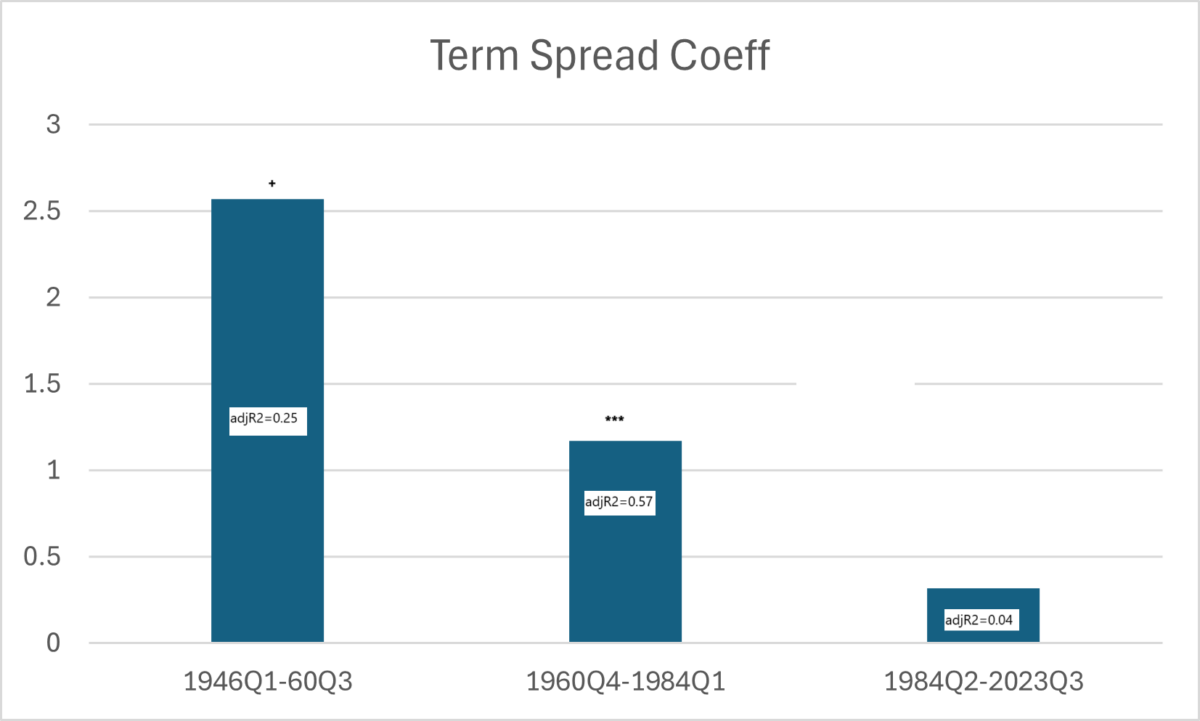

Following up on the examination of what the term spread predicts, here’s the slope coefficients for the term spread, in regressions augmented with short rate, from 1946-2023Q3 (GDP growth 1947-2024Q3).

Figure 1: Regression coefficient of GDP growth lead 4 quarters on 10yr-3mo spread for subsamples. + (***) indicates significance at 11% (1%) msl, using Newey-West standard errors. Source: Author’s calculations.

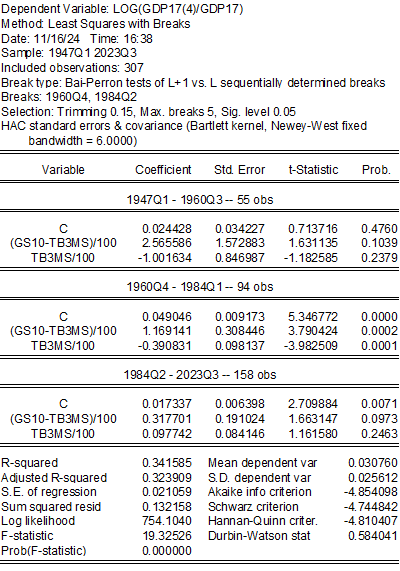

The overall least-squares break regression result (Bai-Perron) is:

If one runs a simple OLS regression on the last subsample (1984Q2-2023Q3), the adjusted-R2 is only 0.04. The prediction looks like the following:

Figure 2: Year-on-Year GDP growth rate (blue) and predicted (tan). NBER defined peak-to-trough recession dates shaded gray.

