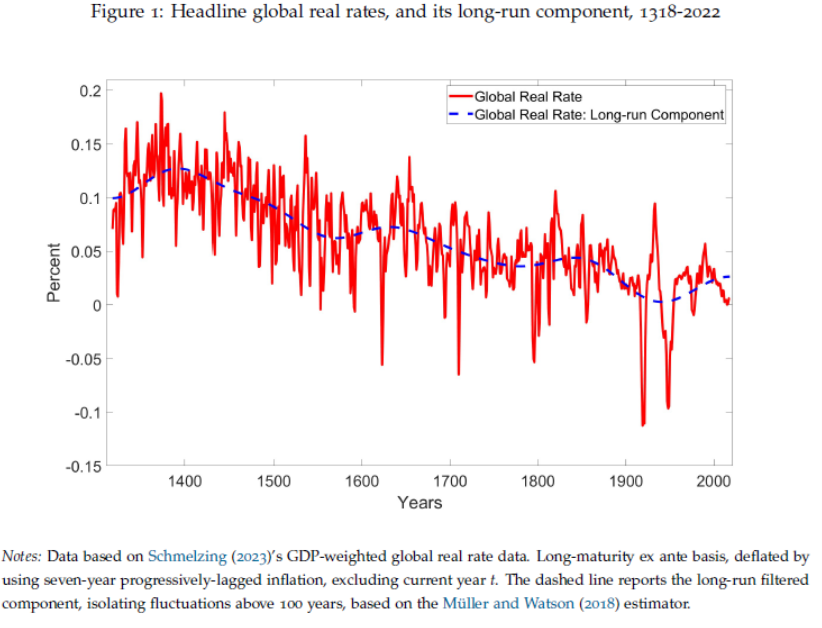

With implications for growth and demographic influences. From Rogoff, Rossi, and Schmelzing (AER, 2024):

Source: Rogoff, Rossi and Schmelzing (AER, 2024).

Contra assertions of a tight and positive link between population growth and the real interest rate, they write:

…aggregate population growth rates and real interest rates have structurally trended in opposite directions, except for the most recent decades. During major population growth shocks, the two series are positively correlated, such as during the Black Death of 1348-1351, the most dramatic demographic “rare disaster” striking advanced economies since the Renaissance – a period coinciding with a sharp plunge in global real rates: but these episodes resulting in positive correlations remain a clear exception over the long-run.

Definitely food for thought.

Paul Schmelzing is very good on interest rate history, and is often very readable. Here’s an example of his non-academic writing that is worth a look:

https://bankunderground.co.uk/2017/01/04/venetians-volcker-and-value-at-risk-8-centuries-of-bond-market-reversals/

Schmelzing cites this passage from Homer and Sylla’s “A History of Interest Rates” on one view of interest rate determination:

“Around the turn of the last century, a famous Austrian economist, Eugen von Böhm Bawerk, declared that the cultural level of a nation is mirrored by its rate of interest: the higher a people’s intelligence and moral strength, the lower the rate of interest. He was speaking of free market rates of interest, not of controlled rates of interest. In his time, market rates of interest throughout the principal trading nations of the world were historically low: 2½ to 3½% for long-term prime credits. And inflation was not then the problem that it would become in this century.”

Unless one equates population growth with moral strength, Böhm Bawerk didn’t seem to think population growth had much to do with interest rates, either. Schmelzing notes that, within a very short time after Böhm Bawerk expressed that view, interest rates in principal trading nations shot up – perhaps a lapse of moral strength.

Economists are notorious for “on the other hand”, so of course, some pretty good ones have found that demographics, or rather “demographic transitions” do affect interest rates. Fernanda Nechio, Carlos Carvalho and Andrea Ferrero, in 2016, wrote:

“We calibrate a tractable life-cycle model to capture salient features of the demographic transition in developed economies, and find that its overall effect is a reduction of the equilibrium interest rate by at least one and a half percentage points between 1990 and 2014.”

https://www.frbsf.org/research-and-insights/publications/working-papers/2016/04/demographics-and-real-interest-rates-inspecting-the-mechanism/

Nechio, Carvalho and Ferrero were studying demographic transition, while Rogoff, Rossi and Schmelzing are concerned with trends over long periods, which more or less by definition means longer than any transition. That leaves room for both to be right, but I’d like to hear the lot of them hash it out.

