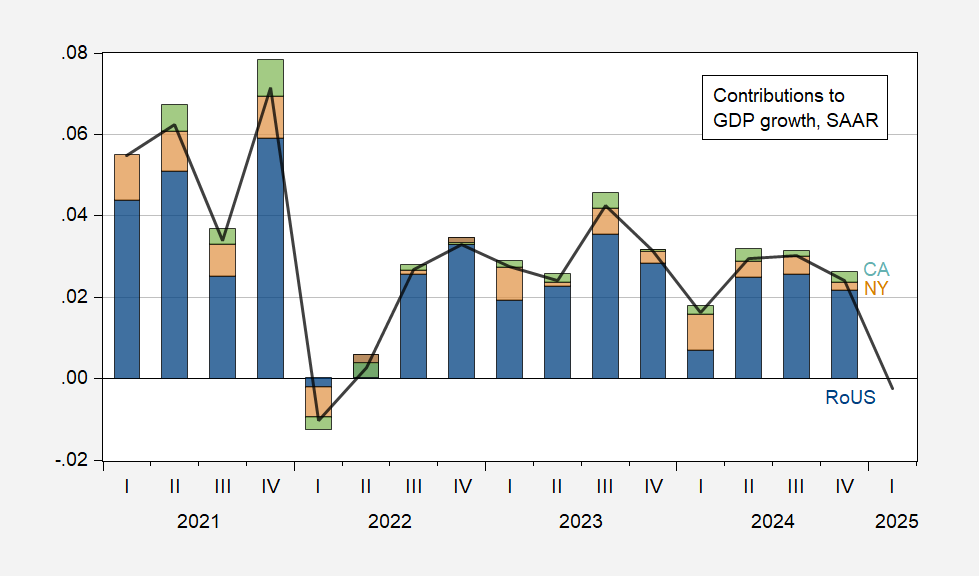

ICE raids are concentrated in blue states, including CA, NY. These states account for about 22% of national GDP, at nominal prices (CA 14%, NY 8%; slightly larger if using real GDP):

Figure 1: US GDP growth (black line), contribution from California (green bar), from NY (tan bar), rest-of-US (blue bar), ppts SAAR.

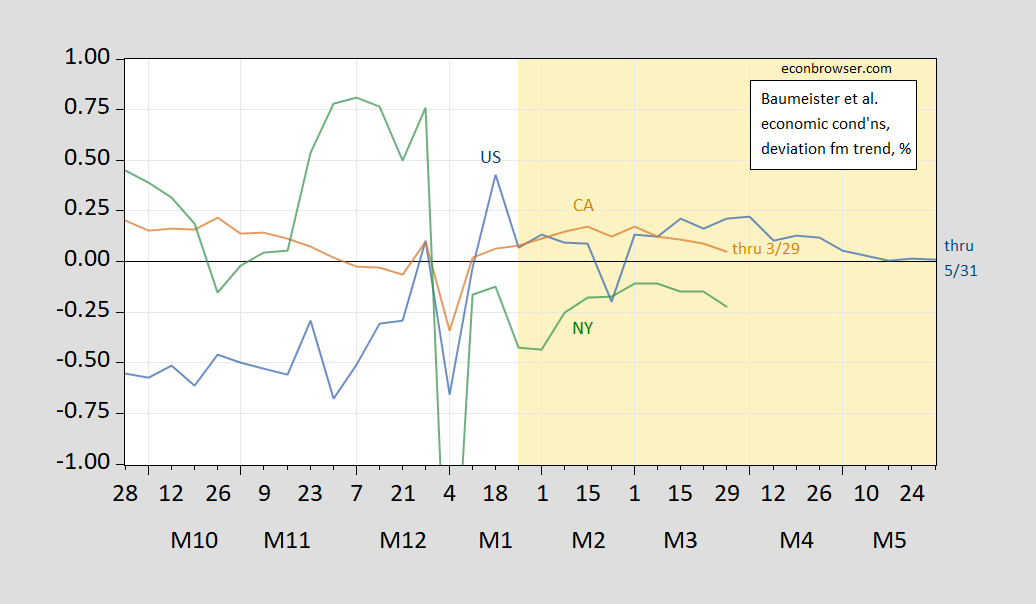

We don’t have Q1 GDP for CA or NY, and in any case Q1 national GDP is distorted by import tariff front-running. We do have Q1 growth deviation from national trend from the Baumeister, Leon-Leiva and Sims weekly state level economic conditions index:

Figure 2: Weekly Economic State-Level Conditions Index for US (blue), California (tan), NY (green), % deviation from national trend. Source WECI.

