I have delayed reviewing this portion of chapter 26 of the Project 2025 because I knew it would be painful to read. But as the election nears, it’s incumbent upon all of us to take up our burdens in support of good policy. So here is some key text from this portion of the chapter, written by my onetime (40-42 years ago) coauthor Peter Navarro (the second portion, “The case for free trade” by Kent Lassman is a useful orthodox treatment of trade policy).

The United States of America is the world’s dominant superpower and remains

the world’s arsenal of democracy. To maintain that global positioning—and thereby

best protect the homeland and our own democratic institutions—it is critical that

the United States strengthen its manufacturing and defense industrial base at the

same time that it increases the reliability and resilience of its globally dispersed

supply chains. That will necessarily require the onshoring of a significant portion

of production currently offshored by American multinational corporations.

Trade policy can and must play an essential role in an American manufacturing

and defense industrial base renaissance. However, several major challenges in the

international trading environment are pushing America in the opposite direction.

The first challenge is rooted in MFN: the “most favored nation” rule of the World

Trade Organization (WTO). According to the MFN rule, WTO members must apply

the lowest tariffs that they apply to the products of any one country to the products

of every other country.3 However, WTO members can charge higher tariffs if they

apply these nonreciprocal tariffs to all countries.

The practical result has been the systematic exploitation of American farmers,

ranchers, manufacturers, and workers through higher tariffs institutionalized by

MFN. In turn, this unfair and nonreciprocal trade has resulted in chronic U.S. trade

deficits with much of the rest of the world. This systemic trade imbalance serves as

a brake and bridle on both GDP growth and real wages in the American economy

while encumbering the U.S. with significant foreign debt.

The second challenge is part of the broader existential threat posed by the

Chinese Communist Party (CCP) in its quest for global dominance. That challenge

is rooted in the CCP’s continued economic aggression, which begins with

mercantilist and protectionist trade policy tools such as tariffs, nontariff barriers,

dumping, counterfeiting and piracy, and currency manipulation. However, Communist

China’s economic aggression also extends to an intricate set of industrial

policies and technology transfer–forcing policies that have dramatically skewed

the international trading arena.

Both the unfair, unbalanced, and nonreciprocal trade institutionalized by the

WTO and Communist China’s economic aggression are weakening America’s manufacturing

and defense industrial base even as the fragility of globally dispersed

supply chains has been brought into sharp relief by the COVID-19 pandemic with

its associated lockdowns and other disruptions and by the Russian invasion of

Ukraine. Russian revanchism, in particular, has demonstrated once again how bad

actors on the world stage can use trade policy (for example, export restraints on

natural gas) as a weapon of war.

At this point, the author launches into a discussion of how trade deficits are prima facie evidence that the US has deindustrialized, in particular those industries important to national security.

During the first year of the Biden Administration, the overall U.S. trade deficit,

including goods and services, soared by 29 percent, from $654 billion in 2020

to $845 billion in 2021.4 Over the same time period, imports of consumer goods, capital goods, and the category of foods, feeds, and beverages were the highest on

record, and imports of industrial supplies and materials were the highest since 2014.

As for the U.S. trade deficit in goods, which primarily measures manufacturing

output, Table 1 catalogues that deficit for the top 13 countries plus the European

Union (EU) in fiscal year (FY) 2022. Note that the trade deficit in goods with Communist

China is by far the largest: It accounts for fully one-third of that deficit and

is more than twice the size of the deficit with the EU.

These trade deficit statistics implicitly measure the large amounts of America’s

manufacturing and defense industrial base and supply chains that have been

offshored to foreign lands.

