A reminder, so when next you hear about fiscal restraint.

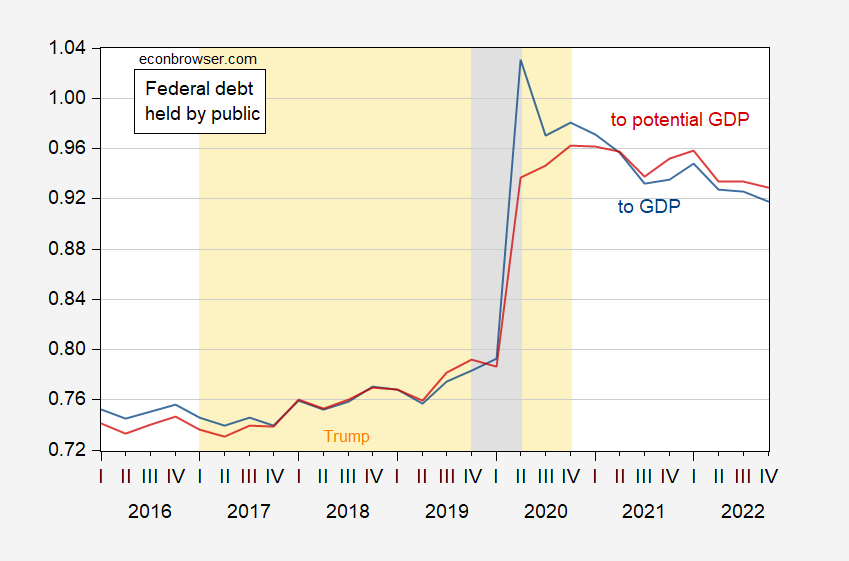

Figure 1: Debt held by the public as share of GDP (blue), and as share of potential GDP (red). NBER peak-to-trough recession dates shaded gray. Source: Treasury via FRED, CBO, NBER and author’s calculations.

Menzie,

I’ve already thanked you for alerting me to the short Biden and short Kamala opportunities, which worked out quite well. But I never did thank you for pushing Predictit. I noticed you liked to bring up that market. On election day I thought I’d check it out, and what do I see? Trump selling pretty equal with Kamala. Very strange, since that’s inconsistent with the other prediction markets. Another buying opportunity! As I mentioned in the comment a couple of days ago, I picked up some additional Trump very cheaply on election morning. Great profits overall.

Okay, so 2020 was a rough year for a few people for some reason that most people probably haven’t heard about, right? Stretching a bit here, eh? I’m going to bet that if federal government relief hadn’t been forthcoming for the economic shutdown triggered by COVID, pushed by the NIH/Fauci, and embraced by states’ governments, there would have been a cacophony of protests in this blog that “Trump doesn’t care about people”.

But you all know that this wasn’t just Trump. This was a “bipartisan” response to what was deemed/alleged to be a national emergency.

https://sherman.house.gov/covidbills

Of course, the spending didn’t end when Biden took office, but the political imperative to create an economic catastrophe was no longer there so businesses were allowed to return to normal operation and people could go back to work. Still, the spending continued and accelerated. The impact of COVID on the economy tended to correlate with the fear and restrictions generated and implemented by states.

This suggests that job losses may have been less severe in states where the population was more willing to risk contracting COVID-19 and participate in out-of-home activities like retail shopping and dining out.

Strangely, health outcomes were most impacted by income level and availability of healthcare services. The question should be: would the outcomes have been different with a Clinton administration? That is to say, would states that shutdown under Trump have less job losses under Clinton and would lower income people with less available healthcare been less likely to have died? If the answer is “no”, then the 2020 economy is not a Trump phenomenon.

https://www.healthdata.org/news-events/newsroom/news-releases/lancet-largest-us-state-state-analysis-covid-19-impact-reveals

So, let’s just drop 2020-21 out of the data and make comparisons about new debt.

Off topic: now we’ll all get to see if all of those dire predictions about another Trump presidency come to pass.

“The impact of COVID on the economy tended to correlate with the fear and restrictions generated and implemented by states.

This suggests that job losses may have been less severe in states where the population was more willing to risk contracting COVID-19 and participate in out-of-home activities like retail shopping and dining out.”

So, you’ve made one assertion of fact and one supposition, without evidence for either. You still haven’t figured out the data stuff? If you don’t know how to gather evidence, why should we accept your assertions of fact? There’s no evidence you know what you’re talking about.

And, by the way, debt/GDP rose under Trump even before Covid. Those tax cut, ya know.

Bruce Hall I’m not sure why you referenced the Clinton Administration, but whatever.

No one has a problem with the debt-to-GDP ratio rising during the pandemic. The problem was the rising debt-to-GDP ratio well before the pandemic when the economy was at full employment. The pre-pandemic rising debt-to-GDP ratio was predicted as a consequence of Trump’s tax cuts.

Off topic: now we’ll all get to see if all of those dire predictions about another Trump presidency come to pass.

That depends on how many of Trump’s campaign promises he’s able to keep. Trump doesn’t exactly have a reputation for keeping his word. But if he implements his promised tariffs, then we can be pretty confident that we’ll see significantly higher prices. And if the GOP Congress goes along with his promised tax cuts, then the debt-to-GDP ratio will start rising again. As to his plan to deport immigrants, just recall 1954’s “Operation Wetback” that deported over a million Mexican immigrants. How’d that work out? And why in God’s name would you want to deport convicted murderers??? If they’re already in prison, why would you want to hand them over to the drug cartels in Mexico? It makes no sense.

Financial Audit:

Bureau of the Fiscal Service’s FY 2024 and FY 2023 Schedules of Federal DebtOverview: GAO-25-107138 7 Nov 2024

“Treasury’s Fiscal Service issues debt to borrow money for federal operations and reports the debt on financial statements called the Schedules of Federal Debt.

As of September 30, 2024, the federal debt was $35.5 trillion—up $2.3 trillion from FY 2023. Interest on the debt in FY 2024 was $1,126.5 billion, an increase of $251.0 billion from FY 2023.

We audit and issue opinions annually on the Schedules and on related internal controls (e.g., processes to reasonably assure that transactions are properly authorized and recorded).

In FY 2024, we found the Schedules were reliable and that controls over financial reporting were effective.”