…to 1% y/y [1]. Their Leading Economic Indicator edges up slightly [2]. Justin Ho discussed their brightening view on Friday’s Marketplace.

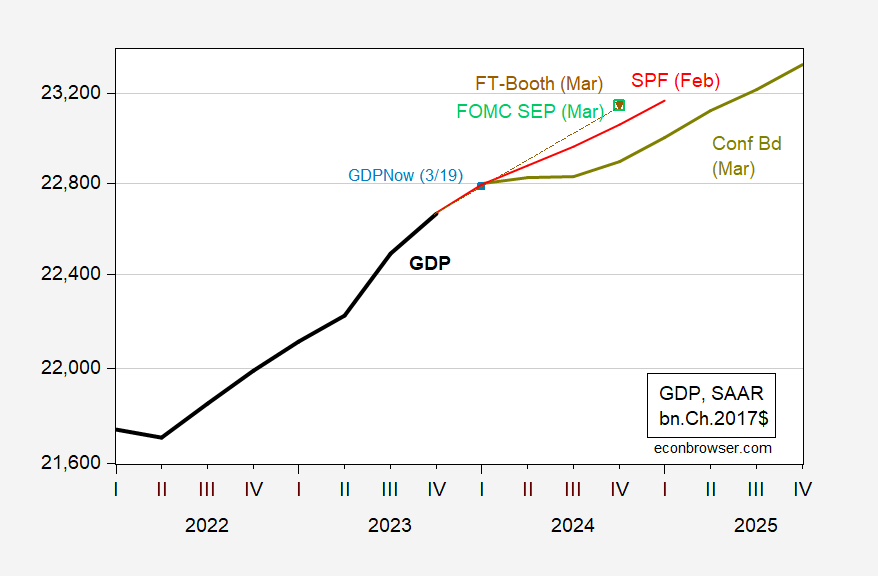

Interestingly, the Conference Board sees near zero growth in 2024Q2-Q3. This is consistent with the term spread based predictions which show a high probability of recession in 2024Q2.

Figure 1: GDP (bold black), CBO projection (blue), Survey of Professional Forecasters (red), FT-Booth median forecast (brown inverted triangle), FOMC Summary of Economic Projections March 20 (open light green square), GDPNow of 3/19 (light blue square), Conference Board as of 3/21 (chartreuse), all in bn.Ch.2017$. Source: BEA 2024Q4 2nd release, Philadelphia Fed SPF, Booth School, Federal Reserve Board, Atlanta Fed (3/19), Conference Board, and author’s calculations.

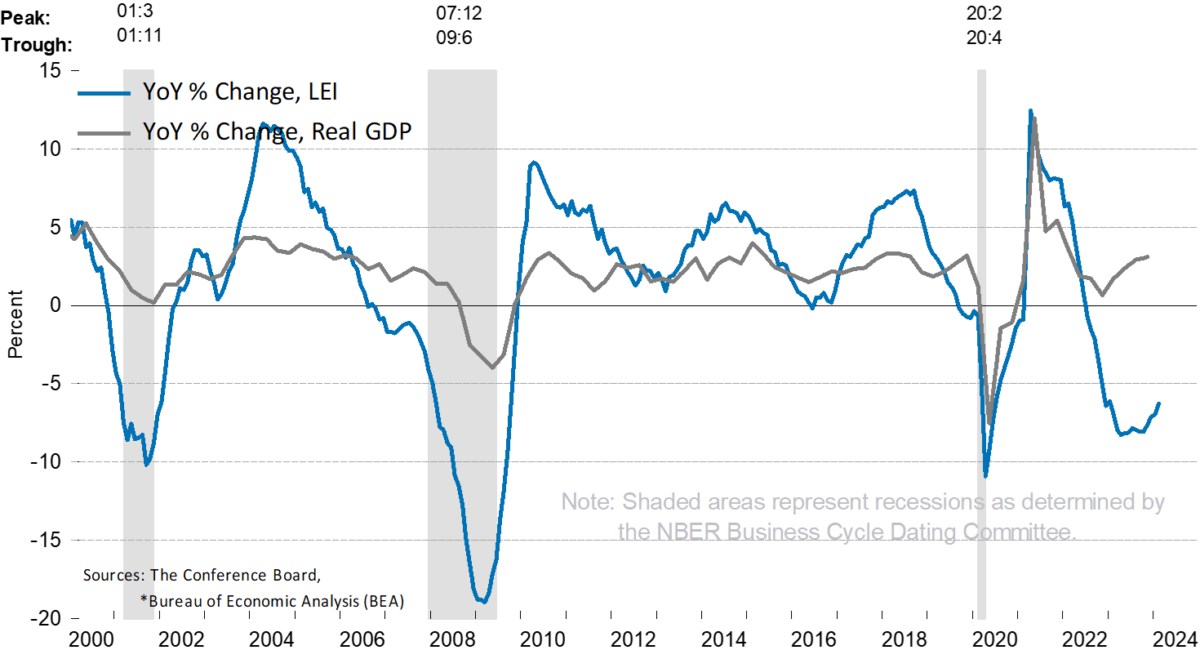

The lower path for GDP vis a vis SPF or FT-IGM survey median is likely due in part to the depressed level of their Leading Economic Indicator which only turned slightly positive in February.