As Robert Z. Lawrence once remarked to me as I was writing a memo on the trade deficit, we’re always going to have records because nominal quantities are typically rising… Here’s a picture of the trade deficit normalized by GDP:

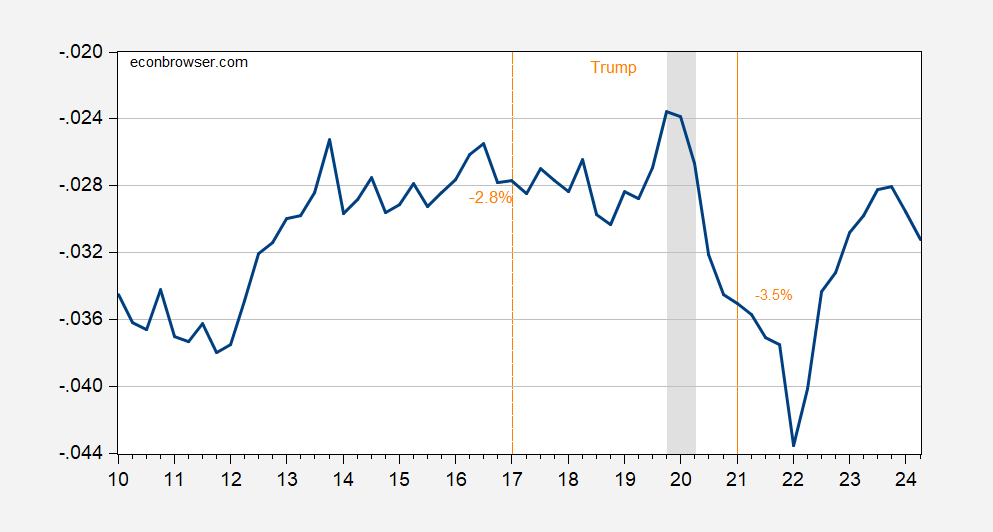

Figure 1: Net exports to GDP. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER.

As this picture shows, on a NIPA basis, the trade deficit was larger as a share of GDP after Trump than before Trump. This was also true after Trump vs. at the beginning of the trade war, in Q2 2018.

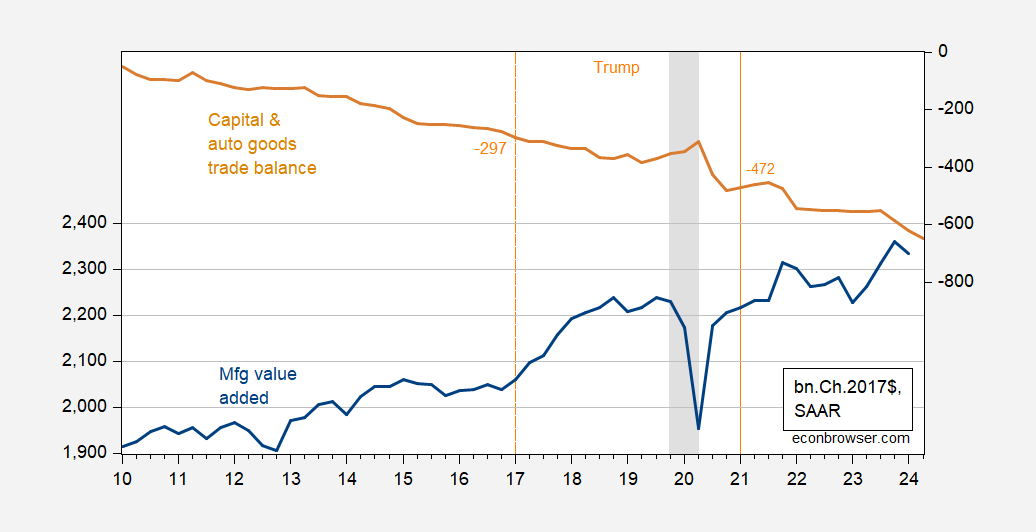

Navarro also argues that the manufacturing base was smaller because of the trade deficit in manufactured goods. I plot manufacturing value added vs. the capital goods + automotive trade balance (all in 2017$).

Figure 2: Manufacturing value added (blue, left scale), trade balance on capital and automotive goods (tan, right scale), both in bn.Ch.2017$ SAAR. Manufacturing value added in 2012$ spliced to series in 20176$ by author. NBER defined peak-to-trough recession dates shaded gray. Source: BEA and author’s calculations.

