Gorodnichenko, in YahooFinance:

Moscow’s economy is extremely dependent on petrodollars, or dollars obtained through the oil and gas trade, Gorodnichenko said. Yet, with Russia’s energy flows upended by sanctions, it’s unclear if sales to friendly nations will be enough to prop up the Kremlin’s hefty war budget — or if Russia will have enough access to dollars to readily import all the goods and resources its economy needs to function, he said.

That could put Russia’s economy on the fast track to a recession in the next 12 months, Gorodnichenko predicted.

“If they have to finance the war and they don’t have this resource, it’s not clear where they will raise this money,” he added. “I predict they’re going to face a very serious recession.”

BOFIT notes that sanctions have been tightened on oil exports, while new EU sanctions on natural gas have been implemented.

The IMF’s July WEO update (released today, but based on exchange rates April 22-May 20) indicates that, while there’s been no downward revision in 2024 y/y growth, 2025 has been marked down by 0.3 ppts, to 1.5% y/y (The World Bank’s June forecast is 1.4%) This despite upward marking in oil prices. If on the other hand, oil prices fall, then one could expect conditionally, slower growth.

BOFIT’s latest assessment of economic challenges was July 5th.

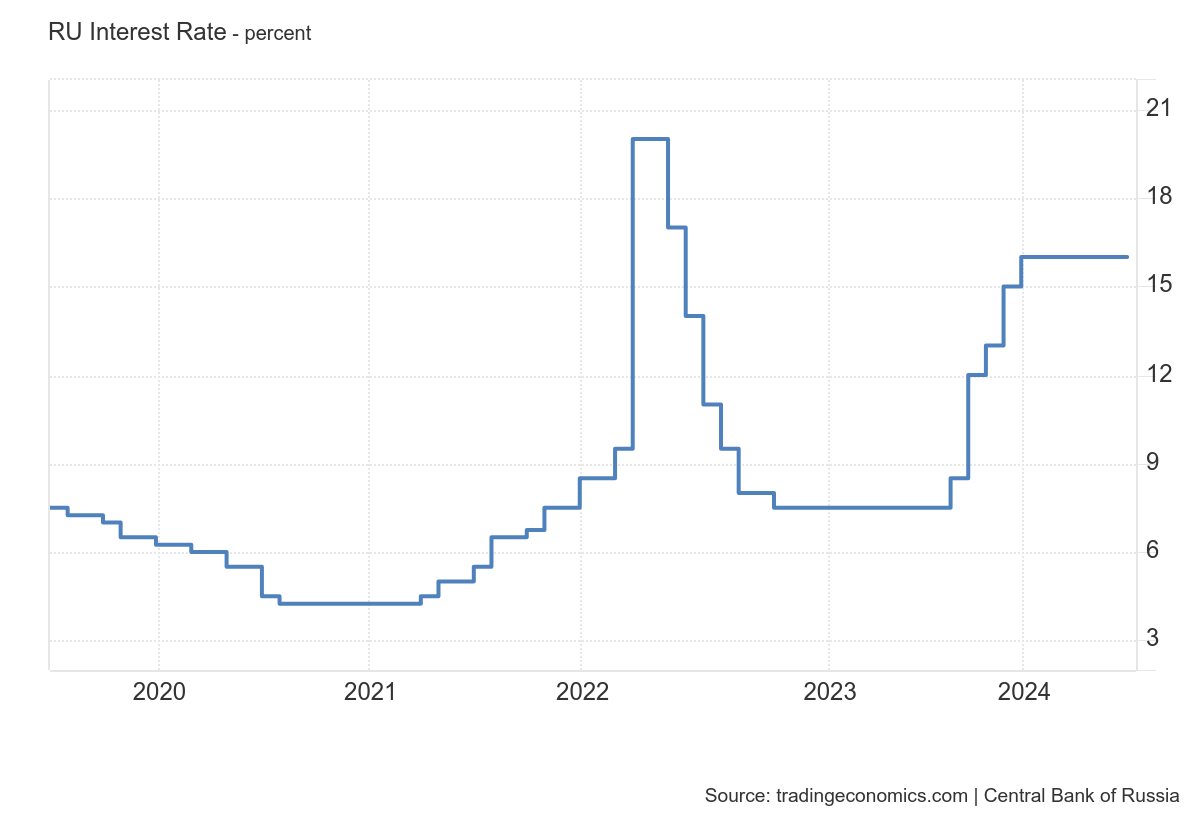

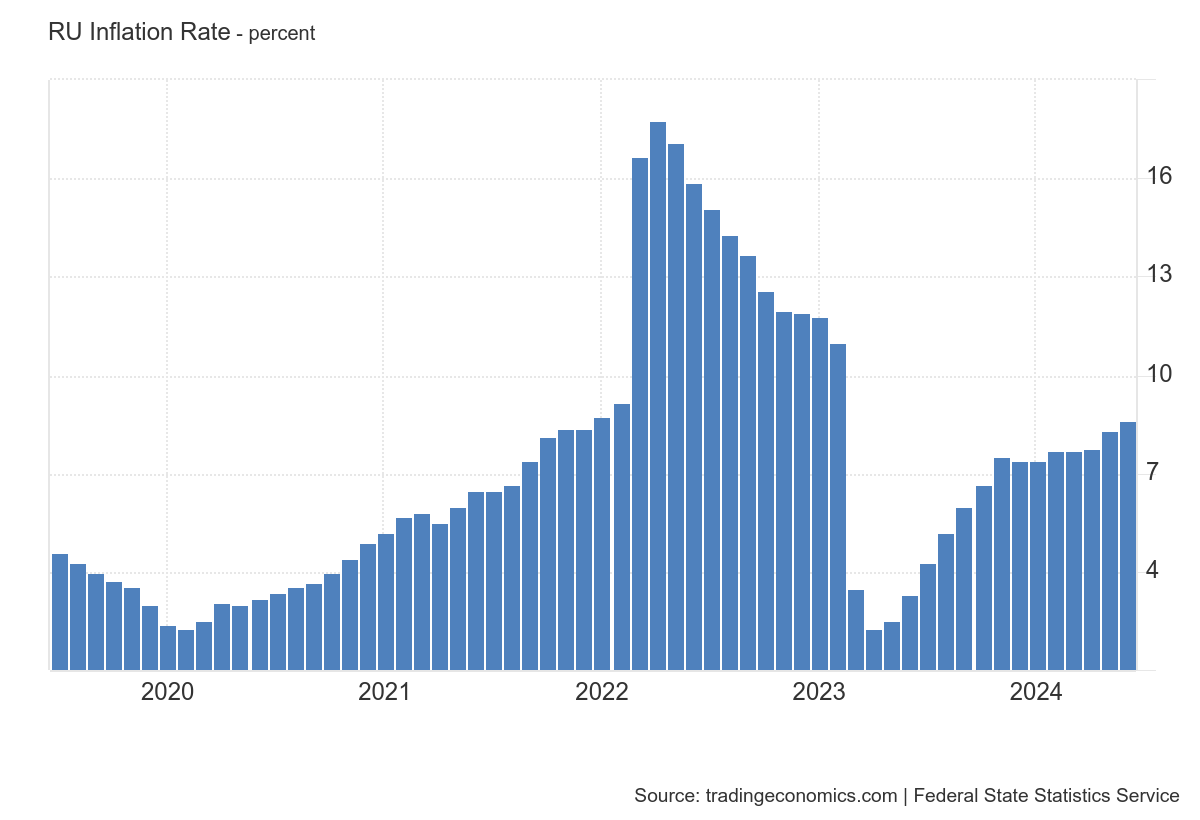

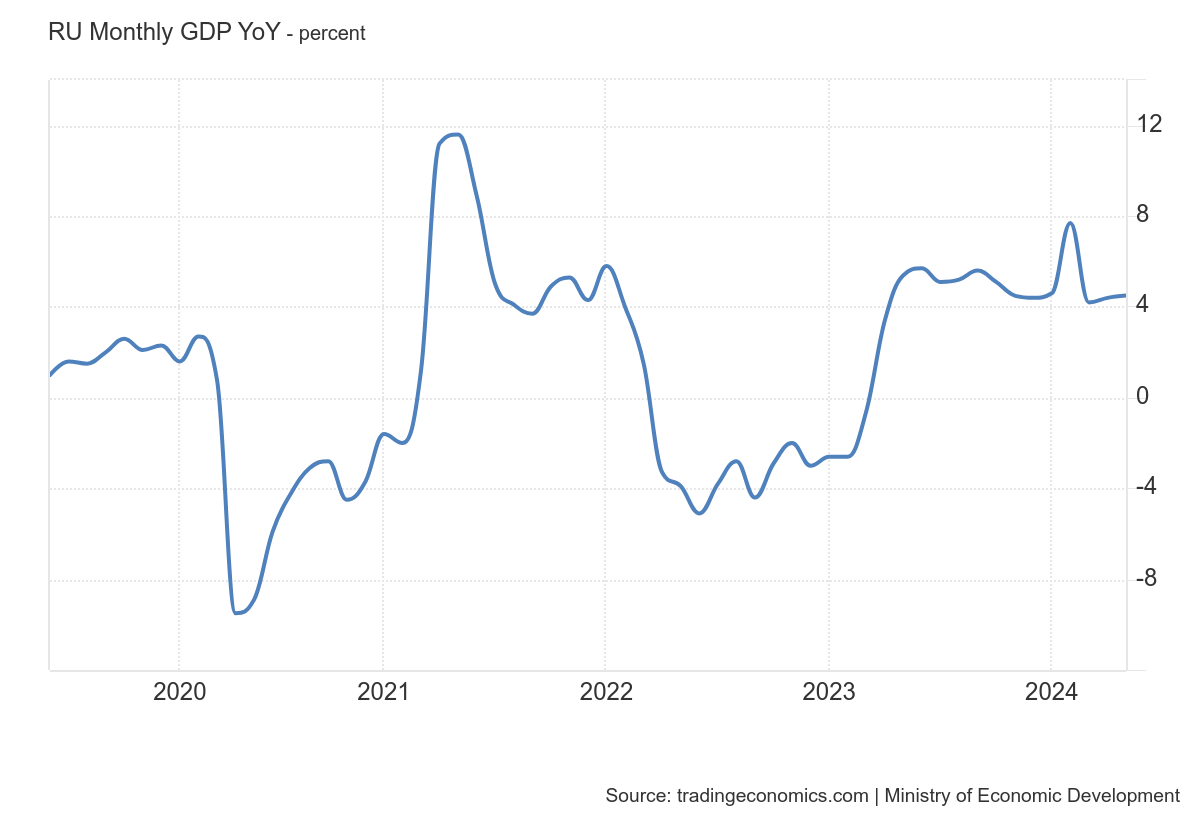

