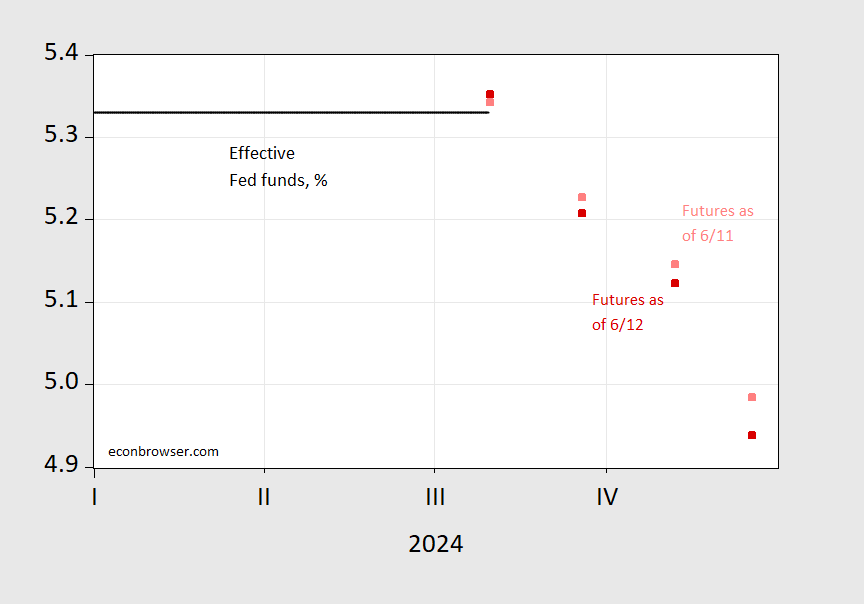

Here’s a picture of the Fed funds pre- and post-CPI release/FOMC SEP:

Source: CME accessed 6/12/2024, 1:30pm.

Before the news, the implied drop over 2024 was 35 bps, now 39 bps. How many drops? Using modal probabilities:

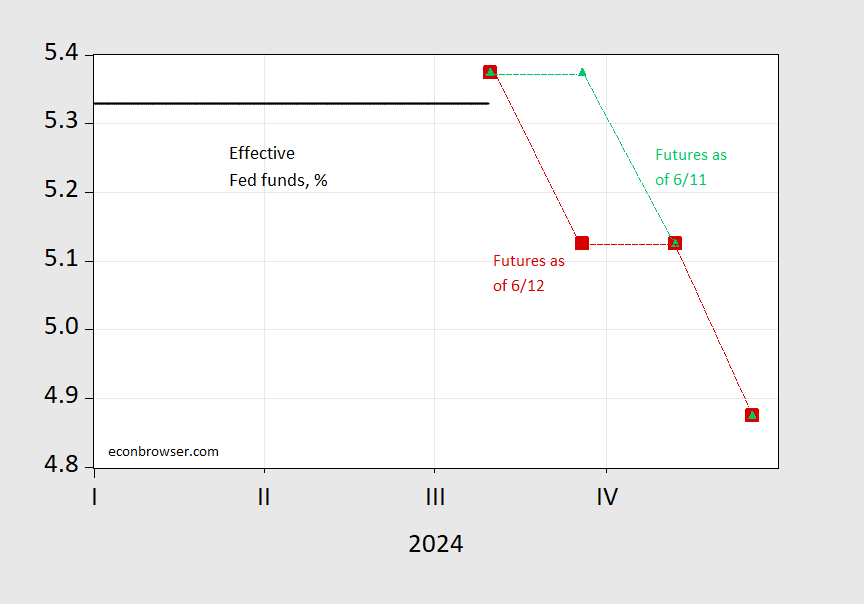

Source: CME accessed 6/12/2024, 1:30pm.

Two 25 bps drops before, two drops after the news.

Current commentary stresses that the close balance between one and two cuts in the SEP (see SEP here).

Market expectations (i.e., ex ante measures) are important for behavior. Which one will turn out to be more accurate in terms of forecasting. This issue is taken up in Carpinelli et al. (2024).

Market participants had already caught on that three cuts of 25 bps each this year was no longer the Fed plan, before the new SEP was published. While any FOMC announcement is going to generate commentary – that’s what commentators are paid for – the new news is mostly the CPI report.

By the way, Jay Powell said today that a healthy labor market is a good thing. He and his colleagues don’t get to decide which sectors are hit hardest by high rates, but they do choose their own reaction function. If they no longer have it in for the labor market, that’s a real step forward.

