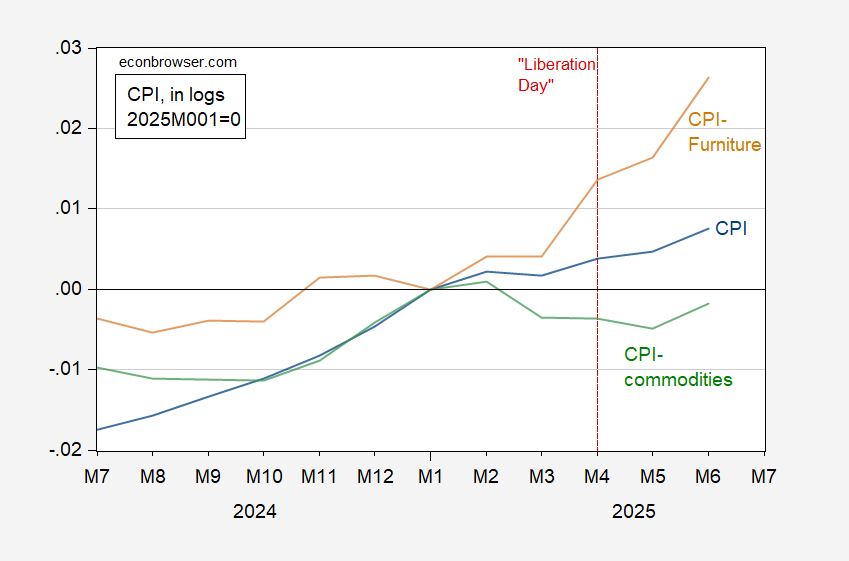

From CPI, note the CPI furniture and appliances category:

Figure 1: CPI all urban (blue), CPI commodities (green), and CPI – furniture and household appliances (tan), all in logs, 2025M01=0. Source: BLS, and author’s calculations.

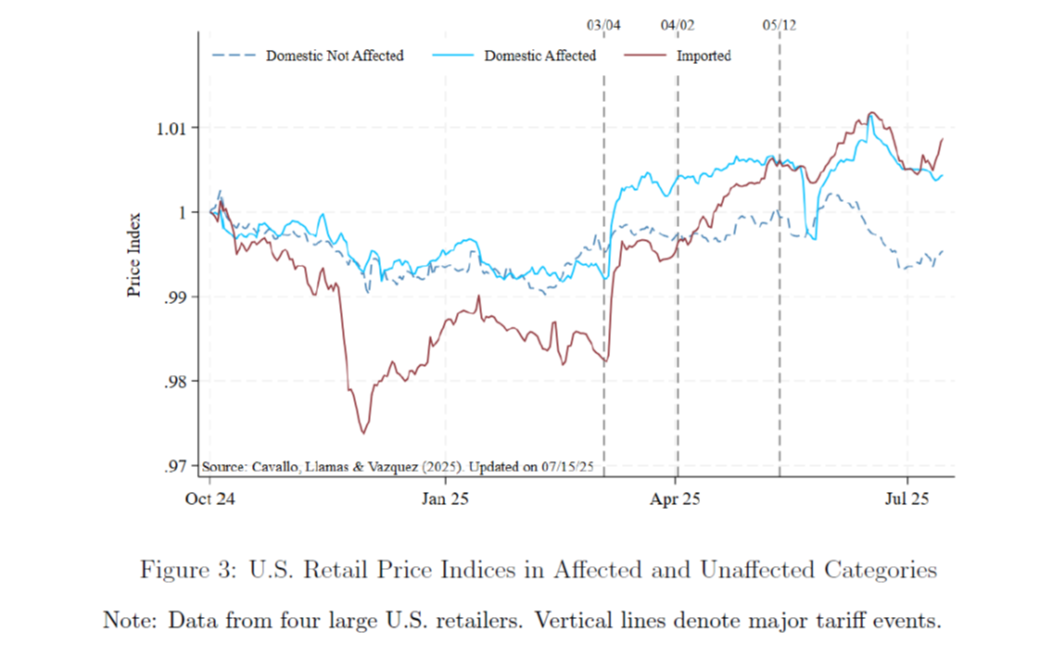

And, on a much more granular level, from Cavallo et al. (July 17, 2025):

Source: Cavallo, et al. (July 17, 2025).

