Actually, no — but perhaps a fast food nation in recession. In arguing that output is mismeasured, so much so we’ve been in recession for the past four years, Peter St. Onge (Heritage) and Jeffrey Tucker (Brownstone Institute) write:

Various studies have shown that since 2019 fast food prices — a gold standard in financial markets for measuring true inflation — have outpaced official CPI by between 25% and 50%.

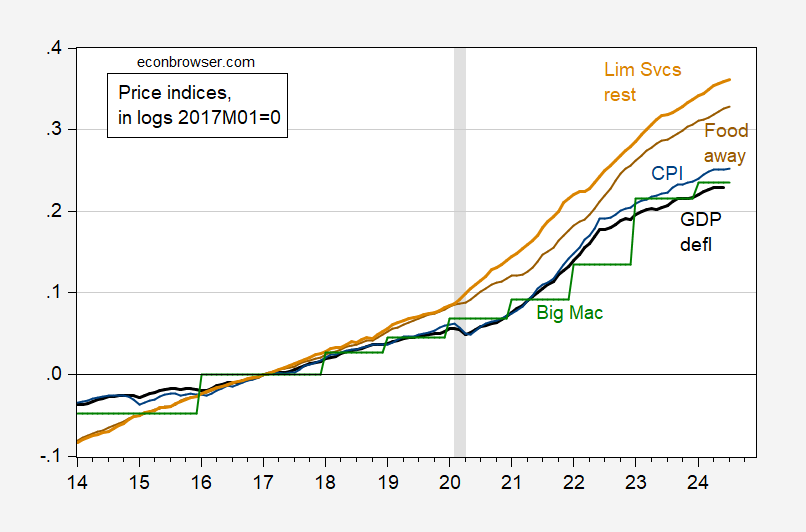

The “various studies” cited are as far as I can tell a set of newspaper articles. What if we measure GDP using fast food prices? Here’s the evolution of the fast food (“limited service restaurants”) component of the CPI, as compared to the GDP deflator, the CPI, and the food away from home component of the CPI:

Figure 1: GDP deflator (black), CPI (blue), food away from home CPI (brown), food away from home – limited service restaurants CPI (tan), Big Mac price (green), all in logs 2017M01=0. Big Mac prices based on price as close to year mid-point as possible. NBER defined peak-to-trough recession dates shaded gray. Source: SPGMI (Macroeconomic Advisers/IHS-Markit) 8/1 release, BLS via FRED, BLS, Economist, NBER, and author’s calculations.

Some discussion of fast food store prices here). My preferred measure is the Big MacTM, which is used in many studies of purchasing power parity (including one published in Economic Journal).

It’s true that using the limited services restaurant price index, prices have risen faster than the CPI (although the same is not true for Big MacTMs!).

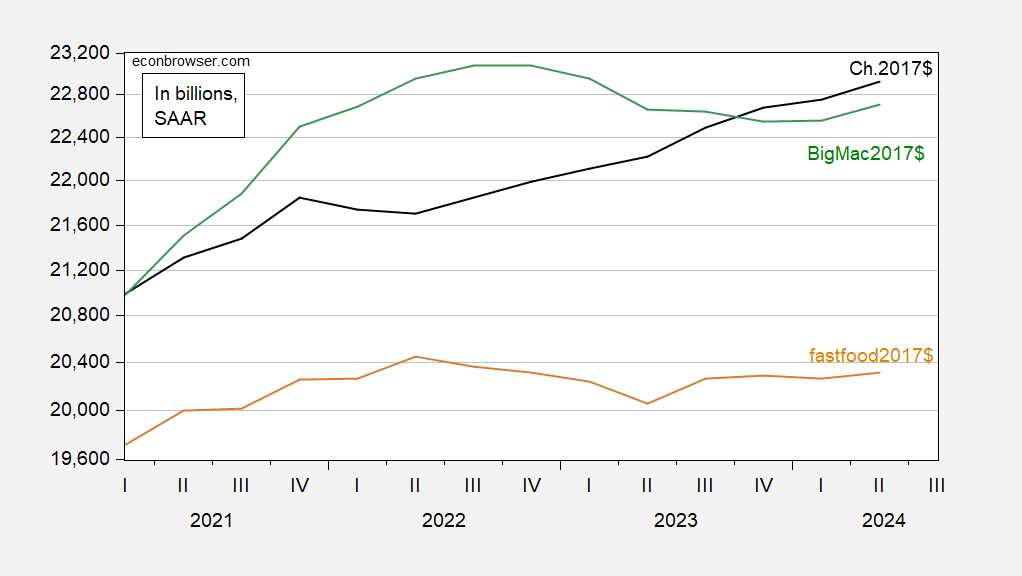

I plot the different measures of GDP over the same period plotted by St.Onge and Antoni.

