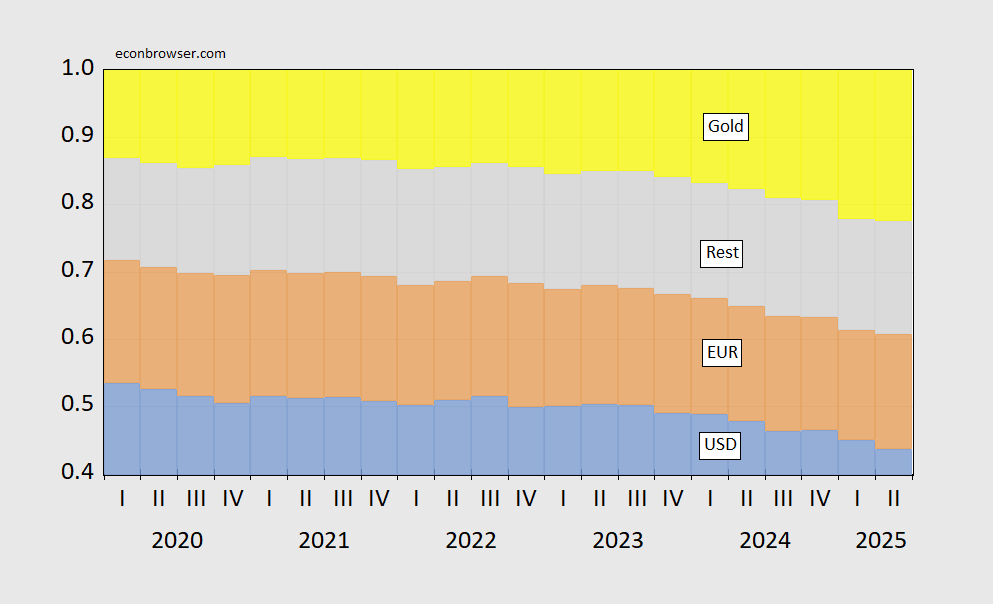

COFER data is out for Q2. With estimated gold held by the central banks, we have this picture of reserve composition.

Figure 1: USD shares of fx (blue bars), EUR (tan), all other (gray). USD(EUR) share assumes 60%(35%) of unallocated reserves are in USD(EUR). Source: IMF COFER, and author’s calculations.

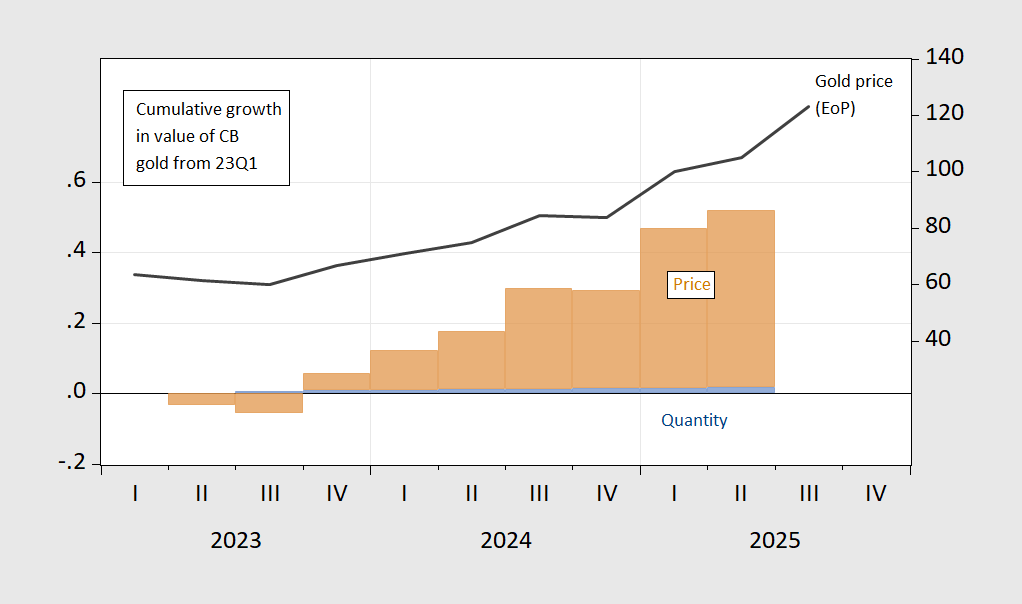

Note that the increase in gold holding shares of value is driven primarily by the increase in gold prices, rather than amount of gold. This is shown in Figure 2, where the change in the value of gold reserves relative to 2023Q1 is decomposed into price and quantity components, along with the price of gold index (right side).

Figure 2: Cumulative growth in price of gold held by central banks (brown bar), and in quantity of gold (blue bar), relative to 2023Q1. 2025Q2 gold is reported acquisitions added to 2025Q1 quantities, multiplied by implied gold price index. Source: COFER, Gold Council to 2025Q1, 2025Q2-Q3 calculations by author based on Gold Council data.

The rise in gold holding shares is primarily due to valuation changes rather than quantity changes. With a Q3 increase in gold prices of 17% (not annualized), this distinction is particularly important.

For an analysis of individual central bank behavior with respect to gold (up to 2022), see Chinn, Frankel and Ito (2025).

either gold is in a bubble or inflation is tearing through the world economy. gold cannot sustain this valuation longer term, without something else bad happening.

I’ve always followed the gold/oil price ratio – how many barrels of oil can be purchased by an ounce of gold. https://www.macrotrends.net/1380/gold-to-oil-ratio-historical-chart

It looks like Gold is at its highest valuation relative to oil since the first months of the pandemic. Does this indicate a bubble in gold? Possibly. Usually high inflation is tied to a high price in oil.

A feature of the world of foreign exchange which is less discussed but massively important is fx turnover; how much of international trade and financial activity is denominated in each currency?

Here’s the latest from BIS on turnover, with data through – funny coincidence – April. The dollar’s share is now 89 2%, a new high, if memory serves.

To the extent that reserves are held to assure that international payments can be made by those domiciled in one’s country, the dollar’s near-90% share in international transactions means dollar reserves need to remain high.

Oops…

https://www.bis.org/statistics/rpfx25_fx.htm

check here gold updates https://rates.gold/