That’s the title of a Timiraos/WSJ article three days ago:

Typically in the recovery from a downturn, households are more cautious about spending and are likely to save. When rates are low, borrowing supports spending. High rates choke off that spending.

This time, economic activity has been supported more by wealth and incomes than by credit. The pandemic altered spending habits which, together with higher asset prices, solid job prospects and government stimulus, left more households feeling flush.

As I noted in a previous recounting business cycle indicators for May/April, the answer to the above question could be: (1) the recession is here and we just don’t see it in the preliminary data, (2) the recession is still coming, since the timing between term spread inversion and recession onset is variable, (3) the model we used is wrong, (4) it’s just luck of the draw (earlier estimates based on shorter samples still did not indicate 100% probabilities, e.g. here).

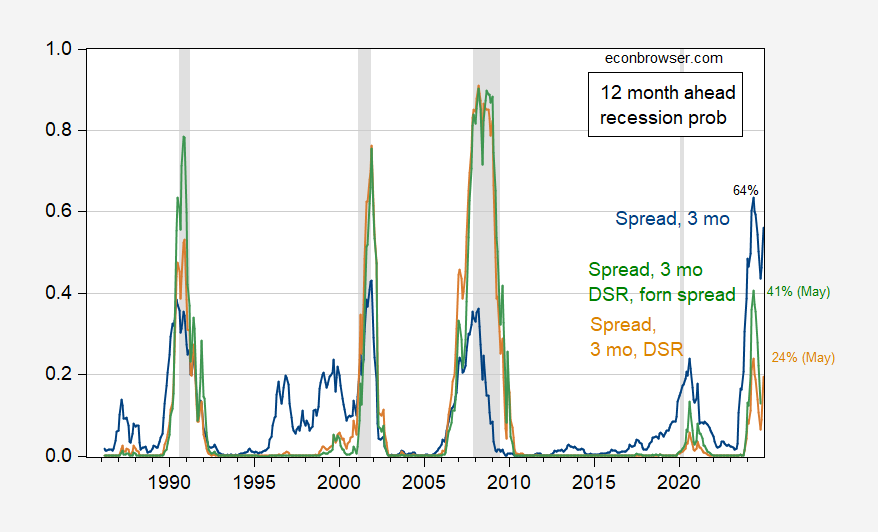

Here is an updated assessment of recession probabilities (for 12 months ahead), including data through May 2024, and assuming no recession has arrived as of June 2024.

Figure 1: Probit estimated recession probabilities for 12 months ahead, using 10yr-3mo spread and 3 month rate (blue), 10yr-3mo spread, 3 mo rate, and debt-service-ratio for private nonfinancial sector (tan), and 10yr-3mo spread, 3 mo rate, debt-service-ratio for private nonfinancial sector, and foreign term spread (green). Sample for estimation 1985M03-2024M06. NBER defined peak-to-trough recession dates shaded gray. Source: Author’s calculations, and NBER.

Note that the foreign term spread augmented specification (an Ahmed-Chinn specification stripped of oil prices, equity returns/volatility, and financial condition index, augmented with debt service ratio) only peaks at 41% for May. The DSR augmented specification (following Chinn-Ferrara, omitting financial conditions index) produces a 24% peak recession probability for May 2024. This latter specification incorporates the idea of strong consumer balance sheets, and the insulation of mortgage holders via fixed rate mortgages, to the extent that the debt service ratio remains relatively low.

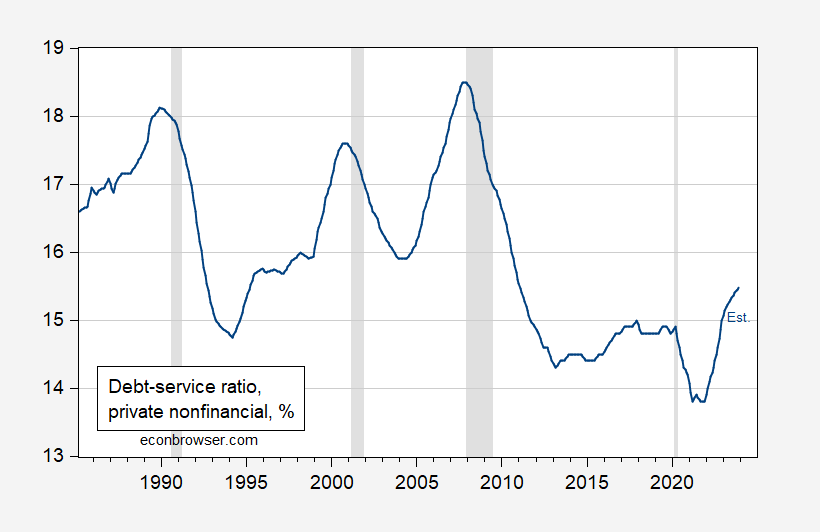

Figure 2: Debt-service ratios for nonfinancial private sector, % (blue). 2023Q4 is estimated using interest rates (see here). NBER defined peak-to-trough recession dates shaded gray. Source: BIS, Dora Fan Xia, NBER, and author’s calculations.

