That’s the almost gleeful conclusion in an article in the Washington Examiner last December. Now, it’s true they based that conclusion on a Legislative Analyst’s Office report. However, that conclusion was based on the (inappropriate) use of the (national level) Sahm rule to state level unemployment rates. And as Dr. Sahm has remarked, this is not the right way to go — rather one needs to examine the appropriate threshold for a given state before using it to infer a recession.

Well, let’s take a look at some indicators.

Figure 1: California Nonfarm Payroll Employment (dark blue), Philadelphia Fed early benchmark measure of NFP (pink), Civilian Employment (tan), real wages and salaries linearly interpolated, deflated by national chained CPI (sky blue), GDP (red), coincident index (green), all in logs 2021M11=0. Source: BLS, BEA, Philadelphia Fed [1], [2], and author’s calculations.

We have a somewhat bifurcated picture — similar to that at the national level — where employment measures (NFP, early benchmark NFP, and coincident index) show growth through 2023, while deflated wages and salaries have not recovered to 2021M11 levels by year’s end. GDP was rising through 2023 though.

Note that the coincident index — based on nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and CPI-deflated wage and salary disbursements — outpaces other measures substantially. For what it is worth, the Philadelphia Fed’s state-level business cycle chronology does not indicate a recession in 2023.*

As for recession in the offing, the UCLA Anderson School forecast (March 13) notes:

The California economy is forecasted to continue to grow faster than the U.S. but not by much. The risks to the forecast are the same as those for the nation: political and geopolitical. There is the potential for interest rates to disrupt the current expansion on the downside, and increased international immigration and accelerated onshoring of technical manufacturing on the upside.

The unemployment rate for the first quarter of this year is expected to average 4.7%, and the average for 2024, 2025 and 2026 is expected to be 4.6%, 3.8% and 3.9%, respectively. The forecast for 2024, 2025 and 2026 is for total employment growth rates to be -0.6%, 2.1% and 1.5%. Non-farm payroll jobs are expected to grow at a 1.4%, 1.7% and 1.2% rate during the same two years.

Real personal income is forecast to grow by 2.0% in 2024, 2.9% in 2025 and 2.7% in 2026. In spite of the higher interest rates, the continued demand for a limited housing stock coupled with state policies that induce new homebuilding should result in the beginning of a recovery this year, followed by solid growth in new home production thereafter. Our expectation is for 123,000 net new units to be permitted in 2024, and permitted new units to grow to 159,500 by the end of 2026. Needless to say, this level of home building means that the prospect for the private sector to build out of the housing affordability problem over the next three years is nil.

* Some readers might recall the great 2017 California-in-recession debate with PoliticalCalculations, here. The Philadelphia Fed fails to identify a recession for California in 2017-18.

Ironman speculated that a recession had begun, on the basis of 12 month moving average on series based on the household survey. Here’s the actual outcome.

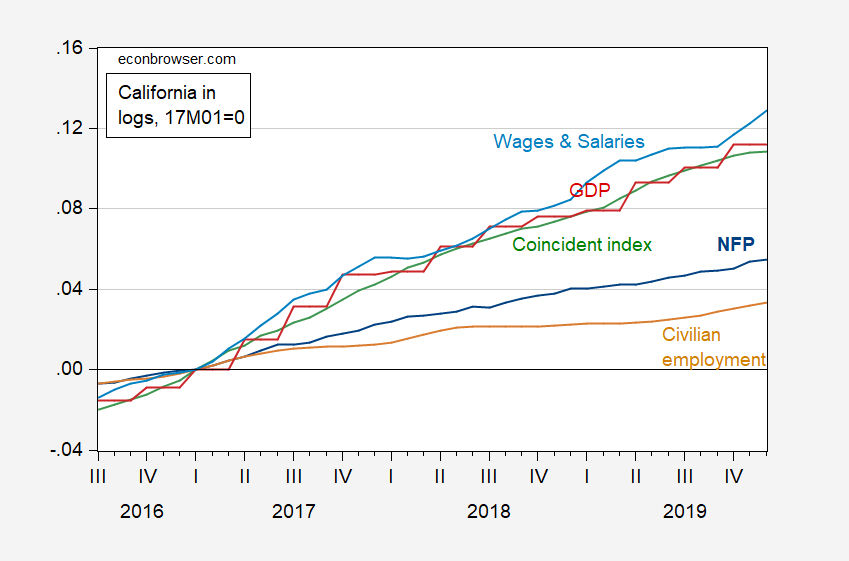

Figure 2: California Nonfarm Payroll Employment (dark blue), Civilian Employment (tan), real wages and salaries linearly interpolated, deflated by national chained CPI (sky blue), GDP (red), coincident index (green), all in logs 2021M11=0. Source: BLS, BEA, Philadelphia Fed [1], and author’s calculations.

Conclusion: Beware the household survey employment series at the state level.

Interesting homophone. Conn—con

Moses, thought you’d like to know:

https://uaw.org/uaw-reaches-historic-tentative-agreement-with-daimler-truck/

Pay gains are sizeable and front loaded.

