Video today.

55% of Americans believe they are in a recession.

Why? Because they have been in one.

Most indicators suggest otherwise.

Here are some of Hovde’s predictions from December 2023:

- Economic Slowdown: The U.S. is likely to enter a recession, with consumers expected to deplete their savings, leading to only one potentially positive GDP quarter in 2024.

- …

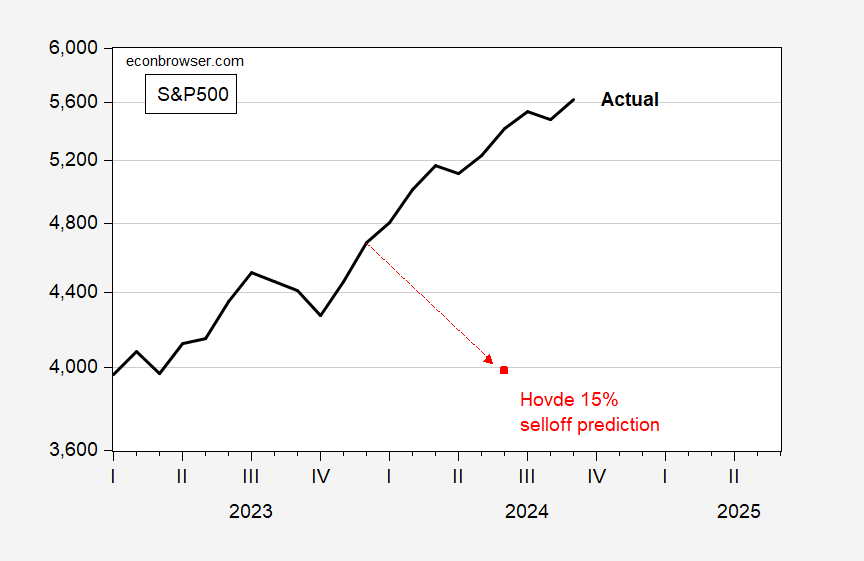

- Stock Market and Bond Market: The stock market is projected to experience a 15% sell-off within the next six months, followed by a moderate rally when rate cuts begin. The bond market, after three consecutive down years, is expected to see positive growth in 2024.

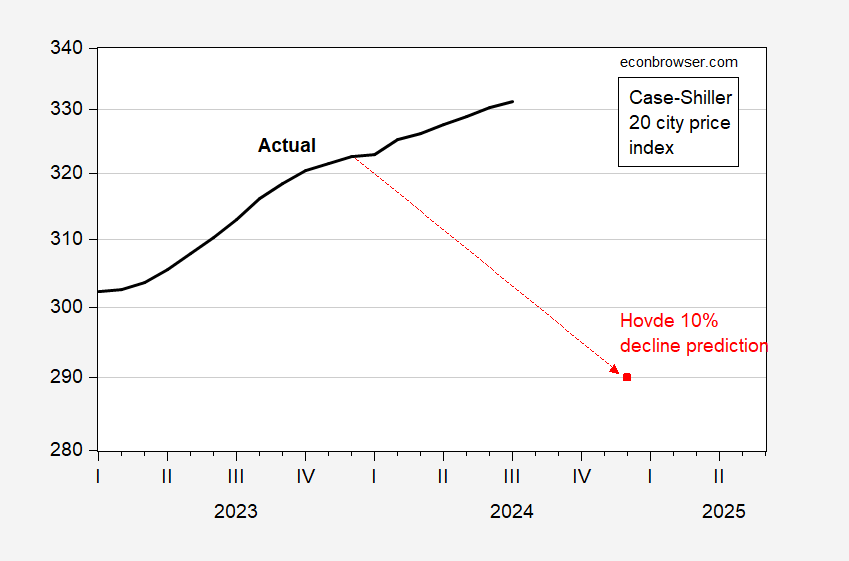

- Housing Market: Housing prices might decline by up to 10%, but limited inventory should provide some resilience.

- …

Here is plot of the S&P500 and what the S&P500 needs to be in June to match Hovde’s prediction.

