From a February 1st post:

I use a regression of DSR growth rate on changes in AAA and 3 month Treasury yields, and 2 lags of DSR growth to forecast 2023Q3 DSR. I then obtain the following estimate of recession probability through 2024M09.

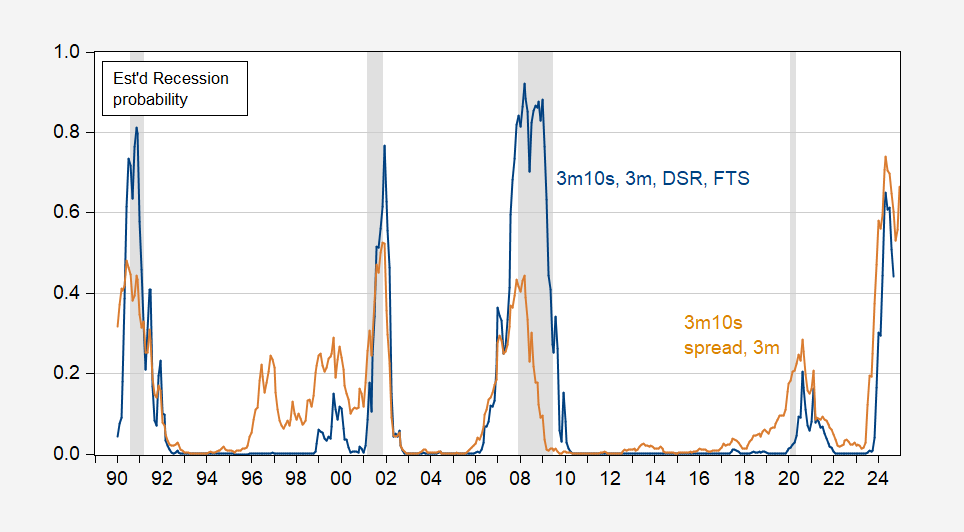

Figure 1: Probability of recession from term spread and short rate (tan), and term spread and short rate, debt-service ratio, foreign term spread (blue). NBER defined peak-to-trough recession dates shaded gray. Source: NBER, and author’s calculations.

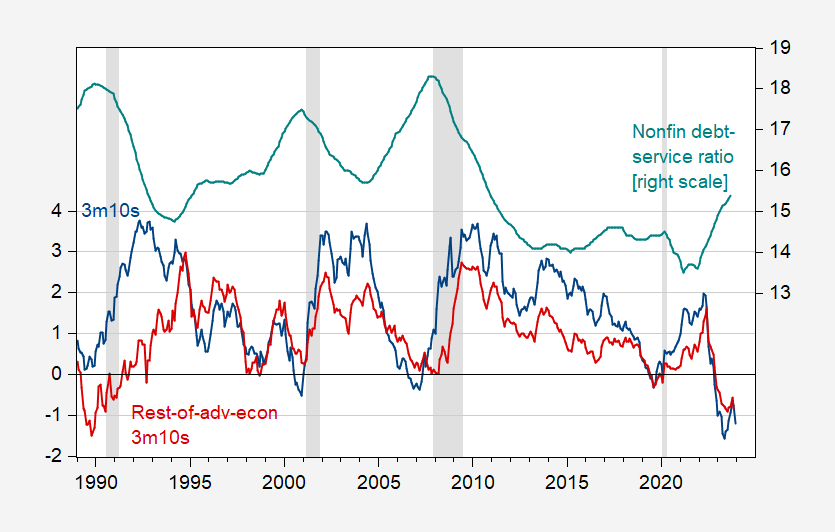

These probability estimates are based on these series.

Figure 2: Ten year – three month Treasury term spread (blue, left scale), and long term-short term sovereign spread in rest-of-advanced economies, GDP weighted, both in % (red, left scale), and debt-service ratio for nonfinancial corporations, % (teal, right scale). Monthly DSR linearly interpolated from quarterly data; 2023Q3 data extrapolated as described in text. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, Dallas Fed DGEI, BIS, NBER, and author’s calculations.

The probability of recession according to either specification is quite high. A simple term spread plus short rate model indicates 56% in February, while the full specification indicates only 29%. In other words, if the full specification is the more accurate (as suggested in Chinn-Ferrara), then the absence of an obvious recession onset thus far should not be taken as proof positive a recession is going to be avoided. Peak estimated probability of recession is May 2024 (65% according to full specification).

So, using data available through September 2023, the probability of recession in August using a simple spread model is still quite high, while that using a debt-service augmented model is at 51%. So, while we can see little evidence of recession in the June and July data, remember that we don’t have any data on August (and only weekly data for releases through 7/27).

For the most recent assessment (using a larger sample, and assuming no recession will be declared by NBER BCDC as starting before June 2024), see this post.

Hi,

Great and very interesting article! Could you provide some context on how you conducted the regression analysis, including the software you used? I am new to this field but find these models fascinating and am eager to start building them myself. If possible, could you share links or examples of sources that helped you in developing these models? Thanks, I look forward to your response!

@ Dorie Poptani

I think E-Views is what most college profs use. maybe some MATLAB.

Younger folks are turning more to “R” (RStudio) and Python.

We have another regular commenter here who goes by “2slugbaits” who is way better versed on this topic than me. Also a sharp guy named Pawel might have some thoughts for you.

Thanks, @Moses Herzog! I have just recently come across this site and look forward to reading what those commentators have to say.

I’ve been exploring R and Python over the past few weeks, and I’m finding them quite riveting. I appreciate the suggestion to look into E-Views and MATLAB—I’ll definitely add them to my toolkit. Thanks again!