What do households (not economists) think inflation will be in three years? I use the deviation of forecast from target as a proxy measure for credibility regarding inflation.

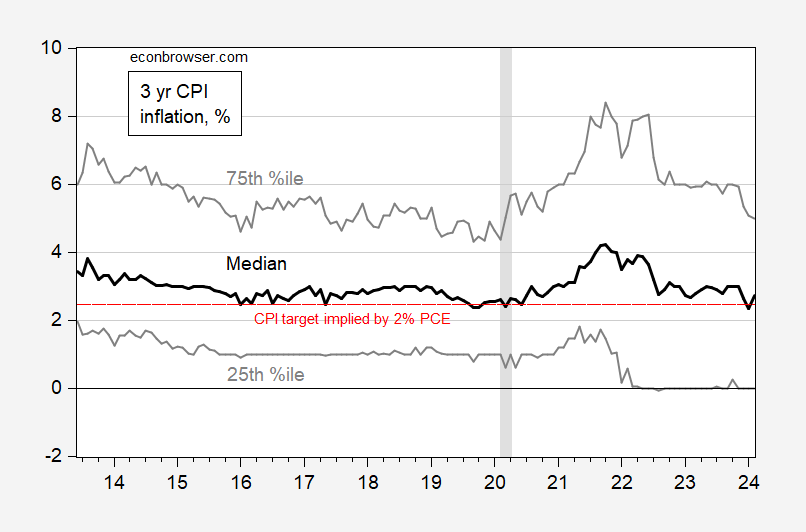

Figure 1: Median 3 year CPI inflation forecast (black), 25th, 75th percentile (gray), in %. CPI inflation consistent with 2% PCE inflation target (red dashed line). NBER defined peak-to-trough recession dates shaded gray. Source: NY Fed, NBER, and author’s calculations.

As of February 2024, the inflation rate expected 3 years out is lower than it was in January 2021. While expected CPI inflation has declined, dispersion of forecasts has increased slightly.

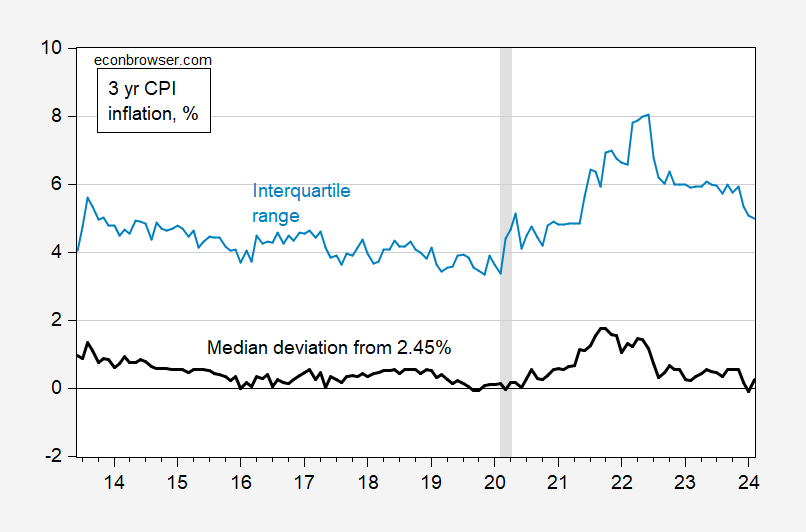

Figure 2: Median 3 year CPI inflation forecast deviation from CPI inflation consistent with 2% PCE inflation target (black), interquartile range (sky bule), in %.. NBER defined peak-to-trough recession dates shaded gray. Source: NY Fed, NBER, and author’s calculations.

Maximal uncertainty, as measured by the interquartile range in 3 year inflation was reached in mid-2022. It’s now dropped to to rates last seen at the exit from the pandemic-induced recession.

Note that some have questioned the use of the earlier framework, pre-New Monetary Strategy laid out in August 2020 (see here for one reader’s critique). I’ll note that as far as I can tell, market commentators are still using the target in the old sense of the word (a sense that seems buttressed by Papell and Prodan-Boul’s recent examination of the various vintages of the SEP), rather than FAIT with, say, a 3 year window, as that would imply we should be seeing an implied target rate of deflation at about 0.8% per annum.

More about measuring credibility, see e.g. Bordo and Siklos (2017), Bicchal (2022).

Off topic – climate change:

Remember how climate change was going to bea good thing because more of the world would be warm? Turns out, that’s true, for certain deadly, antibiotic-resistant pathogens:

https://www.medpagetoday.com/opinion/second-opinions/109323

Not so much for the rest of us.

You didn’t want to live forever, did you?

As I did in comments to the linked blog post, I want to point out that the F in FAIT stands for “flexible”.

