From BOFIT, on 16 February 2024:

PRELIMINARY FIGURES SUGGEST SURPRISINGLY ROBUST RUSSIAN GDP GROWTH IN 2023

last week released its preliminary 2023 data, which showed that Russian GDP grew by 3.6 % in 2023. Growth was clearly higher than either international or Russian forecasters had expected. For example, the most recent forecast published by the Central Bank of Russia (CBR) last November estimated GDP would grow by about 2.5 % in 2023. The forecast update published by the International Monetary Fund (IMF) in late January said growth likely reached 3.0 % in 2023.

This year, Rosstat also released unusually rapidly a breakdown of GDP contributions on the demand and supply sides. Information on exports and imports, however, remained quite limited, making it more challenging to interpret the GDP data. While there are no clear indications of extensive and systematic statistical manipulation, the uncertainty surrounding the data and its inconsistencies have increased. We can be fairly sure that the Russian economy grew last year, but any specific growth figure should be taken with a high degree of caution.

DOMESTIC DEMAND DRIVES GROWTH AND SUPPORTS WAR INDUSTRY

Increased domestic demand was the driver of GDP growth. Preliminary figures show that public consumption rose by 3.6 % last year, i.e. the biggest gain in the history of current GDP reporting starting in 1996. Household consumption bounced back strongly from its dip in 2022. Fixed investment growth reportedly climbed by 10.5 % last year and inventory growth turned substantially positive. The foreign trade components are published only in current prices, which makes it difficult to capture the impacts of price changes. Russia’s isolation from the global economy is, however, evident in the decline in the share of exports, which corresponded to just 23 % of GDP last year – the lowest level in the current GDP statistical series starting in 1996.