Here’s some pictures of the latest monetary conditions. Note the policy rate remains high, at 16%.

We don’t know what the ex ante real policy rate is in the absence of a good estimate of expected inflation. Assuming adaptive expectations (lagged y/y inflation is a proxy for current expected inflation), the real policy rate is positive.

With June y/y inflation at 8.6%, then the real policy rate is 7.4%. A high real rate stabilizes the currency, and tends to stifle inflation, but at the cost of depressing economic activity in interest sensitive sectors.

While reported GDP growth (y/y, through May) is positive at around 4%, if one took out defense and security spending, growth would probably be substantially lower. I haven’t done this calculation for 2023 or 2024, but here‘s the calculation based off of 2023 estimates and forecasts.

These observations would have sparked a flurry of angry comments from our former troll JohnH but I guess we’ll just have to endure the nonsense that will be forthcoming from Steve Kopits. Not only does the discussion notes that the oil sanctions are hurting the Russian economy but the discussion notes that the very high nominal interest rates are in part an indication that real rates are high. No, no, no – Stevie is convinced that Russian inflation must be 15% even though it is not.

Opioid of the Masses

To many, Donald Trump feels good, but he can’t fix America’s growing social and cultural crisis, and the eventual comedown will be harsh.

By J. D. Vance

During this election season, it appears that many Americans have reached for a new pain reliever. It too, promises a quick escape from life’s cares, an easy solution to the mounting social problems of U.S. communities and culture. It demands nothing and requires little more than a modest presence and maybe a few enablers. It enters minds, not through lungs or veins, but through eyes and ears, and its name is Donald Trump.

Interesting words from Mr. Vance some 8 years ago. Compare this H. L. Mencken’s “For every complex problem there is a solution that is simple, straightforward, and wrong.”

This is Bruce Hall’s favorite quote. But Brucie worships the ground Trump walks on. Brucie indeed is one confused MAGA moron.

Why Are Conservative Men So Scared of Cat Ladies?

https://nymag.com/intelligencer/article/conservative-men-scared-cat-ladies.html

“We are effectively run in the country via the Democrats, via our corporate oligarchs, by a bunch of childless cat ladies who are miserable at their own lives and the choices that they’ve made, and so they want to make the rest of the country miserable too,” Vance told Tucker Carlson in 2021.

Vance managed to include Pete Buttigieg as one of those childless cat ladies even though Pete Buttigieg has two children. MEOW!

I am disappointed seems Vance has more rent free space in your psyche than me.

Trump still tops?

Did you get busted for drunk driving last night? At least your prison cell has WiFi so you can continue your worthless troll parade.

