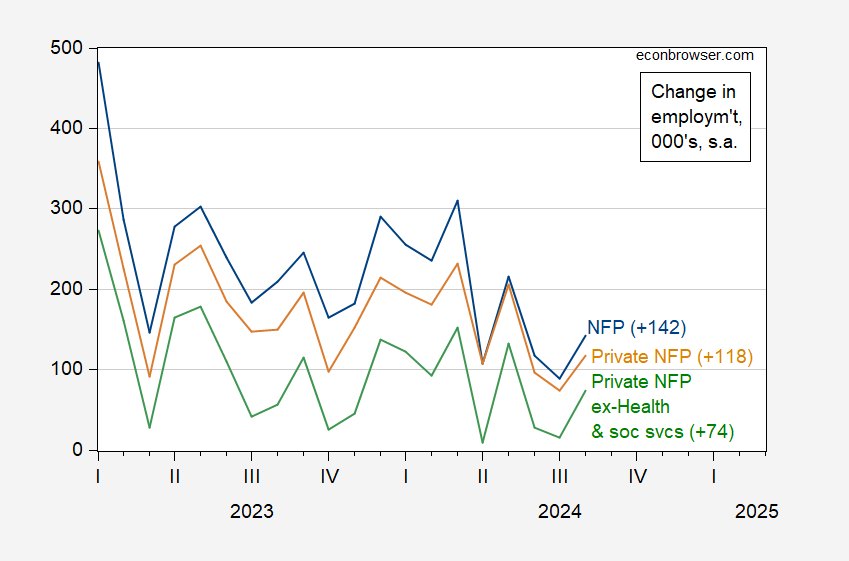

Audio here, at 2:30 approximately. He also says private NFP gain is down to +56K, while private ex-health care and social services (all essentially government), was only up +12K. Here’s the picture I get looking at current vintage/latest release:

Figure 1: Change in nonfarm payroll employment (blue), in private NFP (tan), in private NFP ex-health care and social services employment (green), all in 000’s, s.a. Source: BLS via FRED and authors calculations.

I couldn’t figure out how Kudlow got his numbers. Then I realized he’d incorporated the downward revisions from previous months, so he should’ve said “on net” or something like that. He also mentioned the ISM and construction numbers (the same that Peter Schiff had mentioned). As I noted, these were not statistically significant changes. In any case, I’ve added Mr. Kudlow to the “recession camp” list.

More stuff from Kudlow: weird ways to calculate job gains, no recession in Dec. 2007, etc.

“I couldn’t figure out how Kudlow got his numbers.”

Kudlow has no idea either. He was told what to say by his masters at Faux News. And he has been saying we are in a recession ever since Biden took office.

Thanks for reminding that Kudlow the Klown was telling us that the “Bush Boom” was still in force just as the 2007 recession started. Of course his buddy Luskin was saying that nine months later!

Another classic forecast was when in 2003 he said our invasion of Iraq would lower oil prices to $12 a barrel.

I went back to the classic “Scavino (or Kudlow) Strike Again: Disinformation Edition”

Guess who was trying to justify Kudlow’s mendacity? Yea, that was easy. Bruce Hall!

I used to call Luskin, Moore, and Kudlow the three stooges but me thinks we have six stooges including Antoni, Laffer, and of course Bruce Hall!

I tried to listen to Kudlow. He was mumbling incoherently. I bet that was deliberate as he knew was lying through his teeth.

Now people mock Trump’s recent incoherent babbling but next to Kudlow Trump is another Edward R. Murrow.

I worked for a time with someone who had worked with Kudlow at Bear Stearns. She said that Kudlow commonly said things like “find me some data that show…” In other words, Ludlow would start with a conclusion and then demand data confirming that conclusion. No research needed.

No one will be surprised at this, of course – he’s been doing the same thing ever since. Is it any wonder that Bear Stearns collapsed? They were cool with coked-up Kudlow faking research in order to flatter people who would further his career, so why expect them to perform due diligence on investments?

The bad thing is that it often is easy to find economic data that support a favorite narrative. If you want a parameter to go up you just have to select the starting date at the previous low. The other way if you want to show its going down. Even better if you just want to show that things are getting better (or worse). Now its not just the starting point you can chose but the actual parameter. Out of thousands of parameters you can always find one that is getting better (or worse) to support that narrative. That makes it even more pathetic when Trump fumbles inflation by stating that bacon prices have gone up 4 times. Its not that hard to find a food item that has gone up substantially if you are free to chose the item and also the time period.

Rising unemployment rates and 10 yr – 2 yr spread reversions suggest a recession at the 12 month horizon or so. Not immediate.

10 yr – 3 mo spread remains difficult to interpret. Still looks like suppression dynamics to me. The curve has not disinverted yet. We’d need short rates to fall cc 150 basis points to reach parity with the 10 year rate. I don’t see that happening for at least 12 months, and possibly twice that, depending on the mood of the Fed.

https://econbrowser.com/wp-content/uploads/2024/09/unrate_u6rate.png

https://fred.stlouisfed.org/series/T10Y2y

https://fred.stlouisfed.org/series/T10Y3M

There was some clown named Steven Koptis that insisted we were in a recession back two years ago. Maybe you tell that poser to shut up.

Take it easy on consultant Kopits. Brent oil is below $72 right now, and it pains Steven to think of Americans getting their gasoline cheap when Democrats reside in the White House.

Interesting numbers:

https://tradingeconomics.com/china/producer-prices-change

Looks like Winnie-the-Poo has more work to do on household demand.

https://images.app.goo.gl/6nnc8ygF43onHEot8

https://x.com/scottpr_92/status/1181037962735312896/photo/1

Good luck Old Poo!!!!