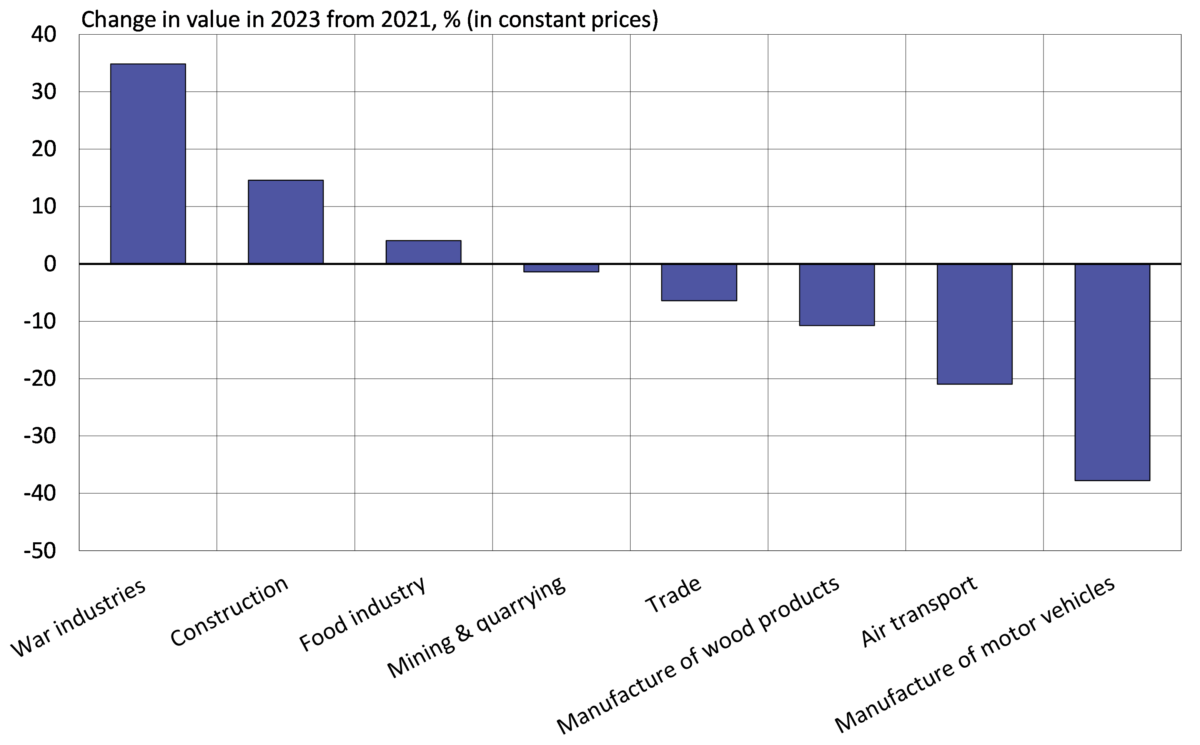

On the supply side, increasing domestic demand has fuelled growth in industries linked to the war effort, construction and retail sales. Industries serving the war effort and the construction industry have grown rapidly during the past two years and their 2023 output figures were much larger than in 2021. Manufacturing growth, in particular, has relied largely on war-related industries. Output of manufacturing branches contributing to the war effort last year were up by roughly 35 % from 2021, while other manufacturing branches as ana aggregate were down by 0.4 %. Even with economic recovery, many industries such as car manufacturing and air transport last year experienced output well below pre-war levels.

Russia’s GDP growth has been led by war-related manufacturing industries and construction sector

Note: War industries is a proxy measure consisting of manufacturing branches linked to the war effort (manufacturing of fabricated metal products, electronics and other transport equipment).

Sources: Rosstat, BOFIT.

OUTPUT GROWTH CONTINUES TO SLOW

Monthly data suggest that output growth has slowed in recent months. Industrial output, retail sales and other services have remained flat for many months. Only construction appears to have showed sustained growth at the end of last year.

…

Recent forecasts see Russian GDP growth slowing this year. The CBR released its new forecast today and expects GDP to grow 1-2 %. The IMF forecasts GDP growth of 2.6 % and the OECD 1.8 %. The Consensus Economics average of forecasts released in January anticipated growth of 1.7 % this year.

From Mark Sobel, US OMFIF Chari, formerly US Treasury, 12 February, in “Russian economic ‘resilience’ is not what it seems”

Don’t overestimate the size of Russia’s economy

Russia’s war footing and the associated fiscal expansion is a clear driver of the economy’s current solid activity. According to draft plans from the government, Russia is increasing real military spending this year by almost one-third, accounting for over a third of spending and around 7% of gross domestic product.

But one should not overstate the economy’s size and vigour. As a share of the global economy, Russia has fallen in purchasing power terms from nearly 4% before the 2008 financial crisis to under 3% (and using market exchange rates to now well under 2%).

Oil proceeds are a crucial revenue source. Russian officials have indicated that Brent crude should be $85 per barrel in 2024. However, Brent has traded below that level so far this year. Moreover, Urals oil trades at a significant discount to Brent, and there is enormous opacity surrounding the discounted price Russia receives as it is highly dependent on deals with China and India.

US and G7 efforts to reinforce the oil price cap and curtail sanctions evasion (for example by Greek tankers) will also impact revenue. They unfortunately have not hurt the Russian economy anywhere near as much as desired.

While Russia should be able to easily finance its deficit, several costly macro factors come into play. Inflation is elevated and the central bank is maintaining high interest rates in the light of the outlook for prices. That will erode real incomes and crimp investment. The ruble will on average weaken as currency depreciation generates more rubles for the budget. The currency would in all probability weaken much further were it not for capital controls. Russia also will presumably draw down on the National Wealth Fund.

More generally, the Russian economy can be increasingly characterised as a system of energy production financing surging military spending, with little innovation elsewhere in a society already well behind others on the technological frontier. But, of course, the reliability of economic data should always be taken with a pinch of salt, and especially Russian economic data in the current circumstances.

Geopolitical vulnerability

Russia’s growing dependence on China, India, Iran and others is a vulnerability beyond energy market developments. India is strengthening relations with the US. China wishes to maintain strong export ties to the US and Europe. Notwithstanding cheap energy, China and its firms will be cautious in their Russia dealings, fearing that they might run afoul of US sanctions, especially those that could block access to the US financial system.

In the meantime, Russia’s human capital is being sharply eroded. The death of soldiers (estimates suggest over 300,000 soldiers killed or badly wounded) and an enormous brain drain (estimated up to 1m, the bulk of whom are young and well educated) are imposing a huge loss of human capital and reportedly straining labour markets. These factors will harm Russian productivity well into the future.

Western sanctions on technology, even if significantly circumvented because of transshipments and other leakages, are hurting the economy. Reports abound about the lack of spare parts – for example, the difficulties in fully keeping Russian airplanes afloat. Russia will also face difficulties developing many energy fields without western services.

The opportunity cost of the war footing is also seen in the numerous reports of burst pipes and the loss of winter heating throughout Russia as basic infrastructure needs go unmet.

See also Martin Sandbhu in FT (Feb 11).