Peak estimated probabilities are for May 2024; we have only employment data for May (at the monthly frequency).

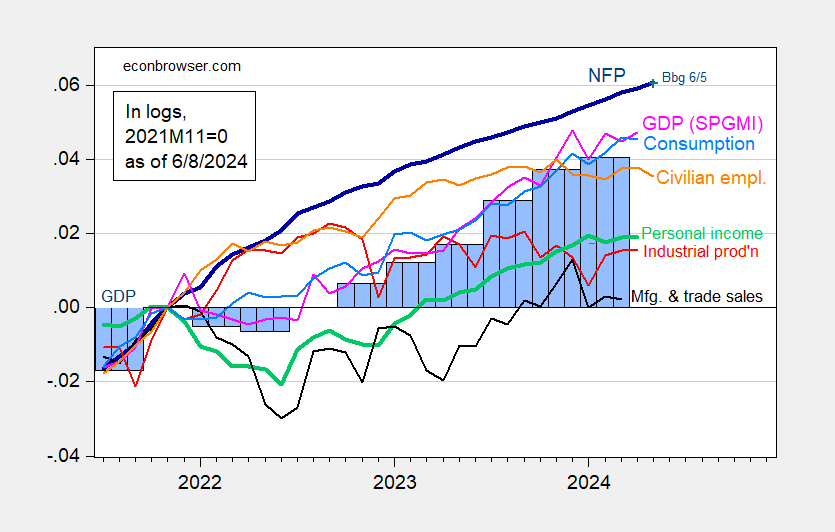

Figure 3: Nonfarm Payroll (NFP) employment from CES (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 second release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (6/1/2024 release), and author’s calculations.

And other more reliable indicators suggest less robust growth, at least through end 2023.

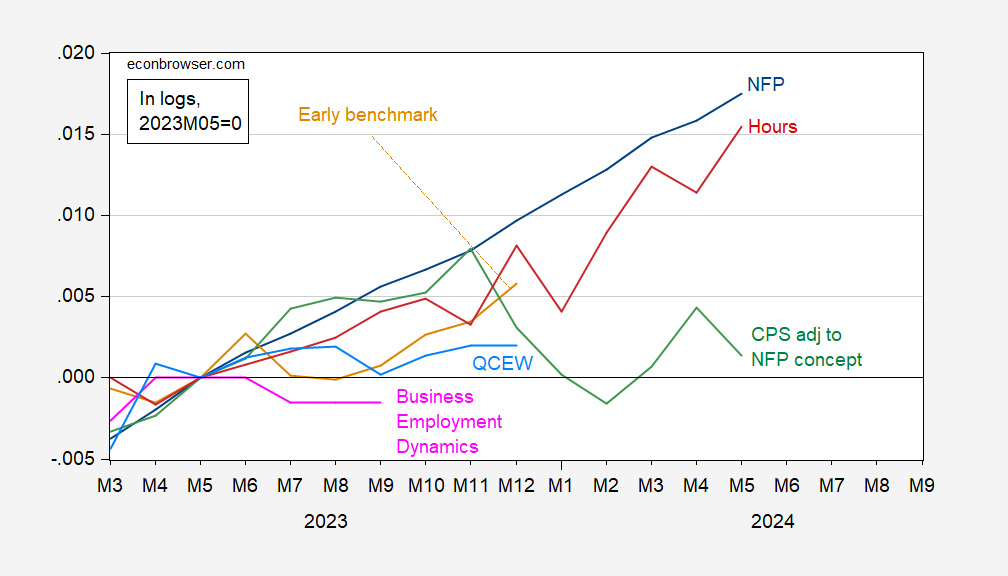

Figure 4: Nonfarm payroll employment (blue), early benchmark, calculated by adjusting actual using ratio of early benchmark sum of states to CES sum of states (tan), CPS measure adjusted to NFP concept (green), QCEW total covered employment seasonally adjusted by author by using geometric moving average (sky blue), Business Employment Dynamics net growth cumulated on 2019Q4 NFP (pink), and aggregate hours (red), all in logs, 2023M05=0. Source: BLS, Philadelphia Fed, and author’s calculations.

3. Model is wrong. Conflating recession w suppression.

Steven Kopits: I’m sorry, are you arguing that the next downturn will be a suppression? I can tell you if I omit the 2020 downturn from the regression, I will obtain low point estimates for the DSR-augmented specification.

Of course not. I am saying that Fig. 1 is suggesting that we are or have recently been in recession, which is clearly not the case. The reason we are not in a recession is likely due to the fact that we’re in a recovery from a suppression. Thus, Fig. 1, which is arguable signaling a false positive for a current recession, would remain reliable indicator of recession, but is not necessarily reliable in the recovery from a suppression. Both the dynamics of a downturn and the subsequent recovery will be different for a suppression than a recession, in other words.

