Daniel Lacalle via Zerohedge writes

Professors EJ Antony and Peter St Onge recently published an excellent study, “Recession Since 2022: US Economic Income and Output Have Fallen Overall for Four Years,” through the Brownstone Institute. It perfectly summarizes why Americans have not responded favorably to Bidenomics and his assessment of his economic legacy as the “best economy in the world” or “the best economy ever.” The study concludes that adjustments reflecting a more realistic measure of average price increases in the period have understated cumulative inflation by nearly half since 2019. An enormous divergence between reported CPI and adjusted inflation led to an overstatement of cumulative GDP growth by roughly 15%. Furthermore, these adjustments indicate that the American economy has been in recession since 2022.

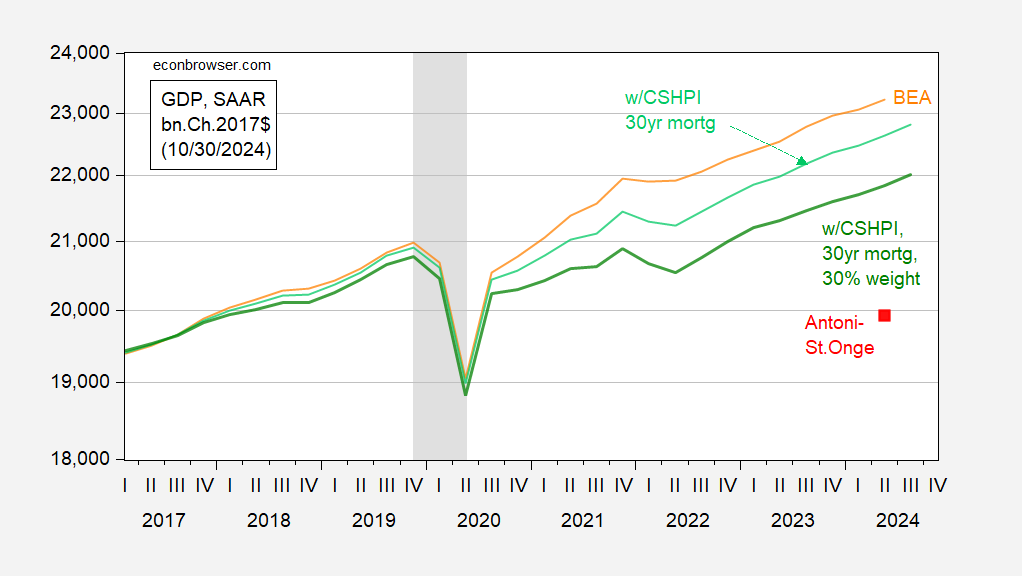

I’ve documented why the Antoni-St. Onge assessment is not to be given any credence [1] [2] [3] [4] (or as much credence as we gave ShadowStats, with which it shares a lot of DNA). I tried to replicate their price level calculations (using house prices and mortgage rates), and the closest I got was the green line below.

Figure 1: BEA GDP (orange), GDP incorporating PCE using Case-Shiller House Price Index – national times mortgage rate factor index, using BEA weight of 15% (light green), using 30% weight (dark green), Antoni-St. Onge estimate (red square), all in bn.Ch.2017$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, S&P Dow Jones, Fannie Mae via FRED, NBER, and author’s calculations.