Figure 2: GDP in bn.Ch.2017$ (black), in bn.BigMac2017$ (green), in bn. bundles of restaurant food 2017$ (tan), all SAAR. Big MacTM prices interpolated (cubic) from annual July observations. Source: BEA 2024Q2 2nd release, BLS, Economist, and author’s calculations.

Using Big MacTM prices, real GDP has been falling since end-2022, albeit from a higher level than GDP measured in Ch.2017$. Using the food-away-from-home limited services component of the CPI, we have a picture slightly more in line with the St. Onge-Tucker thesis.

So…if all we consumed, invested in, paid soldiers and civil servants, and exported was burgers, sandwiches, fried chicken and tacos, then indeed we might have been in a recession for the past four years. (Fast food has a 2.5% weight in the CPI-U, so assuming consumption is 70% of GDP, then fast food consumption accounts for about 1.8% of GDP.)

“… fast food prices — a gold standard in financial markets for measuring true inflation…”

I have never worked at a hyper-partisan institution. I have, however, spent considerable time in financial-market-adjacent positions. I have never seen a claim by financial market types, or anyone else, that fast food prices have special relevance as an inflation measure – certainly not that fast food prices are a superior measure, a “gold standard”.

The Big Mac index exists for one simple reason – it allows the comparison of the prices of identical goods across a large number of countries without going to much trouble. That’s it. No other reason.

Typically, I point out that a misstatement of fact this glaring indicates either ignorance or dishonesty. This combination of misstatements means ignorance, even motivated ignorance, cannot be the excuse. These partisan bimbos, Onge and Tucker, have simply lied about the status of fast food prices in order to lie about inflation. They lie for a living. Their parents must be so proud.

“it allows the comparison of the prices of identical goods across a large number of countries”

Of course what is identical are the ingredients. If you paid $5 for your Big Mac, the cost of ingredients is less than $2. The other $3 goes to things like the labor to make and serve your Big Mac and the profits for the owners of the store. That Big Mac prices do not exactly follow PPP is no surprise give the fact that labor costs and profits are not identical across nations.

Anyone who would claim Big Mac prices represents the gold standard has to be incredibly stupid.

So now the gold bugs are now Big Mac bugs? A world of financial and economic nirvana awaits if we ditch the gold standard and tie the dollar to Big Macs.

Did I miss anything?

‘The “various studies” cited are as far as I can tell a set of newspaper articles.’

That is exactly how Bruce Hall does his serious “economic” research! Personally I don’t eat fast food so Big Macs have a zero weight in my consumption basket. But I get it – Big Macs are a yuuuuge part of Donald Trump’s basket of goods. Which is why he carries so much damn weight.

“It shows the inflation of fast-food prices over the last of 10 years vs. actual inflation of 31%.”

These Crews people define the inflation rate as the change in the price level over a decade rather than a year? OK – the world is becoming dumber by the day as everyone wants to emulate Bruce Hall.

“if all we consumed, invested in, paid soldiers and civil servants, and exported was burgers, sandwiches, fried chicken and tacos”.

In other words, everyone adopted a Donald Trump diet. Such imagine all the very unhealthy people with the cost of providing health care going through the roof.

I just always think back on the times (I tried to keep it to a minimum but I was lazy or tired from standing 4–6 hours straight teaching) I went to McDonalds in China and ordered, and they repeated back to me “Big Ma tse??”, and then waited twice as long for anything else you ordered there. Good times……

Classic cherry-picking to find “support” for an already decided narrative. From thousands of prices that fluctuate picking out one that support just about any narrative you want is grade school math. The results of such math should stay there – in grade school papers.