Very cool, especially since it had become some of media’s habit to create the impression Unions had no bargaining power. While it is hard to argue that unions’ power has dissipated from, say for example 1970. They still have muscle. Part of that muscle is believing in that muscle.

“The four-year agreement delivers major economic gains for 7,300 workers, including raises of more than 25%, the end of wage tiers, and the introduction profit-sharing and Cost-of-Living (COLA) for the first time since Daimler workers first organized with the UAW. The deal delivers on the union’s pledge that record profits mean record contracts.”

And we were told many times by that now banned faux progressive that workers do not even try to lobby for higher compensation.

You know, I’m not gonna name names at the moment, because some of them may be Prof Chinn’s collegial friends, but this thing lately of claiming “the Greek restructuring helped save the European Union” is some of the biggest pile of crap I’ve ever read/heard in my life. It’s revisionist history. I watched it, I watched it closely. Those bureaucratic bodies did everything they could to destroy Greece, while giving haircuts and free hall passes to the bankers who were the ones responsible. And anyone who re-writes that reality, should burn in Hell. Burn in hell. And most likely, many of them will burn in Hell.

Read the ENTIRE book when you can:

https://www.google.com/books/edition/Adults_in_the_Room/LJUqDwAAQBAJ?hl=en&gbpv=1&printsec=frontcover

These folks seem to think more debt restructuring is coming and that the IMF and ESM are have the wrong framework for debt analysis in the Greek case. (I doubt you are surprised.)

I’m going to spill the beans by asking – is it OMFIF you have in mind?:

https://www.omfif.org/podcast/greeces-landmark-debt-restructuring-what-happened-and-why-it-matters/

Khadbia, at least, is impressed with Greece’s economic revival:

https://www.omfif.org/2023/08/greece-is-back-but-the-recovery-is-not-over/

Thing is, cheering for any outcome in isolation can ignore opportunity cost – how much human welfare did Greece forego in order to end up in better shape today? I’m not qualified to express an opinion. I do recall the Greek crisis being another episode in that long-running soap opera “Save the Banks”.

My impression at the time, not that it’s worth much, is that Northern European politicians and policy makers had a “never let a crisis go to waste” view of things.

I remember visiting the FDIC during the Greek crisis. They told us their small and medium-sized bank clients were very worried about Greece. They didn’t see a spill-over mechanism. Rather, they had recently learned that they were not equipped to assess spill-over risk and were begging the FDIC to to the assessment for them.

@ Macroduck

You’re pretty good at reading my mind sometimes. It was Indeed OMFIF. And I like Sobel, but I just don’t like how OMFIF has been selling/crafting this topic recently.

““The number of unemployed workers in California has risen nearly 200,000 since the summer of 2022.” LAO and Washington Examiner.

But wait – employment has been rising. Could it be workers are moving to California so labor force has grown even as employment has also grown.

This is just brilliant by house democrats:

https://www.cnn.com/2024/04/30/politics/house-democrats-speaker-johnson/index.html

Weakening speaker Johnson, even as they pretend to be the adult in the room who saved him. Moscow Majorie is just way out of her league.

Marjorie Taylor Greene has managed to be despised even by her own fellow House Republicans. Now if the voters of her district finally get the clue and tell this ugly nobody to go back to running her gym and hitting on its steroid monsters.

Figured how to get past that Bloomberg firewall:

Stop Applying My Recession Rule To Individual States

MARCH 27, 2024 • CLAUDIA SAHM

https://www.fa-mag.com/news/stop-applying-my-recession-rule-to-individual-states-77477.html

Applying the logic of the rule to individual states would reveal that 20 of them should be in a recession, right? After all, these states account for more than 40% of the US labor force and includes California, which alone has 11%. Although this may appear dire, the increase in unemployment rates stem partly from the strength of the economy the past few years, strength that has attracted much needed immigration to meet the demands of a hot labor market. According to the Congressional Budget Office, net immigration totaled 2.6 million in 2022 and 3.3 million in 2023, rising from an average of 900,000 a year from 2010 to 2019. As immigrants enter the economy, especially in large numbers, it can take them time to find work — likely even longer than US-born new entrants to the labor force. Moreover, immigrants have higher labor force participation rates overall than US-born individuals. The immigration process itself can create delays in legal employment, especially for humanitarian parolees and asylum seekers. More generally, an increase in the labor force has been long understood to be a “good” reason for why the unemployment rate temporarily rises as new workers find jobs. Indeed, the national unemployment rate drifted higher, from 3.5% in July to 3.9% in February, along with increased immigration and other new entrants to the labor force, such as women, people of color, and people with disabilities. However, immigrants are not evenly spread across the country, so the national drift upward in unemployment has been more pronounced in certain states. The three with highest immigrant share in their state population — California (27%), New Jersey (24%), and New York (27%) — have some of the largest increases in unemployment. They also account for 20% of the US labor force. And consistent with an adjustment to a larger labor force — as opposed to a recessionary spiral — the unemployment rate in these states has come down from their peaks last year.

Wow – what I said. Except she went further with the actual data to back it up.