From “Recession Blonde: How Economic Uncertainty Spurred the Latest Hair Color Trend”, March 17th:

What is “recession blonde?”

Recession blonde (or recession brunette) refers to the darker, more brown-tinted hue that many are letting grow in with their normally bright, golden strands. TikTok users explain that while it may look like “old-money blonde,” letting their natural roots grow actually points to how the economy is affecting their spending habits; many are opting out of their touch-up appointments to save money.

While cost still depends on where you get your color done, upkeep for blonde hair can be quite the investment and oftentimes the more expensive option. “There are so many complexities to being blonde, and so many different methods to get to the end goal,” celebrity colorist Jenna Perry tells Vogue. “A double process, hyper blonde, is one of the most labor-intensive on your colorist to provide the biggest blonde impact. Highlights generally feel more natural, although the final may look effortless. A skilled application is akin to that of a trained painter and [cost] ranges depending on your colorist as well.”

…

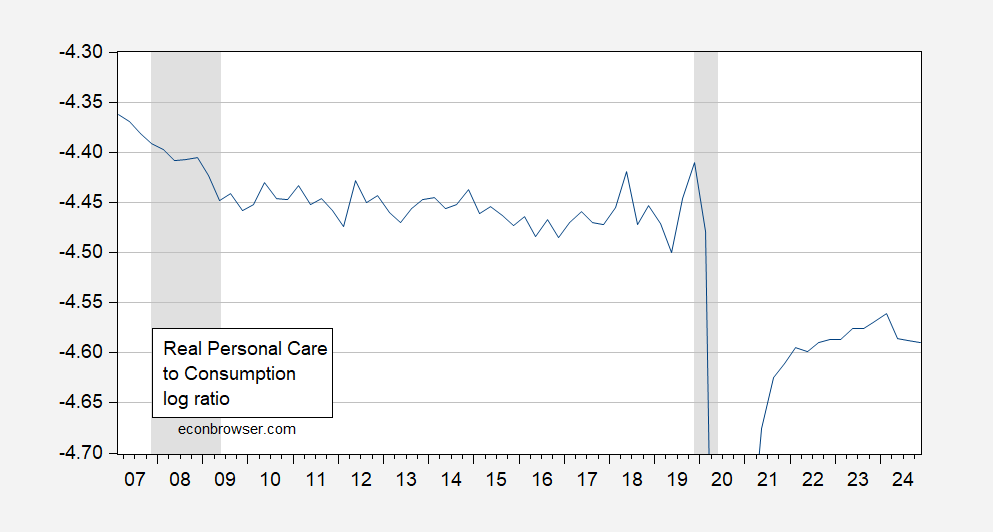

I personally have not noticed this trend, although that doesn’t mean much. I tried to find data on hair salon expenditures, but the closest I could get at fairly high frequency is the BEA’s “personal care and clothing services” category. I plot the log ratio of the real measure of personal care services to total real consumption (keeping in mind these are chained quantities).

Figure 1: Log ratio of personal care and clothing services to total consumption, in Ch.2017$ (blue). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, and author’s calculations.

