My nowcast of BLS private nonfarm payroll employment was for a decreaes of 78K, but with a very wide prediction interval. This is an aggregate number; however, we can infer certain trends from the disaggregate (by firm size) numbers from ADP.

The financial accelerator approach (e.g., BBG, 1996)implies that smaller firms (with less collateral) will evidence a slowdown sooner than larger firms. Using the 500 employee cutoff, can we see the differential trends in the data?

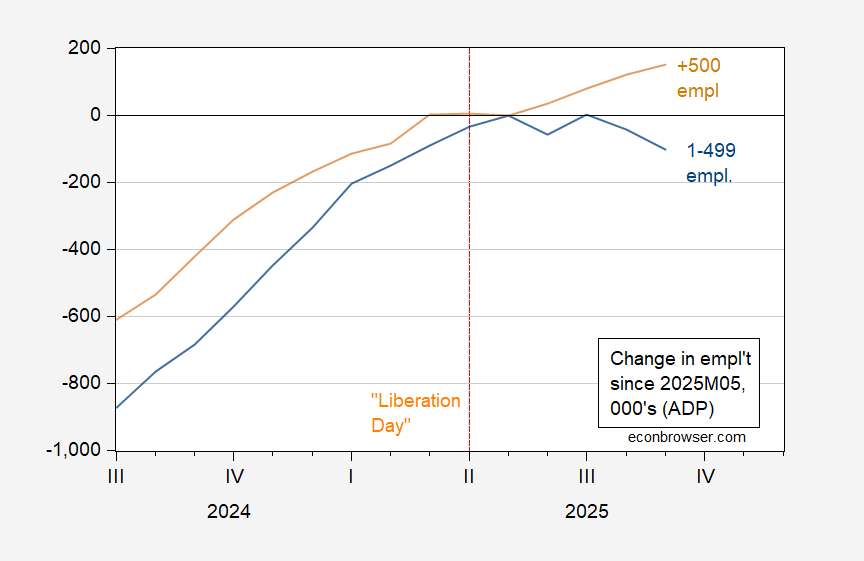

Figure 1: Change in employment from May 2025 in firms with less than 500 employees (blue), in firms with 500 and more employees (tan), both in 000’s, s.a. Source: ADP via FRED, and author’s calculations.

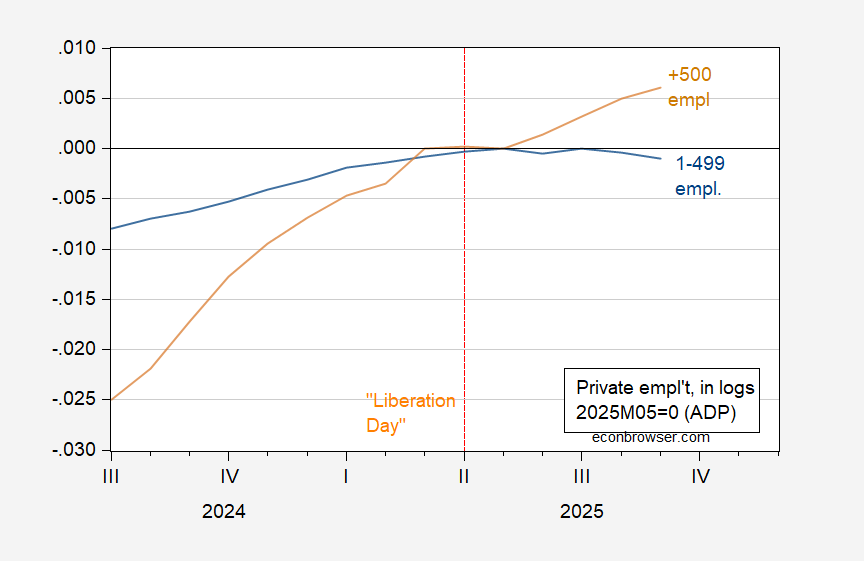

Figure 2: Employment in firms with less than 500 employees (blue), in firms with 500 and more employees (tan), in logs 2025M05=0. Source: ADP via FRED, and author’s calculations.

Private employment in firms with 1-499 employees constitutes about 80% of employment.

Seen either way, employment growth has essentially disappeared for “small” firms.

Addendum:

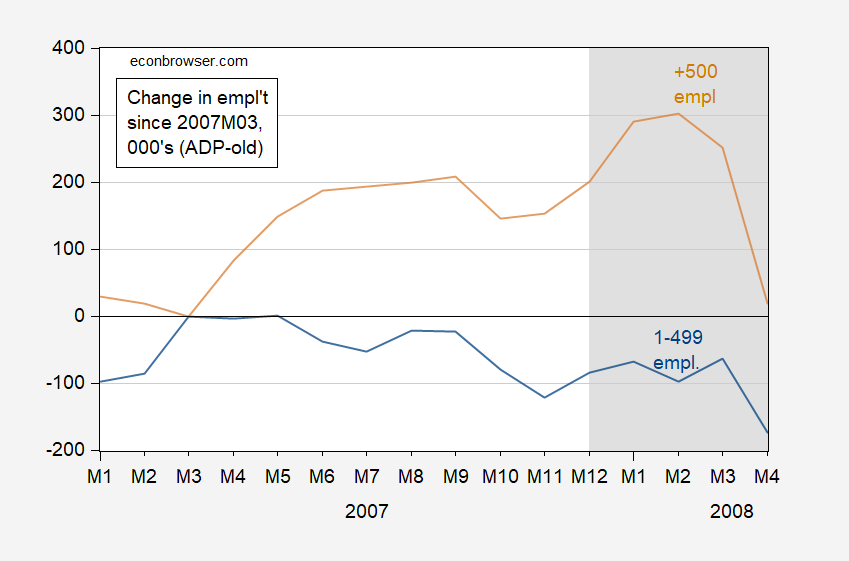

Note that in the runup to the 2007-09 recession, small firm employment declines led large firm by nearly a year.

Figure 3: Change in employment from May 2025 in firms with less than 500 employees (blue), in firms with 500 and more employees (tan), both in 000’s, s.a. NBER defined peak-to-trough recession dates shaded gray. Source: ADP (discontinued series) via FRED, and author’s calculations.

Justin Wolfers makes the good point that the unrevised ADP numbers do not track nonfarm payrolls as closely as the revised numbers do. But the three month moving average of even the unrevised numbers looks like a good estimate. It’s also worth noting that ADP has already incorporated the preliminary QCEW benchmark.

In addition to the ADP, the weighted average of the ISM manufacturing and services sub-indexes have indicated consistent contraction beginning in June.

And the average of the employment components of the 5 regional Feds that report manufacturing and services also indicated slight contraction in November.

Finally, since the data had all been collected before October 1, I suspect that if the official report were going to be good, the T—-p Administration would not have furloughed every single BLS employee but 1, to make sure the report wasn’t released.

The same acccess to capital problem that leads small firms to cut back on hiring in response to stress also means they have less flexibility in dealing with sudden cost increases – like higher tariffs. Small firms are often contractors to larger firms; large firms may cut contracts in preference to cuttinng internal headcounts.

So, yeah, keep a really close eye on small-firm performance.

Speaking of keeping an eye on small firms, the NFIB survey has a handful of employment indicators, and employment indicators are otherwise in short supply. So here goes:

https://www.nfib.com/news/monthly_report/jobs-report/

If memory serves, the NFIB data lead overall hiring. The unfilled openings index is the lowest since July, 2020, but still high compared to the long-term average. This is the same quirk seen in JOLTS openings data in recent years.

The job creation plans index is weak relative to this expansion and the average for the past decade, but also above the long-term average.

Downward trends in these series nearly always lead quickly to recession. This cycle is an exceptio; we’ve had a prolonged downward trend, but from historically high readings early in the cycle, and no (declared) recession. So each of us will have to squint at these data in our own way and reach our own conclusions, though it’s clear the labor market has weakened. When I squint, I see trouble.

A methodological question. I do longitudinal neuroscience studies, and the one thing we can generally rely on is the stable identity of each participant. Even then we have different subsets of subjects at each time point (no shows, data quality problems, etc), and so of course we have to make sure that the trends we see arent really just compositional differences between time points.

Business identities seem less stable. Also businesses can expire, or be purchased and consolidated into another business. And those things might well be more frequent in recessionary conditions. Furthermore, number of employees is not stable either.

Are the 500+ 500- labels reapplied each quarter, or set at the beginning (ie are firms moving between categories at all from time point to time point in your chart?). Could non-intersecting compositional effects be driving this (I understand that there are theoretical reasons to expect bigger and smaller firms to weather adverse conditions better or worse). Also, could layed off workers be moving to bigger firms (because they are the only ones still hiring)?

I’m not qualified to answer your questionns, but I think you’ll find the answer here:

https://www.bls.gov/opub/hom/ces/design.htm#frame-and-sample-selection

The BLS handbook describes how firms are selected, how changes in firm size are controlled for, and how firm births and deaths are controlled for, among other things.

Here’s one step up in the handbook, where you can find links to other statistical design methods:

https://www.bls.gov/opub/hom/ces/design.htm

The point of this article is obvious, but worth noting:

https://theconversation.com/us-economy-is-already-on-the-edge-a-prolonged-government-shutdown-could-send-it-tumbling-over-266327

Government shutdowns cause small damage to the overall econimy, with damage increasing as the shutdown goes on. A shutdown is unlikely to cause a recession. However, if we’re in the brink – we are – then a shutdown could be enough to tip the economy into recession.

Both partiess are furiously blaming each other for the shutdown, but polling and history both suggest the party in power will he blamed. It’s a matter of interest whether today’s Republican leaders are can take that fact on board, whether they can think that their lies will be questioned by the voting public; they have lived in lies now for a very long time.

this shutdown is occurring in year 1 of trump. meaning he will need to live with the downside for the next three years. yes, he will consistently try to blame others for the economy. but republicans will need to go through multiple elections after poor economic conditions that ultimately get blamed on the party in power. if trump and his klan were smart, they would end this shutdown soon. they are not good at fixing their own messes, and have rightly relied on the other party to clean up the mess. this will be hard for trump to get away with over the next three years. you cannot hide economic weakness over a longer time frame.