Residential or nonresidential?

This is a question brought to my attention in a conversation with Joe Schulz. Schulz subsequently outlined some of the trends in residential construction. Without hard numbers broken down to Wisconsin level (that I know of), it’s hard to say how much to apportion to residential vs. nonresidential.

Here’s one thought. What does the surge in construction coincide with? It’s not so much with housing starts as with the CHIPS Act and Inflation Reduction Act.

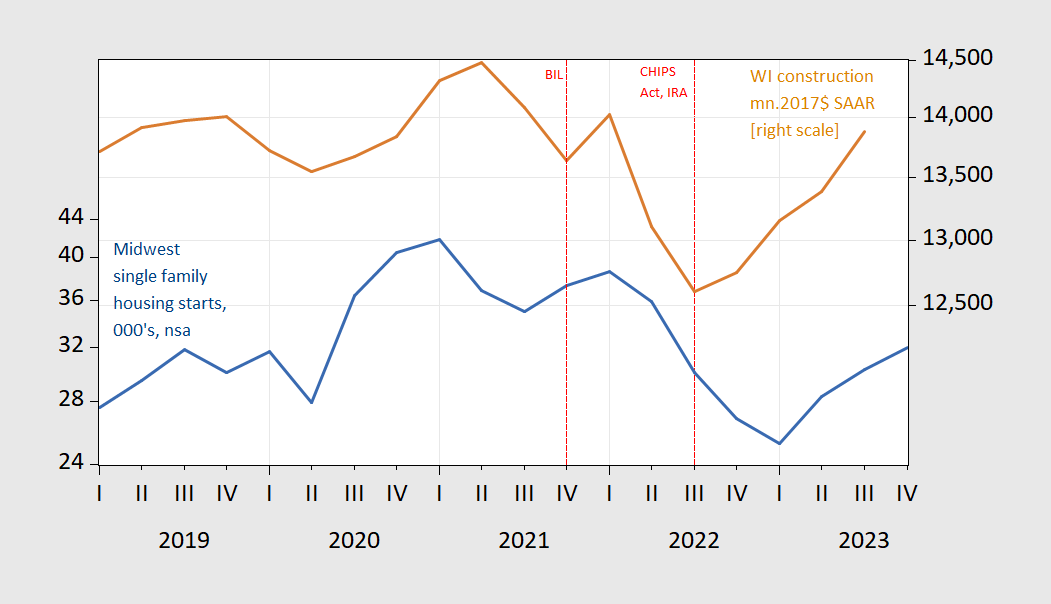

Figure 1: Midwest housing starts single family units, 000’s, n.s.a. (blue, left scale), Wisconsin construction, mn 2017$, SAAR (tan, right scale). Source: Census, BEA.

Wisconsin real construction value added jumped right after the passage of these two pieces of legislation, while housing starts don’t start rising until 2023Q2.

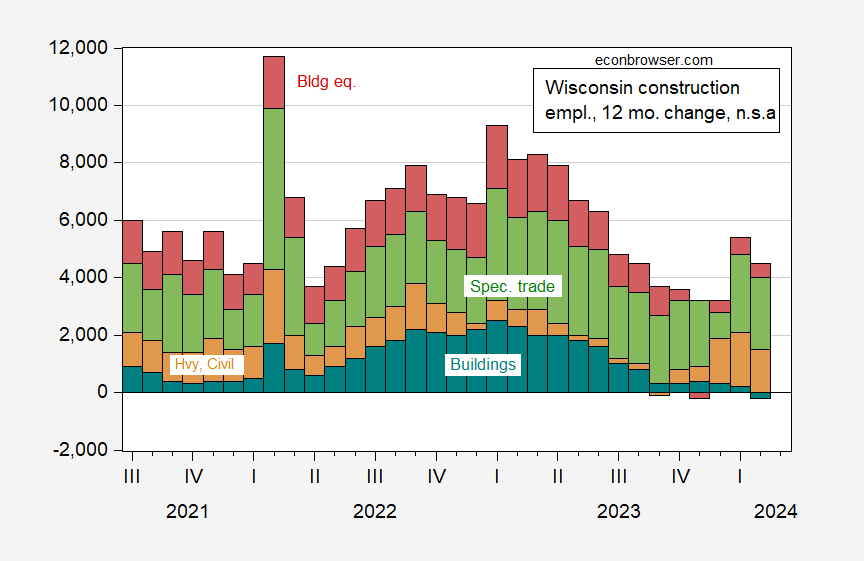

Inspection of the types of construction employment further suggests that nonresidential investment of some type is pushing employment.