Dude – stop using the moronic term “suppression”. Better still – find some other blog to post your worthless trash.

I finally made sense of this term “suppression”. All this time Kopits has been trying to tell us he is suppressing his brain.

Oh joy! I decided to read some of your recent stupid blog posts. Let’s see – Biden can make sure Russia does not get to export oil. Wow – China and India have nothing to do with this. Yea – this from a self styled oil expert. Seriously?

And of course Stevie tells us oil prices would reach $200 a barrel. His favorite forecast, Oh wait – this price has never come close. And Stevie says we would have a European “recession”: Ah Stevie – are you sure you did not mean a “suppression”.

Memo to self – never read that worthless blog again. Life is too short.

“I decided to read some of your recent stupid blog posts.”

Never had you gauged as a masochist

More proof that Rudy Giuliani is as racist as Donald Trump:

https://www.msn.com/en-us/news/politics/rudy-giuliani-sparks-backlash-after-firing-insult-towards-fani-willis/ss-BB1nYfoz?ocid=msedgdhp&pc=U531&cvid=141622165a89458e87636728a6891b18&ei=11

Rudy Giuliani referred to Fulton County District Attorney Fani Willis as a ‘ho’ during remarks at a megachurch. The remarks last week sparked widespread backlash from Democrats who denounced the former attorney and longtime ally of Donald Trump of being ‘misogynistic’ against Willis, who is prosecuting the former president for election interference.

Classy Rudy boy – classy!

Remind me – what did Rudi do for a living when he was on the right side of the law?

If Rudi had done his job back when he was a prosecutor, Trump would have been in jail long ago. We could have avoided this whole stupid mess.

Bruce Hall says you have to know the “real Rudi” and shared with me this photo of Rudi that Bruce Hall always carries with him in his wallet. He says this photo shows the facet of Rudi he has grown to love.

https://images.app.goo.gl/nEUCFrCUdmVbF2jH6

https://finance.yahoo.com/quote/DJT/

Trump Media stock has declined from around $52 a share to near $42 a share since that NYC jury returned their verdict.

https://www.iea.org/data-and-statistics/charts/average-russian-oil-exports-by-country-and-region-2021-2023

Average Russian oil exports by country and region, 2021-2023

Gee, exports to the US and the UK have dropped to zero while exports to EU nations have declined considerably. Exports to China, India, etc. have risen. No surprise but not something that any clown who thinks Stevie’s blog is informative would know.

In other news, Kudlow is telling his Faux News fans that the Biden economy is terrible.

Occupation Has Corrupted the Humanity of Israel’s Military

https://www.nytimes.com/2024/05/20/opinion/israel-gaza-idf-palestinians-human-rights.html

Israel’s military has brought utter devastation to the Palestinians of Gaza after the attack by Hamas on Oct. 7. But the extreme response is not only a reaction to the horrors of that day. It is also a product of the decades-long role the military has played in enforcing Israeli occupation of Palestinian territories. The occupation has cultivated a longstanding disregard among Israeli soldiers for Palestinian lives and similar impulses in the words and actions of commanders can be seen to lie behind the horrors of what we are witnessing today. Israel has governed a people denied basic human rights and the rule of law through constant coercion, threats and intimidation. The idea that the only answer to Palestinian resistance, both violent and nonviolent, is greater — and more indiscriminate — force has shown signs of becoming entrenched in the Israel Defense Forces and in Israeli politics. I know this through the numerous testimonies collected by my organization, Breaking the Silence, which was formed in 2004 by a group of Israeli veterans to expose the reality of Israel’s military occupation. We know firsthand and from thousands of soldiers that military occupation is imposed on civilians through fear, which is instilled by the growing and often arbitrary use of force. For 20 years, we have heard these soldiers speak of the gradual erosion of principles that, even if never fully upheld, were once seen as fundamental to the moral character of the Israel Defense Forces. We have continued our work despite criticism from the military and the government. I also know this because I myself have undergone this moral corruption. I, like many Israeli soldiers, went into the military thinking I knew the difference between right and wrong and had a clear sense of the boundaries on legitimate use of force. But every boundary is destined to be redrawn in a military occupation, whose very existence relies on terrorizing a civilian population into submission.

A generation of this corruption. Of course Israel has been led by Bibi for a generation.

Israel left Gaza in 2005. There was no Israeli occupation there until the current war. The Gazans elected Hamas in 2006, which proceeded to kill all their local opponents and has remained in power ever since. If there were an election today, Hamas would win comfortably, both in Gaza and the West Bank.

The Palestinians have four times been offered a state, and four times turned it down. Why? Because of river-to-the-sea, which calls for the destruction of Israel and the expulsion or killing of Israeli Jews. This is part of Hamas’s manifesto and supported by 70% of Palestinians. That’s why Palestinians are still in refugee camps now 80 years after the end of WW2, when there were so many refugees in the world (including my family). The point for the Palestinians is not to have their own state, it’s to destroy Israel.