The $20 billion swap announced by Bessent (not on US Treasury website as far as I can tell) is funded out of the Exchange Stabilization Fund. As far as I can tell, there’s no conditionality. This transaction is qualitatively different from Fed swap lines with for instand ECB and BoE wherein the Fed had access to their currencies.

Hence, the swap is essentially a loan from US Treasury (i.e., you and me, American taxpaers). I want to know what’s the collateral. Hopefully, we’re not relying on the reliability of Argentina to stabilized its currency…

So far, the Treasury intervened on Friday. It’s not clear that worked to stabilize the currency.

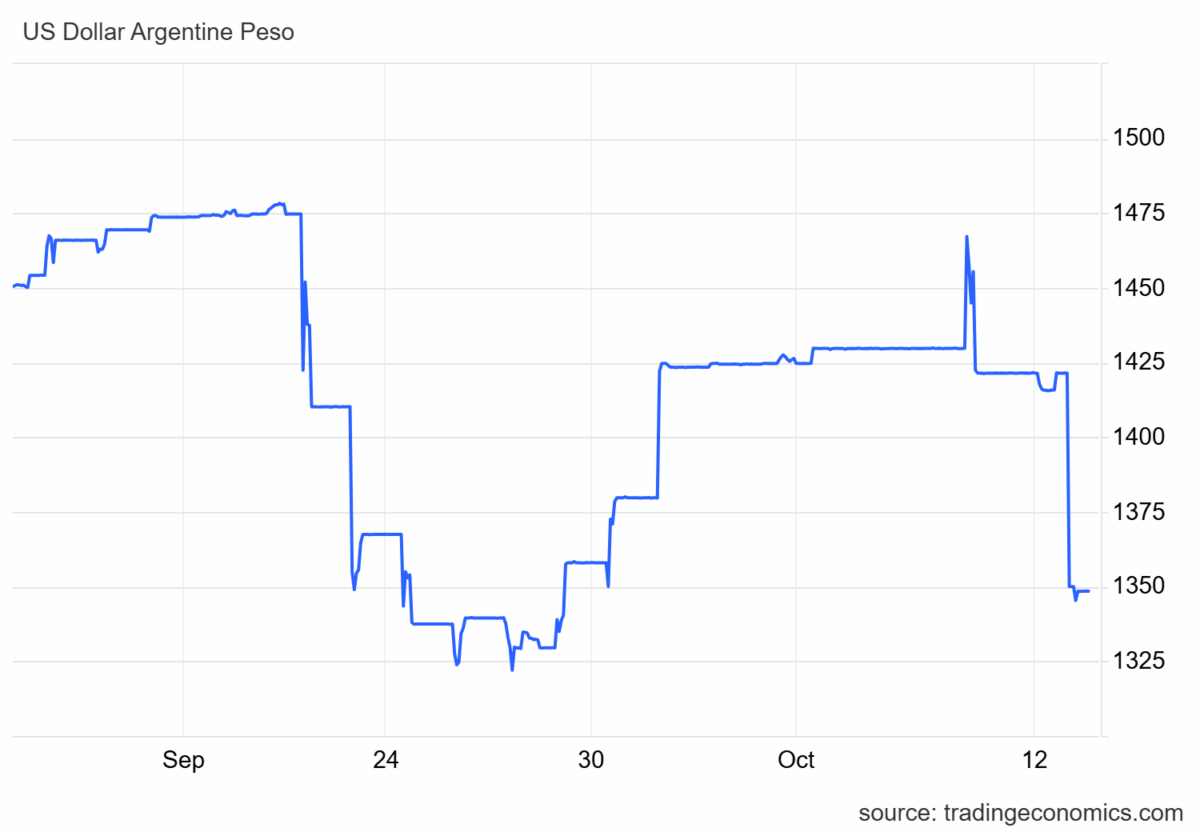

Here’s the Argentine peso’s value over the last month:

bruce hall, you support the us taxpayer bailout of Argentina because of what? dear leader told you to support it? because that is a very America first action item.

For what it’s worth, participants in the 2010 restructuring of Argentina’s debt would have gotten 30 cents on the dollars, assuming all went as planned. Payments had been delayed, and were then deferred under the agreement, so the actual net present value of repayments under restrecturing was far less than 30 cents. But the the hedgies sued, so never mind.

The restructruing begun in 2020 is still under negotiation. It new Treasury lending isn’t made senior to outstanding debt – which would through a new wrench in those negotiations – the pari passu it is . We’ll get what we get, when we get it, just like everybody else.

In reality, it’s never as simple as I’ve described, but debt seniority, restructuring and political and judicial leverage are the basics, I think.

One phoney currency buying a second phoney currency !! The results are a large real stagflation!!

That chatting has a wrong title and is misleading. That’s how many pesos you can buy for a dollar. Essentially, a downward movement implies a strengthening of the peso, i.e. an increase of its value (if you measure value in USD). Hence the wrong title.

That chart has a wrong title and is misleading. That’s how many pesos you can buy for a dollar. Essentially, a downward movement implies a strengthening of the peso, i.e. an increase of its value (if you measure value in USD). Hence the wrong title.

Francesco: It’s not uncommon to see minor blips upon announcement of a program, or forex intervention, that disappear (e.g., see how the peso has evolved since my post). Hence, I don’t think there’s been stabilization, even if the peso appreciated short term.

In addition to our host’s point, there is substantial risk that Argentina won’t repay in full. If all we provide are swap lines, then we risk loss only through peso devaluation. However, the terms of our support are murky, and as our host notes, involves the exchange stabilization fund. It’s historically a loan fund. If the loan isn’t repaid in full – or a swap isn’t reversed- the U.S. loses money. In order to reverse a US$ swap, Argentina needs US$s. Inadequate US$ holdings is the reason for the swap in the firt place.

Argentina has defaulted more often than any other countryand has not yet resolved its 2020 restructuring. As of the end of September, CDS rates priced in fairly high odds of default:

https://www.worldgovernmentbonds.com/cds-historical-data/argentina/5-years/