Here’s the entire Legislative Fiscal Bureau document on Foxconn (since links to original site do not work in my previous post “Wisconsin FoxConned by Walker et al.”:

Table 4 (which underpins these graphs) below:

Source: LFB (2017).

This table provides the basis for these graphs:

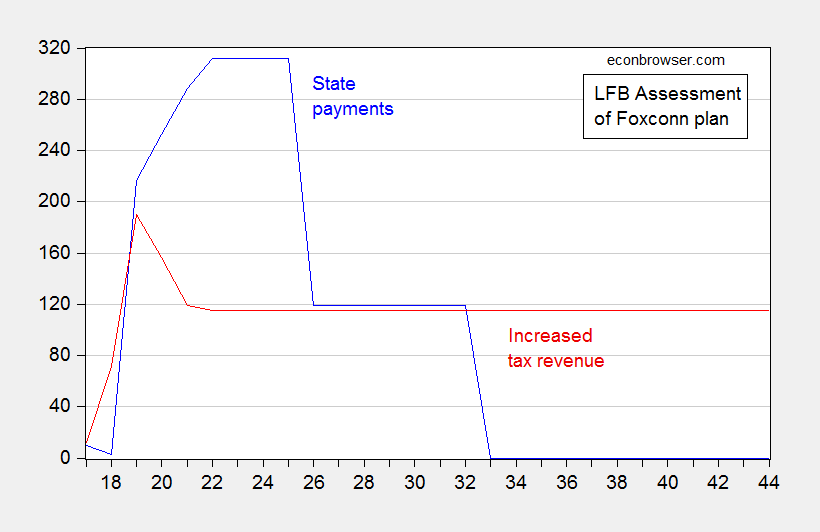

Figure 1: State payments (blue) and increased tax revenue (red) under August 2017 Special Session Assembly Bill 1, in millions of dollars, by fiscal year (2018 indicates FY 2018-19). Source: Legislative Fiscal Bureau, Table 4.

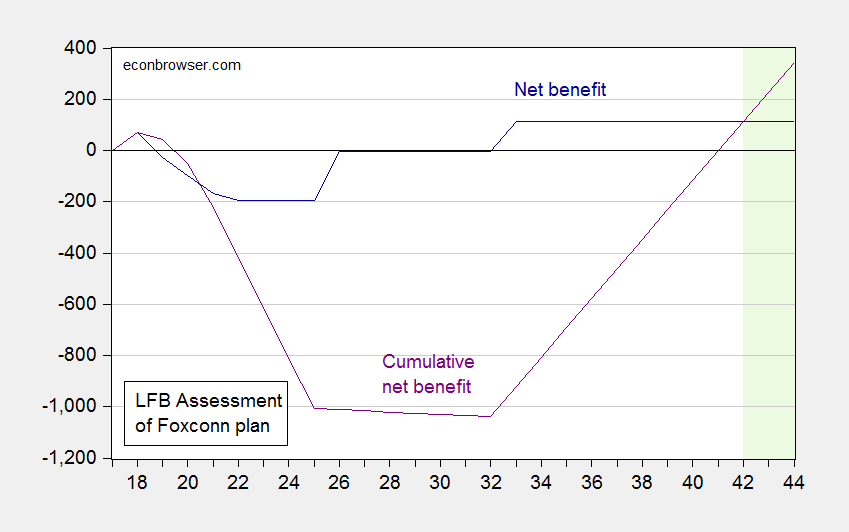

Figure 2: Net benefits calculated as increased tax revenue minus state payments under August 2017 Special Session Assembly Bill 1 (dark blue), and cumulative (purple), in millions of dollars, by fiscal year (2018 indicates FY 2018-19). Source: Legislative Fiscal Bureau, Table 4.

The original contract was substantially revised (!), so here are the obligations under the 2021 contract.

Source: Legislative Audit Bureau (2023).

So Wisconsin taxpayers are on the hook for paying Foxconn to pay employees that are doing minimal work. While this has some multiplier effects (in other words, Scott Walker and the Wisconsin GOP are de facto the greatest exemplars of Keynes’ aphorism “let them dig holes”), it’s doubtful they have the full upstream multiplier effects on suppliers etc. that were envisaged by e.g., Williams (2017).

Note that the above does not take into expenditures by localities. From Mitchell (2019):

In addition to the state subsidies, localities agreed to a $764 million site development subsidy (which subsequently expanded to $911 million), funded via tax increment financing. The state has agreed to underwrite 40 percent of these loans if the local government is unable to pay them off (but we do not include this potential cost in the state subsidies listed in table 1). Beyond these financial incentives, the state also exempted the company from certain wetland regulations, permitting it to circumvent the standard environmental impact reports and to discharge material into nonfederal wetlands without a permit. It also authorized over $332 million in electric and gas utility infrastructure improvements to service the plant, the costs of which will be borne by other utility customers. Finally, the Village of Mount Pleasant declared 2,800 acres as “blighted,” despite the area’s comparatively low crime rate, and has spent $160 million to acquire property through eminent domain in order to transfer it to Foxconn.