You need a lot of help from your friends.

Your need to sober up troll.

This expression – “living in someone’s brain rent free” – has only been used on the internet about a trillion times. So droll. So original.

The point of the expression is to push back against whatever the other guy said, when the other guy’s point is sharper than any response you can think of.

Take the present case:

“Wow, you really seem interested in the thinking of the guy who might be second in line to run the most powerful country in the world.”

Lacks sting, doesn’t it?. So out comes tire old “rent free”. How clever.

Sick burn(s)! I sit at your feet, awash in admiration…

Is perfect season for Long Island Iced Tea!

Relative to gas and oil, coal is a small source of exporter earnings for Russia:

https://energyandcleanair.org/june-2024-monthly-analysis-of-russian-fossil-fuel-exports-and-sanctions/#:~:text=In%20June%202024%2C%20Russia's%20monthly,level%20as%20the%20previous%20month.

As the chart at the top of the linked article shows, Russian gas exports are down most since Russia’s re-invasion of Ukraine, but oil and coal are also down. The problems for Russia’s gas and oil sectors are no secret. Let’s have a peek at coal.

Russia’s coal exports are struggling in both of its biggest markets, China and India. Chinese tax policy has recently changed to favor imports of coal from countries other than Russia:

https://www.bloomberg.com/news/articles/2024-04-23/china-loses-its-appetite-for-russian-coal-as-import-costs-rise

Indian imports of Russia coal have fallen sharply, in part duetl to low quality. U.S. coal is making up some of the difference:

https://www.reuters.com/business/energy/indian-imports-russian-coal-fall-us-shipments-rise-2024-06-25/#:~:text=India%20is%20Russia's%20second%2Dlargest,a%20drop%20in%20global%20prices.

Russian coal exports to China were hampered last year by rail bottlenecks, which also increased costs. We can probably infer that this infrastructure problem is a side-effect of war. It may also be why China has sought coal elsewhere. Whether the quality problem is also related to the war I can’t say.

https://en.wikipedia.org/wiki/List_of_countries_by_coal_production

Russia ranks number 6 in terms of coal production by nation. China and India may import coal but they also produce a lot of the coal they consume. And as far as major exporters – try Indonesia and Australia,

More headline like this please

Trump’s tariffs could mirror Hoover’s Depression-era results

https://www.msn.com/en-us/news/politics/opinion-trump-s-tariffs-could-mirror-hoover-s-depression-era-results/ar-BB1q6pTi?ocid=msedgdhp&pc=U531&cvid=0b0c313c02a34108ad317af968136061&ei=15

As the Republican Convention continues this week, candidate Donald Trump’s ideas for a second-term trade policy look remarkably similar to those of his long-gone but never-quite-forgotten Republican predecessor: Herbert Hoover. Hoover’s 1928 program — a higher tariff across the board — is the obvious ancestor of Trump’s proposed 2024 program of 10 percent tariffs on goods from all countries and 60 percent on Chinese-made products. This would mean a national rate of around 12.5 percent, the highest U.S. tariff since the late 1930s. Would a Trump tariff in 2025 bring the same results Hoover’s Smoot-Hawley Act got then? Depression-like policies don’t always bring Depression-like results. But recent experience at home and abroad, analysis from across the political spectrum and constitutional rules for trade policy give us four things to expect: higher inflation, lower growth, more taxation of working families and less of investors, and perhaps (depending on how a hypothetical Trump administration implements its program) a constitutional crisis verging on taxation without representation.

A side note – Smoot-Hawley did not cause the Great Depression but it didn’t help.

https://direct.mit.edu/rest/article-abstract/80/2/326/57050/The-Smoot-Hawley-Tariff-A-Quantitative-Assessment?redirectedFrom=fulltext

The Smoot-Hawley Tariff: A Quantitative Assessment

Douglas A. Irwin

The Review of Economics and Statistics (1998) 80 (2): 326–334.

Abstract

In the two years after the imposition of the Smoot-Hawley tariff in June 1930, the volume of U.S. imports fell over 40%. To what extent can this collapse of trade be attributed to the tariff itself versus other factors such as declining income or foreign retaliation? Partial and general equilibrium assessments indicate that the Smoot-Hawley tariff itself reduced imports by 4-8% (ceteris paribus), although the combination of specific duties and deflation further raised the effective tariff and reduced imports an additional 8-10%. A counterfactual simulation suggests that nearly a quarter of the observed 40% decline in imports can be attributed to the rise in the effective tariff (i.e., Smoot-Hawley plus deflation).