Industrial production surprises on upside (0.9% vs. 0.3% m/m), while nominal retail sales increase modestly (0.1 actual vs. 0.3% consensus).

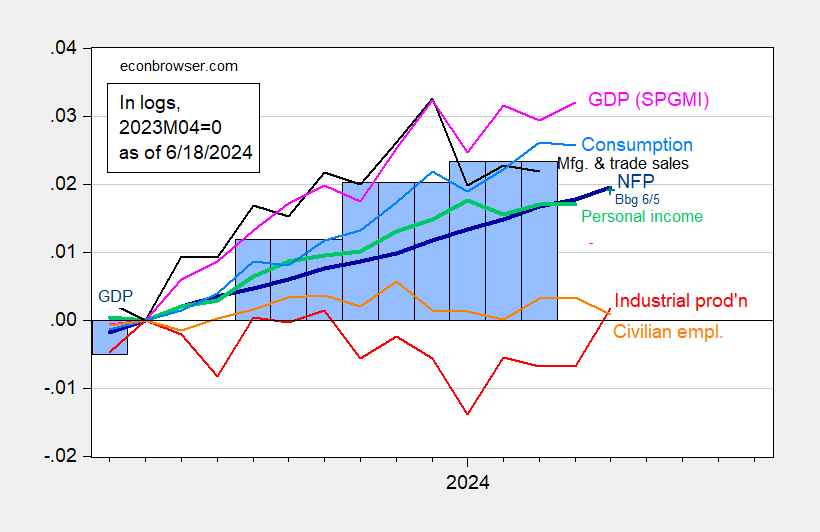

Figure 1: Nonfarm Payroll (NFP) employment from CES (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 second release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (6/1/2024 release), and author’s calculations.

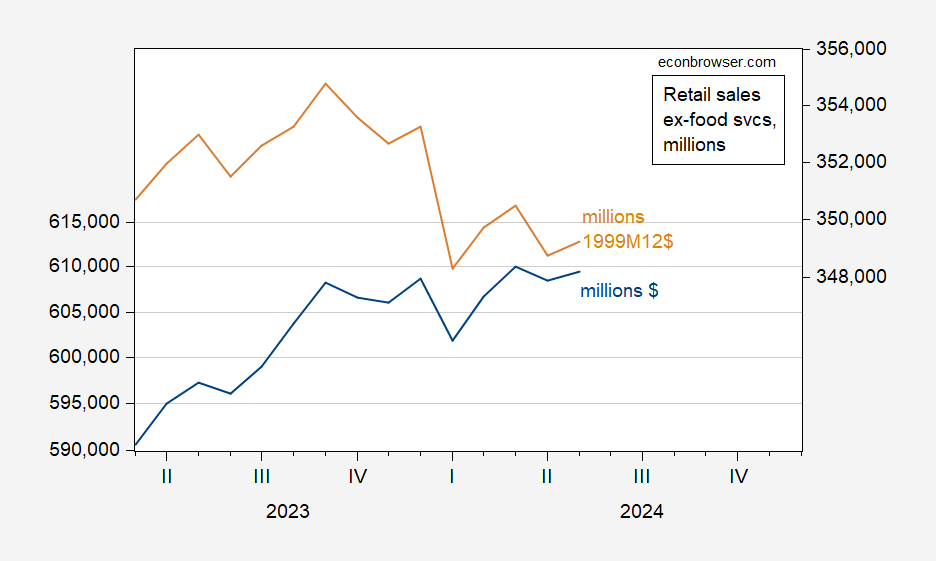

Retail sales:

Figure 2: Retail sales, mn $/month (blue, left scale), and in mn 1999M12$/month (tan, right scale). Deflated using chained CPI seasonally adjusted by author using X-13. Source: Census, BLS, author’s calculations.

Core retail sales were down 0.1% vs. consensus +0.2%.