Hence, while the State of Wisconsin was somewhat insured against costs, the localities were shafted incurred substantial uncompensated costs.

So, when looking back, it is hard to see how much some policymakers (Wisconsin GOP, Scott Walker, Ron Johnson) were so badly bamboozled. (I’m sure almost everybody by now understands how Donald Trump was so badly bamboozled). See more here, here.

Clean win in the Biden column.

Thanks for the proper link. Looking at

TABLE 4

Break-Even Analysis for Foxconn Project (Millions)

This analysis assumes a zero discount rate as it sums the difference between tax revenues v. outlays. But the positive net benefits are very back loaded. I used a 4% discount rate and Excel told me that the net present value was negative 217.5 million.

Even with a discount rate of only 2% puts the net present value at a negative number.

I would ask you to explain WTF your stupid comment has to do with this post. Then again – your writing generally sucks so much that less is more.

Steven Kopits

May 9, 2024 at 10:56 am

We have been instructed in comments that the U.S should not take action against Russian assets unless our allies do the same, as if we needed the lecture. Well, Ta Da!:

https://apnews.com/article/eu-ukraine-aid-russia-assets-bf69ea5773f566ce8148fa0b6d35dc94

The same international law “expert” who said we should not be taking action against Russian assets is now saying colluding to fix oil prices is AOK and the FTC is wrong to say otherwise.

Pioneer Natural Resources Responds to FTC Settlement Complaint Filed as Part of Approval of Proposed Transaction with ExxonMobil

https://investors.pxd.com/investors/news-releases/news-details/2024/Pioneer-Natural-Resources-Responds-to-FTC-Settlement-Complaint-Filed-as-Part-of-Approval-of-Proposed-Transaction-with-ExxonMobil/default.aspx

Pioneer Natural Resources Company (NYSE:PXD) (“Pioneer” or “the Company”) today issued the following statement in response to the decision by the U.S. Federal Trade Commission (“FTC”) to clear the proposed merger with Exxon Mobil Corporation (NYSE: XOM) (“ExxonMobil”) subject to a Consent Order based on allegations in a settlement Complaint directed at Mr. Sheffield:

We disagree and are surprised by the FTC’s Complaint saying that Mr. Sheffield’s record and statements on matters of public interest should disqualify him from serving on the ExxonMobil Board of Directors. Notwithstanding, Pioneer and Mr. Sheffield are not taking any steps to prevent the merger from closing. As he has for his entire career, Mr. Sheffield is electing to place the interests of investors, employees and the competitive health of the U.S. energy industry ahead of his own. At the same time, Mr. Sheffield and Pioneer believe that the FTC’s Complaint reflects a fundamental misunderstanding of the U.S. and global oil markets and misreads the nature and intent of Mr. Sheffield’s actions.

OK enough of this self serving fluff. Pioneer just ducked the actions of Mr. Sheffield that led to the FTC complaint. It reads like the opening of the defense attorneys for Mr. Sheffield when the government hopefully prosecutes Mr. Sheffield. What kind of stupid defense attorney wouid write such gibberish. Oh wait Princeton Steve is now pretending he is some sort of international law expert. Maybe Stevie will defend Mr. Sheffield. I bet that will make the government lawyer’s day!

Not sure this is true, but it could be:

http://infobrics.org/post/41137/

BRICs buying gold as a backing for currencies in place of dollars. There have also been press reports lately of Asian (apparently meaning “Chinese”) private accounts favoring gold because stock and property markets are out of favor.

If the BRICs are buying gold for reserves, they aren’t doing it in scale. European fund sales in April were larger than Asian and North American purchases combined:

https://www.gold.org/goldhub/research/gold-etfs-holdings-and-flows/2024/05

I kinda think we’re seeing financial reporting based on themes rather than evidence; de-dollarization in lots of stories which don’t fit the facts. It’s rather like every wobble in U.S. economic data being explained as the result of interest rates, even though the Fed hasn’t changed rates in 9 months. Don’t understand how people can be so casually bad at their jobs.

Watching Hendrix’s live version of Voodoo Child on YT while Menzie gets his antenna “hate stick” (hate stick in a good way ) on,

“So Wisconsin taxpayers are on the hook for paying Foxconn to pay employees that are doing minimal work. While this has some multiplier effects (in other words, Scott Walker and the Wisconsin GOP are de facto the greatest exemplars of Keynes’ aphorism “let them dig holes”), it’s doubtful they have the full upstream multiplier effects on suppliers etc. that were envisaged by e.g., Williams (2017).”

That’s why I love this blog so much. Outside of James Kwak you ain’t gonna find this no place else kids.

I wish my Dad was still alive to read you Menzie, That’s the best compliment I can give you Bro.