Here’s my August blogpost attempting to determine what growth ex-military spending would look like in 2023.

“On the supply side, increasing domestic demand has fueled growth in industries linked to the war effort, construction and retail sales. Industries serving the war effort and the construction industry have grown rapidly during the past two years and their 2023 output figures were much larger than in 2021. Manufacturing growth, in particular, has relied largely on war-related industries. Output of manufacturing branches contributing to the war effort last year were up by roughly 35 % from 2021, while other manufacturing branches as ana aggregate were down by 0.4 %. Even with economic recovery, many industries such as car manufacturing and air transport last year experienced output well below pre-war levels.”

How dare BOFIT bring up “guns and butter”. Putin’s favorite troll is about to have a fit that guns and butter only applies to the US.

Russia to hold interest rates at 16% after months of tightening: Reuters poll

https://www.msn.com/en-us/money/markets/russia-to-hold-interest-rates-at-16-after-months-of-tightening-reuters-poll/ar-BB1i9s2M

MOSCOW (Reuters) – Russia will hold interest rates at 16% on Friday after 850 basis points of rate hikes in five meetings since July, a Reuters poll showed on Monday, with economists divided over the signal the bank will give to the market. Widespread labour shortages, rouble weakness, strong credit growth and high government spending all contributed to stubborn price pressure in 2023, when annual inflation reached 7.4%, following on from an 11.9% reading in 2022.

Military Keynesianism tends to raise real interest rates. These data suggest a real interest rate in excess of 8%. Yea I’m using a very conventional metric known to all of us since 1907 (Irving Fisher’s A Theory of Interest).

For some stupid reason the world’s worst consultant (Princeton Steve) insists that the 16% nominal interest rate must mean 15% inflation as he is under the weird impression that real rates cannot be much more than 1% in Russia. He claims he is using the Taylor Rule to come up with such stupid notions but it is clear that Stevie has no clue what the Taylor Rule even is.

“Russia to hold interest rates at 16% after months of tightening: Reuters poll”

according to ponzi johnny, this is GREAT for the russian population. they should keep it here forever. why in the world would they want to drop such rate and punish the saves in russia? obviously a 16% interest rate is a sign of a very strong and robust economy in russia that should benefit the country for at least the next decade.

baffling…before you commented, did you bother to check how the Russian economy is doing with 16% interest rates? May I remind you that Russian GDP grew 3.6% in 2023 and is forecast to grow 2.6% this year? Since you are a supporter of endless war and low interest rates, do you actually want Russia to lower interest rates and–according to your theory–have the economy perform even better?

https://www.rferl.org/a/russia-imf-economy-forecast/32798488.html

BTW Russian real wage increases also beat inflation in 2023, even with high interest rates.

https://www.msn.com/en-us/money/markets/salaries-in-russia-rose-by-over-7-last-year-further-showing-how-the-war-is-boosting-the-countrys-economy/ar-BB1iv7QA

In case you hadn’t noticed, Western propaganda–essentially wishful thinking–repeatedly underestimates Russia, the Russian economy and its resilience…and not just by a little bit! Two years ago, one fellow here stated that the Russian economy was slated to contract by 30%! A year ago another deluded fellow declared that “A Total Russian Collapse is Surprisingly Close!!!” https://richard-kemp.com/2023/03/02/a-total-russian-collapse-is-surprisingly-close/ Then he declared that “Putin is Terrified of Ukraine’s Counteroffensive!!! https://richard-kemp.com/2023/05/31/putin-is-terrified-of-ukraines-counteroffensive/ And another fellow declares that Russia is little more than a Potemkin Village!!! A year ago Rand claimed that “, over the longer term, Russia does not have the capacity for a long war in the face of economic sanctions. Although Russia can continue to generate revenue from oil and gas exports, it does not have the ability to manufacture advanced weapons or even sufficient materiel to keep the Russian army fielded.” https://www.rand.org/pubs/research_reports/RRA2033-1.html

Such propaganda/wishful thinking is characteristic of all of the US’ pointless and futile quagmires. The question is, “why delude the public?” Well, the answer is surprisingly simple: to maintain public support and war funding, the foreign policy blob needs to give the public the impression that it has invested in a successful venture, not throwing good money after bad, when that is what they are actually doing. And then they leave it to the news media and to the neocon echo chamber to constantly hammer the wishful thinking home. T

As Patrick Armstrong, an analyst who served in the Canadian embassy in Russia for 15 years, notes “I have written many times on this site about bad Western intelligence and the unending stream of nonsense spewed in the West about Putin. Indeed, if there is one big theme of my website it’s that the Western view of Russia and Putin is almost completely false. In a word, Russia is much much stronger, in every way, than the Western establishments thought it was. This is all being revealed in Ukraine right now: the Western “experts” were all wrong.”

https://patrickarmstrong.ca/2023/12/30/listen-to-what-hes-saying/

The real danger is that policy makers end up believing their own propaganda…unnecessarily prolonging the carnage, devastation, and wasteful spending of their pointless and futile wars, which, as I said, is a feature of US foreign policy, not a bug.

