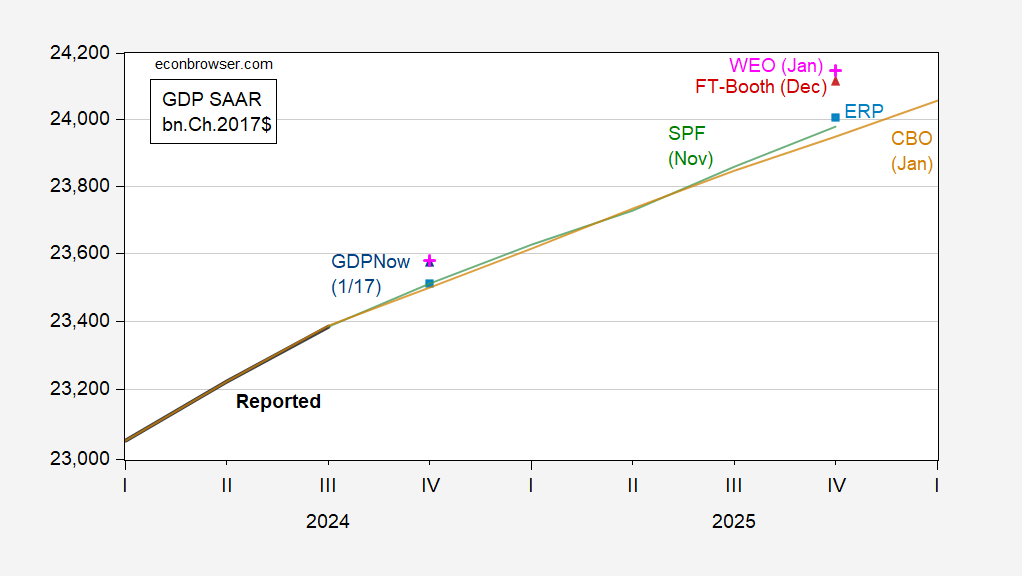

CBO released its ten year outlook today (as did the IMF in the WEO January update). Continued but decelerating growth, slightly less optimistic than Administration, noticeably less than the IMF, and FT-Booth survey.

Figure 1: GDP reported (bold black), CBO (tan), Administration (light blue square), IMF (pink), FT-Booth survey (red triangle), Survey of Professional Forecasters (green line), GDPNow of 1/17 (blue +), all in bn.Ch.2017$ SAAR. IMF, FT-Booth, GDPNow levels calculated by iterating growth rate on relevant lagged level. Source: BEA 2024Q3 3rd release, CBO Budget and Economic Outlook, January 2025, Economic Report of the President, 2025, IMF WEO January 2025, FT-Booth Macroeconomists Survey, Philadelphia Fed, Atlanta Fed, and author’s calculations.

The economy is projected by CBO to continue to grow (under current law, using data available as of mid-January), and the output gap to remain positive for quarters to come. As of 2024Q3, the output gap was 1.8% (log terms), using the most recent estimate of potential GDP (compared to 2.6% using the June 2024 vintage of potential GDP). The output gap will be 1% in 2024Q4 according to the Atlanta Fed’s nowcast of GDP.

The IMF forecast (based on exchange rates Oct 22-Nov 19) is in line with Atlanta Fed nowcast, but considerably more optimistic for 2025Q4, with q4/q4 growth in 2025 pegged at 2.4% (not far from the FT-Booth median forecast).