There’s no obvious relationship (at business cycle frequency) for a relationship between the capital and automotive goods trade balance and value added in manufacturing. Maybe value added would’ve been greater in the absence of the trade deficit, ceteris paribus. however, maybe it would’ve been larger, given imported (cheaper) inputs allow greater production.

In any case, the proposed remedy for the perceived imbalance is the US Reciprocal Trade Act, summarized by CRS thusly:

United States Reciprocal Trade Act

This bill allows the President, in certain circumstances, to (1) negotiate with a foreign country for tariff reductions on exported U.S. goods, or (2) impose additional duties on imported goods. Specifically, the President may take these actions if it is determined that the country (1) when importing a good from the United States, applies a higher rate of duty on that good than the rate imposed by the United States when imported from that country; or (2) similarly imposes other, nontariff trade restrictions on that good.

The President must terminate a rate of duty increase under this bill if the country no longer applies such higher rates or nontariff trade restrictions, or if the higher rate is no longer in the interest of the United States.

Congress may nullify a rate of duty increase implemented under this bill through a joint resolution.

This bill is effective for three years, subject to one three-year renewal.

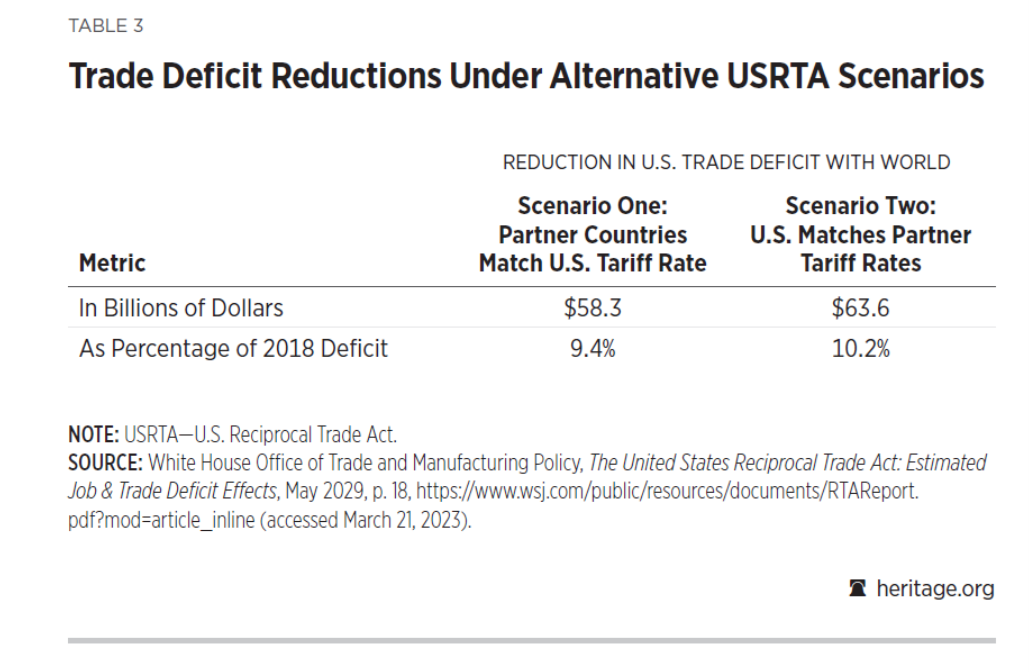

Navarro cites the simulations run by his office, using the World Bank’s SMART tariff simulator.

One in Table 3 assumes that our trading partners lower their applied tariff rates on specific products to U.S. levels in cases where their applied tariffs are higher. Scenario Two assumes that our trading partners refuse to lower their tariff rates to match those of the U.S. Instead, in order to uphold the principle of reciprocity, the U.S. raises its tariffs to mirror levels. To calculate the trade deficit reductions under Scenario One and Scenario Two, the analysis relied on the World Bank’s SMART tariff simulator. Table 3 provides the simulation results.

