Talking about the dollar as an reserve currency next week [2], and noticed these interesting trends.

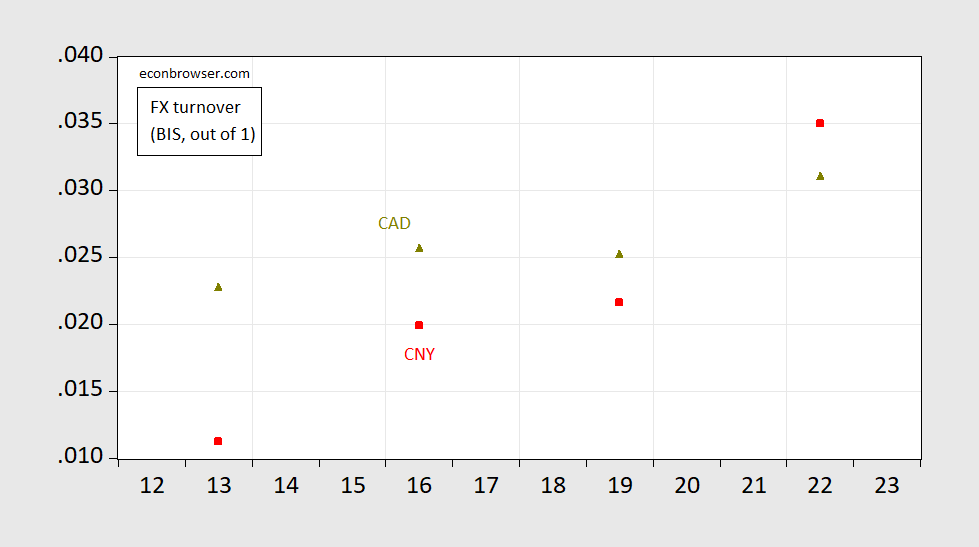

Figure 1: Share of FX turnover in CNY (red square), in CAD (chartreuse triangle), in April. Normalized shares to 1.00. Source: BIS Triennial Surveys.

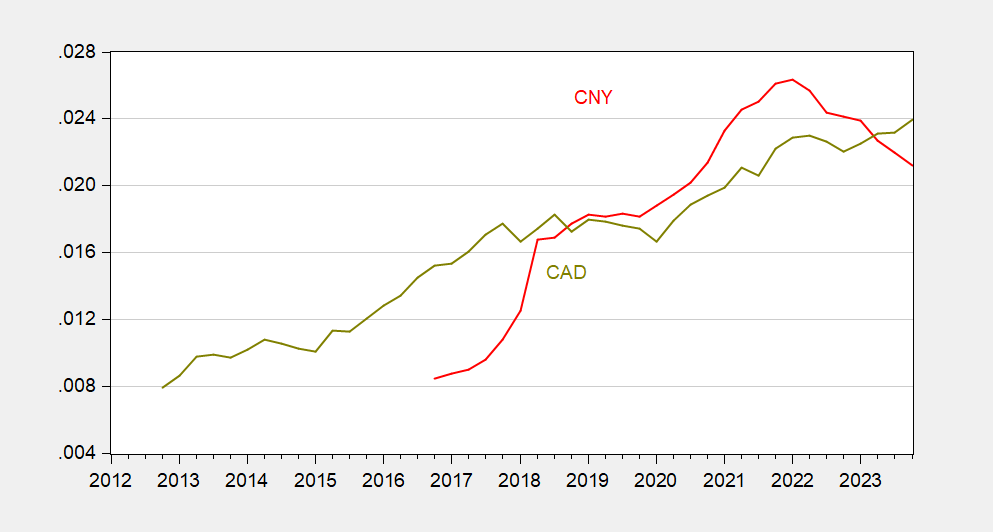

A similar pattern holds for central bank reserve holdings as reported in the IMF’s COFER.

Figure 2: Share of central bank reserves in CNY (red), in CAD (chartreuse). Source: IMF.

While there’s been some retrenchment in CNY holdings share since 2022, there’s a complication in interpreting this trend. Most if not all of the reduction can be poentially accounted for by CNY depreciation against the USD (9% in log terms, compared while the ratio has dropped about 5 ppts).

Still, I don’t think the CNY will become a major international currency anytime soon, as discussed here (remember, the euro accounts for 18.5 ppts of total central bank fx reserves at year-end-2023).

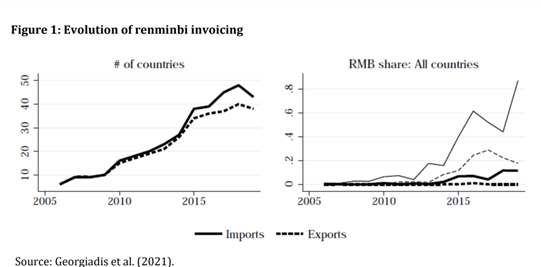

The area where the CNY has become important is in invoicing, not unsurprising given China’s dominant role in trade. Ito and Chinn (2014) discusses this issue, but more recent estimates are provided by Georgiadis (2021).

Notes: The left panel sows the number of countries with data on renminbi invoicing. The right panel shows the share of exports and imports invoiced in renminbi, with the median (thick lines) and the 75th percentile (thin lines).

Of topic, but on the previous topic of recession odds –

Housing Starts are looking flat, and down from the peak for this cycle:

https://fred.stlouisfed.org/graph/?g=1o2LG

Building Permits the same :

https://fred.stlouisfed.org/graph/?g=1o2Mb

MBA mortgage purchase applications are quite soft:

https://tradingeconomics.com/united-states/mba-purchase-index

Of course, purchase applications reflect both new and used home purchases, so perhaps this indicator isn’t as dire as it looks.

Here are new home sales, which are a mess due to Covid, but don’t seem healthy:

https://fred.stlouisfed.org/graph/?g=1o2Ms

So, is the housing cycle the business cycle? Does the housing shortage reinforce the expansion, even if the mechanism for turning notional demand into effective demand (or supply) is gummed up?

Evidence of housing’s leading role is not isolated to the mid-2000s housing bubble. The claim that the housing cycle “is” the business cycle is not a claim about GDP shares, but rather an empirical observation: Housing leads.

It is certainly possible that housing’s role in the economy has changed since 2007, or whenever, but that hasn’t been demonstrated. We’ve only been through one business cycle since then, and that one ended because of a pandemic – a bit of a special case.

Welcome to the party. Best not to be too dismissive of the views of others.

Even further off topic – the radicalism of the Robert’s Court:

Senator Whitehouse has published a law journal article detailing the Supreme Court’s usurpation of the fact-finding role in the judicial scheme of things:

https://www.whitehouse.senate.gov/news/release/whitehouse-details-in-ohio-state-law-journal-roberts-courts-penchant-for-judicial-activism-through-false-fact-finding/

Think of Alito’s ridiculous review if the legal “history” of abortion overturning Roe. As Whitehouse demonstrates in his article, not only is the Roberts Court’s journey into fact-finding a usurpation, but also an opportunity to insert factual error into Court findings at a level which cannot then be corrected. (“Error” is polite for what seems almost certainly to be intentional.)

The Supreme Court once justified slavery, then segregation and discrimination, so it’s hard to argue that the Roberts Court is the most unethical we’ve had. Even so, this Court’s disdain for ethics and for accountability is remarkable. Rehnquist shares the blame, having started the ball rolling.

Roberts manages a David-Brooks-style “reasonable conservative” facade, but he’s the one assigning the drafting of opinions, and it’s written opinions in which these power grabs show up.

Powell has Covid. Second time.