Some recent items: papers by Chinn, Frankel and Ito and Kamin and Sobel; talk by Mark Copelovitch on Tuesday.

By Chinn, Frankel, and Ito (2024), updating Chinn and Frankel (2007, 2008), on the central bank reserve aspect:

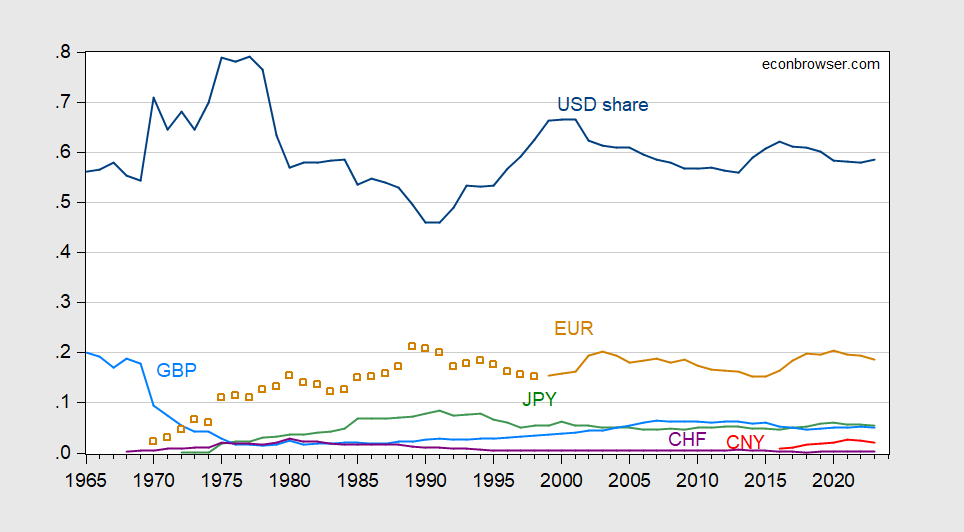

Figure 1: Central bank holdings of foreign exchange, by currency. 2023 value is for Q3. Source: Chinn, Frankel, Ito (February 2024).

Below is a list of some of the sanctions imposed by the US and other G7 countries on Russia since it invaded Ukraine:

- Financial sanctions

- Freezing $300 billion in Russian international reserves

- Prohibiting US/Russia transactions in IMF SDRs

- Removal of prominent Russian banks from SWIFT

- Freezing US assets of some Russian banks

- Prohibiting US institutions from process Russian debt payments

- Trade restrictions and export controls

- Oil price cap

Not all of these sanctions depend on the dominance of the dollar in the international financial system, but many of them do. In particular, actions that cut Russia off from dollar transactions or freeze its dollar assets can exert material harm on its economy, and are a helpful complement to other US and Western diplomatic and strategic instruments.

Some critics have complained that such a “weaponization” of the dollar by the United States risks diminishing the dollar’s dominance by pushing countries to use other currencies in order to evade the sanctions. Financial sanctions have increasingly been used by Administrations, particularly in the wake of 9/11. Policymakers view financial sanctions as a strong and useful ‘stick’, short of warfare, that complements the ‘carrot’ of diplomacy. Recourse to excessive or abusive use of financial sanctions could accelerate foreign propensity to use alternatives to dollars – for example, Europe’s effort to build an alternative payments mechanism in the wake of US abandonment of the Joint Comprehensive Plan of Action against Iran.

But again, America’s extensive alliance structures significantly mitigate such a development. Moreover, when financial sanctions are imposed multilaterally in coordination with our allies rather than pursued unilaterally, and applied with restraint and only in response to egregious actions and in furtherance of strategic objectives, any adverse impact on the dollar’s financing and reserve role should be substantially minimized. In contrast, we would argue that excessive US use, if not abuse, of financial sanctions will weaken the effectiveness and ability to use this tool in the future.

In short, concerns about the use of financial sanctions significantly hurting the dollar’s stature are overstated. First, as noted above, only a small fraction of countries are likely to be motivated by sanctions to seek alternatives to the dollar. Most advanced economies have close ties with the United States, either through political/military arrangements such as NATO, through largely economic arrangements such as the G7 or the OECD, or through shared values such as respect for democratic norms. Many emerging markets and developing countries also have close political ties with the United States, even if some of them choose to also maintain relations with countries that have tense relations with the “West”. Finally, for all of these countries, the enormity of the US economy as a market for goods, services, and investment cannot be underestimated. Very few countries would be prepared to run the risk of losing significant access to the US market. These considerations both buttress the effectiveness of US sanctions and ensure that use of these sanctions will not jeopardize the dominance of the dollar.

Mark Sobel on video at UW Madison, back in April.

