Reader Steven Kopits, commenting on inflation now vs. Korean war post:

Not even remotely comparable. The comparison would be the post-1918, Spanish flu, period. A shut-down, supply-constrained economy with significant inflation; a sharp, deflationary correction; followed by a near decade-long economic boom.

If we’re talking suppressions, that’s the model to use.

Since Mr. Kopits did not provide any data of any sort to support his conjecture, I decided to look up to see what inflation behavior looked like back then (101 years ago).

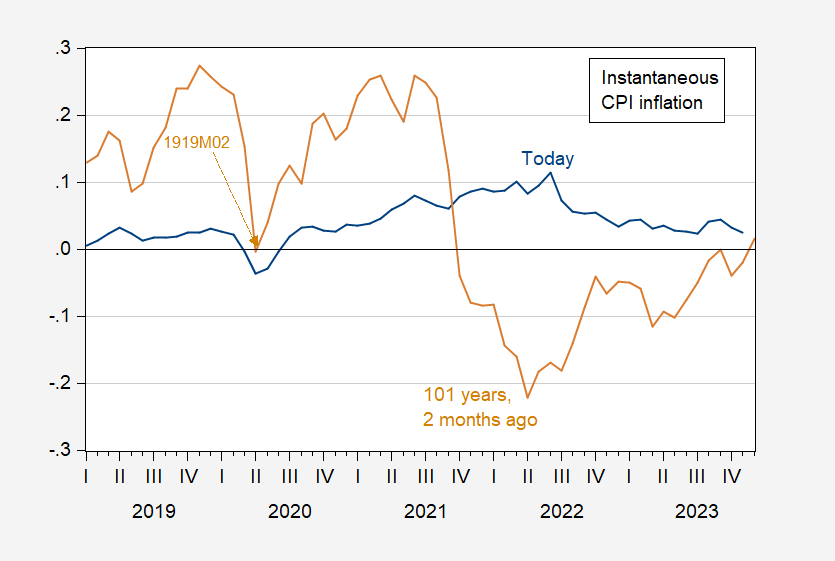

Figure 1: Six month annualized CPI inflation now (blue), and 101 years ago (tan). Source: BLS, and NBER MacroHistory Database via FRED, and author’s calculations.

I’ve matched up the minima in inflation to make the series correspond as much as possible. The year-on-year picture looks even less promising for the thesis forwarded by Mr. Kopits.

Figure 2: Instantaneous CPI inflation now (blue), and 101 years, 2 months ago (tan). Instantaneous inflation calculation per Eeckhout (2023), T=12, a=4. Source: BLS, and NBER MacroHistory Database via FRED, and author’s calculations.

So, not sure the inflation experiences match well. After all, inflation had surged with entry into WW I, and didn’t go negative by the 12 month or 6 month inflation rates, and barely hit negative for one month using instantaneous inflation. In fact, by October 1919, y/y inflation was 13%.

As teaching is about to commence again, I restate my admonition. The data will set you free (in this case, from saying stupid things).

Amen.

I don’t even know how to get my head around someone thinking that the drivers of inflation 100 years ago would be the same as now. Just for starters, as you mention, there was a world war back then.

Chinny I believe the spanish flu was 1918-1920. I know I never experienced it.

Not Trampis: Thanks, fixed. Living too much in the present… (or typing too fast).

It would be interesting to plot the US government fiscal stance against the GDP data from the post-WW I and post-Spanish influenza period.

The primary sector’s share of total employment has risen in China for the first time in 2 decades:

https://www.scmp.com/economy/china-economy/article/3247440/chinas-primary-sector-workforce-sees-first-increase-decades-migrants-back-farm

From the article:

‘Experts said the rise may reflect a return of migrant workers to their rural hometowns amid strict pandemic controls and a bleak urban job market in 2022, and it may continue if other sectors do not compensate with a return to sustained growth.

‘“It [shows] urban services sectors, as well as small and medium enterprises, both major job creators, have shrunk gravely,” said Wang Dan, chief economist at Hang Seng Bank China.’