The current FOMC is mostly comprised of those who were part of the Committee when the evils of persistent, below-target inflation drove the Fed to search for a way to raise dangerously low inflation by increasing the credibility of Fed policy commitments. The idea that FAIT could involve a period of deflation, as Econned seemed to imply, is daft. A deflationary policy stance would shoot the Fed’s full employment mandate in both feet, by inducing recession and by weakening the power of monetary policy. The Fed isn’t pursuing “average inflation targeting”; it’s pursuing “flexible average inflation targeting”.

On the point of credibility, I will also repeat anearlier point. If, by credibility, we mean “knowing what the Fed pledges to do and believing the Fed will do it”, there is a problem. There is good evidence that the general public doesn’t know that the Fed has an inflation target, what that target is, that the Fed has adopted either FAIT or a Taylor rule to pursue that target, what the inflation rate is or what inflation is. Heck, some commenters here don’t seem to know the standard definition of inflation, what the “F” in FAIT means.

If, instead, we leave out the part about “knowing what the Fed edges to do”, then credibility is an easier target to hit, but that also means the adoption of any particular monetary policy regime can have little effect on public confidence beyond the public’s hazy appreciation of actual inflation performance. FAIT seems pretty much the result of specialists talking to specialists and assuming the public is listening eagerly.

Time to read Jeremy Rudd’s paper again…and reconsider the notion that consumer expectations magically result in consumers getting what they expect.

https://www.federalreserve.gov/econres/feds/files/2021062pap.pdf

A more likely relationship between consumer expectations and inflation is that the measurement and publication of consumer expectations serves as a signal for how much in the way of price increases that Corporate America can get away with.

But, as we know, most economists here think that Corporate America has little agency when it comes to setting prices, even though they are the ones who set the prices and have the means, the motive, and recently have even had a great opportunity to indulge in greedflation.

“But as we know… “ Who’s we? Are your personal pronouns now plural?? Don’t see much support here for your continued arrogance, pomposity, and outsized ego.

Maybe there’s a “we” here who knows less about economics or economists than you, but that would be difficult. CoRev is gone, and Econned is too busy throwing tantrums. and exhibiting continued adolescent behavior.

That leaves you. Singular.

Thanks for this take down of Jonny boys latest trash. To be honest I’ve grown bored of reading his incessant BS

Noneconomist–you need to pay more attention to what is said here. Where are the economists who acknowledge that Corporate America has a lot of pricing power? The silence is deafening!

Go ahead…show me the posts and comments. I recall a single a post where the host noted that corporations might have good reason to raise prices in anticipation of inflation. If companies can do that…and avoid competitive push-back …they really do have pricing power.

JohnH: https://econbrowser.com/archives/2021/04/when-us-corporate-tax-rates-reductions-last-bloomed

https://econbrowser.com/archives/2011/06/when_price_does

https://econbrowser.com/archives/2009/07/output_gap_meas

https://econbrowser.com/archives/2009/02/the_output_gap

Johnny repeats nonsense like this, no matter how many times he has been shown to be wrong. He’s a liar, plain and simple. Telling Noneconomist to pay attention is utter hypocrisy – Johnny never pays attention to anything but his own biases. “Show me this, show me that.” That’s just another cheap rhetorical trick; facts have never mattered to Johnny.

Noneconomist should enjoy this one: “Large Grocers Took Advantage of Pandemic Supply Chain Disruptions, F.T.C. Finds…The report found that some large firms “accelerated and distorted” the effects of supply chain snarls, including by pressuring suppliers to favor them over competitors. Food and beverage retailers also posted strong profits during the height of the pandemic and continue to do so today, casting doubt on assertions that higher grocery prices are simply moving in lock step with retailers’ own rising costs, the authors argued.

“Some firms seem to have used rising costs as an opportunity to further hike prices to increase their profits, and profits remain elevated even as supply chain pressures have eased,” the report read.”

https://www.nytimes.com/2024/03/21/us/politics/grocery-prices-pandemic-ftc.html

In Nonecoonomists’s view, a bona fide macroeconomist should disregard certain inconvenient factors driving inflation…

Johnny, nothing Noneconomist wrote had anything to do with whether firms have pricing power. You’re claim against him is a lie. What Noneconomist did was take you down a couple of pegs. Your resentment doesn’t change that fact.

You keep pretending that nobody here thinks firms have pricing power. That’s just dishonest nonsense.

Nobody here thinks you know anything. It’s pretty clear that most commenters here think you’re an ignorant blowhard, and every time you lie about what people here believe or where they work, you prove them right.

Sad little man.

“In Nonecoonomists’s view, a bona fide macroeconomist”

GOD – you are stupid. Hey Jonny boy – this story comes under the category of Industrial Organization (sometimes called market structure). Then again – Jonny boy does not know the difference between fields of economics. No – Jonny boy still thinks he will finally learn to tie his shoes by taking advanced basket weaving.

