Bessent says Moody’s downgrade is a lagging indicator…

But then the Moody’s statement itself states:

We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration. Over the next decade, we expect larger deficits as entitlement spending rises while government revenue remains broadly flat. In turn, persistent, large fiscal deficits will drive the government’s debt and interest burden higher. The US’ fiscal performance is likely to deteriorate relative to its own past and compared to other highly-rated sovereigns. [emphasis added]

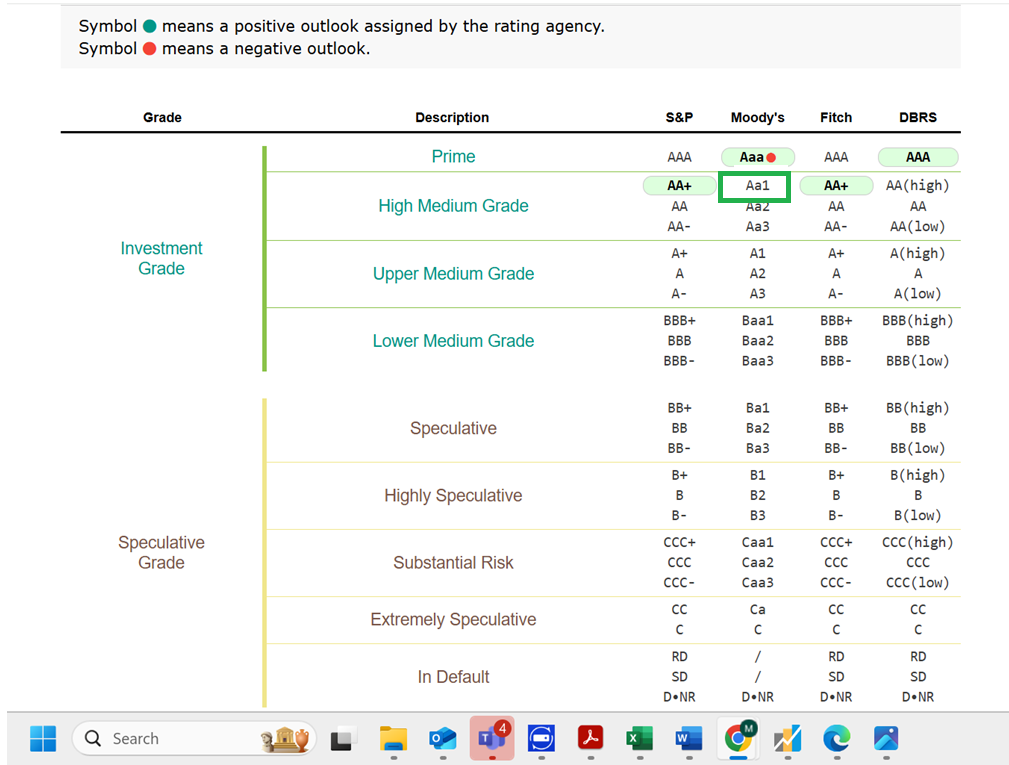

Note that Fitch dropped its rating in August of 2023.

What about market indicators? Here’s 5 year CDS on US Treasurys (from worldgovernmentbonds.com)

To see the context, consider this 6 month detail:

Thanks, Trump!

Even the reasonably well informed Kai Ryssdal at MarketPlace Radio messed up recently when talking about the U.S. credit rating. He said it doesn’t matter because the U.S. issues debt in its own currency. He repeated without thinking.

Issuing debt in one’s own currency means never being FORCED to default. That’s the only protection conferred upon investors. Intentional default is still possible – see the CDS graphs above. Inadvertent default is still possible, and has happened briefly. Currency depreciation is possible. Unexpected inflation is possible. Illiquidity and price volatility are possible.

Moody’s downgrade is late to the game. The two other big ratings firms have already cut the U.S. rating, and in the game of credit, it’s two strikes and you’re out. Aside from that, the oft-repeated moan that ratings are irrelevant because they’re priced in before they occur is dumb for a couple of reasons. As a matter of context, ratings exist to allow investors to manage risk without doing research on every single bond in the market. Regulators allow (sometimes require) portfolio managers to use the weighted average credit rating of portfolios to inform investors of portfolio risk – blah, blah, blah. Anyhow, if the safest asset in a bond portfolio suffers a ratings cut (by two ratings firms), then the rating of the portfolio falls unless some riskier bonds are sold. Selling lower-rated assets offsets a rating cut to higher-rated assets. See the problem? Treasury stubs its toe, single B bonds fall down.

The other reason saying “ratings don’t matter because they’re already priced in” is stupid is because its like saying inflation doesn’t matter because it’s already priced in. Ratings exist, so investors anticipate ratings changes and price them in. If there were no ratings, we couldn’t try to price in changes before they happen.

Bessent, by the way, is just trying to blame Biden for the felon-in-chief’s mess. Menzie has already explained that Moody’s cut was in response to the deteriorating OUTLOOK, and that deterioration is all down to the felon and Congressional Republicans. Moody’s is, in fact, being responsible in acting before another budget-busting tax cut is passed.

“Currency depreciation is possible. Unexpected inflation is possible. Illiquidity and price volatility are possible.”

ray dalio madę a similar point recently. the credit rating agencies rate against default. default is unlikely to happen. however, they do not rate against currency depreciation. the dollar index is down about 10% from mid January.

so I had been perplexed by the move a couple weeks ago where stocks dropped significantly, while concomitantly bond rates increased (ie bond prices fell). this seemed very odd, and people were looking at the source of the issue, such as a foreign player selling, etc.

I think we have asset risk repricing going on in the bond market. and this will continue to put pressure on yields to rise. inflation will not help the matter. if tariffs continue, they will reduce profit margins for most companies. so the current equity market will be overvalued, if future earnings will be reduced compared to today. and the dollar index has lost 10% since January. so foreign holders are beginning to get crushed by currency exchange. and this will be exacerbated if they hold us treasuries to maturity in the near term. seems like a ticking time bomb. possible to defuse. not sure if the current bomb squad is capable.

trump administration has been going after education accreditors recently, as a means to influence the higher education field. make accreditors approve/disapprove the trump agenda, and influence universities by that pathway.

I see trump doing the same thing with bond rating agencies. if moody’s, s&p and fitch don’t adjust their ratings in a way that is beneficial to the trump agenda, then you will begin to see talk out of the White House indicating that the rating agencies should be harmed until they begin to cooperate. because trump cannot complete his agenda if ratings agencies force interest rates to rise due to dropping of treasury and other government bond ratings. I am sure there are some regulatory items that trump can manipulate which force the hand of rating agencies.

And teh outcomes will be that ratings becomes meaningless to investors. Maybe foreign based rating agencies will be used for those who want a reliable risk analysis.

The problem is accreditation and rating agencies provide access to education funds or bond purchases. So it mucks up the system in bad ways.

If you’d written a fictional novel about this orange colored adulterating bastard about 16 years ago everyone would have said the novel “jumped the shark” in realism.