Hiro Ito and Robert McCauley have compiled a dataset(first discussed in this 2019 working paper) of the currency composition of international reserves over the 1999-2021 period. This dataset was used in Ito and McCauley (2020), Chinn, Ito and McCauley (2022), and Chinn, Ito and Frankel (2024).

The IMF’s COFER only presents aggregate currency shares. Other datasets of individual central bank reserves are less comprehensive, and/or report gross rather than net values (Iancu, et al. 2020).

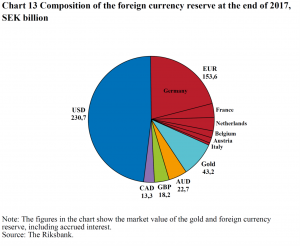

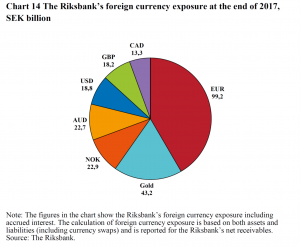

For an individual central bank, the differences can be striking. Figure 13 for Sweden’s Riksbank is based on Iancu et al. (2020) data, Figure 14 is based on Ito and McCauley (2022) data.

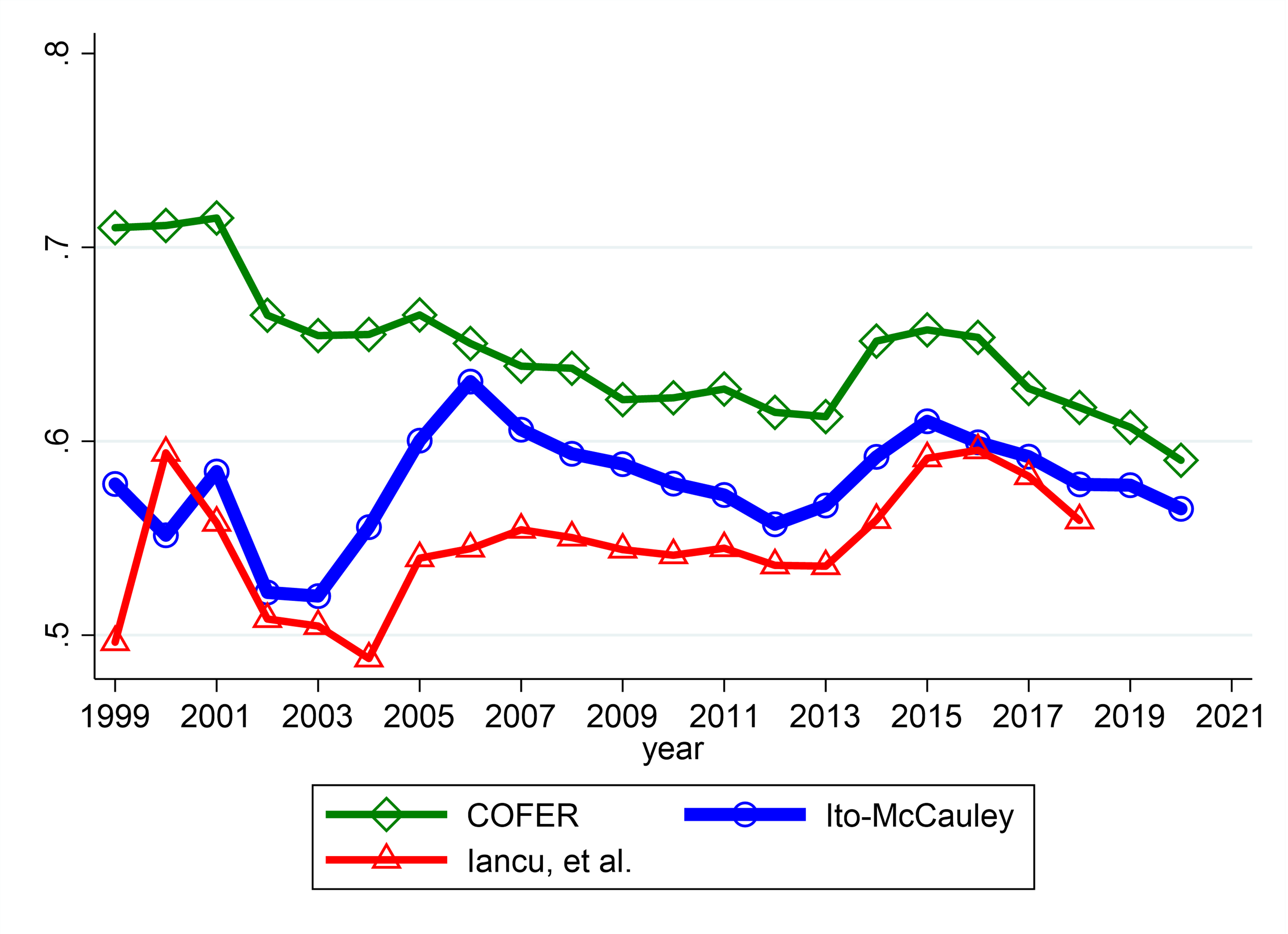

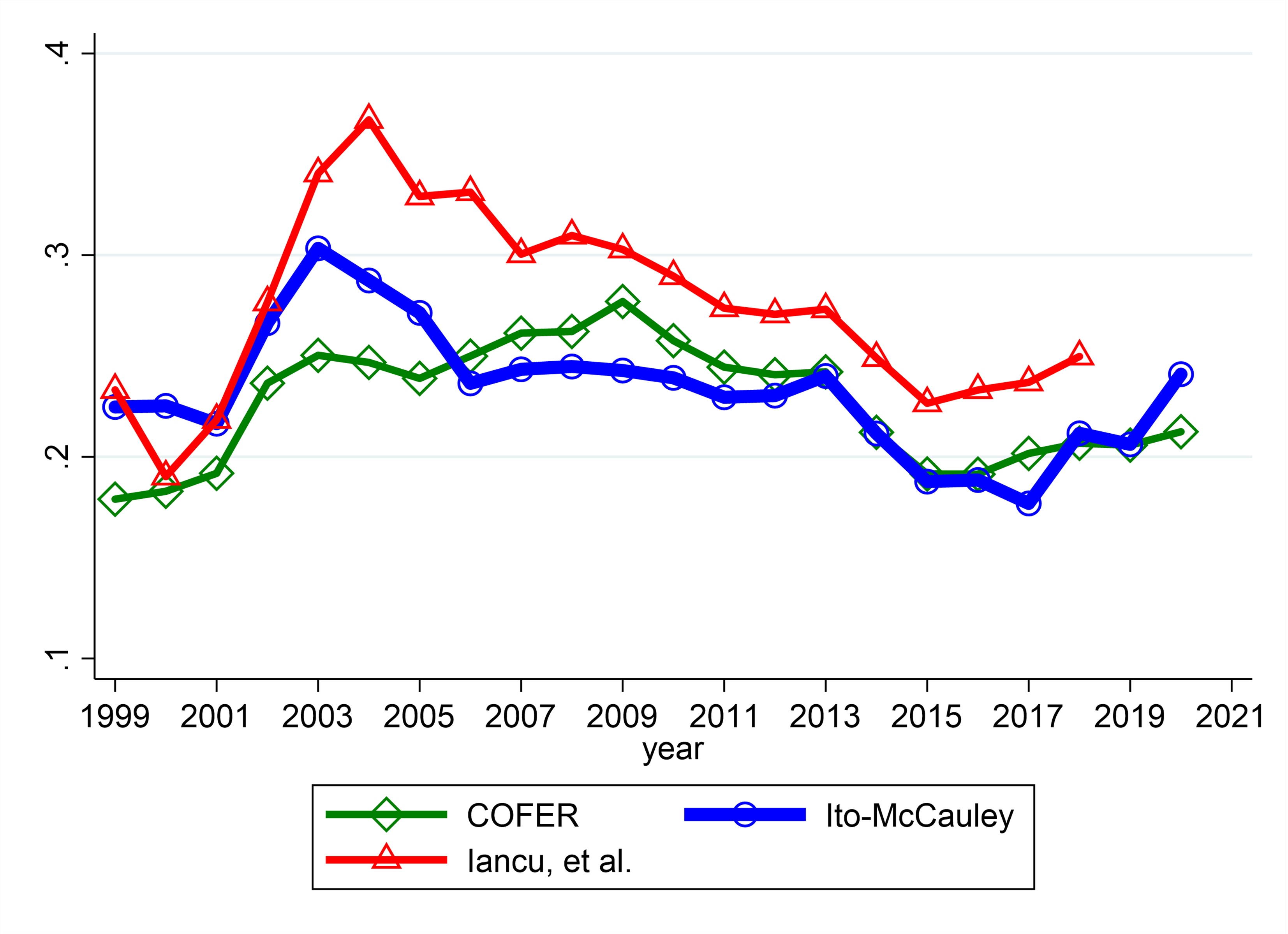

In the aggregate, there are differences between the relevant data sets. The first figure is for USD shares, the second is for EUR shares.

Figure 1: USD shares of international reserves from IMF COFER (green), Iancu et al. (red), and Ito and McCauley (blue).

Figure 2: EUR shares of international reserves from IMF COFER (green), Iancu et al. (red), and Ito and McCauley (blue).