So for Q1, California GDP growth is projected to be approaching national trend growth (where California trend is above US trend), and NY is already dipping below.

The UCLA Andersen Forecast is for approximately zero NFP employment growth for 2025. The CA Department of Finance official forecast is for 0.6% (0.2%) annualized civilian employment growth in 2025Q1 (2025Q2), and 0.2% (0.4%) annualized NFP growth.

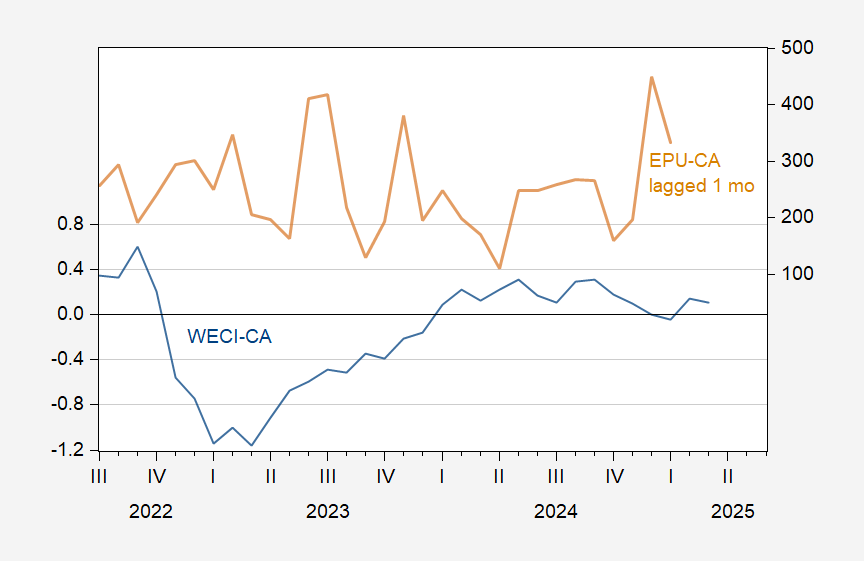

With these continued ICE raids and mass removals and deportations, the administration’s objective of sowing confusion and fear is likely working. With this comes policy uncertainty. The EPU for California extends to December:

Figure 3: Weekly State-level Economic Conditions index for California, % deviation from national trend (blue), EPU for California (tan, right scale). Source: WECI and policyuncertainty.com.

If state level economic conditions are affected by uncertainty in the same manner as national, then any elevated policy uncertainty in California will have a depressing effect on economic activity.

Midwest manufacturing was reviving with investment from the Biden administration – now policy uncertainty/tariff chaos from Trump administration is leading to a decreased investment and reduced sales outlook – https://www.bloomberg.com/news/articles/2025-06-09/trump-s-tariff-chaos-threatens-his-push-for-rust-belt-revival ¯\_(ツ)_/¯

test

California has a large trade sector and the big ports, which are already under pressure because of the felon-in-chief. Tourism, same problem. Going after urban workers takes aim at yet another part of California’s economy.

California is not just a Democratic state. It’s the home of Gavin Newsom. Just like the hissy fight with Elon, this is the felon taking on a rival for the spotlight. My guess, Newsom will gain even more name recognition as a result of standing up to the felon. Both rank-and-file primary voters and low-attention general election swing voters may be more prone to vote for Newsom as a result. The felon is presumably out of the election game, so it doesn’t matter.

Speaking of Elon, notice how this new headline-grabbing anti-immigrant crops up just as both the Elon spat and the Big Bloated Bill were making the felon look bad.

And even if sicking soldiers on immigrants is unpopular, it diverts attention away from the unpopular Bloat. The Senate is back to work this week, and the Bloat is really the only thing on the agenda. Look over there! Riots and soldiers and smoke and stuff!