If they no longer have it in for the labor market, Larry might have to give them a stern lecture.

Different topic but I thought I’d pass this along:

Taxing Windfall Profits in the Energy Sector by Baunsgaard, M. T., & Vernon, N. (IMF, August 2022).

https://www.imf.org/en/Publications/IMF-Notes/Issues/2022/08/30/Taxing-Windfall-Profits-in-the-Energy-Sector-522617

Commodity prices for coal, oil, and natural gas have increased sharply during 2022, although prices have retreated somewhat more recently. The increase stems from a combination of factors, including a mismatch between energy demand and supply during the economic recovery from COVID-19, further amplified by the Russian war in Ukraine. The surge in fossil fuel prices has generated substantial windfall profits in the energy sector. This has benefited mainly firms that extract fossil fuels, but, in some cases, profits have increased elsewhere in the energy sector, such as for oil refineries and renewable-energy-based electricity generators. Meanwhile, countries face fiscal pressures to support the post-COVID economic recovery and alleviate the strain on vulnerable households and firms arising from the high energy prices. Looming over all of this is the need to contain inflation, maintain energy security, and transition to renewable energy. This raises a key tax policy question: whether and, if so, how to tax windfall profits realized by energy companies.

The answer is particular to each country and energy segment, but the following guidelines are recommended:

Introduce a permanent tax on windfall profits from fossil fuel extraction, if an adequate fiscal instrument is not already in place. The tax should be imposed on a share of economic rents (that is, excess profits) because rent-targeting taxes raise revenue without reducing investment or increasing inflation. Economic rents generally arise from fossil fuel extraction as a result of the fixed supply and diverse quality of natural resource deposits, rather than from other segments of the energy value chain.

Use caution when it comes to temporary taxes on windfall profits: these tend to increase investor risk, may be more distortionary (especially if poorly designed or timed), and do not provide revenue benefits above those of a permanent tax on economic rents. Investors prefer a stable, predictable tax regime over the risk of future temporary taxes when prices rise.

Encourage the switch to renewable energy, given the need for decarbonization in energy generation. It is counterintuitive to introduce exceptional taxes on renewable energy-based electricity generation, especially if these are poorly designed. Such taxes may deter future investment by increasing investor perception of risk. Moreover, transitioning to renewable energy improves energy security.

Still, apply the following design principles if political pressure makes it necessary to tax windfall profits from electricity generation: The tax should apply to a clear measure of excess profit (for example, profit above a specified return on capital) that avoids arbitrary references to specific price levels or time periods. The tax should not apply to revenue (as this can be inflationary and is more likely to reduce investment). The tax should allow for carryforward of losses to ensure symmetrical treatment of losses and profits. The tax can be permanent if excess profits are expected to be persistent.

Consider future reforms to market mechanisms that may unnecessarily result in windfall profits for electricity generators and fossil fuel refiners. For example, electricity generators may earn windfall profits because of the design of electricity tariffs or because market access is restricted.

Speaking of (dis)inflation, look at that vote total:

https://clerk.house.gov/evs/2024/roll248.xml

H.R. 6543 “No Hidden Fees Act”

Wonder why the orange creature and Republicans never got this passed before?? How “curious”/

I would start looking for “hidden” campaign contributions. Who has been lobbying against this and who did they give money to?

https://fred.stlouisfed.org/series/CUSR0000SAF11

I posted a link to food prices at home in light of the MAGA moron campaign that we were somehow better off 4 years ago, blah, blah, blah.

Josh Hawley says this is true as nominal food prices have risen by 40% while wages have fallen. Now it seems food prices have risen by less than 20.5% while nominal wages have risen by about the same amount. But don’t let the facts get in the way of this Senator as he is still running like a scared girl terrorized by the events of 1/6/2021.

If you’re like me, and roughly 9 years into MAGA, you’re still having a hard time understanding how Blacks, Hispanics, and any woman can vote for the orange abomination. I still don’t have a 100% explanation. But the best way I think we can understand females, Blacks, and Hispanics voting for donald trump, watch Mike Rinder on Youtube talking about L. Ron Hubbard and scientology and “thought-stopping”. Mike Rinder, as he explains scientology will give you the best explanation for the existence of MAGA, and how people who donald trump would spit on if he met them on the street, will vote for him with delight. Look up this video on YT:

“I escaped Scientology…here’s what Tom Cruise is really like: Mike Rinder | OTE Podcast 184”

Matthew Klein’s thoughts

https://theovershoot.co/p/the-fed-looks-through-a-great-inflation