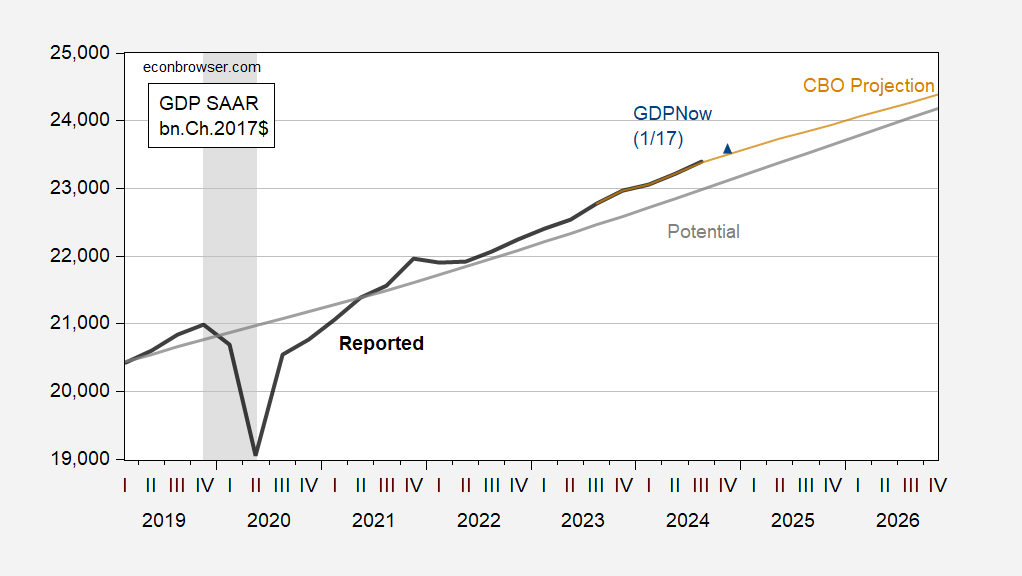

Figure 2: GDP reported (bold black), CBO (tan), potential GDP estimate from CBO (gray),GDPNow of 1/17 (blue +), all in bn.Ch.2017$ SAAR. NBER defined peak-to-trough recession dates shaded gray. GDPNow levels calculated by iterating growth rate on relevant lagged level. Source: BEA 2024Q3 3rd release, CBO Budget and Economic Outlook, January 2025, Atlanta Fed, NBER, and author’s calculations.

By the current tally, output has been above potential for 14 quarter (not counting Q4, 2024). Assuming I’m counting right, the longest period of officially above-potential output was 23 quarters in the middle and late 1960s. That was in the golden age of U.S. growth, prior to the period of OPEC-induced inflation and the subsequent Great Moderation. The second longest such period of above-potential GDP was 14 quarters in the late 1990s and 2000. So we are already tied for the longest above-potential period during the Great Moderation, and CBO is forecasting at least 9 more quarters of above-potential output. Hmmmm…

The CBO never forecasts recession, and with good reason. Recession forecasting is a mug’s game, says Bill McBride, and Bill’s right. If you don’t forecast recession, then you have a hard time pulling above-potential GDP down to potential; recession has always been the way above-potential output has been brought down in the past:

https://fred.stlouisfed.org/graph/?g=1CZXQ

So, recession pretty soon, or not. If not, then this time is not like all the others, based on the current estimate of potential GDP. Realistically, we’d probably want to rejigger the estimate of potential GDP, since cruising along above potential for a long time calls “potential ” into question.

One reason for caring about potential at all is the assumption that above-potential output is inflationary – we need to know when the economy is headed for inflation. If above-potential output, by whatever definition, is not inflationary, someone should tell the Fed. So far in this cycle, the Fed hasn’t caused a recession. If above-potential output isn’t inflationary, maybe we can get away without one.

Treasury Secretary nominee Scott Bessent has unveiled his 3-3-3 plan for the economy. (This is reminiscent of Herman Cain’s equally nutty 9-9-9 plan. Recall that Cain was killed off by Covid exposure from Trump’s defiant no-mask campaign rally in Tulsa in June 2020. Hat tip to Hassett for that.)

Bessent’s three planks are:

3% annual GDP growth. (Good luck. Deportations and immigration restrictions work opposite to that. CBO projects 1.9% over the next 10 years.)

3% of GDP budget deficit. (Currently 6.4%. That’s a $1 trillion annual cut in spending which is mathematically improbable to say the least, especially with trillions in promised additional tax cuts.)

3 billion barrels a day increase in oil production. (Already oil and gas production are highest in history. Oil companies aren’t interested in increasing production with the current glut and low prices. 3 billion barrels a day increase would ruin them as prices crashed. This is plain old MAGA “drill, baby, drill” foolishness.)

All of which raises the question, who is stupider, Bessent or the media pundits who laud him as Trump’s sensible cabinet appointee. For sure, he’s no Janet Yellen.