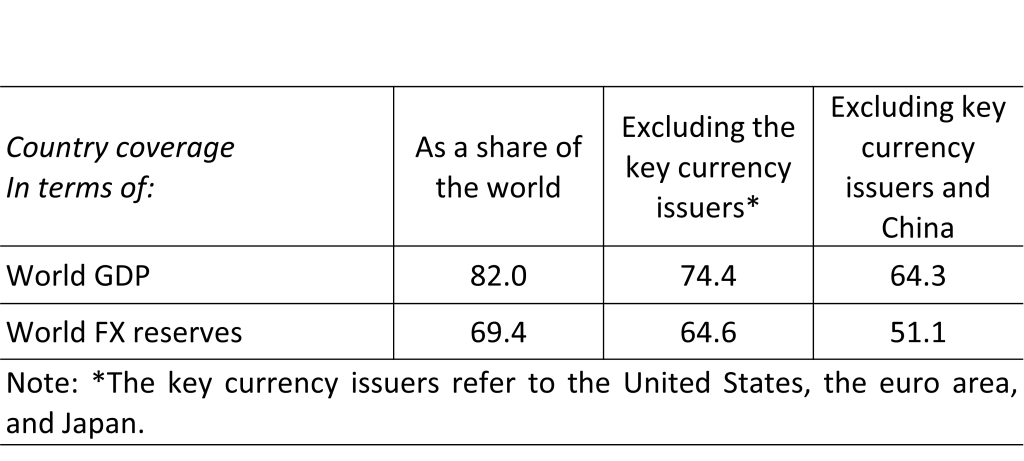

The differences are attributable to coverage (COFER covers in principle all reporting IMF members, while Iancu et al. and Ito-McCauley cover different sets of countries), and treatment of reserves.

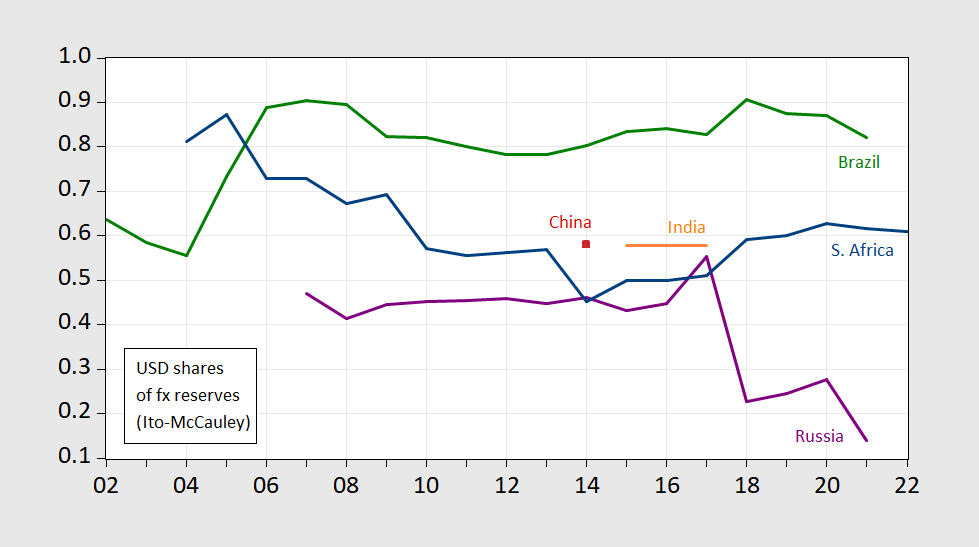

We have used this data set to investigate whether de-dollarization is occurring in the BRICS.