The same press outlet reported not long ago that China’s government is working to send new graduates (among whom unemployment is very high) to work in the countryside. These two stories fit together.

Heading back home, where the cost of living is presumably lower, makes sense when jobs are scarce, and “back home” gernerally means primary sector jobs. As to the government’s effort, it’s better to have disaffected folks in the countryside, away from cities where they can be disruptive.

Here is a look at the distribution of labor across industry, services and agriculture (where “agriculture” is “primary sector”):

https://www.statista.com/statistics/270327/distribution-of-the-workforce-across-economic-sectors-in-china/#:~:text=The%20statistic%20shows%20the%20distribution,percent%20in%20the%20service%20sector.

Notice that the share of emoyment in factory production had been declining along with primary-sector employment, but rebounded in 2021 (looks Covid-related). In 2022, the primary- sector share rose at the expense of both factory and service employment.

The article doesn’t mention China’s reported drive to reduce vulnerability to the outside world. The data are for 2022, so maybe it’s too sion for isolationism to show up.

The data on farm imports don’t support the idea that China is becoming much more self-sufficient:

https://www.statista.com/statistics/749961/chinas-import-value-of-agricultural-products/#:~:text=This%20statistic%20shows%20the%20import,dollars%20were%20imported%20to%20China.

Iron and steel imports hit a record high in 2022, but fell in 2023:

https://tradingeconomics.com/china/imports-of-iron-steel#:~:text=Imports%20of%20Iron%20%26%20Steel%20in%20China%20averaged%201816051.03%20USD%20Thousand,Thousand%20in%20February%20of%201997.

For now, this is another manifestation of Covid and anti-Covid policy. If it persists, it would be a sign that China’s growth trend is flattening.

Young couples “Chinese dream” turning into a nightmare:

https://www.bbc.com/news/world-asia-china-67563596

A sad story including

Ms Dong came home with bad news – she was forced to accept a salary cut, bringing it down to just 2,000 yuan (about $282; £222) a month.

But have no fear – JohnH is telling Macroduck that this fall in their wages is nothing more than a neocon plot. Yea Jonny boy could care less for the average worker as long as Putin and Xi keep feeding their pet poodle with dog food.

That still looks about right to me.

Of course, circumstances were different. The last few years of WW1 had clearly created material inflationary pressures in the US, but these were subsiding by 1918 March, when the Spanish Flu began. With that, the US saw a really severe bout of inflation lasting until June 2020 and averaging 19% at an annual pace. The following two years saw a major reversal, with prices falling at the pace of 9% / annum from July 2020 to October 2022. So the total round trip was 4.5 years. If we allow the start of the current pandemic at March 2020, then the effects would wash through the system by Q4 2024 assuming similar policy dynamics.

Of course, the US did not have a central bank at the time, which led to considerably greater volatility than we see today. Notwithstanding, I think the Spanish flu is probably the best analog for the dynamics we’ve seen over the last four years.

Steven Kopits: I tried moving around the lags to make the humps match. These are about the best.

I might note that the Fed came into existence Dec. 23, 1913.

You are of course right about the Fed. Mea culpa. There’s a very good book on this, which I have read but apparently not remembered.

https://www.amazon.com/Americas-Bank-Struggle-Federal-Reserve/dp/0143109847

Notwithstanding, the Fed wasn’t doing very much to help, was it? Inflation going well beyond 20% before crashing to deflation of -9%, and the whole financial crisis and the Great Depression. All big zeros for the Fed, really. And that had to do with the Fed not acting as a true central bank at the time, partly due to its institutional structure and partly due to underdeveloped theory and practice, as I understand it.

I would be interested in a little monetary history here.

“the Fed wasn’t doing very much to help, was it?”

Well how could it since you think it did not exist. Now if you were remotely interested in monetary history we have already provided you with lots of good discussions. None of which you will read and even if you did you could not understand given your clear lack of any knowledge of basic macroeconomics.

