Nominal PCE slightly below consensus (+0.2% vs. +0.3%). Here are some key business cycle indicators followed by NBER BCDC, with real personal income ex-transfers flat (along with real consumption)

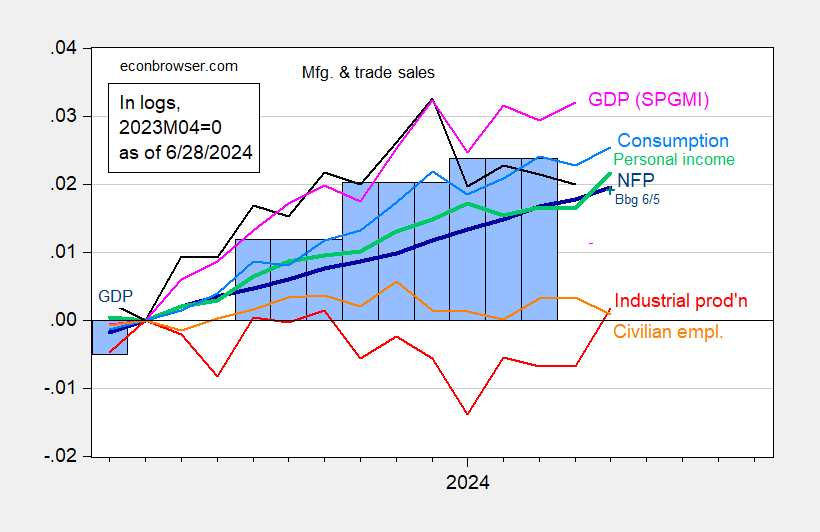

Figure 1 (corrected 1:22pm CT): Nonfarm Payroll (NFP) employment from CES (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 third release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (6/1/2024 release), and author’s calculations.

GDPNow estimate for Q2 as of today is 2.2%, down from 2.7% yesterday.

Menzie, it seems your chart does not incorporate May data for income and outlays. Real PCE and real PI ex transfers grew m/m in May, https://www.bea.gov/sites/default/files/2024-06/pi0524.pdf.

First of all, thanks for using an updated starting point, since we can safely put the 2022 controversy in the rear view mirror. And I see someone else has already caught that real income and spending in the original graph above weren’t updated through May.

I did want to point out that there are a number of yellow caution flags in the data. Below I link to a FRED graph using all of the same monthly data as above, except substituting real spending on goods for total real spending, since spending on services almost never go down, even during recessions. All series are normed to 100 as of last November:

https://fred.stlouisfed.org/graph/?g=1pDBB

All of the goods-related measures are either down, or up insignificantly since then, as is civilian employment. Only payroll employment and real income are up significantly. And there are good reasons to believe (the QCEW and Business Dynamics Survey) that nonfarm payrolls will be revised down significantly.

Nothing says “recession” to me, but some yellow caution flags are flying.

https://www.supremecourt.gov/opinions/23pdf/23-5572_l6hn.pdf

The Supreme Court decision in Fischer v. United States has to go to great lengths to redefine “otherwise”. 40 mentions of this single term.

Kevin Drum explains this strange fixation and how it led to this corrupt Court to make an absolutely absurd ruling:

https://jabberwocking.com/supreme-court-spends-pages-and-pages-deciding-what-otherwise-means/

I rarely discuss politics on this blog, but I have noted elsewhere that the Supreme Court’ majority’s reasoning in this case is completely at odds with their typical “textualism” interpretation (for e.g. the Second Amendment “it says what it means and it means what it says”), jettisoning it in favor of the inferred intent of Congress. In other words, retconning a rationale for an apparently desired result.

Economists Endorse September Fed Rate Cut As Inflation Falls To March 2021 Level: ‘The Policy Mistake Has Already Been Made’

https://www.msn.com/en-us/money/markets/economists-endorse-september-fed-rate-cut-as-inflation-falls-to-march-2021-level-the-policy-mistake-has-already-been-made/ar-BB1p4Udf?ocid=msedgdhp&pc=U531&cvid=6e2cbce4107d454e8a463ce87f209b0f&ei=7

I am generally reluctant to cite what a bunch of “business economists” have to say but these guys get it.

See New Deal Democrat’s comment on real goods consumption. Goods are more sensitive to rates than services, in part because (durable) goods are more often financed, but also because goods are just more sensitive to cyclical factors in general.

Private economists and CEOs, whatever gaps in knowledge they may have, know a heck-of-a-lot about the current state of demand and input costs. If weak demand is gaining ground as a concern against input prices, they’re going to want the Fed to ease.

Both goods demand and input price inflation have been softening for some time, but now we’re hearing calls for a policy switch. A threshold has been crossed.