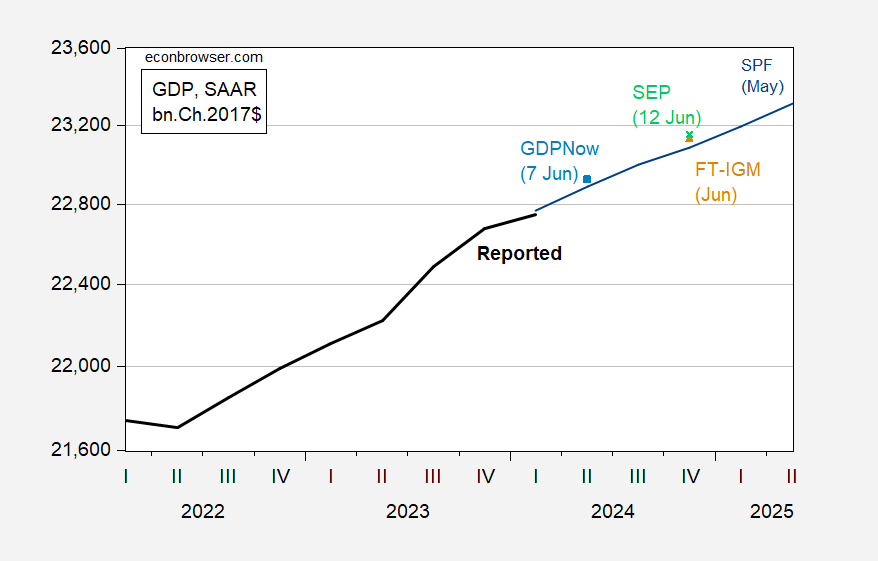

The survey indicates 2.0% median growth q4/q4, not far from June SEP at 2.1% (unchanged from March).

Figure 1: GDP (bold black), May Survey of Professional Forecasters median (blue), FT-Booth School implied (tan square), Survey of Economic Projections/FOMC June median implied (light green x), GDPNow of 7 Jun implied (sky blue square), all in bn.Ch.2017$ SAAR. Source: BEA 2024Q1 2nd release, Philadelphia Fed, Booth School survey, Federal Reserve Board, Atlanta Fed, and author’s calculations.

While median is 2.0% 2024 q4/q4, the 10th/90th percentile range is 1.8%-2.7%. I was considerably more gloomy, with median at 1.8% (0.8% to 2.5%). Central tendency for SEP (removing bottom and top 3) is 1.9%-2.3%, range (all responses) is 1.4%-2.7%.

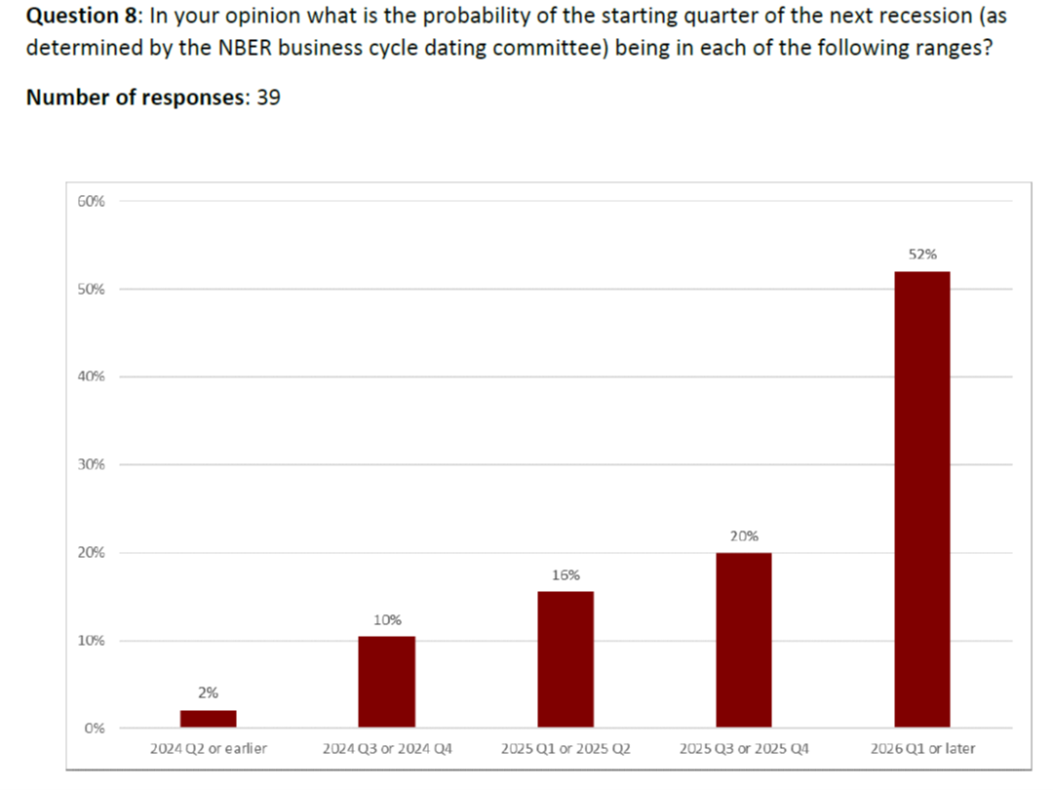

The modal response for recession start is now 2026Q1 or later, compared to March (see here).

Source: FT-Booth School survey (June 2024).

The probability of a recession start in 2024 has dropped from 18% in March to 12% in May, while the modal prediction of 2026Q1 or later has risen from 46% to 52%. Once again, I’m more gloomy short term, at 40% probability in 2024, reflecting the implications of the term spread (but keeping in mind the debt-service ratio).

FT article here.

So these economists think we will not see a recession for another two years. I guess these forecasts are why the FED held off in lowering interest rates.

And to think our Troll Choir said we were in a recession two years ago! Oh wait – Trump said we would be in a depression early next year. Or was that a Kopits depression? I guess I’m behind the curve since I refuse to watch Faux News!