I understand that the numbers don’t quite line up, but I think it’s still the best precedent, albeit under different institutional conditions.

You thinking something isn’t sufficient for…well, for anything. How often have you had errors in your view pointed out, only to say “That still looks about right to me.”

I still think you need to stop enshrining your first thought into the “Steve believes it” data base.

Kopits has it “penciled in”. I have it on high authority Stevie Baby pencils everything in. At least his unreliable forecasts—meaning—ALL his forecasts.

We need a database for Steve Kopits euphemisms, but I doubt the technology is scaled large enough.

‘circumstances were different.’

But YOU claimed there were the same. Make up your mind troll.

‘The last few years of WW1 had clearly created material inflationary pressures in the US, but these were subsiding by 1918 March, when the Spanish Flu began. With that, the US saw a really severe bout of inflation lasting until June 2020 and averaging 19% at an annual pace.’

Inflationary pressures were subsiding in early 1918 but they lasted another couple of years. Do you realize how utterly stupid your claims are? Everyone else does.

…June 1920…

and …July 1920 to October 1920…

‘Since Mr. Kopits did not provide any data of any sort to support his conjecture, I decided to look up to see what inflation behavior looked like back then (101 years ago).’

Amen – it is not hard to check on this data but of course Princeton Stupid Steve needs no data. He just makes up stupidity as he goes. BTW – did little Stevie ever heard of World War I? Or maybe the bloviating bozo thinks we had World War III from 2014 to 2019. Odd – I don’t remember that but I’m sure Stevie can mansplain it to us.

Not that Princeton Stupid Steve will appreciate figure 8 of this discussion but the adults here will:

https://www.ntu.org/foundation/detail/government-spending-in-historical-context

Federal spending as a share of GDP outside of temporary booms in defense spending was much smaller before the New Deal than it was during the Korean War period. But don’t tell Stupid Steve as he is mansplaining us about worthless terms such of suppression and velocity.

Chapter Title: World War II Inflation, September 1939–August 1948

Chapter Author: Milton Friedman, Anna Jacobson Schwartz

Chapter URL: http://www.nber.org/chapters/c1138

https://www.nber.org/system/files/chapters/c11389/c11389.pdf

Friedman & Schwartz focused on inflation during and after WWII but did discussion the WWI experience. Interesting stuff that never had to mention that Princeton Stupid Steve nonsense about some alleged suppression model.

Y’all know that I’m in the pocket if moneyed interests -Johnny said so and he’d never, ever lie. So’s pgl – Johnny said so.

I suppose as a reflection of my fealty to monkey interests, I keep an eye on anti-trust policy developments. In this spirit, I provide a link:

https://www.wsj.com/tech/big-tech-braces-for-wave-of-antitrust-rulings-in-2024-860f0149

In fact, “big tech braces for” turns up more than one recent report from the business press:

https://www.reuters.com/technology/big-tech-braces-roll-out-eus-digital-services-act-2023-08-24/

But that’s Europe, so who cares?

The U.S. drug industry is doing some bracing, as well:

https://finance.yahoo.com/news/big-pharma-why-the-drug-industry-faces-a-3-front-battle-with-the-ftc-medicare-and-the-white-house-154030948.html

Speaking of building monopoly power, M&A volume was down 20% in 2023:

https://www.wsj.com/articles/what-happened-in-m-a-in-2023-and-whats-ahead-in-five-charts-236b2dbf

Credit for the decline is shared between the cost of borrowing and stepped-up federal opposition to mergers. Lina Khan may earn herself a place in history as having actually changed history. And by the way, her new merger guidelines are out:

https://www.ftc.gov/news-events/news/press-releases/2023/12/federal-trade-commission-justice-department-release-2023-merger-guidelines

If the cost of borrowing falls as expected this year, it’s likely that M&A efforts will pick up. How much is actually completed depends considerably on Ms. Khan and her new guidelines.

