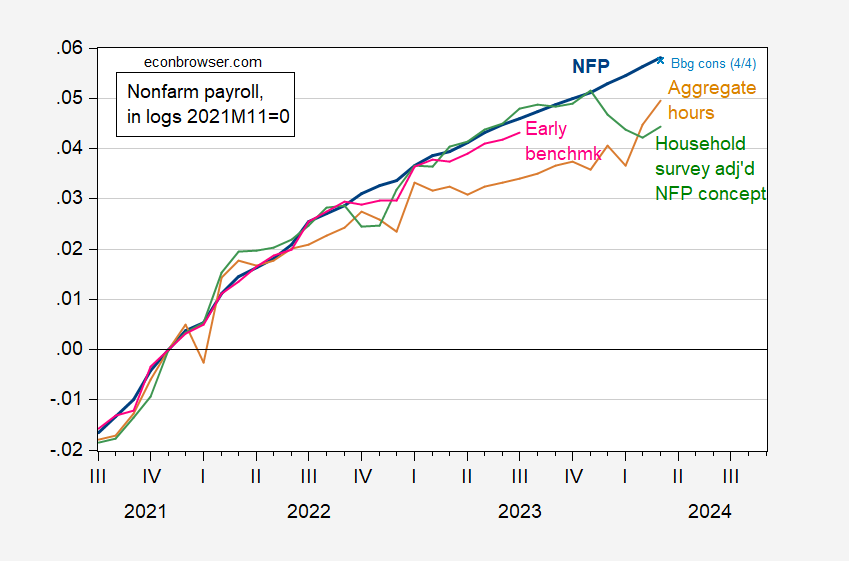

The employment surprise in context.

Figure 1: NFP (bold blue), Bloomberg consensus of 4/4 (light blue x), household series adjusted to NFP concept (green), Philadelphia Fed early benchmark (pink), aggregate weekly hours index of private production & nonsupervisory workers (tan), all in logs, 2011M11=0. Source: BLS via FRED, Philadelphia Fed, Bloomberg, and author’s calculations.

Claudia Sahm takes a whack at the job market:

https://stayathomemacro.substack.com/p/the-labor-market-is-strong

Among her points:

– Part time work doesn’t account for much of the employment gain since the Covid recession.

– Pay disparities have narrowed since the Covid recession.

– Part time work isn’t necessary bad.

– Immigration is helping to solve labor shortages.

Sahm gives a pretty thorough analysis of the interaction of immigration and unemployment. Given her fame and reputation, commenters in the economy have no excuse for ignoring what she has written, however inconvenient they may find her analysis.

The full scale panic about asylum seekers at the border seems even more idiotic now. Had it not been for the surge at the border we would have an even worse labor shortage – with all the associated problems. We have been able to grow our economy without increasing inflation and having full employment – its great to have a competent president.

Payroll survey says: employment rose by 303 thousand

Household survey says: employment rose by 498 thousand with both employment/population and labor force participation rate rising by 0.2%

Odds of a June rate cut have moved from 65% yesterday to 50% today:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Georgetown Jerome only cuts rates to help donald trump trade policy that kills off farmers. It doesn’t help secure his job now, so he views it as useless.

Summers Says Hot Jobs Data Show Neutral Fed Rate ‘Much Higher’

Former Treasury secretary says economy may be re-accelerating

Summers says it’s a mistake for Fed to set neutral rate aside

Oh gee – the headline says LARRY is at again. But wait – let’s read the story:

https://www.bloomberg.com/news/articles/2024-04-05/summers-says-hot-jobs-data-show-neutral-fed-rate-much-higher

Former Treasury Secretary Lawrence Summers said that the surge in US payrolls in March illustrates that the Federal Reserve is well off in its estimate of where the neutral interest rate is, and cautioned against any move to lower rates in June. “This was a hot report that suggested that, if anything, the economy is re-accelerating,” Summers said on Bloomberg Television’s Wall Street Week with David Westin. Alongside other factors including an “epic” loosening in financial conditions, “it seems to me the evidence is overwhelming that the neutral rate is far higher than the Fed supposes,” he said. The neutral rate is the theoretical level for the Fed’s benchmark that neither stimulates nor restrains growth. Fed policymakers last month estimated it at around 2.6% — the median estimate of their forecasts. Summers reiterated his own view is that neutral is 4% or higher. That compares with the current target range of 5.25% to 5.5%.

Come on LARRY – stop confusing matters with this neutral rate language which is the sum of the natural rate (a real rate) and expected inflation. If expected inflation is near 2.5% even LARRY is saying the natural rate is near 1.5%. Now maybe the FED thinks it is lower and maybe they are overstating the natural rate. But one would think an economist of Summers stature would using clearer language. And if current interest rates are about this natural (real) or “neutral” (nominal), reducing the target rate by a modest amount sounds prudent.

What is the neutral rate of interest?