My colleague Mark Copelovitch (on leave, at American Academy in Berlin) has a talk on the dollar’s role on Tuesday.

The Atlantic Council has a “Dollar Dominance Monitor” if you want to see up-to-date figures. Other views: CFR in July, Eswar Prasad in 2022. Jeffrey Frankel on “Dollar Rivals” (2023) . JP Morgan on dedollarization (August). My January look at BRICS dollar vs. RMB holdings. Friendshoring in reserves, from OMFIF (August).

The ECB’s the international role of the euro (June).

PIIE’s “Floating at 50” conference, April 2023.

Senator Theoden, on the use of economic sanctions as a threat to dollar’s role as an international currency. (Senator Theoden on Navalny’s death: null set (as of 3pm CT today)).

“Echoing Putin’s talking points, Johnson also baselessly claimed U.S. economic sanctions against Russia threaten the supremacy of the U.S. dollar by forcing Russia to trade with foreign currencies.”

I get RonJon says a lot of stupid things but this just takes the cake. Put aside the currency nonsense. Does this fool know that we only export $7 billion worth of goods (cars mainly) to Russia? Somehow I doubt GM or Ford are worried. Yea we imported about $27 billion in oil in 2021. Like the US cannot get energy supplies without Putin? Seriously?

In other words, making use of U.S. (and allied) power risks a loss of U.S. power. So the point of all the effort and expense of alliances and institutions is to have the potential for action, but never to use that potential? Seems like an awful waste of effort and expense. Reluctance to use power in support of our principles amounts to an abandonment of our principles and a loss of power. Sounds like Johnny’s agenda.

What principles of the U.S. demand defense 6000 miles away from US?

If it is sanctity of nation states I would say look at Iraq, Afghanistan, Syria, Libya…..

I guess you never heard of Hitler.

pgl: I suspect he has. And I suspect he admires him, too.

Is this our Menzie stalker?? Earnest question.

I decided to check the comments to “Senator Théoden* on Funding Ukraine”.

Right on cue Putin’s pet poodle JohnH was rehashing the same trash we get from Tucker Carlson, Senator Théoden, and of course Donald Trump – Putin’s number one pet poodle.

Raw data: The ups and downs of egg prices

https://jabberwocking.com/raw-data-the-ups-and-downs-of-egg-prices/

Kevin Drum has an interesting way of showing how the relative price of eggs has evolved over the last 12 years. The recent spike was due to the bird flu which also impacted us during the second Obama term.

I can see it now – Trumpian trolls saying no bird flu in between was because Trump was such a tough guy. Heck he even started a stupid trade war just to keep egg exports down!

https://www.msnbc.com/morning-joe/watch/trump-makes-his-first-public-comments-about-navalny-but-mostly-they-re-about-him-204475973644

Trump finally mentions Navalny’s death saying only that the prosecutions of Trump is destroying America. Yea Trump is one pathetic self absorbed price of trash.

China’s homegrown passenger jet makes international debut

https://www.cnn.com/2024/02/19/business/china-comac-c919-international-debut-intl-hnk/index.html

Beijing’s C919 airliner, a potential rival to Western-made Boeing and Airbus planes, made its first foray outside Chinese territory on Sunday by staging a flyby at the Singapore Airshow. The single-ais le jet, manufactured by the state-owned Commercial Aircraft Corporation of China (Comac), is a prominent symbol of Beijing’s broader “Made in China” strategy, which aims to reduce reliance on foreign manufacturers. China calls the C919, which can carry just under 200 passengers, its first large homegrown passenger jet. The aircraft took to the skies for its first commercial flight last May. It s certified to carry passengers only within mainland China and flies with China Eastern Airlines. This is “the first time we will be having exhibitors from China,” Cindy Koh, executive vice-president of Singapore’s Economic Development Board, one of the airshow’s organizers, told reporters Sunday. China has made no secret of its ambition to eventually compete against Boeing (BA) and Airbus (A BNB). The C919’s overseas debut comes at a time when Boeing is making headlines for all the wrong reasons. Last month, part of the fuselage of a 737 Max 9 Boeing plane fell off during an Air Alaska flight in the United States. Shukor Yusof, founder of Endau Analytics, a firm that tracks the aviation industry, said the C919 would be “the most scrutinized aircraft at the Singapore Airshow,” an event that draws company executives and high-ranking government officials from around the world. “There is a lot of interest to see the actual aircraft, how it performs and how it is in flight,” he said.

That Boeing and Airbus have some real competition is a good thing.

MAGA’s Violent Threats Are Warping Life in America

https://www.nytimes.com/2024/02/18/opinion/magas-violent-threats-are-warping-life-in-america.html

David French may be entirely correct here but the dude could have written this years ago.