Probabilities have peaked, using a standard spread model.

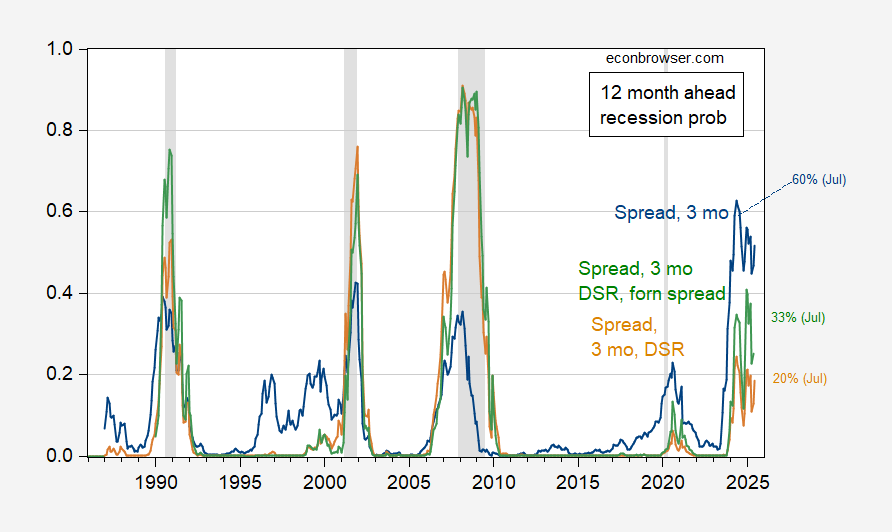

Here is an updated assessment of recession probabilities (for 12 months ahead), including data through June 2024, and assuming no recession has arrived as of July 2024.

Figure 1: Probit estimated recession probabilities for 12 months ahead, using 10yr-3mo spread and 3 month rate (blue), 10yr-3mo spread, 3 mo rate, and debt-service-ratio for private nonfinancial sector (tan), and 10yr-3mo spread, 3 mo rate, debt-service-ratio for private nonfinancial sector, and foreign term spread (green). Sample for estimation 1985M03-2024M06. NBER defined peak-to-trough recession dates shaded gray. Source: Author’s calculations, and NBER.

The pseudo-R2 for the debt-service ratio augmented specification, and that including the foreign term spread as well as debt-service ratio, are 0.56 vs. 0.58. The foreign term spread augmented model was investigated in Ahmed-Chinn (JMCB, 2024), while the debt-service ratio augmented model was examined in Chinn-Ferrara (revision 2024).

The forecasted probabilities for July 2024 range from 60% (term spread, short rate) to 20% (term spread, short rate, debt-service ratio).

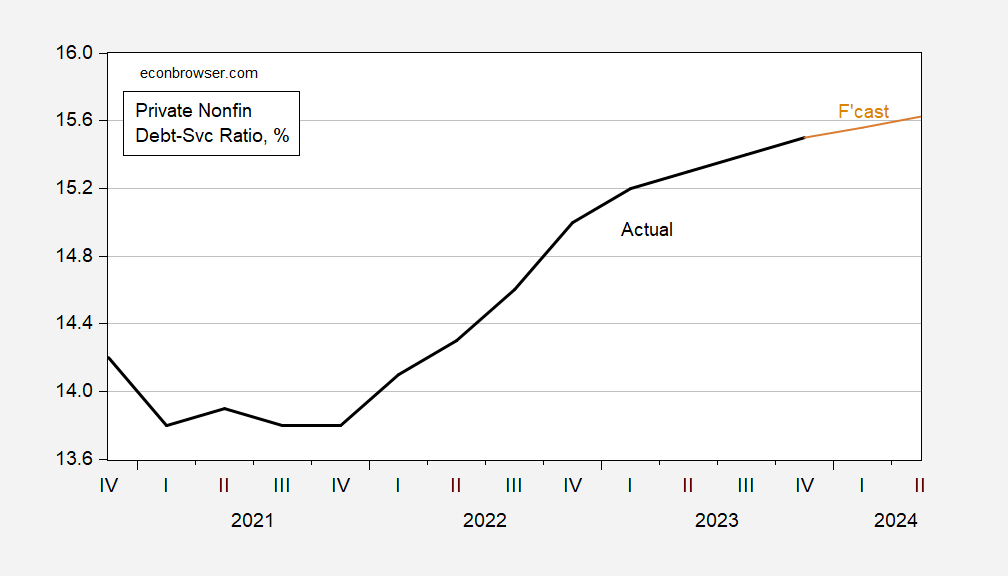

The declining probabilities for the debt-service augmented models rely on the declining pace of increase, which I’ve extrapolated dynamically for the first six months of 2024.

Figure 2: Debt-service ratios for nonfinancial private sector (black), dynamically forecasted (tan), both in %. 2024Q1-Q2 is estimated using interest rates (see here). NBER defined peak-to-trough recession dates shaded gray. Source: BIS, Dora Fan Xia, NBER, and author’s calculations.