Not only have tariffed goods prices risen, domestic competitor prices have as well. Thanks, Drumpf!

Interesting, but necessarily somewhat speculative. However, one piece of data is incontrovertible.

Every day the Department of the Treasury publishes the “Daily Treasury Statement” of moneys incoming and outgoing from the federal government. And one specific line is for “Customs and Certain Excise Taxes.”

That particular line as of several days ago indicated that about $125 Billion had been received in such taxes this fiscal year, about $50 Billion more than had been received one year ago at this time.

That $50 Billion was paid by importers, who either ate the cost or passed it on to consumers, or some combination of the two. If we simply figure a 50/50 split between the two possible parties bearing the brunt of the tariffs, that averages out to about a $200 increase per household so far this year. That’s money that could have been saved, or spent on other items. Instead it was spent on the increased cost of items bought.

CPI data reliability is getting worse. The CPI is calculated in a spreadsheet of about 90,000 cells containing price information. But because of DOGE personnel cuts to people collecting prices, more and more of these cells are filled with estimated data instead of real data.

In a typical month over recent years, about 10% of the cells contain estimated prices using similar item prices from neighboring cells. But in May the number of estimated cells rose to 30% and in June rose to 35%. This is a bad trend. Economic data coming out of the Trump administration is getting worse and worse.

As Trump screamed during the start of the COVID epidemic “Stop the testing. If there wasn’t so much testing, the numbers would be much lower.”

https://www.wsj.com/economy/labor-department-relied-more-on-fuzzier-price-guesses-in-june-inflation-data-a07da246

in texas, we are already seeing inflation in the fresh food market. fruits and vegetables are more expensive and imports are taxed higher, and local growers cannot find enough farm workers to pick the fields. my guess is within a 2 year timeframe, we will have lost about 10% minimum of purchasing power due to the tariffs and other policy mistakes. and that does not include the consequences of a possible recession from those policies. markets are extremely frothy right now, all of this will be exacerbated when that corrects again.

by the way, is the fed job to control interest rates to help the government fund its spending? I thought the fed mandate was price stability and employment? when did we add the third mandate to its responsibility?

Regarding tariffs in the data, here’s a good one from your favorite economist EJ Antoni. It’s hilarious.

Antoni: “Import prices just came in WAAAY below expectations: June was up just 0.1% M/M, -0.2% Y/Y, while May saw a huge downward revision from flat to -0.4% M/M; still waiting for tariffs to be passed on by foreign producers…“

And then we have the response from economist Justin Wolfers:

Wolfers: “Who wants to tell him that the import price index measures the pre-tariff price?

If foreigners were eating the cost of (roughly) 10% tariffs, pre-tariff import prices would be down 10%. They’re not. Therefore Americans are paying basically all of the tariffs.“

not all institutions put a quality control check on the distribution of phd’s. some institutions simply need a cheap ta to grade papers and labs. the reward is a cheap phd. I doubt Antoni has done any legitimate research in his lifetime. that is how he can make such a mistake, and not think anything of it.

That’s why little Antoni is chief budget economist at Heritage – ’cause he know so much about economics.

Sheesh.

If it’s both, then consumers face tarff+greed price increases. Oh, good.

I’ve seen the assertion that tension between labor expectations and capitalist expectations is an factor driving inflation. If so, well what drives expectations?

Profits as a share of GDP were higher in Q1 than in any quarter prior to Covid. Profits since 2005 have generally been a larger share of GDP than in any period prior to 2005. If capitalists’ expectations are set over a whole generation, there might be some expectation of lower profits in the future. Over two generations, even lower. But then why are profits so high now, after so many years of higher-than-historic profits?

https://fred.stlouisfed.org/graph/?g=1KIs8

So I kinda don’t think profit expectations are backward-looking. I think what’s happening is that firms jockey for market power and set profit goals based on success in gaining that power. Only by preventing the acquisition of market power – ya know, like in the competition between price takers which is the basis of the Econ 101 story used to justify capitalism (worship)* – do we make sure that labor gets its share of GDP.

*The admission that “it’s both” is prima facie evidence that we are not in an Econ 101 world. Nuff said.

TBF, retailers have low margins and have to raise prices pretty much annually. If they can blame a “regular” price increase on tariffs, they will, without greed playing any part in it.