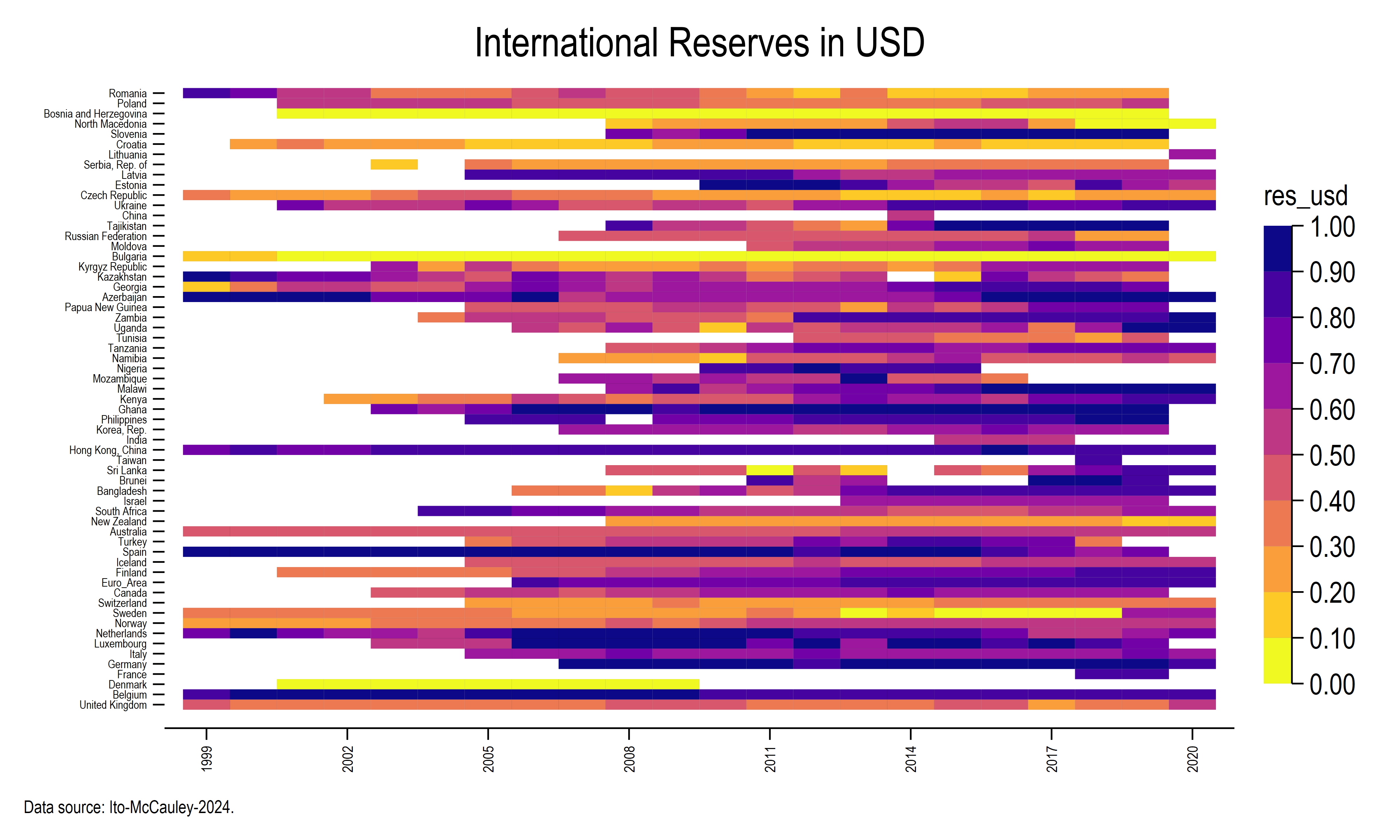

Figure 3: Share of foreign exchange holdings in USD, by central bank. Source: Ito-McCauley database,.

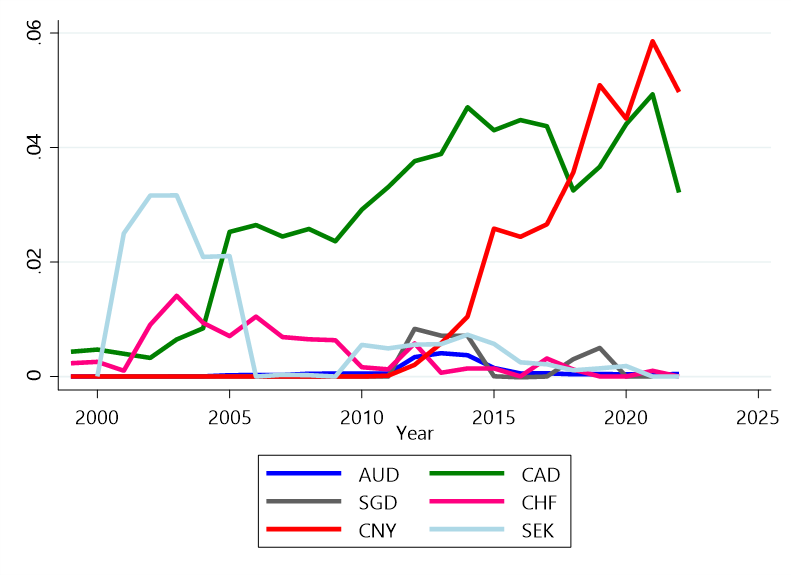

Hiro Ito has also done an early check on nontraditional reserves through 2022:

Figure 4: Geometric average of reserve holdings (expressed in USD) for reporting central banks. Very incomplete data for 2022. Source: Ito calculations on unpublished version of Ito-McCauley dataset.