Sam Boocker, Michael Ng, and David Wessel

October 3, 2023

https://www.brookings.edu/articles/the-hutchins-center-explains-the-neutral-rate-of-interest/

Interesting paper even if their “neutral rate” is the real “natural rate”. As far as what the FED thinks about r-star:

At the September 2023 FOMC meeting, the median projection for the long-run real neutral rate was 0.5%, but five of 17 participating members suggested they believe the rate (the nominal rate minus the Fed’s 2 % inflation target) is now 1% or higher. At their June meeting, only three had projections of 1% or higher. (Back in 2013, the median projection for the long-run real neutral rate was 2.0%.) Powell said, “[I]t may … be that the neutral rate has risen … you do see people raising their estimates of the neutral rate … and that’s part of the explanation for why the economy has been more resilient than expected.”

On Monday Dr. Chinn’s post noted how Trump Media and Technology Group’s stock price had dropped to just over $48 a share. It is now less than $40 a share. Did I recommend on Monday that one should short sell this turkey?

Not DR it is Prof!!

gosh you yanks are having a lengthy recession.

Bidenomics is working –

“Best economic recovery from COVID in the G7, stock market breaking records.

GDP grew by 4.1% over the past two quarters, and has been on average over 3% in Biden’s Presidency, 3 times higher than Trump averaged per year

Lowest unemployment rate in peacetime economy since WWII, jobs more plentiful today than any time since the 1960s. 8 times as many Biden jobs in 36 months as last 3 GOP Presidents combined over 16 years. Overwhelming majority of Americans have never experienced a job market this robust and strong. All measures of consumer sentiment are improving

Inflation has fallen, dramatically, and prices of many goods, including many food items, continue to fall. Inflation is lower here today than any G7 nation

Very elevated wage gains, new business starts and prime-age worker participation rate. 1.3 job openings per unemployed person – a good stat at this stage of business cycel.

Lowest uninsured rate in history, ACA signups this past year highest ever

The annual deficit is trillions of dollars lower today than it was when Trump was in the White House”

Should we go on…

“Median wealth up 37% from 2020-2022; median wealth for 18-34 year olds in this period more than doubled

The Biden Administration has erased more than $130b in student debt

Home ownership rates for Gen Z were above both Millennials and Gen X at this point in their lives

Many cities and states have raised the minimum wage in recent years, creating a much higher income floor for young and low-wage workers”

https://www.hopiumchronicles.com/p/another-great-jobs-report-the-economy

As Biden admin gets things done – adjudicated rapist Trump and Ron – I flew in from my home in Florida – Johnson tell a bunch of mostly 20-55 year old white men taking PTO from work that immigrants are breaking through your windows and going through your drawers and if he is elected he will deport all the people taking care of your grandmother, milking cows, and helping you find that faucet washer at the hardware store. More hateful rhetoric from Trump https://www.washingtonpost.com/opinions/2024/04/05/trump-swindle-crowd-green-bay-rally/

I wonder if Trump and Ron told that 69 year old man complaining that $100 only gets two bags of groceries that the GOP wants to cut Social Security.

As MD notes, Claudia Sahm’s “The Labor Market Is Strong” is really good. My favorite part was actually the first footnote:

“Some argue that workers are being forced to take multiple jobs to make ends meet. However, only 5% of the employed currently work multiple jobs, the same as the fraction in 2019. The labor market in 2019 was also strong, though inflation was lower. The hardship story does not hold up for the country as a whole.”

Yea – she took down that trash from Princeton Stupid Steve. And of course:

“Only 2.7% of all workers are part-time because they can’t find a full-time position or economic conditions are bad. While the fraction has edged up, it is still near all-time lows. That’s good.”

She backs it up with a graph that we could produce ala FRED by taking the following series and dividing by total employment:

Employment Level – Part-Time for Economic Reasons, All Industries

https://fred.stlouisfed.org/series/LNS12032194

pgl,

Based upon your comments, I looked at FRED series, LNS12032194, Part-Time for Economic Reasons, All Industries. I then divided LNS12032194 by FRED series, CLF16OV, Civilian Labor Force Level, in order to derive the percentages by month since 1955. The resultant series is stationary. I then used a Markov model, similar to what has appeared on Econbrowser in the past.

I found it interesting that the results show that the mean percentage of part-time workers to the labor force is 2.95% for the low regime and the mean of the high regime is 4.58%.

Using the EViews Markov Switching Smoothed Regime Probabities function, the model seems to say that there is a 100% probability of the March 2024 value being in the low regime with a percentage of 2.57.

It seems that the higher the percentage of part-time workers to the labor force, the higher the risk of being in a recession. “So far so good”.

(LNS120321/CLF16OV)*100 shown below.

https://fred.stlouisfed.org/graph/?g=1jG96

Impressive work. And you clearly defined employment. I went back to Sahm’s graph to see how she defined employment as it was not clear (at least to me).

You saw the footnotes on the graphs?? Actually above the graphs, from BLS.