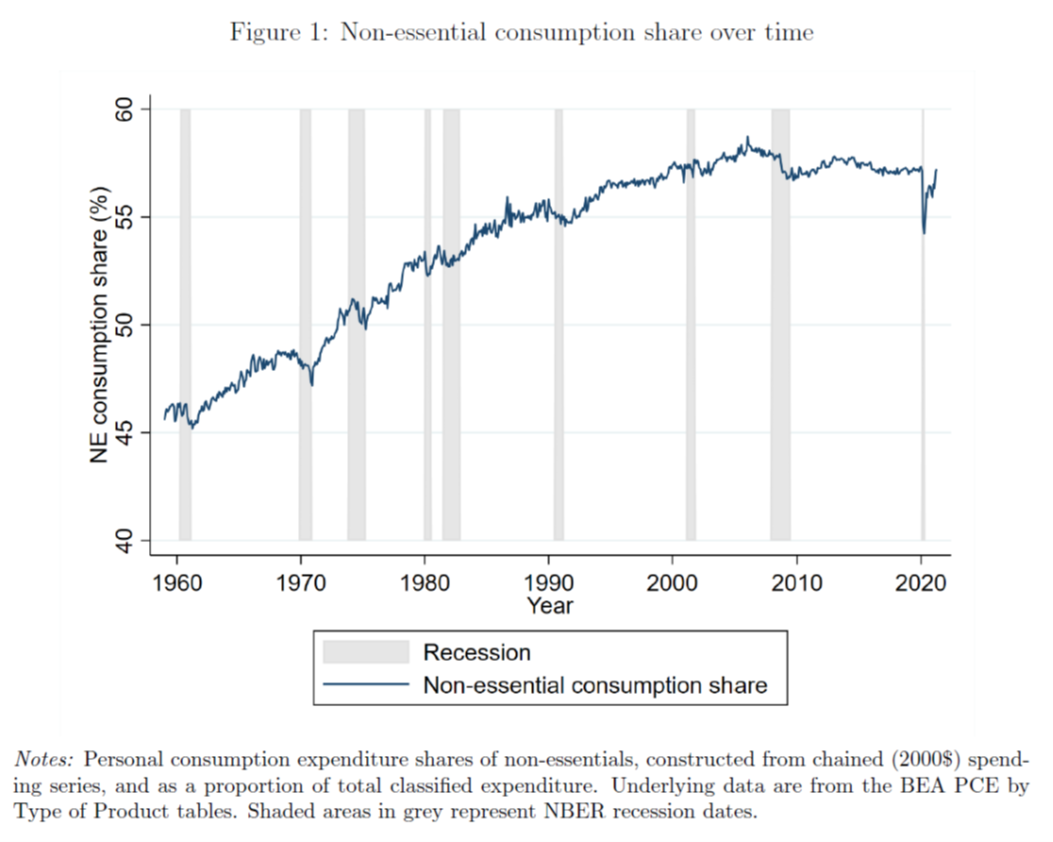

The recent peak is at 2024Q1, and has been declining since then (through 2024Q4). How reliable are such indicators? This real series goes back only to 2007Q1 at the quarterly frequency; however, as discussed in this post, Michele Andreolli, Natalie S. Rickard, and Paolo Surico have conducted a more formal analysis, in “Non-Essential Business Cycles”

From the abstract:

Using newly constructed time series of consumption, prices and earnings in essential and non-essential sectors, we document three main empirical regularities on post-WWII U.S. data: (i) spending on non-essentials is more sensitive to the business-cycle than spending on essentials; (ii) earnings in non-essential sectors are more cyclical than in essential sectors; (iii) low-earners are more likely to work in non-essential industries. We develop and estimate a structural model with non-homothetic preferences over two expenditure goods, hand-to-mouth consumers and heterogeneity in labour productivity that is consistent with these findings. We use the model to revisit the transmission of monetary policy and find that the interaction of cyclical product demand composition and cyclical labour demand composition greatly amplifies business-cycle fluctuations.

Here’s a key picture.

Source: Andreolli et al (2024).

See also Orchard (2024).

So, one thing to look at is Q1 consumption composition, as well as the level. A continued downward movement in “personal care and clothing services” might well signal an imminent downturn.

Off topicc – crushing U.S. bulk exports to balance trade:

https://www.businesstimes.com.sg/international/global/proposed-us-port-fees-china-built-ships-begin-choking-coal-agriculture-exports

The felon is threatening port fees (fines?) on vessels made in China as a way of boosting U.S. ship building. The immediate result is that vessel owners are declining to do business at U.S. ports, so that U.S. coal and grain exporters are having a hard time finding ships. A coal industry exec claimed the fees would put $130 billion in exports at risk. U.S. coal exports amounted to about $15 billion in 2023 (I got nuthin’ on 2024), while farm exports totaled $191 billion in 2024, so I’m guessing the $130 billion estimate covers both.

I don’t think we have a workforce willing to compete in large scale ship building. large scale shipbuilding requires that blue collar workers stay in the industry for a lengthy period of time. a lot of that work cannot be taught and trained in the first few weeks of work-it takes years of experience to keep a large scale shipbuilding yard operational. I am not sure that is actually possible in the United States, today, given our current approach to jobs and longevity. it is one of the reasons that steel mills have left the country. that labor may pay well, but it can be pretty brutal working conditions. hard to get people to commit long term.