In Scenario One, if all 132 countries were to lower their higher nonreciprocal tariffs to U.S. levels, the overall U.S. trade deficit in goods would be reduced by $58.3 billion, or about 9.4 percent of that deficit. In contrast, in Scenario Two, if these countries were to refuse to reciprocate and the U.S. were to raise its tariffs to mirror those countries’ levels, the reduction in the U.S. trade deficit would be slightly larger: an estimated $63.6 billion, or 10.2 percent of the deficit. This suggests that implementing the USRTA would help to create between 350,000

and 380,000 jobs.

Here’s Table 3:

SMART is a tool within the World Bank’s World Integrated Trade System (WITS). It’s partial equilibrium, so as the tariffs change overall economic output, and other macro aggregates and prices (including exchange rates) stay fixed. This is fine for changes in tariffs covering small amounts of imports. Not so for large changes in tariffs on most goods.

I would say for such widespread tariff increases, it’s much more likely to see big macro changes, as we saw in the wake of the 2018 trade war. In 2018, the global EPU rose 60%; the elasticity of the real value of the dollar with respect to the global EPU is 0.2. That implies 12 ppts of the dollar’s strength in 2018 was attributable to the policy uncertainty spurred by the Trump trade war. Say a Trump trade war 2.0 induces a EPU jump of comparable magnitude; this would imply a 12 ppt increase in the value of the dollar, much of any expenditure switching coming from higher tariff rates. Using estimates from Chinn (2004), the dollar appreciation alone would cause a $455 billion dollar (SAAR) increase in the trade deficit (using 2024Q2 figures). 2024Q2 net exports are about -$894 billion.

For the sake of argument, suppose the affects are additive. the $455 billion dwarfs the $63 odd billions from the SMART simulation (take it up to $70 billion to account for traded goods price inflation).

The other portion of Navarro’s portion of the chapter deals with how China cheats and poses a national security threat to the United States. Actually, I agree that China trade and economic policies distort trade (particularly explicit and implicit subsidies to state owned enterprises), and even more so that China poses a national security threat in its competition in high tech. I’ll address some of those concerns (again) in another post. Suffice to say, I think tariffs and other NTBs (as used in Trump trade war 1.0) are probably too blunt and inefficient ways to deal with these threats.

For now, let me end with the following conclusions, which I largely agree with.

National Security Benefits and Costs. On the benefit side, protectionism within certain basic industries like autos, steel, and electronics helps to create and sustain and industrial base that, in times of war or national peril, can be shifted to defense purposes. However, this national security argument–and the existence of any benefits resulting from protecting these industries–can legitimately be called into question for several reasons.

First, the existence of any sizable benefits rests on the assumptions that import competition in our defense-related industries would not only reduce the size of these industries but also shrink them to the point where they would be too small to support our defense needs…

Second, it is highly possible that our defense capability might actually be enhanced–not damaged-by import competition. Without the umbrella of protectionism, our defense-related industries would be forced to operate at lowest cost, engage in more research and development, aggressively innovate to stay one step ahead of the competition, and modernize their plants at a faster pace. …

On the national security cost side, the major effect of protectionism is to threaten the stability of the international economic order through a global trade war. …

That excerpt is from Peter Navarro, The Policy Game (Wiley, 1984), p.82, on the national security/trade policy nexus.

I thought Trump has nothing to do with Project 2025. Oh wait!

Trump took a private flight with Project 2025 leader despite saying he doesn’t know people behind the plan

https://www.msn.com/en-au/news/other/trump-took-a-private-flight-with-project-2025-leader-despite-saying-he-doesn-t-know-people-behind-the-plan/ar-AA1osDku?ocid=BingNewsSerp

BTW – thanks for this:

SMART is a tool within the World Bank’s World Integrated Trade System (WITS). It’s partial equilibrium, so as the tariffs change overall economic output, and other macro aggregates and prices (including exchange rates) stay fixed. This is fine for changes in tariffs covering small amounts of imports. Not so for large changes in tariffs on most goods.

I had asked about it a while back. Now I have some reading to do!

My brain is a strange thing (I’d say weird, but that word seems more derogatory to me recently). Sometimes I think my brain works really well, like upwards of 90% percentile compared to most people. Sometimes like in the bottom 5% percentile (those moments that make me grimace when alone in a room at some latter time). But I was reading the last portion of this post, and the entire time thinking “Huh, which part of Project 2025 is this from??” Navarro proves one thing. Some of us do indeed regress as time goes buy. I am praying I am not one of these people.

