Suppose it’s the end of August, and one want to get the best estimate of Wisconsin real GDP for Q2. As of August, only Q1 Wisconsin GDP is available. What’s the best guess of of Q2 GDP, keeping in mind the number of monthly indicators at the state level is much lower than that for the Nation. Here’s my tentative answer.

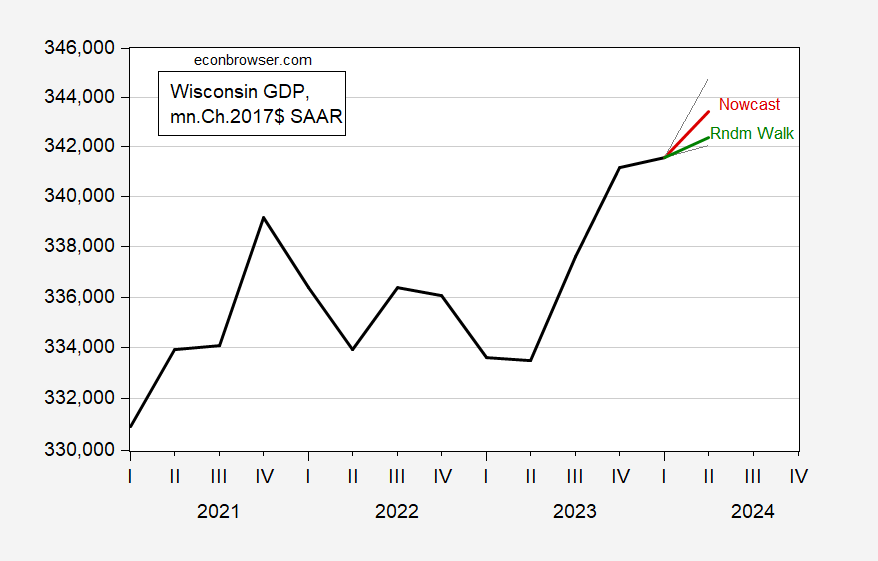

Figure 1: Wisconsin GDP (bold black), random walk with drift forecast (green), error correction model (red), +/- one standard error band (gray lines), all in mn.Ch.2017$ SAAR. Source: BEA, author’s calculations.

Forecast based upon these data, and this regression:

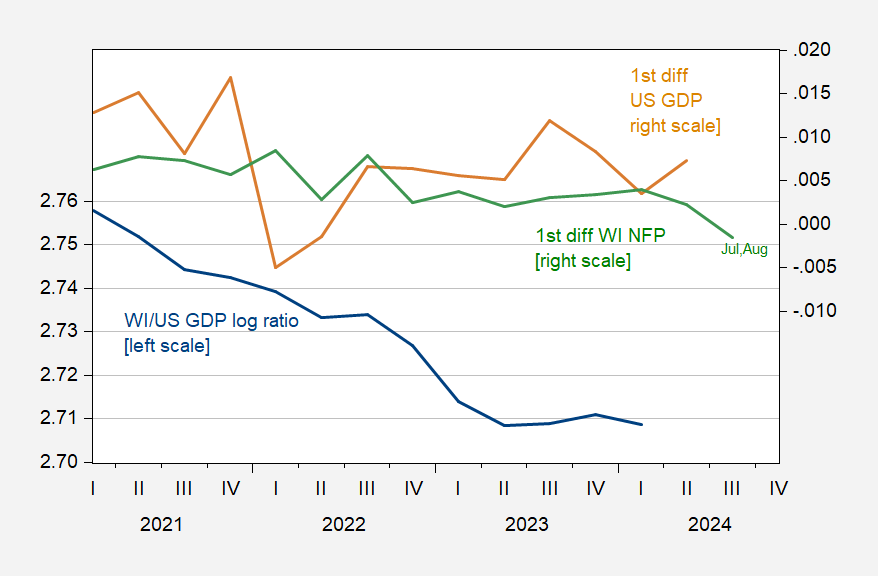

Figure 2: Wisconsin GDP to US GDP, in logs (blue, left scale), US GDP in log first differences (tan, right scale), Wisconsin NFP in log first differences (green, right scale), all s.a. 2024Q3 WI NFP observation is the average for July, August. Source: BEA, BLS, author’s calculations.

ΔyWIt= 0.720 + 1.130ΔyUSt – 0.268(yWIt-1-yUSt-1) + 1.428ΔnWIt

Adj-R2 = 0.78, SER = 0.0036, N=13, DW=1.85, sample 2021Q1-2024Q1. Bold face indicates statistical significance at 10% msl, using Newey-West standard errors.

13 observations seems like a slender thread to hang a nowcast upon. Unfortunately, this specification fails completely for the full sample of available data (2005Q1-2024Q1, where I’ve spliced the real GDP series in Ch.2012$ and Ch.2017$). Pre-pandemic, the error correction terms has a positive sign; this is true, regardless of whether the pandemic recession and immediate aftermath (2020Q1-2020Q4) is omitted or not. Rather, a single regressor dominates (US GDP growth). Here’s a comparison:

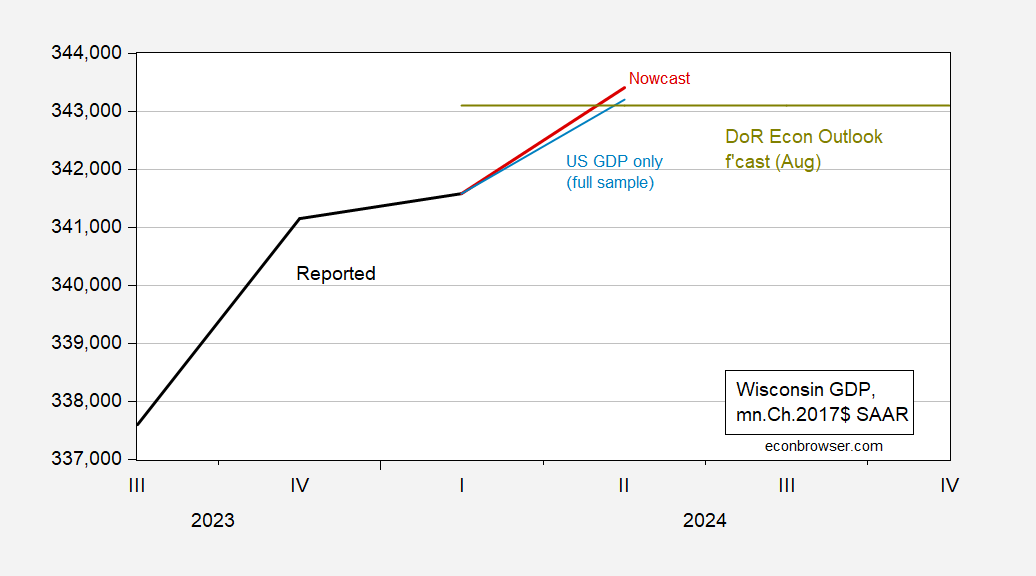

Figure 3: Wisconsin GDP (bold black), full-sample US GDP based (light blue), error correction model (red), Wisconsin DoR Economic Outlook forecast (chartreuse), all in mn.Ch.2017$ SAAR. Source: BEA, DoR, author’s calculations.

While the difference between the two nowcasts seems small, the implied difference in q/q annualized growth rates is noticeable: 2.1% vs. 1.9%.

The release of Wisconsin GDP is slated for tomorrow.

Addendum, 3:04 PT: Since the annual revisions have made large changes to national GDP, the same is likely to occur to the level of state GDP.

So I mentioned yesterday the facts with respect to the manufacturing job lost from January 2019 to February. I guess the clowns at the Washington Post got a different transcript than I did which gave them the sick glee of calling her a liar:

https://www.msn.com/en-us/money/markets/harris-flubs-manufacturing-jobs-claim-in-msnbc-interview/ar-AA1rdtM4?ocid=msedgdhp&pc=U531&cvid=901862d4e0b2408dbc731c35348a594b&ei=10

But they did add this:

Donald Trump’s economic record before the pandemic was pretty good, with steady growth in overall jobs. But in 2019, the year before the pandemic, manufacturing went into a mild recession, and the number of manufacturing jobs fell nearly 50,000 from January 2019 to February 2020. While president, Trump never acknowledged this dip and instead kept insisting manufacturing was on an upswing. From February 2017, the first month of jobs data in his presidency, to the time the pandemic struck in March 2020, manufacturing jobs increased about 400,000, according to the Bureau of Labor Statistics — though Trump kept rounding up to 500,000 even as jobs were shedding.

So yea – Trump lied over and over about this but that I guess could not be the Post’s lead. Gag. But let me repeat. The early gains in 2017 and 2017 had nothing to do with Trump’s economic policies as the rise was a continuation of the Obama boom. And what causes the pre-pandemic losses in 2019? Oh yea – that stupid Trump trade war. Which of course the clowns at the Washington Post could not be bothered to mention.

JD Vance Hits Back at Zelensky After Ukraine Leader Calls Him ‘Too Radical’

https://www.msn.com/en-us/news/politics/jd-vance-hits-back-at-zelensky-after-ukraine-leader-calls-him-too-radical/ar-AA1rgoCW?ocid=msedgdhp&pc=U531&cvid=fa1bfa458f294f619cdce895a2777653&ei=47

JD Vance said he does not appreciate Volodymyr Zelensky “telling the American taxpayer what they oughta do” in response to the Ukrainian president calling him “too radical.” Zelensky criticized Donald Trump’s running mate in an interview with The New Yorker that was released this past Sunday, in which he spoke out against Vance’s idea to end the Russia-Ukraine war. During an interview on the Shawn Ryan Show podcast on September 11, Vance said, “Ukraine retains its independent sovereignty, Russia gets the guarantee of neutrality from Ukraine—it doesn’t join NATO, it doesn’t join some of these allied institutions. That is what the deal is ultimately going to look something like.” On a visit to the U.S. last week, Zelensky hit back, saying: “The idea that the world should end this war at Ukraine’s expense is unacceptable.” He went on: “Let Mr. Vance read up on the history of the Second World War, when a country was forced to give part of its territory to one particular person. What did that man do? Was he appeased or did he deal a devastating blow to the continent of Europe—to many nations, broadly, and to the Jewish nation in particular? Let him do some reading.”

Vance was asked by a reporter to respond to this at a campaign event in Traverse City, Michigan, on Wednesday. The Ohio senator stressed that the idea he laid out on the podcast was “not a plan” but “one possible scenario.” Vance then went on: “But look, I don’t appreciate Zelensky coming to this country and telling the American taxpayer what they oughta do. He oughta say thank you to the American taxpayer.”

Poor little JD – don’t call him weird. Don’t call his racism. And don’t call out how he and Trump are surrender monkeys!

Hey I have an idea. Let little JD and Zelensky put on boxing gloves and get in the ring. My money would be on a brutal KO in the first 30 seconds!

But, but…”with drift” means taking history at its word. Why should we listen to history? Just because something happened, on average, through every period in the past is no reason not to assume recession,…er, I mean, to assume it is likely now. Is it? Isn’t recession the appropriate assumption, at least until early November?