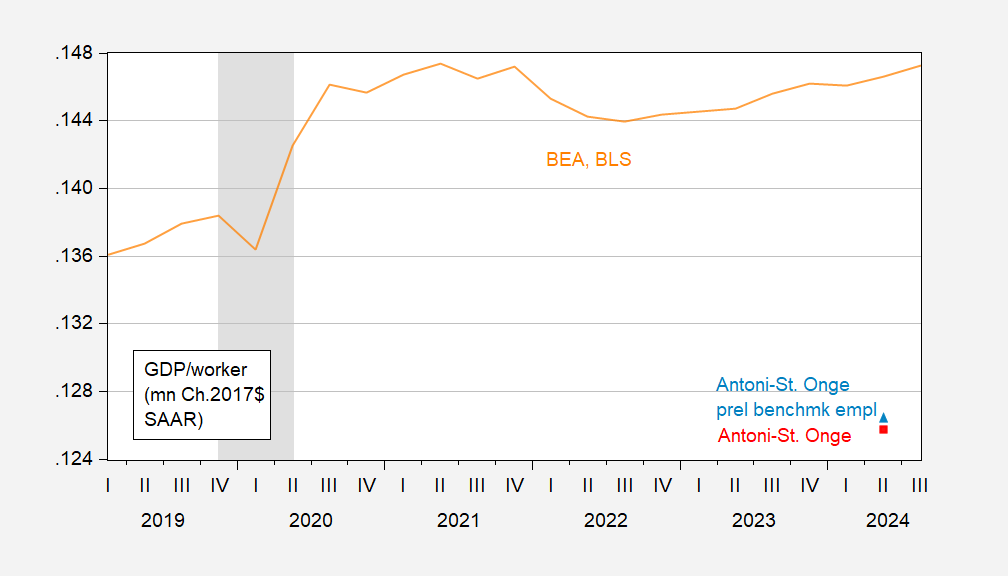

One way to think about the plausibility of their estimates is to think about what their GDP calculation implies for productivity. The red square is their number, the GDP/worker number I get from BEA and BLS series is the orange.

Figure 2: Real GDP divided by nonfarm payroll employment (orange line), and Antoni-St. Onge GDP divided by nonfarm payroll employment (red square), Antoni-St. Onge GDP divided by benchmarked nonfarm payroll employment (light blue triangle), all in mn.Ch.2017$ per worker. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, BLS, NBER, and author’s calculations.

Dr. Antoni has made much of how the preliminary benchmark has drastically reduced the number of employed (although Goldman Sachs has estimated the final revision will not be downward as much as the preliminary). Using the preliminary benchmark only pushes up the extremely low output per worker a slight amount.

Forget about it. The election is over and Trump won so the recession is magically over. Nothing but good times ahead.

Antoni’s papers in the year ahead should be — interesting.

Not that these guys would ever test the implications of their claims against reality, but how could one test whether productivity growth had suddenly diverged from the underlying trend in place since around 1870? One could, for instance, look at real net non-residential fixed investment:

https://fred.stlouisfed.org/series/A593RX1A020NBEA

Oh, look! It’s rising. And this is a flow, so any positive number represents an addition to the stock of capital. And no quibbling about the deflator, because the Heritage boys didn’t include capital equipment in their claim about mis-measurement of inflation.

So no, it’s not reasonable to claim that productivity has fallen.

Off topic – credit conditions:

About a week ago, results from the Fed’s senior loan officer survey were released. Overall, lending standards cotinued to tighten for households and businesses, though the tightening was neither across the board nor extreme.

There was considerable differentiation in treatment of good and bad credits in lending to households. Small firms are having an increasingly difficult time qualifying for loans. Commercial real estate lending standards tightened (quelle suprise).

Banks reported that tightening in credit standards was partly in response to reduced liquidity in loans and reduced competition from other banks – banks just have less appetite for new loans right now.

Demand for loans weakened, though not across the board. It’s possible political uncertainty reduced demand for loans.

Tightening of lending standards is typically associated with slower economic growth. So far, bank lending is still growing reasonably well:

https://fred.stlouisfed.org/graph/?g=1Bumb

Off topic – you know how I obsess over foreign policy:

So what might we expect from Little Marco?

Rubio is vehemently anti-Cuban, vehemently pro-Bolsonaro and Milei, anti-Obrador/Sheinbaum and Lula de Silva. He has tried to legislate the Biden administration into tussles with Bolivia and Honduras. Rubio’s time at State will be a happy one for neo-conservatives. He reaches for the stick more readily than the carrot, and that’s not helpful in the top diplomat.

Outside of Latin America, Rubio finds no fault, ever, with Israel. He’s tough on China, tough on Iran. Lately, there is no daylight between Trump’s views on the Ukraine war and Rubio’s. One big disagreement between Rubio and Trump is over NATO; Rubio and Tim Kaine once sponsored a bill to require a 2/3 majority vote in the Senate to approve withdrawal fron NATO.

Little Marco has demonstrated little understanding of how international markets work; but then he’s a Senator, so that’s not a surprise.

Rubio’s top political donor is a pro-Israel PAC, as are 3 of his top ten donors. He was the fourth largest recipient of campaign funds from the weapons industry in the 2022 election cycle. Again, neo-con heaven.

Taken together, this all suggests that Rubio was chosen because he and Trump see eye-to-eye on nearly every foreign policy issue that Trump cares about – he’s a Trump mini-me. Rubio has a strong focus in Latin America, where he favors right-wing strong men. That’s probably where he hopes to have influence and probably will have, since his views on authoritarianism align with Trump’s.