Figure 2: S&P500 (bold black), and Hovde’s prediction (red square). May observation is through 16th of May. Source: FRED, and author’s calculations.

Finally, what about the housing market? The 10% price decline is for 2024, so I assume the 10% decline is off December’s level.

Figure 3: S&P Case Shiller 20 City house price index, s.a. (bold black), and Hovde’s prediction (red square). Source: FRED and author’s calculations.

Forecasting would be a tough business, if forecasters we’re routinely held responsible for their forecasts. There are a few rules of thumb which help avoid getting things wrong most of the time.

– Don’t forecast larger than normal changes.

– Don’t forecast against trend.

– Don’t forecast based on imagined relationships. Another way to say essentially the same thing is don’t forecast based on untested relationships.

I’m sure others can supply similar rules. I suggest these because it’s obvious Hovde has violated all three. A 10% drop in housing prices in a year? Not even during the housing:

https://fred.stlouisfed.org/graph/?g=1wiFV

A 15% drop in stocks in a single year? Only twice in the past 20 years and, by the way, not during the Covid recession:

https://fred.stlouisfed.org/graph/?g=1wiH8

I understand that Hovde is a huckster; I’ve seen his pitch. Go ahead, be a huckster. But these forecasts are insulting to his audience, not the sorts of things someone pretending to be serious would say.

“Forecasting would be a tough business, if forecasters we’re routinely held responsible for their forecasts.”

Well there are some professional forecasters where their track record can be monitored. Of course we know Steven Koptis’s forecasts are not recorded. And I guess many of these right wing hacks play the same game as Koptis. Which means their forecasts are to be ignored.

Being a huckster forecaster, he is pretty much doomed to be wrong most of the time. He is “forecasting” with a pre-specified outcome – which is actually “peddling” no matter how much professional lipstick you try to put on it. But the thing is that as long as your forecast things your masters want you to “forecast”, they will never hold you accountable for a “worse than the flip of a coin” track record.

“Not even during the housing crisis.”

Ahem. I listened to his rant. He is lying about real wages. Of course by his metrics (high deficits and falling real wages) we were in a recession for the entirety of St. Reagan’s reign!

Nestlé Says Slowdown in Rising Food Costs Isn’t Soothing Pinched Shoppers

Nescafe coffee and Purina pet food owner intends to offer more promotions to lure consumers

https://www.wsj.com/business/earnings/nestle-lowers-2024-guidance-after-nine-month-sales-decline-ddca3bf2?st=h1srqh&reflink=desktopwebshare_permalink

Nestlé is feeling sorry for itself it seems. Costs are high – eek! Our high prices might have to be lower – boohoo!

I just looked at their 2023 Annual Report seeing that on sales of 93 billion Swiss francs, Nestlé is reaping in a 15.6% operating margin. Me thinks their shareholders are doing well enough. Geesh!

Endless Fed Puts Wealth Effects and Wall Street Bailouts are just perverted forms of Communism for the already rich.

Increasing Asset Values while poor people fight each other is their only goal.

“Their”? Who, pray tell, are the “they” you have in mind?

If you mean the Federal Reserve, you are clearly wrong. Look at the simultaneous loss in both equity and debt during the most recent series of rate hikes. And no bailouts.

If you have someone else in mind, then who?

Not saying you’ve got the Fed dead wrong. A strong focus on preventing a wage-price spiral when there has been no such spiraling decades is clearly the wrong focus, bad for wages. But your story isn’t right.

I notice as I walk to the Central Library that Hovde has torn down the Silver Dollar Tavern so he can join in the building boom that has been going on in Madison – no recession here – Mr Hovde – you might have noticed – if you had actually lived here in the past ten years rather than in California.

I always wondered why that dilapidated Hovde property sat there for years as every other property around the Capitol square/downtown Madison got developed – . I guess Hovde was too busy funneling drug cartel money through his bank to care about what was happening in Wisconsin https://www.msn.com/en-us/news/politics/gop-senate-candidate-s-business-received-millions-from-bank-linked-to-mexican-drug-cartel/ar-AA1qRmWO