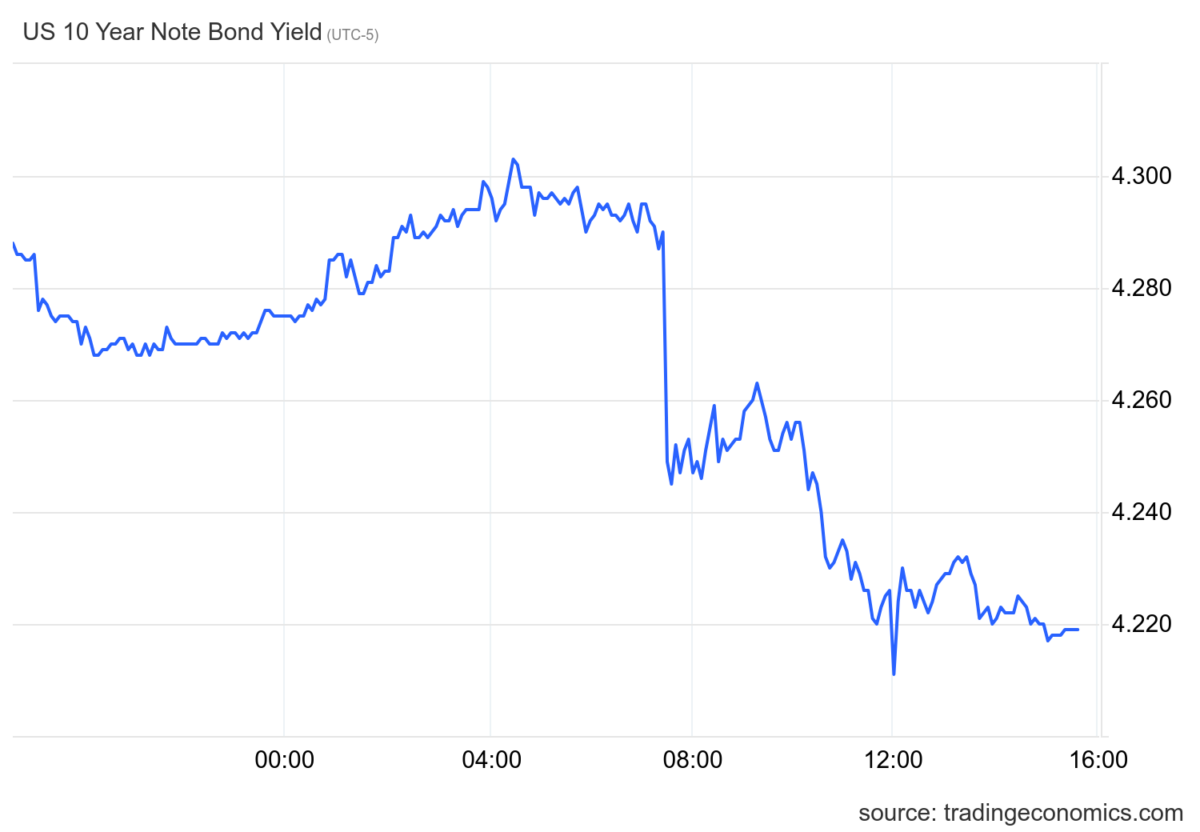

Treasury yields came down noticeably, as a consequence of the cooler than expected retail number.

Another classy member of the MAGA cult with family problems.

https://www.distractify.com/p/what-happened-to-mike-glover

Will Mike Glover be sharing a prison cell with Peter Navarro??~~and will Glover teach Navarro which foods to keep you alive during a nuclear holocaust??

https://discover.texasrealfood.com/food-shelf-life/velveeta

Dumb guy question alert: Would looking at CPI in log be a useful exercise??

OK, apologies, dumb guy just read the footnote. Sorry

More as a comment on commercial real estate than on retail sales –

Retail sales, with and without e-commerce:

https://fred.stlouisfed.org/graph/?g=1pchI

Brick-and-mortar store sales are still above the pre-recession peak, before adjusting for inflation. That’s worth some sort of congratulations, given how long it had been since any real gains were made. Trajectory ain’t good, though.

Shopping can often involve a large part of a “social experience” that a person cannot get online or even on something like “Zoom”. That’s why I think sometimes brick and mortar stores are making a mistake having customers bar code scan items and only 1 human clerk. They are taking away one of the things that makes them better or just differentiates them. Most people (not anti-social weirdos like me) were dying to have social experiences again after Covid was waning.

Are retail sales down, or just returning to their old levels?

https://jabberwocking.com/are-retail-sales-down-or-just-returning-to-their-old-levels/

Kevin Drum presents two charts on inflation adjusted retail sales per capita. Down over the past 2 years but shoppers “reverting to their pre-pandemic habits”.

Bit of a false dichotomy in the title. Sales are down and returning to normal. Sales are down because they are returning to normal.

“before adjusting for inflation”. Always adjust for inflation. OK – I’m quoting Kevin Drum who does that AND does this in per capita terms. I put a link to his latest blog post which you may appreciate.

GDPNow estimate for Q2 is unchanged at 3.1% after today’s data. Real PCE growth revised to 2.5% (SAAR) from 2.8%, completely offset by upward adjustment to fixed investment.

Frisky bonds suggest consumer demand is seen to be more important to the policy outlook than fixed investment.