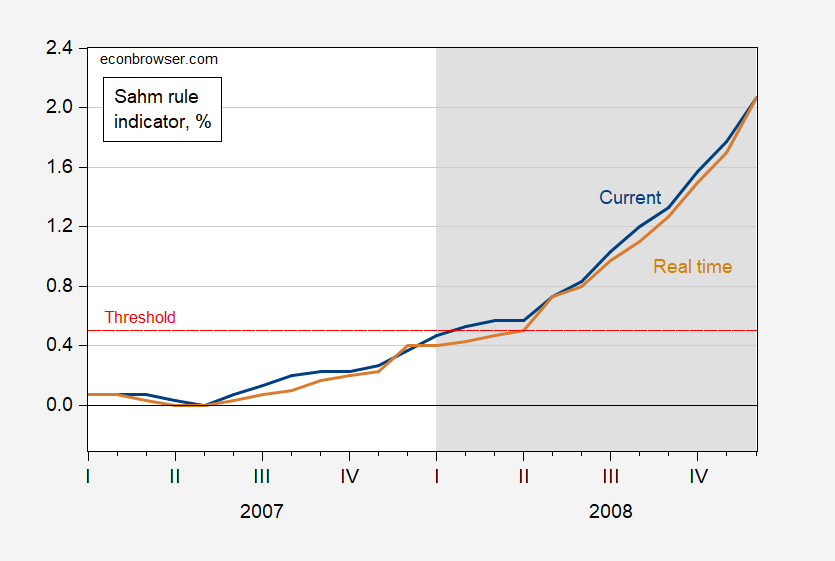

Here’s 2007-08:

Figure 1: Sahm rule real time (tan), current vintage (blue), in %. NBER recession dates (post-peak to trough) shaded gray. Source: FRED, NBER.

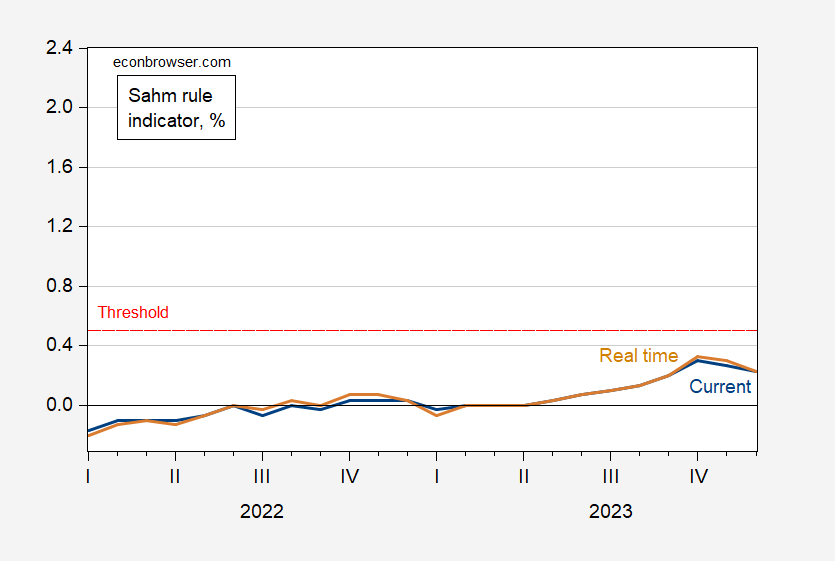

And here’s now (on same vertical scale, for context):

Figure 2: Sahm rule real time (tan), current vintage (blue), in %. Source: FRED.

As long time adherent to term spread predictor of recessions, I must say doesn’t look like the recession has yet arrived. This in line with monthly and weekly business cycle indicators shown in this post, and this post.

Addendum:

I will note as an aside that, using the Sahm rule, the 2022H1 does not appear to be a recession period, much as Mr. Kopits would assert it is.

well sahmtimes it works and sahmtimes it doesn’t~~

“You can fool all the people some of the time and some of the people all the time, but you cannot fool all the people all the time.”

And yet fixed-income asset curves are still inverted.

Barring yet another global negative supply shock, it looks like 2024 could be a year of steady, albeit modest real economic growth. Energy markets are well supplied.

It is indeed interesting how well the US economy has performed post-pandemic and yet how negative the sentiments have been in polling data.

You are not going to succeed in messing up these people opinions with facts!!!

“It is indeed interesting how well the US economy has performed post-pandemic and yet how negative the sentiments have been in polling data.”

it is an indictment of the partisanship and misinformation that has grown since trump took office. and asymmetrical, from a political point of view. this is why I view the issue of misinformation, and the growth of alternative facts, as one of the greatest negatives of the last decade. trying to redefine reality has consequences in the real world.

Shipping is becoming more difficult:

Maersk, Hapag-Lloyd Deny Reported Safe Passage Deal With Houthis

https://www.bloomberg.com/news/articles/2024-01-08/shipping-stocks-drop-after-report-of-pacts-with-houthi-rebels