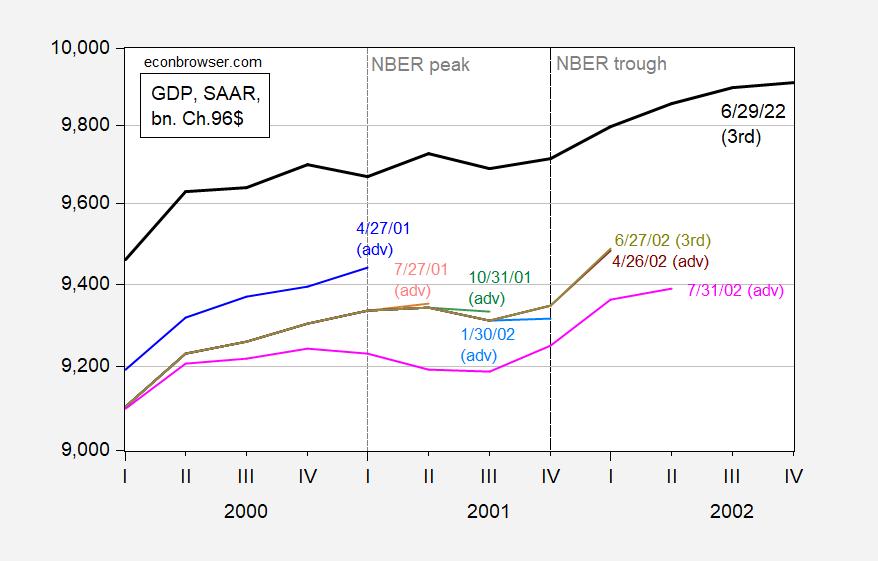

Here’s the evolution of estimates of GDP contours around the 2001 recession (I’m self-plagiarizing from this post).

Figure 1: GDP in billions Ch. 1996$ SAAR. NBER defined peak and trough dates at dashed lines. 6/29/22 GDP calculated dividing nominal GDP by GDP deflator rescaled to 1996=100. Source: BEA via ALFRED, NBER, and author’s calculations.

The first reading of GDP at then end of April 2001 allowed people to breathe a sigh of relief – q/q annualized growth was around 2%:

Figure 2: Quarter-on-quarter annualized real GDP growth. NBER defined peak and trough dates at dashed lines. Source: BEA via ALFRED, NBER, and author’s calculations.

That positive reading remained true through the second and third releases. The advance reading for 2001Q2 was also positive. This remained true through the second and third releases, and only in Q3 did the advance reading go negative, and remain so. However, the advance Q4 reading (1/30/2002) was positive — so there was no two-consecutive-quarter string of negative readings.

Only with the advance 2002Q2 release — incorporating the annual revision — did we get consecutive negative readings, in this case three quarters, starting Q1 running through Q3. The annual revisions adjust the preceding 5 years of GDP estimates (see here).

However, every five years, the BEA undertakes comprehensive revisions, incorporating the latest data. This once again changed the contours of GDP – as shown in Figure 1 and Figure 2. As the most recent series show, there are no consecutive quarters of negative growth. And yet, the NBER declared a recession running from (peak-to-trough) March 2001-November 2001, 2001Q-2001Q4 (recession announcement November 26, 2001, expansion announcement, July 17, 2003).

So, it’ll be a while before I say with confidence that there’s no recession, on the basis of GDP at least. Other indicators may give an all clear much sooner. (Of course, this also means I’ll be reluctant — too reluctant for some — to declare a recession underway).

On the other hand, I still think it highly unlikely there was a recession of 2022H1.

The problem with using mentions of “soft landing” in the press is that “soft landing” usually comes up when there is a recognition of recession risk. We can readily substitute “I think we can avoid recession” for “soft landing”. It’s a late-cycle thing.

This isn’t bad economics. It’s sloppy journalism. The writer, the editor, Bloomberg as a company, wants a story with a contrarian twist, so a high number of “soft landing” mentions is equated with optimism – “see, they got it wrong”. Not necessarily; just as likely, the discussion of a soft landing only occurs because the central bank is busy cooling things off, risking rece.

Very important point. Talks about “soft landings” are only in the press if the economy is “soft” enough that it could go either way.

There are so many hard to predict and hard to control parameters that feeds into economic growth that it becomes extremely hard to predict whether the economy will just dip down below or just manage to stay above the recession threshold. I know the human brain is coded to demand binary yes/no concepts – but I still prefer to look at the economy as a continuous parameter.

It’s a logical train of thought. I don’t think anyone of reason would snarl about any of this post, credentialed economists or not.

I feel very strongly there will be no dating of a recession pre-January 1 2024. But I have no “model” and much of my thinking is “subjective” on the matter.

Regarding the “soft landing”, it’s clear that the plane has its wheels on the runway. The only question now is whether the Fed will lock up the brakes so that the plane skids off the end of the runway and into the drink.

The Fed needs to start cutting interest rates — yesterday.

It seems if anyone should anyone should realize that interest rate hikes take 6 months to a year to have an impact – it would be the Federal Reserve. Time to start looking at current indicators like new housing starts and not trailing indicators like inflation indexes.

Also – since I am fascinated with China’s ability to ensure food security – their work into the use of saline soils is instructive – BTW – saline soils have been the bane of many civilizations over the centuries – if you constantly irrigate sandy soils they accumulate mineral salts over time. https://www.scmp.com/economy/china-economy/article/3246033/china-vaults-salt-saline-tolerant-crops-increasing-yields-and-advancing-food-security-goals

Thanks Menzie for your work –

The Princeton Steve VMT indicator:

https://fred.stlouisfed.org/series/trfvolusm227nfwa

I see no sign of a recession here either.

Merry Christmas to you all. Even you, pgl.

Hope you have a pleasant time with your family Mr. Kopits. I have a feeling your family is a little larger than mine. So that can be a gift or can add stress. But I hope you have a good time and you don’t forget “the real reason for the season” underlying Santa and all the TV commercials.

I got some Chinese food in the late afternoon from a place I frequent a decent amount. They had their son manning the drive-thru. Mature little tyke and very friendly. Then I went to Wal Mart and they had more Asians working than usual. I almost feel like we “owe” Asian Americans for covering bases during Christmas, but anywayz, by surface appearances they don’t seem to mind.

Thought of this blog’s comment section when reading this note from a fortune cookie:

“The clash of ideas is the sound of freedom”

Isn’t it nice to have a blog host who permits criticism of the host, and even amazingly permits the occasional personal attack on themselves?? It’s a gift to the dialogue. Many blog hosts do not even permit contradicting opinions to the host’s, nevermind personal attacks. That makes this blog a notch above many. Some newspapers and newspaper writers attack blogs, but among today’s newspapers, do you see much in the way of alternative opinions, even in what used to be the place for alternative opinions in newspapers—the Editorial section?? Not much friends, not much.