CPI comes in above consensus, on both headline and core. Instantaneous inflation (per Eeckhout (2023)) has a slight uptick.

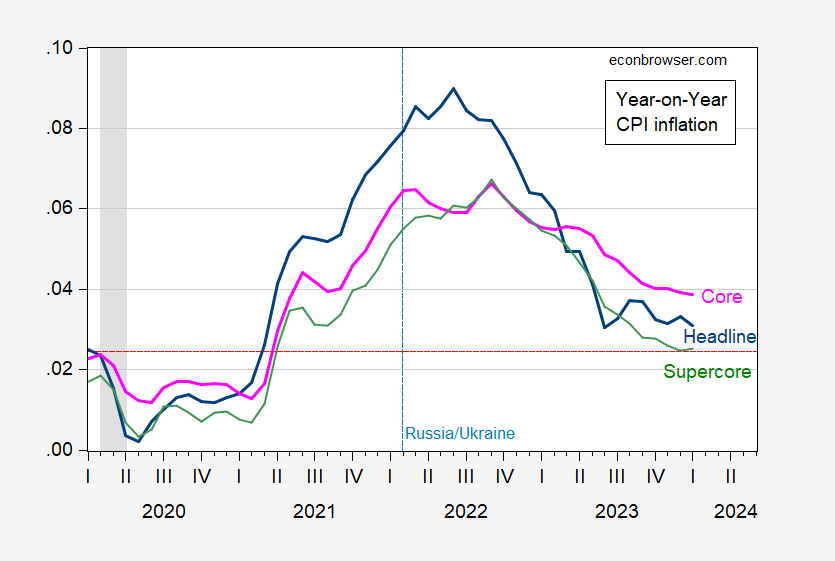

Figure 1: Year on Year CPI inflation (blue), core CPI inflation (pink), supercore CPI inflation (green), %, decimal form. NBER defined peak-to-trough recession dates shaded gray. Red dashed line is implied CPI inflation rate consistent with 2% PCE inflation rate. Source: BLS, NBER, and author’s calculations.

Supercore CPI includes all items less food, shelter, energy, and used cars and trucks.

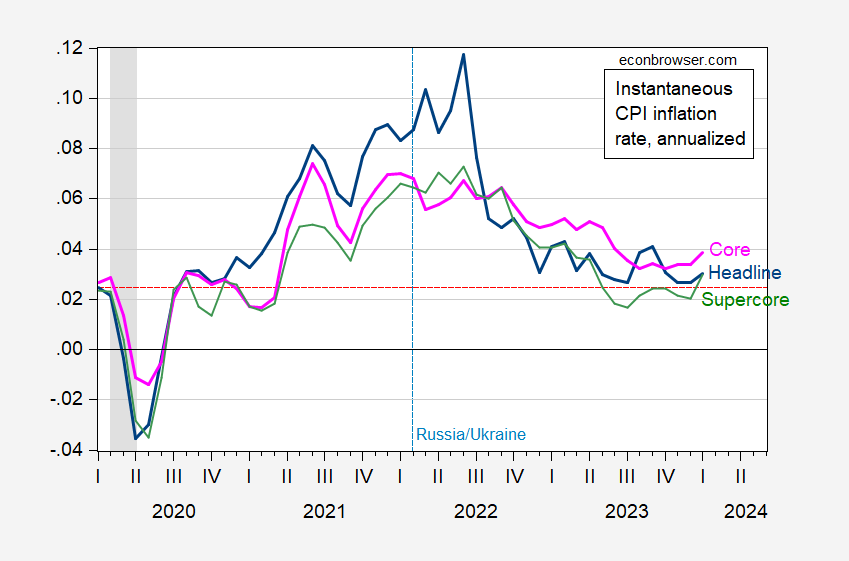

While the year-on-year inflation rate is convention, it upweights the distant past rendering it sensitive to including or excluding initial month’s CPI. For an alternative measure which shows some kind of trend, I show instantaneous inflation for the same categories, using Eeckhout‘s formula (T=12, a=4).

Figure 2: Instantaneous CPI inflation (blue), core CPI inflation (pink), supercore CPI inflation (green), %, decimal form, per Eeckhout (T=12, a=4). NBER defined peak-to-trough recession dates shaded gray. Red dashed line is implied CPI inflation rate consistent with 2% PCE inflation rate. Source: BLS, NBER, and author’s calculations.

Note that by headline CPI inflation, we’re close to the Fed’s target; that’s true also for supercore.

Some of the surprise was driven by owner equivalent rent, which suggests that upward pressure on inflation might be more persistent, given the rebound in house prices.

Related to Menzie’s last sentence of the post. This is from late January. I may not subscribe to all of his thoughts, but I still think it’s a pretty good breakdown:

https://numbernomics.com/housing-sector-poised-for-a-rebound/

Excellent link. Affordability is the key to home sales. I doubt any rebound in house prices is going to be substantial or last long. The link suggests that y-o-y price increases are below inflation. Not sure what their methodology is, but detecting changes in house prices is notoriously difficult. One of the confounders that may play a role currently is that the higher income groups may be better able to deal with low affordability, so that sales will skew towards that group. Another is that individuals/family members that would usually have purchased their own, may get discouraged and pool together for a shared higher priced home. With the Fed potentially stalling at current rate levels, some buyers may jump in from the sidelines knowing that they can always refinance later – but improvements in affordability may slow down if rates stay up. The crystal ball seems dusty with greasy fingerprints.

This article getting some social media attention:

https://www.axios.com/2024/02/12/how-biden-botched-border

On Susan Rice: “But even many of her critics credit her with taking on more responsibility on the border at a time when most other top Biden officials were shying away from it.”

On Susan Rice: “Rice referred to Becerra as a ‘bitch-ass’ and privately called him an ‘idiot,’ according to multiple sources.”

“During one meeting when Biden was tearing into Becerra, Rice passed Mayorkas a note that read: ‘Don’t save him,’ according to two people familiar with the meeting.”

“Rice appeared to others to take pride in being more informed on the border than Harris.” <<—Well, I'm shocked.

I'm putting bold print on the following for both Professor Chinn's benefit and the late Barkley Rosser's benefit:

“Since Rice left her position last year, the new head of the Domestic Policy Council — Neera Tanden — has been less engaged on the border.” Oh Wow, another “shocker”.

And Barkley Rosser had me thinking Hillary Crony and Arab sheikh extortionist/beggar Neera Tanden was going to be 21st century’s “Technocrat of the Century”. I thought a Juris Doctor holder would be a “problem solver”?? Miss Tanden lost her special powers when kicked downward from Oval Office “gatekeeper”?? Wow…… Hmmm, shall we rank this as #FAIL for the “go getter/Juris Doctor/HillaryCrony???

https://econbrowser.com/archives/2020/11/the-new-economic-team#comment-245350