Fed’s Powell: Latest data ‘add somewhat to confidence’ inflation is returning to 2%

https://www.msn.com/en-us/money/markets/fed-s-powell-latest-data-add-somewhat-to-confidence-inflation-is-returning-to-2/ar-BB1q1IN0?ocid=msedgdhp&pc=U531&cvid=21adc09a59ad461fa7d27cb3e562d44e&ei=8

Federal Reserve Chair Jerome Powell said on Monday the three U.S. inflation readings over the second quarter of this year do “add somewhat to confidence” that the pace of price increases is returning to the Fed’s target in a sustainable fashion, remarks that suggest a turn to interest rate cuts may not be far off. “In the second quarter, actually, we did make some more progress” on taming inflation, Powell said at an event at the Economic Club of Washington. “We’ve had three better readings, and if you average them, that’s a pretty good place.” “What we’ve said is that we didn’t think it would be appropriate to begin to loosen policy until we had greater confidence” that inflation was returning sustainably to 2%, Powell continued. “We’ve been waiting on that. And I would say that we didn’t gain any additional confidence in the first quarter, but the three readings in the second quarter, including the one from last week, do add somewhat to confidence.”

Well – then lower interest rates already!

One thing I notice in Figure 1 is that whenever recession probabilities rise at all for either measure except the simple 10year-3month spread/3-month rate, recession happens. The math says probabilities are this or that, but history says “buckle up”.

Now, four business cycles isn’t much history, but in cooking up recession indicators, there is always a limited sample.

I think we are taking a theoretically wrong approach when we try to find a single parameter that can predict recessions.

I think that there can be a number of different triggers/causes for the kind of economic slowdown that eventually gets designated as a recession. Every recession can have their own specific causes or unique mixture of causes. One may come from a bubble in consumer assets causing a financial meltdown, another may essentially be the consequences of a worldwide pandemic.

If you tell me you have a parameter that can predict recessions precipitated by such extremely different channels – I would say that you just have a parameter that is measuring what you are trying to predict. The detection of recessions a number of months before it gets declared officially may be useful – but is it really more useful than simply looking at the delta on GDP?

You are pointing out the difference between model-based and indicator -based forecasting.

When it comes to indicator-based forecasting tools, we often find theoretical explanations attached to them, but their claim to predictive value is based very largely on having been right more often than competing tools in the past. Theoretical justification is a sideshow.

Consider the Sahm rule. Claudia Sahm proposed it as a way of knowing that we are in recession because it has worked over and over again. No theory needed. She has also acknowledged that, as you point out, some cycles are different enough that indicators don’t work. So you have a point, but not because of a theoretical error; indictators don’t require theory.

In one way, Labour is no different from the Tories. No matter which party is in power, England loses to Spain:

https://apnews.com/article/spain-england-euro-2024-final-dc46b104e6bf3b94b7d6d70e18f8220d

Is there anything Spain hasn’t win recently? Hello, Olympic Games!

Where to begin?

Biden does not control the Federal Reserve, and so cannot “order it”.

Yield-curve inversion is a fairly reliable forecast of future recession, not a cause of recession. The curve has been inverted for some time, so it’s too late to prevent a recession signal.

Causing the curve to turn positive doesn’t erase the signal.

The extent of easing needed depends on economic and financial conditions, not a magic number.

It’s not clear what “yry drops” means, but it looks like evidence of another misconception on your part.

“Leave no fig leaf left” is redundant.

Otherwise, what you’ve written is just fine.

How stupid can you get. No – Biden is not going to fire Powell. BTW – do you have a clue about monetary policy? Any at all? Didn’t think so.

Listen MORON. We know you can’t read but do have someone explain this to you:

https://www.brookings.edu/articles/what-happens-if-trump-tries-to-fire-fed-chair-jerome-powell/

Mark Redding: The Fed Chair can be fired for cause, not much else. Who was the last Fed chair you can remember being fired?

No one has said we need deep interest rate cuts. Name one person who has. Yea – another pointless rant from our new troll.

https://www.worldgovernmentbonds.com/country/united-states/

Helping our new pointless troll with the concept of actually presenting data – duh:

The United States 10-Year Government Bond currently offers a yield of 4.185%. This yield reflects the return investors can expect if they hold the bond until maturity. Government bond yields are critical indicators of economic confidence and investor sentiment. The spread between United States 10-Year and 2-Year government bonds is -24.3 basis points (bp).

Menzie – before the corporate media turns over our economy to Dictator Trump and fake good old boy venture/vulture capitalist Vance to destroy us with cutting renewable energy initiatives and giving tax cuts to billionaires – can we get at least one or two front page articles from the Washington Post and NY Times documenting what a master class in progressive fiscal policy the Biden admin has produced in getting our economy back from the latest Republican disaster?

15.7 million jobs under Biden (compared to 1.9m under 16 years of Trump, Bush, Bush), inflation now 2.1% annualized over the last 6 months, historic reduction in wage inequality, investments in accelerating the energy transition to combat climate change, historic investments in replacing water systems, roads, and rural broadband to create remote job opportunities in rural areas, etc.

Also Biden has reinvigorated the Western alliance and helped Europe in defeating Dictator Putin (BTW – Vance has said he doesn’t care about Ukraine – he doesn’t care that Putin regularly targets and kills civilians including their main children’s hospital.)

Biden also is working to protect women’s access to reproductive health care at the federal level – (Felon/Adjudicated Rapist trump doesn’t care and Vance supports a federal abortion ban and wants to eliminate no-fault divorce so women can be forced to stay with their abusive husbands.)

Corporate media can we get at least one or two reports about the policy implications of the Dems and Repubs – and want they mean for all of us – rather than endless fawning reports of Trump playing golf?