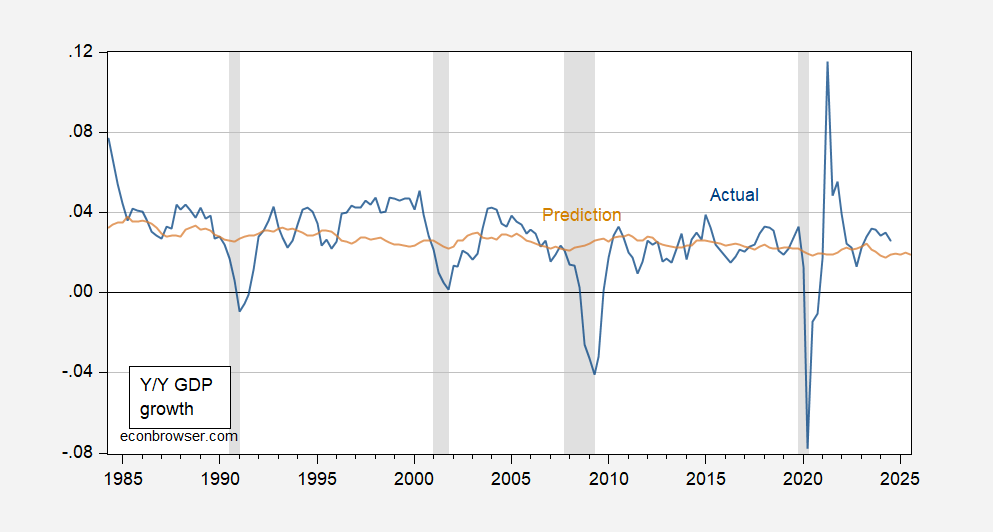

Clearly, the term spread Compare with the middle period identified by the Bai-Perron method:

Figure 3: Year-on-Year GDP growth rate (blue) and predicted (tan). NBER defined peak-to-trough recession dates shaded gray.

These results suggest that the term spread is not currently a great predictor of growth (although it may become so again in the future).

Addendum, 11/17, 12 noon PT:

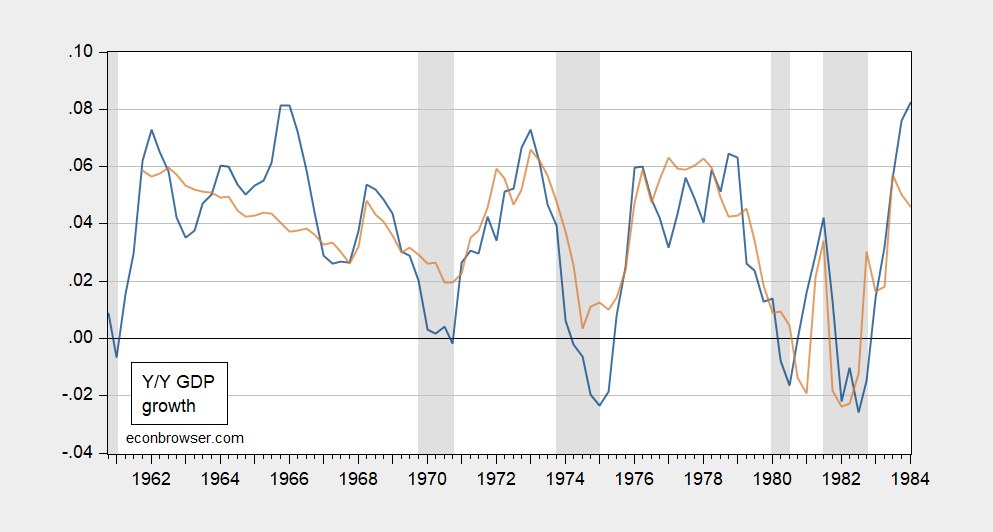

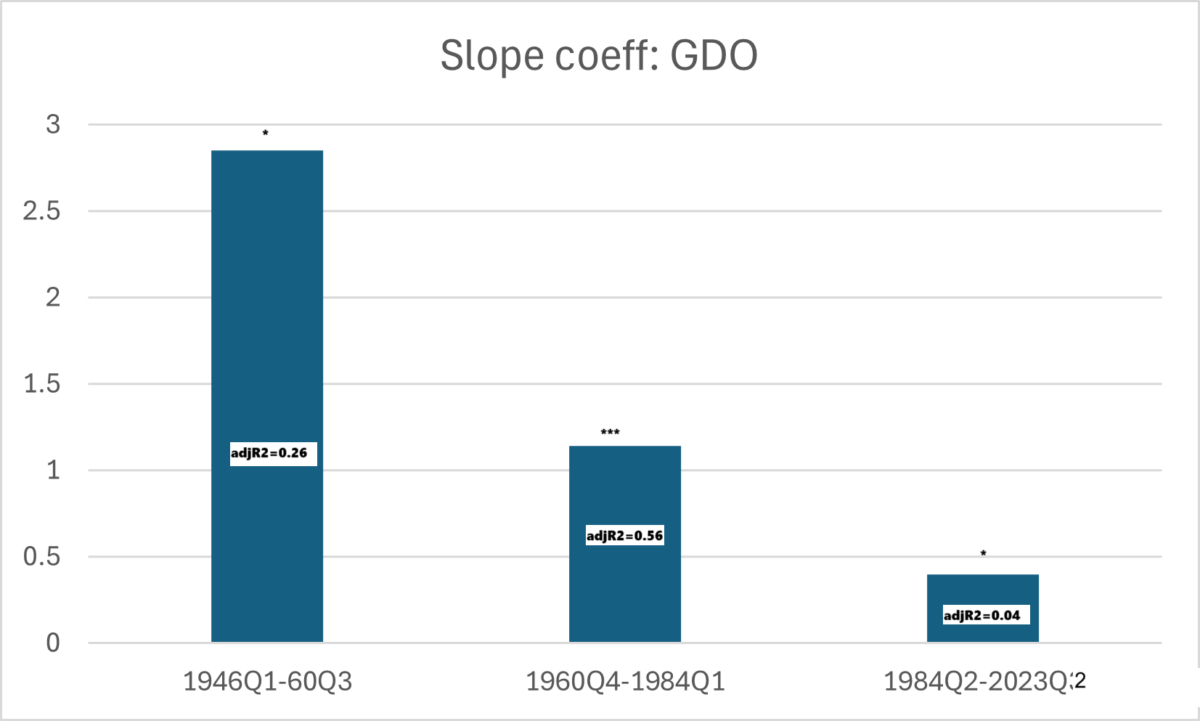

Similar results using GDO.

Figure 4: Regression coefficient of GDO growth lead 4 quarters on 10yr-3mo spread for subsamples. * (***) indicates significance at 10% (1%) msl, using Newey-West standard errors. Source: Author’s calculations.

Monetary policy and other interest-rate policies seem like a good place to look for structural changes that might explain structural breaks in the explanatory power of term premium.

Volcker’ Fed created an expectation that swings in inflation – and swings in interest rates – would be limited. This expectation has not been universally held, but it has been a measurable thing.

The Great Moderation – among other features of the Moderation, the real Fed funds rate began to fall progressively from the early 1980s:

https://fred.stlouisfed.org/graph/?g=1Bpxq

The Monetary Control Act of 1980 phased out bank interest-rate ceilings.

Policy transparency increased progressively from the initial publication of the Beige Book in 1983.

Aside from monetary policy, maybe debt dynamics play a role? If as Chinn and Ferrera (among others) point out, household debt is a predictor, perhaps a causal factor, of business cycles, so perhaps the increase in debt has led debt dynamics to supplant term premium as a predictor of economic performance. Here’s household debt/GDP

https://fred.stlouisfed.org/graph/?g=1BpdP

An older notion is that business debt drives business cycles. Here’s non-financial corporate debt/GDP

https://fred.stlouisfed.org/graph/?g=VLW

Corporate debt accumulation stalled in the 1970s through to around 1983/4. New highs ever since.

Just suggestions. I’m not smart enough to draw conclusions.