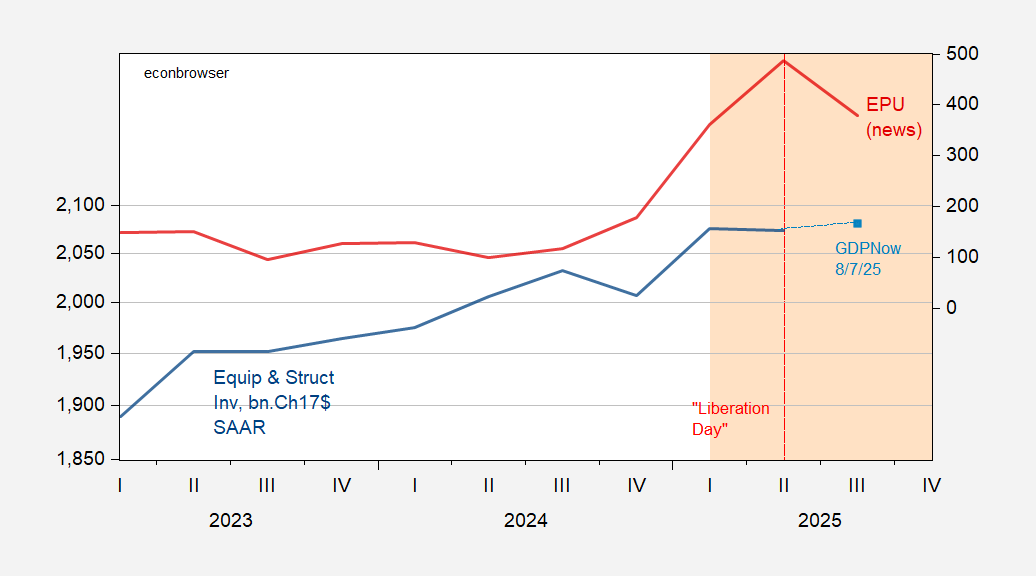

We’re about halfway into Q3. Nowcasts put equipment and structures investment — particularly forward looking investment — at near flat relative to Q2.

Figure 1: Equipment and Structures investment (blue line, left log scale), GDPNow nowcast of 8/7 (light blue square), both in bn.Ch.2017$ SAAR; EPU (news) (red, right scale). Source: BEA, Atlanta Fed (8/7), policyuncertainty.com, and author’s calculations.

See what consumer durables are doing, here.

Thanks, Drumpf!

If spending on artificial intelligence weren’t so strong, the picture would be worse. Here’s private nonresidential investment, computer and software investment, and nonresidential investment without computers and software:

https://fred.stlouisfed.org/graph/?g=1Lej0

Take out computers and software, which are flying due to the AI craze, and nonresidential fixed investment peaked back in Q2 of last year.

Which brings us to a potential alternative to a policy-induced recession. Roubini is talking up an AI boom:

https://www.businessinsider.com/recession-prediction-dr-doom-us-economy-nouriel-roubini-markets-outlook-2025-6?op=1

Superficially, stock investors seem to like the idea, but outside of returns to the AI sector, its hard to see where stock investors think AI will pay off. The Magnificent 7, meme stocks and crypo are running wild, while the rest of the equity market is mediocre. If AI isn’t going to boost returns in the wider economy, where does Roubini’s 4% growth come from? Roubini’s 4% growth call depends on productivity climbing 3% per year due to the flowering of artificial intelligence; sectors outside of AI ought to be able to ride that kind of productivity gain. I’d like to see Roubini’s math.

while I have used AI to do some nice coding, there were several recent examples of complete and utter failures of AI to complete some simple tasks I would expect a college intern to do in an hour or so. complete failures. AI still seems to be a ways off in terms of true productivity as promised.

recent articles on the failure of computer science graduates to get first jobs is a bit alarming. I don’t think AI is good enough to replace those folks yet.

Off topic – this suggests that at least one side anticipates a possible end to Russia’s war against Ukraine soon:

https://www.newsweek.com/russia-ukraine-2111187

More ground battles now than at any previous time in the war. Grabbing the last bit of ground – either as a prize or a bargaining chip – before a new map is drawn.

And once again, the felon-in-chief is going to meet Putin without Zelensky. This is not shuttle diplomacy. The felon isn’t sophisticated enough, nor does he have the disposition, to engage in shuttle diplomacy. He’s treating the Ukraine war like everything else – pretending that he’s in charge.

Putin, meanwhile, is behaving like a guy who intends to make heavy demands based on grabbing anything he can grab and exploiting the weariness (Ukrainians) and weakness (felon, Congress) of his adversaries.

Best guess: the felon will announce progress toward peace, while Putin plays for advantage. Then it’s down to whether the felon decides to lie about success or remain annoyed by Putin’s lies.

P.S. It’s remarkable that a guy who breaks deals left and right and who lies all the time gets blindsided when Putin does the same thing. Serious blinders.

Judging from recent comments by FOMC folks, Bowman, Mary Daly, Kashkari, Chris Waller, everyone in Fed fantasyworld is signing on to lower rates. Cool to see the Fed is as easy to politicize/manipulate/bully/feather-in-the-wind as our great and all-knowing SCOTUS. Never doubt our ivy-league backboned types.