FTC Releases Report on Grocery Supply Chain Disruptions

https://www.ftc.gov/news-events/news/press-releases/2024/03/ftc-releases-report-grocery-supply-chain-disruptions

It took me 2 second on Google to find the actual FTC report. Most people would read the report and not some NYTimes take on it but not little Jonny boy. Why can’t you be bothered with reading the actual report Jonny boy? Oh wait – it is economics so I guess it is way over your feeble little brain.

Feeding America in a Time of Crisis The United States Grocery Supply Chain and the COVID-19 Pandemic An FTC Staff Report March 21, 2024

https://www.ftc.gov/system/files/ftc_gov/pdf/p162318supplychainreport2024.pdf

For the adults here – if you wish to read the report without the FTC’s summary. Now we know little Jonny boy will not read this as he is too dumb to understand it anyway.

Good thing, JH, that you receive only verbal spankings here. Those have scarred you enough. Anything more severe and you might sue for Economist Abuse.

And that’s on top of your daily penchant of setting fire to your pants and being a daily recipient of treatment for multiple burns from the attending economists.

BTW, while handing out advice to readRudd’s opinions, you missed his admonition to avoid the “Everybody Knows” Econ trap. “But as we know” you remain happily clueless. On purpose.

Exactly.

“A more likely relationship between consumer expectations and inflation is…” What evidence of this greater likelihood does “we” offer? None, and “we” is notoriously weak in his – excuse me – “we’s” knowledge of economics.

“But, as we know, most economists here think…” Really? I’m suspicious. I’m suspicious because “we” routinely lies about me, my views and my “affiliations”, routinely lies about the economics profession in general, and probably can’t tell us who among commenters here does or does not have a degree in economics. So it’s probably safe to assume that “we” is just making stuff up…again.

“A report found that large firms pressured suppliers to favor them over competitors.”

I guess Jonny boy did not fully read the title of his own link. This sentence refers to monopsony power rather than monopoly power. Oh wait – Jonny boy does not what either term even means. Never mind.

“But, as we know, most economists here think that Corporate America has little agency when it comes to setting prices”

Did you read Rudd’s paper? I did – Rudd never endorsed Jonny boy’s pet thesis.

But there is something more basic to your stupid rants – they are self-contradictory. Let’s take it that Jonny boy’s pet thesis is valid (never mind it isn’t). I guess little Jonny boy thinks he is SO smart that he is the only one who gets this. Even after Jonny boy repeats the same old thesis hundreds of times.

One would think professional forecasters would incorporate Jonny boy’s thesis into their forecasts. Which means what Jonny boy keeps chirping about would not lead to forecast errors. But Jonny boy claims (with no basis) that this thesis of his is why there are forecast errors. I guess Jonny boy has declared professional forecasters are stupid while Jonny boy is a friggin genius.

Never mind that almost everyone of Jonny boy’s comments here has shown to be a pack of lies chocked full of the most stupid things ever written by man.

Amadou Ba, the chosen successor of President Macky Sall, has conceded defeat in the first round of the Sengalese presidential election, even before official vote counts have been released. Opposition candidate Bassirou Diomaye Faye will almost certainly be inaugurated president.

This has happened in what defeated insurrectionist former U.S. president Trump once described as a “shit-hole country”. Both Senegalese and international observers have noted that peaceful transition of presidential power is the rule in Senegal – there has never been a coup in Senegal’s modern Democratic period.

A report cited by the FTC analysis of food prices during the pandemic:

https://www.ers.usda.gov/webdocs/publications/105558/err-314.pdf?v=3309.1

A Disaggregated View of Market Concentration in the Food Retail Industry

Eliana Zeballos, Xiao Dong, and Ergys Islamaj

January 2023

USDA Economic Research Service

Since little Jonny boy will not read this either, let me note one key portion:

Concentration in the Food Retail Industry During the Past Three Decades

Figure 1 presents the concentration ratios of the top 4 (CR4), top 8 (CR8), and top 20 (CR20) food retailers—common measurements of concentration for market power—at the national level from 1990 to 2019. Results show that the 20 largest food retailers totaled $680 billion in 2019, which accounts for 63 percent of food sales in the United States. The CR4, CR8, and CR20 ratios slightly declined in the United States after the 2008–09 Great Recession, which is consistent with Cho and Volpe (2017). However, the longer-term trend of consolidations upturned around 2012–14, with all indicators showing an increase in market concentration between 2012 and 2019. Specifically, the top 4 food retailers (CR4) accounted for 31 percent of food sales in 2012 and grew by 3 percentage points to account for 34 percent of total sales in 2019. Similar trends occurred for CR8 and CR20 (USDA, ERS, 2022B).

Of course this report is about Market Structure aka Industrial Organization. But little Jonny boy thinks this is macroeconomics. Yea – Jonny boy is a MORON.

Ponzi johnny, what is your view on communist economy? Thumbs up or down?