Declining harvests of chip potatoes are a leading indicator of recessions… or so I’ve heard. Obvious correlation with fewer people have enough discretionary income to afford those snacks or other frivolous items, so fewer chipstock potatoes planted. Not sure how that affects McDonalds.

https://www.farmcrediteast.com/en/resources/todays-harvest-Blog/250212PotatoIndustryOutlook2025

If you don’t care for economics, why show up here? Orders from your Orange Master?

Is the RV shipments indicator still worth considering?

Looks like the data through 2024 hinted at no recession.

I’m glad you brought this topic up because that indicator is one of my favorites (for forecasting and just for nostalgia fun) Prof Chinn often brings up “heavy truck sales” at this time which is also a sentimental favorite of mine.

Hi, Moses. Good to see you(r electronic footprint).

haha, I always wanna give you my regular joke/asshole answer but it’s 50/50 it will upload my dearest blog friend, but always remember, answer or not, by best wishes are upon you

Elon Musk, who has already spent over $11 million on ads in the Wisconsin supreme court race, is now handing out $100 bribes to anyone who signs a petition “rejecting the actions of activist judges”. Vote buying is illegal but Musk is skirting the law by only requiring them to sign the petition, but everyone knows what he is really doing.

Musk is the most dangerous person in the world. He has the money to buy any election he wants. Is Greenland next? There are only 40,000 voters in Greenland and it wouldn’t take much to flip half of them. Musk easily has the cash to do so.

Oh, and just for fun, today Trump and Hegseth announced that the next generation fighter to replace the F-22 and F-35 will be called the F-47.

47 — get it? Trump’s narcissism knows no bounds. I wonder if it will be gold-plated to match Trump’s favorite decor.

that can be easily changed by the next president.

The F-22 Raptor. The F-35 Lightening. The F-47 Dodo.

More likely, it will simply be made obsolete by unmanned drones before it even goes into production. Drones can be faster, more maneuverable, lower human risk, mass deployable, and a lot cheaper than any new manned fighter. A fitting end for an expensive boondoggle. It’s going to be interesting to see how DOGE reacts to being pulled in two different directions on this one.

Off topic – diplomacy:

The U.S. has a crazily mixed record on soft diplomacy. In the one hand, our foreign aid budget, though a tiny share of overall government spending and GDP, is the largest in the world. Well, was the largest. We bring hundreds of bright young students and professionals to the U.S. on our dime every year, just to show them around and let them know we want to be friends. We feed the hungry. We have a huge advantage in cultural diplomacy, what with democracy, universities, Hollywood and the English language.

And yet… We bully. We insult. We arrest and detain. We kill and sell weapons so that others may kill. We sometimes tell others they are either with us, or against us – generally a sign that we’re in the wrong. Vietnam, Iraq and Cuba, the wars on drugs and terror, the death penalty – they’re all stains that make soft diplomacy much less effective.

Krugman writes today about what may turn out to be profound changes in Western Europe in response to the felon-in-chief’s repeated insults and attacks:

https://paulkrugman.substack.com/p/is-the-sleeping-giant-awakening

He doesn’t mention soft diplomacy, but that’s what jumps out when I read his piece. We have lost our allies respect. We’ve alienated their friendship, insulted their pride, jeopardized their security – done so repeatedly – to satisfy the egos of a handful of people. Bush, the felon, neo-conservatives, paleo-conservatives. There is no underlying U.S. interest served by alienating the citizens of our allies. We just keep giving power and a pulpit to narcissists who revel in belittling our friends, and lose soft power as a result.

When we had no rivals for power, we could afford to be stupid. Those days, brief as they were, are gone.

You knew libraries are bad. They have books, and information and voter registration forms. Bad.

Apparently, the felon-in-chief knows, too. He’s gunning for libraries now:

https://apnews.com/article/institute-doge-musk-museum-library-services-executive-order-trump-30ebde013ce3e9f97e2f4af72c869c0b

Remind me – which 20th Century political movement famously burned books?

I grew up attending a Carnegie library weekly. in my view, it was the greatest institution in our local town. it is too bad that folks like trump are happy to do away with such buildings. knowledge is what allows somebody to move from humble beginnings to great things. why would republicans want to take away that opportunity? libraries are symbols of this nations success. why trash them?

“why would republicans want to take away that opportunity?”

Because it’s an opportunity.