‘The “march-in rights” as they are known, established by the 1980 Bayh-Dole Act, allows the government to exercise intellectual property rights on patents developed with the use of federal funds or by the government. The most recent example of such government research being used in a commercial product is the work from the NIH that eventually lead to the Moderna (MRNA) COVID-19 vaccine — which Moderna eventually paid the government rights for, after it lost a legal battle.’

An act passed under President Carter but not used by Saint Reagan either Bush or two past Democratic Administrations. Biden on the other hand is taking pharma competition seriously!

https://www.frbsf.org/economic-research/wp-content/uploads/sites/4/S04_P1_JohnVDuca.pdf

It’s interesting that Princeton Stevie pooh did not consider monetary policy given that Stevie fancies himself as some expert on monetary policy with his die hard belief in the Quantity Theory of Money. So I decided to look for some paper that looked at “velocity” over an extended period of time. This interesting discussion graphs velocity from 1929 onwards. And it does appear to be quite volatile for the period after WWII and throughout the 1950’s.

Little Stevie dismisses the role of monetary policy for the high inflation in the years after WWI (that inflation was high was something Stupid Steve did not even know about before our host schooled this moron) as Little Stevie claims the US did not have a “central bank” then. Of course the Federal Reserve was created in 1913 – something else little Stevie did not know.

An interesting paper on the roles of monetary policy back then:

PROTECTING FINANCIAL STABILITY IN THE AFTERMATH OF WORLD WAR I: THE FEDERAL RESERVE BANK OF ATLANTA’S DISSENTING POLICY

Eugene N. White

http://www.nber.org/papers/w21341

July 2015

https://www.nber.org/system/files/working_papers/w21341/w2134

During the 1920-1921 recession, the Federal Reserve Bank of Atlanta resisted the deflationary policy sanctioned by the Federal Reserve Board and pursued by other Reserve banks. By borrowing gold reserves from other Reserve banks, it facilitated a reallocation of liquidity to its district during the contraction. Viewing the collapse of the price of cotton, the dominant crop in the region, as a systemic shock to the Sixth District, the Atlanta Fed increased discounting and enabled capital infusions to aid its member banks. The Atlanta Fed believed that it had to limit bank failures to prevent a fire sale of

cotton collateral that would precipitate a general panic. In this previously unknown episode, the Federal Reserve Board applied considerable pressure on the Atlanta Fed to adhere to its policy and follow a simple Bagehot-style rule. The Atlanta Fed was vindicated when the shock to cotton prices proved to be temporary, and the Board conceded that the Reserve Bank had intervened appropriately.

Yea – FED decided to reign inflation in 1920 but little Stevie thought the FED never existed and was two years off as to demand restraint as this ignorant twit thought it was 1918 rather than 1920. Of course little Stevie told us two years ago we were already in a massive recession. Yea – little Stevie is as dumb as it gets.

What Happened to the US Economy During the 1918 Influenza Pandemic? A View Through High-Frequency Data (REVISED July, 2020) By François Velde, Federal Reserve Bank of Chicago Working Paper, No. 2020-11, April 2020

https://www.chicagofed.org/publications/working-papers/2020/2020-11

A very good discussion detailing how the US economic behaved in 1918 and 1919 from someone who works for the FED and knows it existed back then unlike our resident moron Princeton Steve. The adults here might want to read some real research since we are all tired of the Know Nothing bloviating from Stevie pooh.

BTW turn to page 34 on how the FED (which Stevie pooh claims did not exist) was accommodating the large Federal deficits, which sounds a bit inflationary to me. But of course Stevie says otherwise base on his usual display of complete ignorance of the facts.

The Federal Reserve’s Role During WWI

August 1914–November 1918

https://www.federalreservehistory.org/essays/feds-role-during-wwi

OK Princeton Stupid Steve told us that the FED did not exist back then but someone at the FED wrote this noting the role of monetary policy during WWI and the period after it. Not exactly what Princeton Stupid Steve claimed but come on – when has this troll got anything right?