Thet’s Jeffrey Tucker in the Epoch Times via ZeroHedge.

It’s a reasonable supposition that a recession will become obvious to all by next summer. It will then be declared by year’s end. The following year it could become backdated with data revisions that take us to 2022. At that point, it will become obvious to people that we have a major problem. Money velocity will freeze up, and banks will start failing.

Could happen. I’m certainly with Mr. Tucker that a recession could occur. He believes we’ll finally update the data so.

It is not discernible in our time that we are already in recession, but that is because of some brittle statistical measures. If you extend the inflation numbers to include housing and interest, plus extra fees and shrinkflation, minus hedonic adjustments, and then adjust the output numbers by the result, you end up in a recession now.

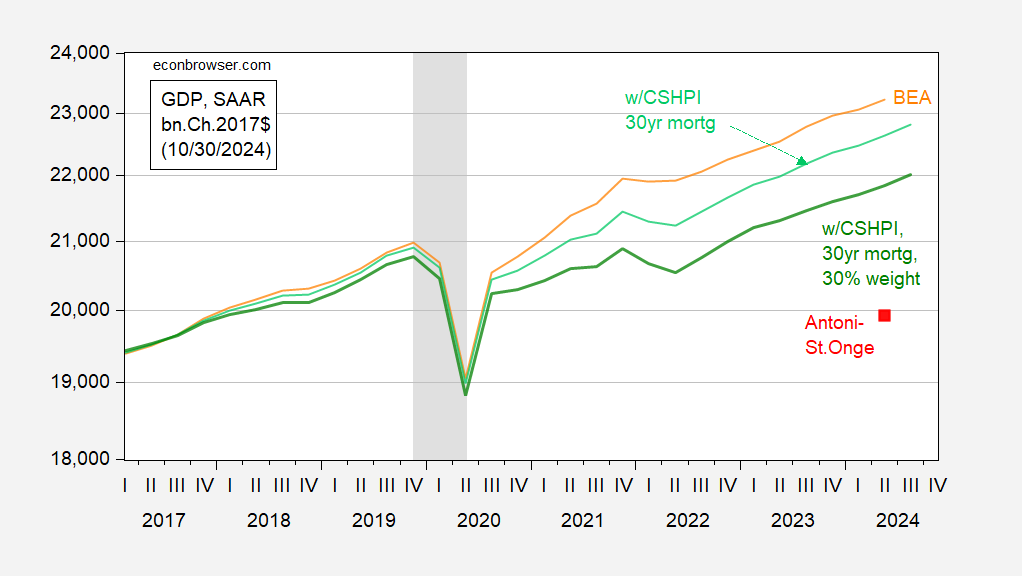

I think Mr. Tucker is channeling the Antoni and St. Onge (2024) thesis, which was published in his journal. However, as I have noted (also Chinn (2024)), it is almost impossible to reproduce those results. In this updated graph, I show how much the current BEA estimates differ from the Antoni-St. Onge number, and what I get trying to incorporate housing costs using house prices and mortgage rates.

Figure 1: BEA GDP (orange), GDP incorporating PCE using Case-Shiller House Price Index – national times mortgage rate factor index, using BEA weight of 15% (light green), using 30% weight (dark green), Antoni-St. Onge estimate (red square), all in bn.Ch.2017$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, S&P Dow Jones, Fannie Mae via FRED, NBER, and author’s calculations.

To match the Antoni-St. Onge level of GDP for 2024Q2, BEA’s GDP level would have to be revised down 15.3% (log terms)! I think I am safe in saying revisions this large have not occurred in modern history. For instance the downward revision from April 2001 to July 2002 — which made the recession look much worse — was only about 2.5%.

Although the data is noisy and lags a little, I’ve found that income tax withholding payments are the acid test. And they have been up smartly almost all this year.

California has a good graphic tracker. Here’s their latest update:

https://lao.ca.gov/LAOEconTax/article/Detail/756

Up about 10% YoY almost all year. Yeah, no, we’re not in a recession.

So, now that the election is over, the motivation for concocting a recession out of nothing has changed. Here’s Tucker’s subtext:

1) Trump’s policies are likely to cause a recession.

2) That recession must be blamed on someone other than Trump.

3) Blame Biden.

Since clear-headed people won’t be convinced, there is no need to employ a reasonable argument to blame Biden. The Heritage boys already have a ridiculous story about inflation aimed at gullible people, so why not use that?

Tucker is a follower of Ron Paul and Lew Rockwell. He wears bow ties.

test

Off topic, perhaps – China and Trump’s tariff threat:

Capital Economics estimates that “the yuan might have to fall 18% against the dollar to fully offset 60% U.S. tariffs, implying a rate of 8.5 per dollar” according to Reuters. It’s 7.18 today.

https://www.reuters.com/world/china/why-chinas-economy-is-more-vulnerable-trump-tariffs-this-time-2024-11-06/

The risk of so much depreciation, Reuters notes, would likely mean capital flight, so that Chinese authorities would resist.

Mostly the article points out that this is a bad time for China to face new tariffs – y’all knew that already. In fact, China’s recent stimulus package includes a “plan B” in case Trump won. Plan B includes extra stimulus measures to offset the impact of new tariffs.

China’s decision to increase support to the factory sector makes sense on the face of it – help to the sector that’s directly hurt. However, stimulus to production when domestic demand is weak was already a questionable policy. Now, with tariffs likely to weaken demand for exports, stimulating production rather than domestic demand seems an even worse choice.

Speaking of international trade, the PMI global export index has been below 50, with two monthly exceptions, for a quite a long time, and is weakening:

https://www.statista.com/statistics/1032013/global-purchasing-manager-index-manufacturing-new-export-orders/

That’s a poor start to a trade war. Odds are, U.S. imports will pick up for the rest if this year and for as long as new tariffs aren’t imposed and warehouse space is available; import-dependent U.S. firms will try to front-run tariffs. That will help global exporters, including China, for a time.