Source: Conference Board.

The literature from the Conference Board indicates that LEI turning points lead GDP turning points by 7 months, so September 2024.

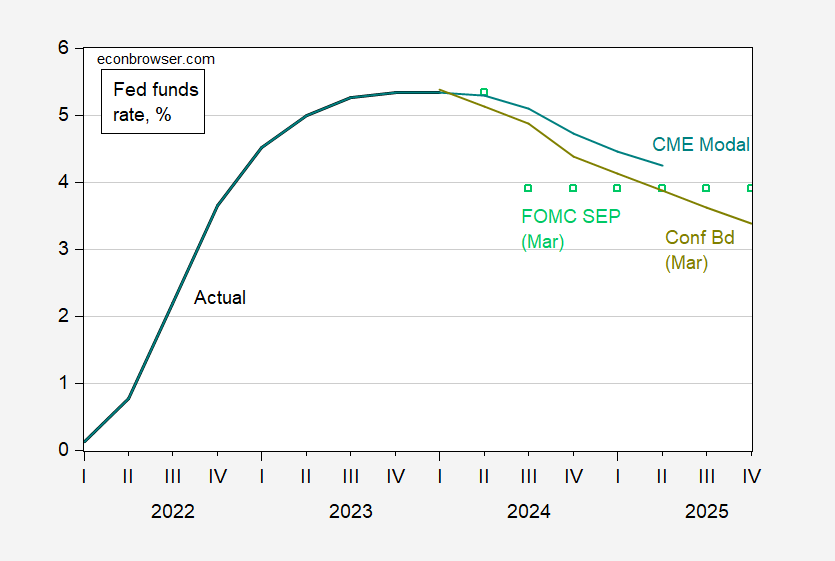

The Conference Board forecasts a lower Fed funds probably as a consequence of the lower projected growth.

Figure 2: Fed funds rate (black), FOMC March 2024 SEP (light green squares), Conference Board forecast (chartreuse), CME modal forecast as of 3/23 (sky blue). Source: FRB via FRED, FRB, Conference Board, CME, and author’s calculations.

I never thought my thinking will go this way, but I am becoming more and more cynical about the term spread. I think Fed moves (and other free market factors) can change the results that would be assumed in prior contexts. I’m not predicting the curve will be wrong, I would just say I am much less confident about it’s predictive qualities than in prior years.

I remember in my very early teens I could not understand anyone who likes Ozzy Osbourne music, then eventually in my early 20s I started to like Ozzy music. So….. I just I can’t “go to the bank” anymore on the curve inversion stuff. Not in ’24 anyway,

Just making stuff up, but if r* is higher that is conventionally thought, then a lot of other conventional thinking is also wrong. For instance:

To the extent the yield curve is inverted on anticipation on the nominal funds rate averaging 2.5% in the future, yields on longer maturities need to rise. If we enter a period of persistently higher nominal interest rates, equity yields would have to rise. Real estate yields would have to rise. Returns on capital would have to rise.

That would be quite disruptive, but that doesn’t mean it won’t prove true.

Why would r* be higher than conventionally thought? Lots of reasons; we can all make up stories. Is it likely that conventional estimates are wrong? Conventional estimates of future interest rates are commonly wrong.

Chuck Todd finally grows a spine as he blasted the hiring of Ronna McDaniel at NBC:

https://www.nbcnews.com/meet-the-press/meet-press-march-24-2024-n1309365Look, let me deal with the elephant in the room. I think our bosses owe you an apology for putting you in this situation because I don’t know what to believe. She is now a paid contributor by NBC News. I have no idea whether any answer she gave to you was because she didn’t want to mess up her contract. She wants us to believe that she was speaking for the RNC when the RNC was paying for it. So she has – she has credibility issues that she still has to deal with. Is she speaking for herself or is she speaking on behalf of who’s paying her? Once at the RNC she did say that,” Hey, I’m speaking for the party.” I get that. That’s part of the job. So what about here? I will say this. I think your interview did a good job of exposing I think many of the contradictions. And, look, there’s a reason why there’s a lot of journalists at NBC News uncomfortable with this because many of our professional dealings with the RNC over the last six years have been met with gaslighting, have been met with character assassination. So it is – , you know, that’s where you begin here. And so when NBC made the decision to give her NBC News’ credibility you’ve got to ask yourself, “What does she bring NBC News?”

Of course the real question is why did Chuck Todd not speak up earlier.