“During the first year of the Biden Administration” Focused on only 2021. As you note – the trade deficit as a share of GDP rose under Trump. As your chart shows, the trade deficit as a share of GDP fell considerably since 2021. Ah but as one former troll would say – I’m moving the goal posts!

Steve Benen writes what needs to be said about Vance’s disgusting Swift Boat II:

It’s not just birtherism making a comeback, so is Swift-boating

Last week, the Trump-Vance ticket brought back birtherism. This week, the Republicans have targeted Tim Walz by bringing back Swift-boating, too.

https://www.msnbc.com/rachel-maddow-show/maddowblog/birtherism-swift-boating-election-2024-trump-vance-walz-military-rcna165748

Have you noticed that after little Bruce Hall decided to post a dishonest 2018 “paid for” letter dredging this up, the coward has ran and hid as usual?

trump-vance are unoriginal. and you will start to see, they are becoming rather boring. in addition to being just plain weird.

Arguments like ‘our manufacturing capacity must be down because manufacturing imports are up’ can only result from ignorance or dishonesty.

When someone as well educated as Navarro is the one to say it, the reason can’t be ignorance.

Consider a vertically integrated sector. We make more final goods which requires more inputs some of which are made abroad. If Navarro does not get this – no wonder the Trump trade war was such a mess.

Or an increase in goods’ share of consumption, accommodating both higher goods imports and higher domestic manufacturing.

But I guess nothing like that has ever happened.

@ Macroduck

Any idea how tough the Geography courses are at Dartmouth??

https://www.thedailybeast.com/laura-ingraham-mixes-up-midwest-geography-while-bashing-walz

“During a discussion that was critical of the “radical policies” of Minnesota Gov. Tim Walz, Ingraham implied that Milwaukee was in the border state of Minnesota.”

She was just in Milwaukee. I guess all the black residents got her all flustered.

You know that if Ingraham touches a coffee cup a Black barista at Starbucks handed her she puts on a fake smile, throws the cup in a trash bin in the parking lot, then runs back to the hotel for a full body wash with “Lava” brand soap.

Let’s stipulate that tariffs and Project 2025 recommendations are not “good” economic policies.

How does the USA develop a practical plan to continue moving up the comparative advantage ladder.

How do we develop and train a workforce to operate in the desired economy.

Especially, how do we elevate workers who may be considered “marginal” in ability and education, so as to maximize their employment?

Heard a hiring manager talking about how tough today’s labor market is. Said something like “In the past, 80% of new hires already knew sheet metal work. Now, we have to train 80% of them.”

As reported, that change from little need to train to big need to train sounded like a problem, but from the trainee’s perspective, it’s an improvement. Tight labor markets are good at providing new skills, at increasing productivity.

Much of what passes for business reporting is emotion-laden and unobjective – gotta instill a bitof drama to sell ad time. Take outthe emotion and things look different. Objectively, increased training cost is simple adaptation to circumstances, justified by market conditions. Anyhow, a long-winded way of saying “we’ll adapt”.

It would be wonderful if our once-great educational system hadn’t become a budget football in a partisan game. It would be wonderful if we had a Pigiouvian tax system that guided investment in socially useful directions. But even without those things, a market-based economy adapts reasonably rapidly.

a hiring manager who is upset because they need to train new hires is a problem. you should be training both new hires and existing hires. otherwise, you simply believe it is the responsibility of “others” to absorb the cost to train the people you would like to hire. pretty stoooopid outlook. probably the reason you are hiring to replace somebody rather than hiring to expand your business.

“In the past, 80% of new hires already knew sheet metal work. Now, we have to train 80% of them.”

that means today the economy is actually robust. and yesterday, the economy was poor. and it appears this manager would prefer the poor economy.

Now I am older than most people here but when I was at University fair trade was an issue argued by mad lefties. how times change what was left is now right?

you would not recognize the Conservative Party today. the maga party is not conservative in the traditional sense.