Yes! From Rashed Ahmed and Menzie Chinn, just published in the Journal of Money, Credit and Banking.

This paper was previously discussed in this post; the revised (August 2023) version is here.

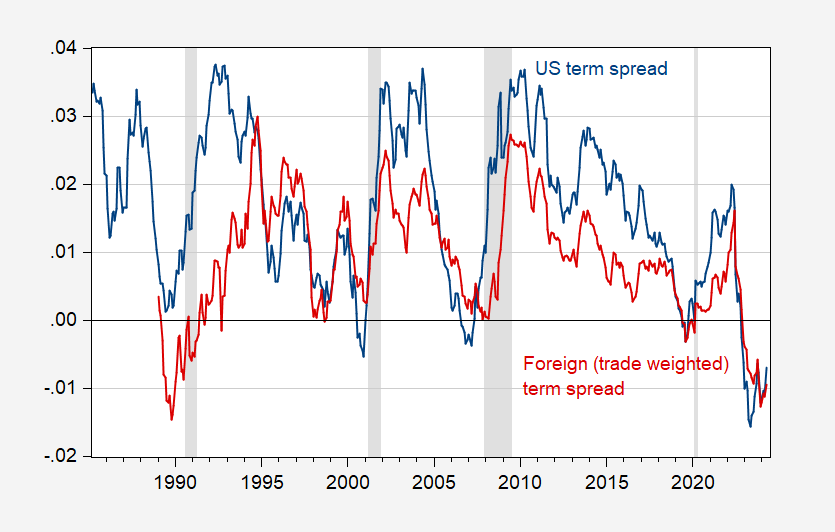

The foreign term spread (vs. US) is shown below. (The foreign spread is the US trade weighted spread using long term and short rates tabulated by the Dallas Fed, but in recent years is close to the Ahmed-Chinn foreign term spread used in the paper.)

Figure 1: US 10yr-3mo term spread (blue), foreign long term-3 month term spread (red). NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, Dallas Fed DGEI, NBER and author’s calculations.

“Smaller U.S. term spreads lead to smaller foreign term spreads and U.S. Dollar appreciation. Smaller foreign term spreads do not lead to significant U.S. Dollar depreciation but do lead to persistent declines in U.S. exports and foreign direct investment (FDI) flows into the United States. These findings are consistent with the proposition that foreign term spreads embed growth spillovers from the U.S. and the resulting Dollar strength and slowdown abroad spill back to the United States.”

Interesting. Congrats on getting a publication in JMCB!

Lordy, you are keeping busy! Congratulations. Again.