Way the heck off topic, but I can’t help myself – Krugman fans probably know that he’s paying increased attention to “financialization” as a cause of income disparity. He mentions it and promises more here:

https://paulkrugman.substack.com/p/understanding-inequality-part-ii

Shame about the paywall. Pretty sure Paul has more money than me.

Anyhow, the idea that financialization is a bad thing, or a sign of other bad things, is not new. Fernand Braudel, a giant among 20th century historians, wrote about financialization in his 3-volume “Civilization and Capitalism”:

https://archive.org/details/BraudelFernandCivilizationAndCapitalism

Braudel saw that capitalists turn from production to finance once gains from monopolizing production have mostly been exploited. You can see the manifestation of Braudel’s financialization notion in the decline of goods production, increase in industrial concentration and the roughly simultaneous rise of finance as a share of the U.S. economy in the latter half of the 20th century.

For Braudel, financialization is both a cause and a sign of weakness in an economy. It’s interesting how little mention Braudel receives among the current critics of neo-liberalism, since he covered most of the basic criticism half a century ago. Braudel described what was was going to happen in the latter half of the 20th century in the U.S. by studying what had happened in earlier times and other places. Critics of neo-liberalism and Braudel both see economics in terms of power, not so much in terms of competitive markets as described in Econ 101. I guess historians don’t matter.

By the way, the first Athenian bank that we know of (not a temple or a simple money changer), set up by two guys named Antisthenes and Archestratus, gives a great example of how financialization leads to a concentration of wealth. First bank in town, started from scratch, so small by necessity. As business picked up, they needed to hire staff, so they bought a fellow named Pasion; he proved good at his job. Around 400 BC, Pasion was emancipated and bought the bank from Antisthenes and Archestratus. Cost him a bundle. By the time Pasion retired, he was not just the wealthiest banker in Athens, but also the richest manufacturer and perhaps Athens’ richest citizen. He had donated so many triremes and so much weaponry to the city and done so many good works for the poor that he was granted citizenship.

This fantastic accumulation of wealth all resulted from financialization, even in an economy which mostly wasn’t capitalistic.

yeah, you see much of tech is migrating to financial services of various sorts. even musk got rich initially by financialization. and just as a reminder, musk was not a founder of PayPal. he was bought up by PayPal. even the big banks of today, like chase, run very large technology divisions. saw a recent article indicating that AI was better at stock picking than professional traders. funny, when i first started playing with AI it explicitly said it would not provide financial and trading advice. how times have changed in a matter of months!

We’re at the end game with digitalized tokens representing wasted electricity with no independent exchange value being touted as an “investable” asset that is seeping its way into everything from the S&P 500 to hedge funds and migrating into the regulated banking system and the financial structure. I thought CDS were insidious but the Fed managed that breakdown and SVB was doable; but this end game has no positive outcome. Hope we have a few more good years before it breaks and given the Gen X/Y gambling mentality that seems possible. But next year Powell will be gone so the possibilities are very limited.

There was an interesting incident in California where some people broke into a residence and took over various rooms. They demanded food and medical care and some money. The owners were not too happy about the situation and called the police department that indicated they could not do anything about the situation because it was policy that once residence had been established, the new occupants were allowed to remain. The owners then called the mayor who said that any attempt to remove the new residents would be met with legal actions against the owners because the new residents were protected. Furthermore, the owners were required to provide any food, care, and funding the new residents required. The owners decided that was absurd and called in some friends to help them get rid of the new residents, but the owner and friends were attacked by the new residents and portions of the house were badly damaged. News reporters got wind of the situation and decided that it made a good story about how unwelcoming and selfish the owners of the home were. Crowds gathered around the home and began throwing objects at the home and the owners’ vehicles. Police were reluctant to do anything because it was against the mayor’s orders. State police said this was a local issue. When the owners called in the FBI, those federal officers were met with an angry crowd calling them fascists and threatening them.

California politicians saw this as an opportunity to gain popularity with the crowds supporting the new residents, so they cheered on the situation and condemned the FBI for interferring with a local issue. The news reported that the attempt to remove the new residents would have a terrible impact on the local economy which relied heavily on federal funds to help support these new residents and the multiplier effect it had throughout the state.