“baffling…before you commented, did you bother to check how the Russian economy is doing with 16% interest rates?”

ponzi johnny, if you really believe that a 16% interest rate signals a strong and healthy economy, you are a bigger idiot than you play on this site.

you continue to defend an immoral and illegal war perpetrated by Russia on the peaceful people of Ukraine. no matter how you try to spin things, that is a fact that cannot be overcome with your lies and misinformation. putin is simply a treacherous murderer. and you adore him. I fully support Ukraine standing up to putin. and am willing to offer unlimited resources to Ukraine so that evil people like putin are defeated.

“The wage rise is due to a labor shortage tied to the war and an exodus of workers.”

Jonny boy forgot to mention the SECOND bullet point in his own link. Jonny boy also forgot to tell us the wages in Russia are FAR lower than wages in the US or Germany.

Yea – Jonny boy may be serial liar but his lies are dumber than retarded rocks.

https://tradingeconomics.com/russia/wage-growth

Russia Real Wage Growth

I knew that there has to be a reason why you only mentioned real wages during 2023. Could it be the fall in real wages during early 2022.

This is the same Jonny boy you tried to tell us UK real wages rose under Cameron. No they initially fell a lot but did have a single year when they only partially recovered.

Jonny boy – once a liar, always a liar. n

https://tradingeconomics.com/russia/wage-growth

Russia Real Wage Growth

I knew that there has to be a reason why you only mentioned real wages during 2023. Could it be the fall in real wages during early 2022.

This is the same Jonny boy you tried to tell us UK real wages rose under Cameron. No they initially fell a lot but did have a single year when they only partially recovered.

Jonny boy – once a liar, always a liar.

Cheney warns of Republican Party ‘Putin-wing’ after Navalny death

https://www.cnn.com/2024/02/18/politics/liz-cheney-navalny-putin-gop-cnntv/index.html

GOP former Rep. Liz Cheney on Sunday warned of a Republican Party “Putin-wing” after former President Donald Trump responded to the death of outspoken Kremlin critic Alexey Navalny without actually mentioning him or Russian President Vladimir Putin. “We have to take seriously the extent to which you’ve now got a Putin-wing of the Republican Party. I believe the issue this election cycle is making sure that the Putin-wing of the Republican Party does not take over the West Wing of the White House,” Cheney told CNN’s Jake Tapper on “State of the Union.” President Joe Biden and Trump struck dramatically different tones in their respective responses to the death of the jailed Russian opposition figure. Biden, in his comments at the White House following the announcement of Navalny’s death, forcefully pinned the blame on “Putin and his thugs.” “Make no mistake: Putin is responsible for Navalny’s death. Putin is responsible. What has happened to Navalny is yet more proof of Putin’s brutality. Nobody should be fooled,” Biden said. Trump, meanwhile, said nothing directly about Navalny in a post that his campaign said was his official response to the opposition leader’s death – instead posting more than 20 times about a variety of topics including his criminal cases and his political opponents. “When you think about Donald Trump, for example, pledging retribution, what Vladimir Putin did to Navalny is what retribution looks like in a country where a leader is not subject to the rule of law,” Cheney said Sunday.

It is as if Trump was happy that Navalny was murdered. Well Trump is not alone – JohnH has made it clear that he celebrates the murder of Navalny.

Cheney isn’t the only one calling them out as either Russian-aligned or the Putin wing. I have seen more and more references to the Russian-aligned Representatives and Senators. That will eventually sink in. Fast enough to save Ukraine and keep Putin from wounding Russia so badly through this endless war that its empire dissolves? Maybe, maybe not.

Military spending is a stimulus. It shouldn’t surprise anybody that Russia’s economy appears to be growing now. What they produce is all getting burned up in their war on Ukraine. Things will get far, far uglier when the war ends. I do not expect the Russian empire to survive long after this is over.