The demographic transition can affect the equilibrium real interest rate through three channels. An increase in longevity-or expectations thereof-puts downward pressure on the real interest rate, as agents build up their savings in anticipation of a longer retirement period. A reduction in the population growth rate has two counteracting effects. On the one hand, capital per-worker rises, thus inducing lower real interest rates through a reduction in the marginal product of capital. On the other hand, the decline in population growth eventually leads to a higher dependency ratio (the fraction of retirees to workers). Because retirees save less than workers, this compositional effect lowers the aggregate savings rate and pushes real rates up. We calibrate a tractable life-cycle model to capture salient features of the demographic transition in developed economies, and find that its overall effect is a reduction of the equilibrium interest rate by at least one and a half percentage points between 1990 and 2014. Demographic trends have important implications for the conduct of monetary policy, especially in light of the zero lower bound on nominal interest rates. Other policies can offset the negative effects of the demographic transition on real rates with different degrees of success. – Ferrero, Andrea, Carlos Carvalho, and Fernanda Nechio. 2016. “Demographics and Real Interest Rates: Inspecting the Mechanism,” Federal Reserve Bank of San Francisco Working Paper 2016-05

The authors lay out the theory behind demographics and real interest rates which of course is a lot more nuanced than the usual blather we have to endure from Princeton Stupid Steve.

https://www.youtube.com/watch?v=SYPsoC5XWSg

This FRED blog entry is interesting, showing a DIY method for constructing real rates.

https://fredblog.stlouisfed.org/2022/05/constructing-ex-ante-real-interest-rates-on-fred/#:~:text=Despite%20the%20usefulness%20of%20real%20interest%20rates%2C%20FRED,data%20to%20estimate%20the%20expected%20rate%20of%20inflation.

“To calculate historical real interest rates, one can either use a forecast of inflation or the average rate of inflation that actually occurred over the period of the loan/bond. When one uses a forecast of inflation to construct a real rate, that measure is called an “ex ante” real rate, while using realized inflation produces “ex post” real rates.”

An important distinction that always seemed lost on a couple of our trolls. OK – one has been cut off but let’s see if Princeton Steve finally gets this.

Different topic but one has to salute this reporter!

I spent 24 hours on Trump’s Truth Social so you don’t have to. No wonder it’s tanking

https://www.latimes.com/entertainment-arts/tv/story/2024-04-03/i-spent-24-hours-on-trump-truth-social-so-you-dont-have-to

Trump Media saved in 2022 by Russian-American under criminal investigation

Trump’s social media company went public relying partly on loans from trust managed by person of interest to prosecutors

https://www.theguardian.com/us-news/2024/apr/03/trump-media-es-family-trust-2022-loans?s=04

Donald Trump’s social media company Trump Media managed to go public last week only after it had been kept afloat in 2022 by emergency loans provided in part by a Russian-American businessman under scrutiny in a federal insider-trading and money-laundering investigation. The former US president stands to gain billions of dollars – his stake is currently valued at about $4bn – from the merger between Trump Media and Technology Group and the blank-check company Digital World Acquisition Corporation, which took the parent company of Truth Social public. But Trump Media almost did not make it to the merger after regulators opened a securities investigation into the merger in 2021 and caused the company to burn through cash at an extraordinary rate as it waited to get the green light for its stock market debut.

The situation led Trump Media to take emergency loans, including from an entity called ES Family Trust, which opened an account with Paxum Bank, a small bank registered on the Caribbean island of Dominica that is best known for providing financial services to the porn industry. Through leaked documents, the Guardian has learned that ES Family Trust operated like a shell company for a Russian-American businessman named Anton Postolnikov, who co-owns Paxum Bank and has been a subject of a years-long joint federal criminal investigation by the FBI and the Department of Homeland Security (DHS) into the Trump Media merger. The existence of the trust has previously been reported by the Guardian and the Washington Post. However, who controlled the account, how the trust was connected to Paxum Bank, and how the money had been funneled through the trust to Trump Media was unknown. The new details about the trust are drawn from documents including: Paxum Bank records showing Postolnikov having access to the trust’s account, the papers that created the trust showing as its settlor a lawyer in St Petersburg, Russia, and three years of the trust’s financial transactions. The concern surrounding the loans to Trump Media is that ES Family Trust may have been used to complete a transaction that Paxum itself could not. Paxum Bank does not offer loans in the US as it lacks a US banking license and is not regulated by the FDIC. Postolnikov appears to have used the trust to loan money to help save Trump Media – and the Truth Social platform – because his bank itself could not furnish the loan.Postolnikov, the nephew of Aleksandr Smirnov, an ally of the Russian president, Vladimir Putin, has not been charged with a crime. In response to an email to Postolnikov seeking comment, a lawyer in Dominica representing Paxum Bank warned of legal action for reporting the contents of the leaked documents.