The data set website is here (available in either Excel or Stata formats). Unfortunately, the coverage in this publicly available data set is smaller (63 countries) than that used in Chinn-Ito-McCauley (73 countries) or Chinn-Ito-Frankel (2024), due to confidentiality restrictions imposed by several Latin American central banks.

Recently, Laser, Milhailov and Weidner (2024) have circulated a database on individual central bank holdings for eight currencies. I suspect coverage for the reserve currencies such as CAD, AUD and CNY is going to be fairly spotty (and spotty for all currencies in 2022 and particularly 2023), given what information we have in the Ito-McCauley dataset.

Addendum, 9/7:

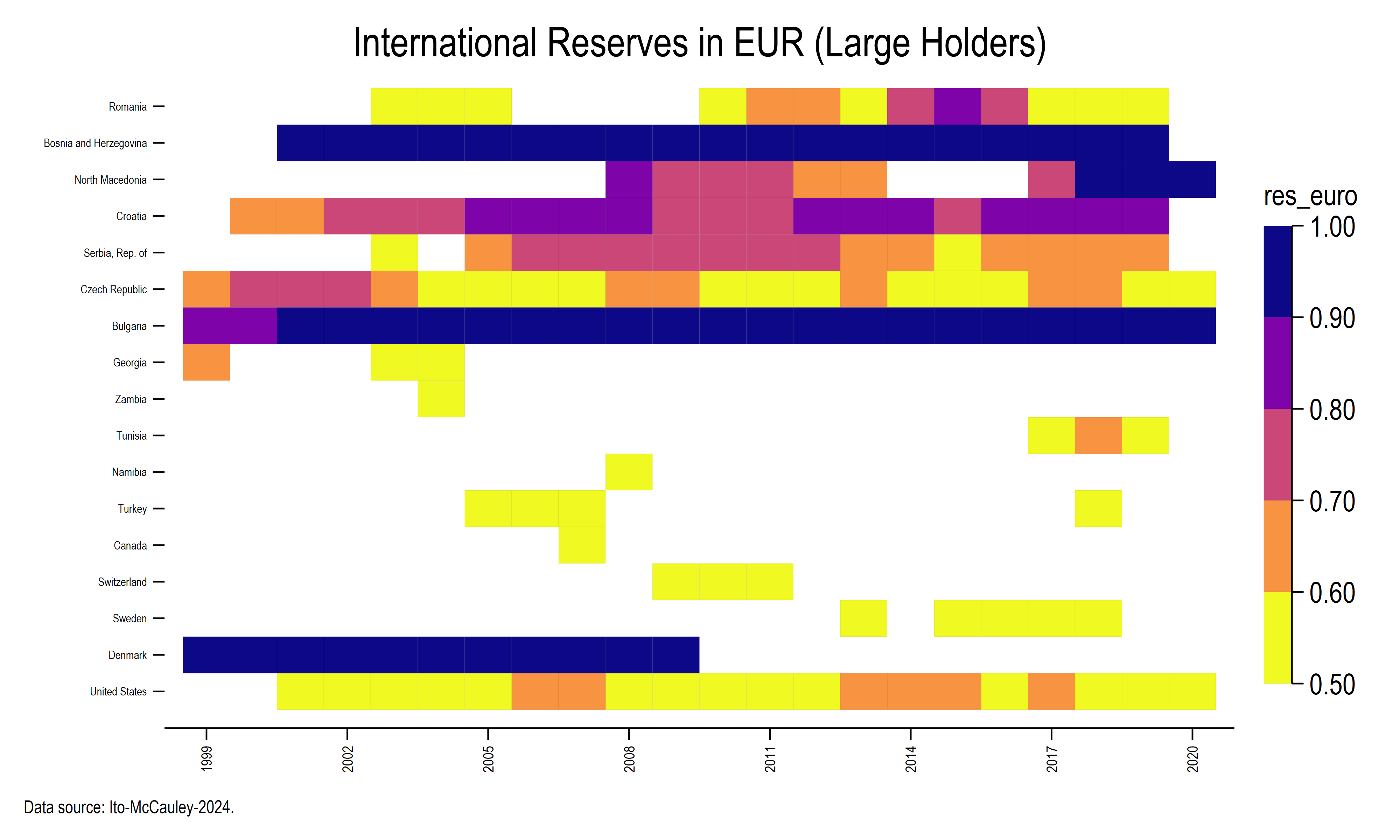

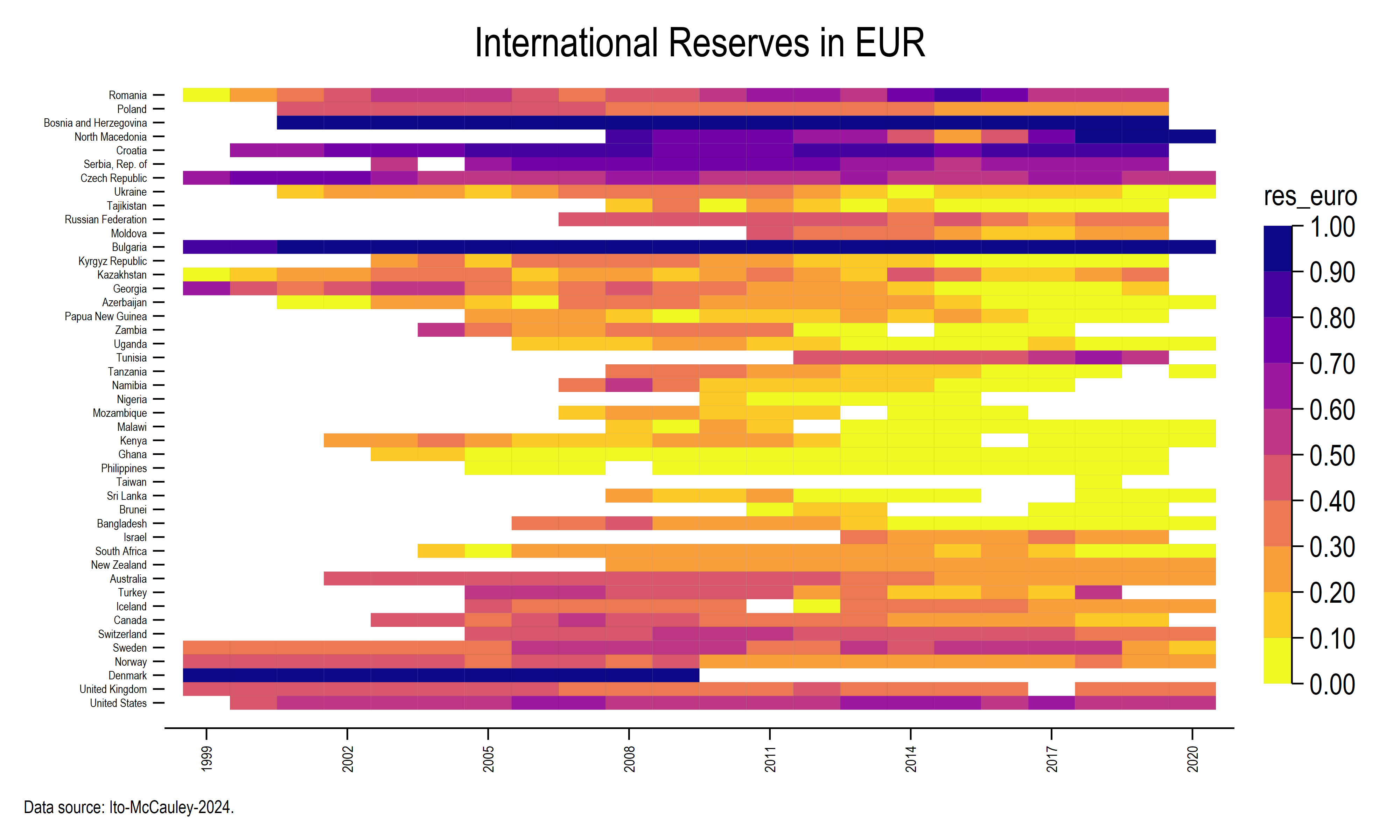

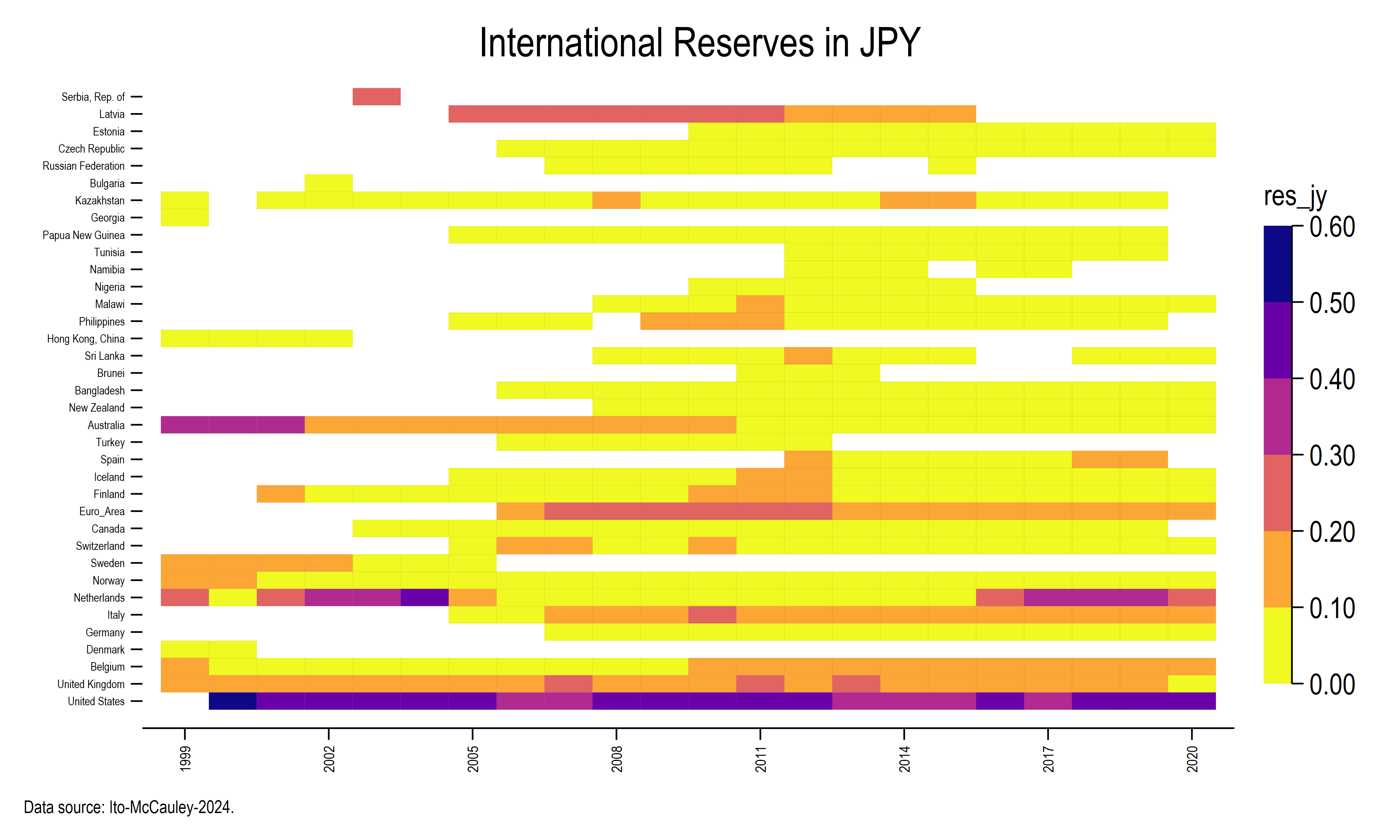

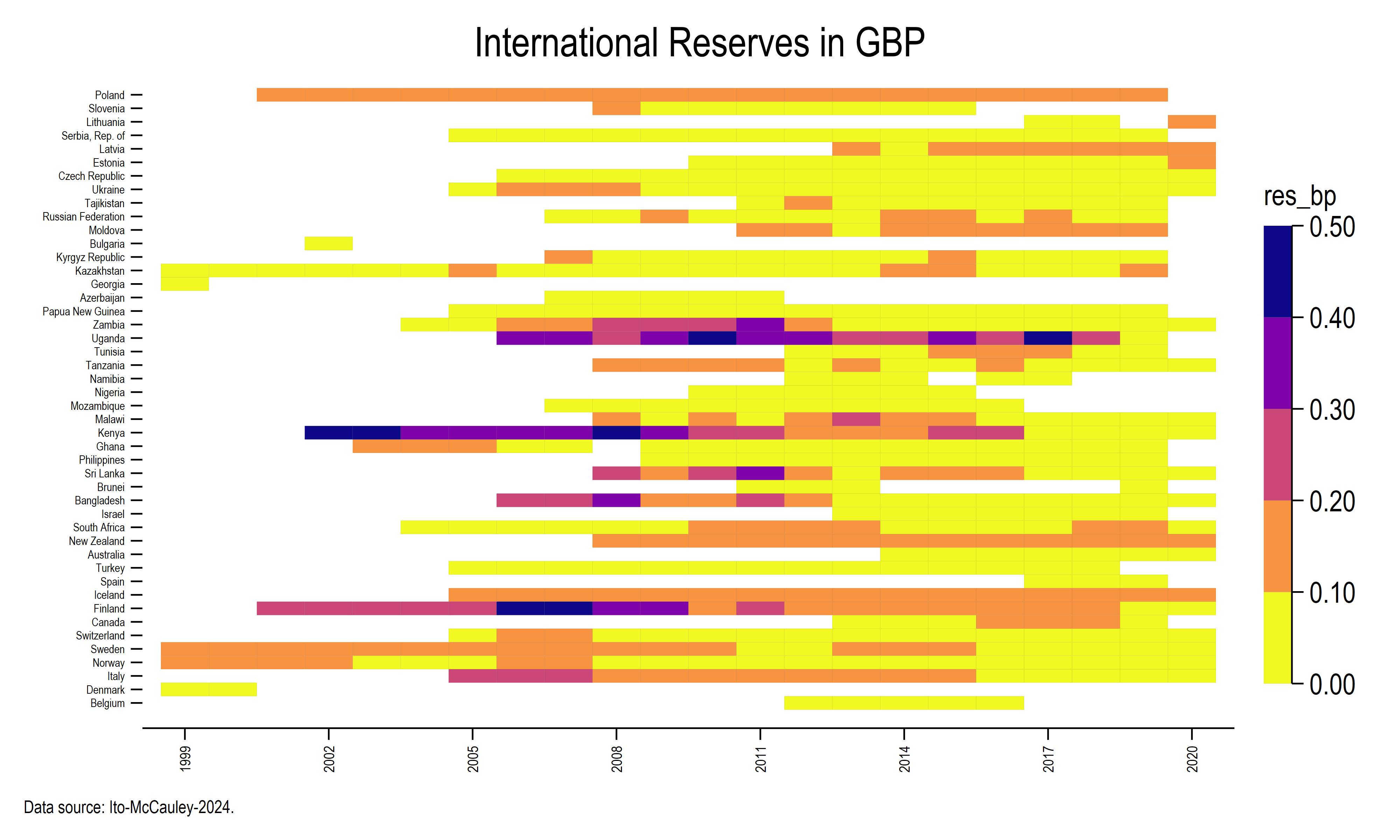

Jamel Saadaoui presents some super-neat heat plots for the Ito-McCauley dataset:

Saadaoui also shows heat maps for the Laser et al. (2024) dataset, here.

Off topic – The FOMC:

Futures markets are pricing in 30% odds of a 50 basis point Fed rate cut this month, same as prior to Friday’s jobs data. A week ago, before either the jobs report or the Beige Book, odds were also 30%; 25 bps remains odds-on favorite.

There is increasing evidence of a softening in the labor market, but that evidence remains problematic.

There has been a clear deterioration in the anecdotal information gathered by Fed District Banks, as reflected in the Beige Book. That is not what the FOMC wants to see at this point in the cycle.

In both cases, that deterioration changes the context for “the last mile” in bringing inflation down to target. Weaker demand growth, higher inventories, slower hiring all suggest that inflation will cool in coming quarters on its own. And though y/y inflation comparisons remain above target, many shorter-term measures suggest inflation is now at target. We’re at target and have reason to expect inflation to slow – the Fed will soon be tangling with undershoot soon. Inflation below target weakens the Fed’s rate tool. “Opportunistic disinflation” is not the Fed’s friend right now.

So, do Fed officials ignore the future? Do they ignore everything but y/y inflation? The recent message is that they won’t remain bull-headed, and will take steps to avoid recession.

What did Bernanke teach us about fighting recession? Go big. Don’t wait. Don’t listen to thoughtless “keep some basis points in reserve” advice from the peanut gallery. Going to neutral is a no-brainer, and standard Taylor rule estimates put neutral at roughly 50 to 150 bps lower than today’s funds target:

https://www.atlantafed.org/cqer/research/taylor-rule

That leaves one impediment to a 50 basis point rate cut. There is a tradition of concern that a big cut will “send the wrong message”, causing people to think the Fed has seen reason to panic, causing people to panic, worsening a slowdown. I’m not aware of any evidence that has ever happened. There is evidence that going slow can leave the Fed behind the curve with weakened tools.

Trump at the Economic Club of New York on Thursday. I wasn’t as I abhor this for rich people organization. So forgive me if I get this wrong. Trump said something about talking to Ivanka about child care and it seems the grand plan is for Trump to make the rest of us pay a lot in tariffs so he can help his daughter pay for child care. What a guy!

Now JD Vance had his own plans for this child care issue suggesting we cut down on training and certification requirements for day care workers. Yea – let any old deranged incompetent be put in charge of your kids. MAGA!

This is an earnest/unfeigned query: How does my May 16th comment look right about now??

https://econbrowser.com/archives/2024/05/six-measures-of-consumer-prices#comment-312704

“Insightful”?? “Throwing darts in the dark”?? “Spitting in the wind”?? “Idiotic”?? “Your choice of words here”??

It always amazes me on this blog when I make an open invitation for people to take a punch at my head and nobody takes me up on it/

I really was just asking people what they thought of what I said. No biggee, I can take it.