Figure 2: Wisconsin 12 month employment change in building construction (teal), in heavy and civil engineering (tan), in specialty trade contractors (green), and building equipment contractors (red), not seasonally adjusted. Source: DWD, and author’s calculations.

I’d imagine heavy and civil engineering more associated with building factories and putting in infrastructure (linked with manufacturing, and with alternative energy) than residential.

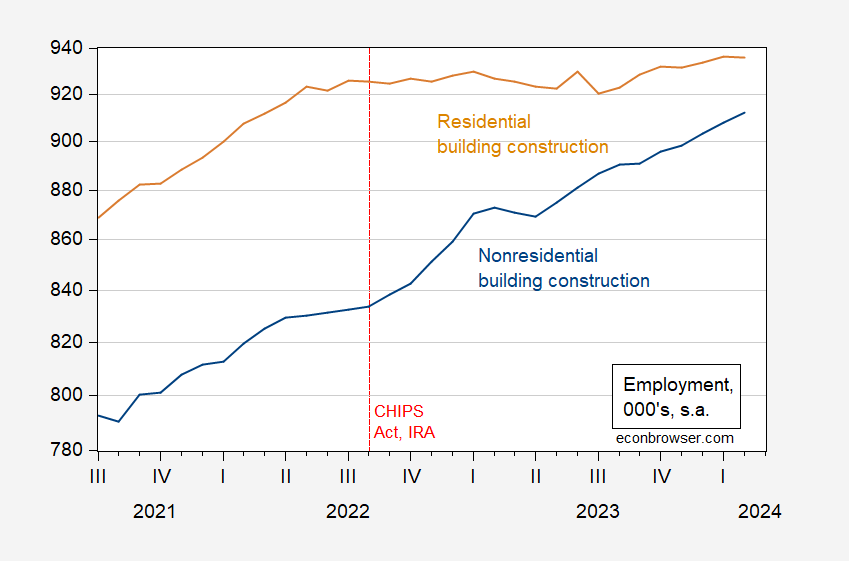

We do have a breakdown of construction workers between residential and nonresidential employment at the national level.

Figure 3: Nonresidential building construction employment (blue), residential building construction employment (tan), both in 000’s, s.a. Source: BLS via FRED.

Clearly, nonresidential construction employment is growing rapidly, while residential has only picked up since recently (4% vs. 1% y/y).

According to this site it looks like it’s mostly infrastructure. Are jails considered infrastructure?

You’re probably thinking of “incarceration structure”, a related category.

This is what the Federal government has to say about the benefits and costs of the Inflation Reduction Act. Not sure how or if the actions directly affect building efforts in Wisconsin: https://home.treasury.gov/news/featured-stories/the-inflation-reduction-acts-benefits-and-costs

The Inflation Reduction Act (IRA) represents the United States’ biggest investment to date in fighting climate change. In recent months, we have considered two important economic aspects of the IRA: its role as a pro-growth policy that expands our economy while reducing greenhouse gas emissions, and its role as a place-based policy that directs climate investments to parts of the country that have been historically reliant on the fossil fuel economy and that have relatively low wages, employment, and college graduation rates.

The CHIPS Act is more specifically targeting semiconductor production: https://www.congress.gov/bill/117th-congress/house-bill/4346

Intel chooses Ohio over Wisconsin for massive microchip factory

MOUNT PLEASANT — What is billed as the largest microchip factory in the world almost came to Racine County. As with a Foxconn electric-vehicle factory before it, it’s going to Ohio instead.

Intel confirmed Friday plans to spend $20 billion to build two factories northeast of Columbus, that state’s capital, that is to employ 3,000 and to create at least 10,000 auxiliary jobs.

“Ultimately, we hope to establish the largest semiconductor manufacturing site on the planet,” Intel CEO Pat Gelsinger and Senior Vice President Keyvan Esfarjani wrote in a December letter, reviewed by USA Today, to Republican Ohio Gov. Mike DeWine.

Business has been generally recovering from the 2020 economic shutdowns, so without more specifics it may be difficult to determine if the improvement in Wisconsin’s building construction is just part of a general recovery or more associated with those two pieces of legislation. Correlation or causation?