Speaking of libraries, you know the famous library in Derby Line, Vermont and Stanstead, Quebec that literally straddles the border with a line across the floor. The line that Kristi Noem skipped back and forth across while mockingly chanting at Canadians:

US number 1

51st state

US number 1

51st state

US number 1

51st state

Well, the US is closing the free access to Canadians that they have had since 1901. The main entrance is on the American side but Canadians were permitted free and friendly access without passports. Everyone would walk freely across the line on the floor and everyone just returned to their own side when they left.

Now the Americans are requiring a full customs check and passports for anyone from Canada. The Canadians are starting a GoFundMe campaign to build a new rear entrance.

So a century old symbol of a friendly alliance and bond between the two towns is now up in smoke at the directions of the psychopath Kristi Noem, the dog killer.

I was reading my LOCAL (Oklahoma) newspaper. And even they were shocked that library funding was being attacked by MAGA in the last two days, Imagine these snobby stupid ass Republican suburban B*thcez / c*ntz taking/gathering their kids into the public library for freebiez. Big surprize waiting for these snob c*ntz, I see them nearly everyday

Another take on the sanewashing of the felon-in-chief:

https://www.project-syndicate.org/commentary/trump-tariffs-threats-incentive-for-canada-mexico-and-everyone-else-to-break-free-by-j-bradford-delong-2025-03

Delong at Project Syndicate, again putting the spotlight on the NYT interview with the FT’s Gillian Tett. She really did give a masterclass in how our cultural elites bend to avoid giving offense to power – forehead right down on the floor.

But anyhow, Delong’s thesis is wider than Tett’s subservience. He takes the felon’s treatment of Canada and Mexico – they agreed to his rebranding of NAFTA to avoid trade sanctions and are now threatened with trade sanctions – as evidence that deal-making with the felon won’t work, and that everybody in power now knows it. This reality is set against Tett’s assertion that the felon’s behavior is “coherent”.

For Delong, in this essay, Tett’s sanewashing is a way into an examination of the real state of affairs, not the main issue. For my money, sanewashing is the bigger issue, because it extends to trade, finance, healthcare, book banning, rights violations, and on and in. Delong does make the point that needs to be made endlessly – you can’t save the country of laws unless you identify what threatens its existence as a country of laws, and sanewashing keeps us from identifying the problem.

Delong can get space at Project Syndicate, but even Krugman is no longer welcomed at the NYT, and the Washington Post has announced that it’s editorial policy is now the service of the rich. Sanewashing the lunacy of the powerful is part of the business plan for these firms. I don’t know how we get the message to everyday people if we can’t even get it into the NYT and WP.

Further to Delong’s point about the felon-in-chief not being a reliable counterparty to any deal:

https://archive.is/lZyIk#selection-1711.0-1711.103

Having signed a deal in Riyadh on March 11, the felon now wants to change the deal. Same thing he’s doing with Mexico and Canada. He has reneged on his very own rebranding of NAFTA, refused to pay his workers, refused to obey the law of the land, engaged in insurrection, so why wouldn’t he renege on his deal with Ukraine? And why would anyone agree to negotiate any deal with him?

Sorry to flood the zone, but it’s my response to the felon-in-chief flooding the zone:

https://www.washingtonpost.com/politics/2025/03/21/social-security-benefits-trump-doge/

The felon’s hand-picked Social Security commissioner threatened to shut down the Social Security Administration because he didn’t get his way. A judge ruled that DOGE monkeys-with-clubs could not be given access to SSA data, so Dudek threatened to take his ball and go home. There are 73 million recipients of payments from the SSA, a little over a 5th of the U.S. population. For many of them, their health insurance premium (Medicare) is taken straight from their monthly Social Security benefit.

Dudek threatened the livelihood and healthcare of a significant portion of the population because he didn’t get to do whatever the hell he wanted, while working for us. I don’t recall ever being allowed to do whatever the hell I wanted when working for someone else. Snowflake.

the sooner you let musk and company gut social security and medicare, the sooner you can get rid of trump. my feeling is why delay the inevitable. let him gut the programs, shut down the government, whatever. my party is going to have to come in and clean up the mess anyways. too many people kept him from destroying the country last time, and so it gave him a chance to come back, with a vengeance. do you really think you are going to keep him from mucking things up for four years? if not, lets get to the task of rebuilding sooner rather than later.