“During an exchange with Sanders, Bessent said that the issue of the minimum wage is ‘more of a statewide and regional issue.’ Sanders then asked if the federal minimum wage should be increased from $7.25 and Bessent said it shouldn’t be. The last time the federal minimum wage increased was in 2009, after a 2007 measure phased in minimum wage increases over the next two years. According to the Department of Labor, that’s the longest stretch in U.S. history that the federal minimum wage has remained stagnant since the Federal Labor Standards Act established the minimum wage in 1938.” (But trillions in unproductive tax cuts for billionaires – that’s just fine. What about all those people that voted for trump because they couldn’t afford groceries?)

I see endless corruption and grifting from the Trump administration – And Trump will make cryptocurrency a national priority – forget healthcare, abortion rights, gun control, climate change, food prices, housing costs – https://www.bloomberg.com/news/features/2025-01-18/trump-commerce-nominee-lutnick-is-backer-of-outlaws-favorite-cryptocurrency

An idea that doesn’t get much attention, but should, in my estimation, is the politics of distraction. Abortion and guns have served as distractions from kitchen-table issues all of my life. Gay rights, too. Howling about crime when crime is at an historic low, same thing. There are vanishingly few transgender athletes, but every Republican-controlled state legislature and Congress in DC have been all over the issue. Crypto-currency is less a distraction than a grift, but it serves as a distraction just fine. If the minimum wage is left to the states, and a Republican-majority legislature is focused on the three of four transgender athletes in its state, then the tens of thousands of minimum-wage workers in that state don’t get a raise.

Class warfare, climate change, the rule of law, democracy, educational attainment- these are real issues, so we need to be distracted from them. They’re all complicated, so much the better, since poor educational attainment keeps much of the electorate off the scent of anything that takes much thought. And as icing on the cake, let’s make sure that those who didn’t benefit much from their school years get good and angry when the rest of us point it out.

Of course, above, that should be 3 million barrels a day increase, not billion.

Quite convenient that they are moving the inauguration into the Capitol Rotunda since Trump’s supporters already know the way in. Hopefully most will use the doors this time rather than breaking windows for entry.

A housekeeping note for Dr. Chinn:

Your web server has been throwing a lot of “http 403 Forbidden: NGINX” errors lately. This prevents users from posting to the forum. This is usually due to an incorrect configuration for server permissions for files.

This might explain why you have had a large drop off in user comments. (Hey, maybe that is a good thing!) You can find more information by googling “http 403 Nginx”. Your IT webmaster should be able to figure what is wrong.

+1

The CBO forecasts the 3 mo treasury rate at 3.3% for the next decade, with the 10 year note at 3.9% for the period. Historically, that is, from 1982-2007 (including cycle peaks), the 10 yr – 3 mo has averaged 1.75%. Thus, by historical standards, we might expect the 10 year rate around 5.0% for the next decade. Interest expenses are likely understated.

Um, no. The historical average you’ve used includes a period of high inflation and high inflation expectations. We are no longer in an era of persistent high inflation and inflation expectations. Any claim based on yield spread from the other side of this fundamental structural change in fixed income spreads is nonsensical.

You don’t understand how fixed income works. That’s clear from the error you’ve made here. In making grandiose pronouncements involving fixed income, you make yourself look silly. You should stop.

For casual readers who don’t get how badly Kopits has messed up here, I’ll explain. Long-term government interest rates are driven by three components – the expected cost of short-term borrowing, expected inflation and the risk premium associated with lending money to the government over time. Three things, that’s all. The risk premium, also known as “term premium” accounts for everything not covered by the other two.

Now, here’s a useful bit of information – expected inflation drives both the expected cost of short-term borrowing and, to some extent, term premium. When thinking about future long-term interest rates, by far the most important think to know is expected inflation.

Let’s have a look at the ten-year yield and expected inflation beginning in 1982, the starting point of Kopits average:

https://fred.stlouisfed.org/graph/?g=1D4nv

Notice how the 10-year yield fell right along with inflation expectations in the early years represented here. Notice also that inflation expectations have been low and relatively steady since around 2007, when Kopits ENDS his average. His argument is that the earlier period of high inflation expectations is all we should look at, while ignoring the more recent period.

Why would Kopits insist that “historical” analysis of yields consider the period of high inflation expectations, but not the more recent history of lower inflation exectations? I’m pretty sure I know, but will leave readers to draw their own conclusions.