Tomorrow, we’ll get another piece of business cycle information, in the form of industrial production, manufacturing production, and capacity utilization [correction: no G.17 release h/t Paweł Skrzypczyński ].

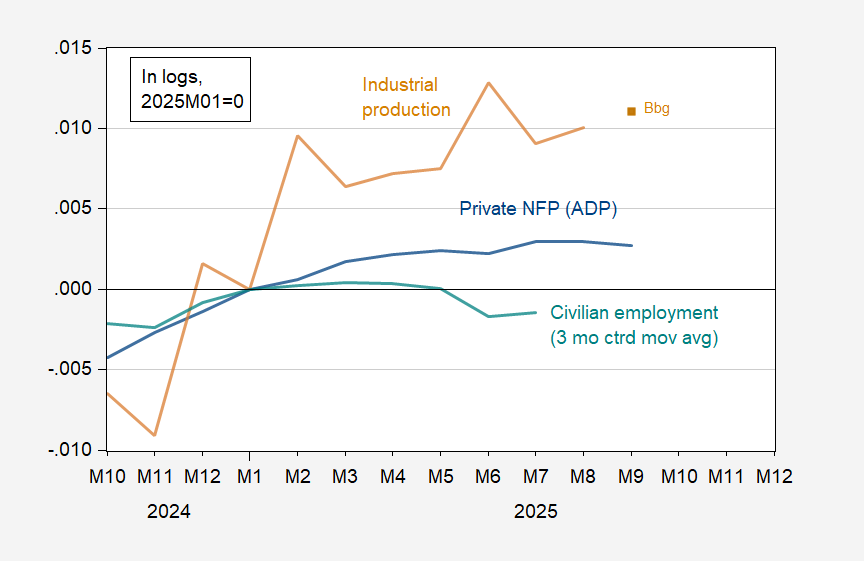

Figure 1: Private nonfarm payroll employment – ADP (blue), civilian employment, 3 month centered moving average, smoothed population controls (teal), and industrial production (tan), and Bloomberg consensus (brown square), all in logs 2025M01=0. source: ADP, BLS, Federal Reserve via FRED, and author’s calculations.

Civilian employment is not actually an observable during the shutdown, but the other two are. I include it for reference. With current betting on a 40 day shutdown, the next key indicator for release is probably the DP report.

Trump and Bissent now giving $40 billion to Argentina – as the Republican govt shutdown continues. Hassett said that the administration has “identified many, many, many billions of dollars of farm aid that can go out” to US farmers. Beyond initial draft agreements no trade deals have been made.

A little tidbit regarding Bessent’s Treasury Department. Joe Lavorgna is employed as “counselor” to Bessent. Lavorgna is a fixed income specialist with a long career in finance. He’s reasonably good at up-and-down economics, good at markets. Somewhat troubling is that Lavorgna had been at Deutsche Bank from 1997 till he was picked up at Treasury. DB is a money-laundering, bail-out-needing, Russia-oligarch-enabling operation that was the only place the felon-in-chief could get credit for some years prior to his first election:

https://www.americanbanker.com/author/joseph-lavorgna-bb286

Nowadays, Lacorgna is making the press rounds, saying politicized, goofy things about the bailout (“it’s not a bailout”) and about Argentina (“key geopolitical space”).

My guess is that Lavorgna is gunning for a hedge fund job as his next step. Most of the “it’s not a bailout” money will end up with hedgies.

The Fed will not publish the G.17 release as scheduled. https://www.federalreserve.gov/feeds/g17.html#3785

October 10, 2025

G.17 October 17th release delayed

The industrial production indexes that are published in the G.17 Statistical Release on Industrial Production and Capacity Utilization incorporate a range of data from other government agencies, the publication of which has been delayed as a result of the federal government shutdown. Consequently, the G.17 release will not be published as scheduled on October 17, 2025. The Federal Reserve will announce a publication date for the G.17 release after the publication dates of the necessary source data become available.

Off topic – fighting against fighting inflation:

https://www.cnbc.com/2025/10/15/trump-xi-china-bessent-price-floor-rare-earth-critical-mineral.html

Bessent has promised to impose price floors on imports in a range of “stratefic industries”. The goal is to keep China from dumping cheap exports in the U.S. Rare earth metals are apparently one such industry.

China has stopped exporting rare earth metals to the U.S., and we are trying to stop them from exporting those metals at too low a price. Seems redundant. Yeah, I understand that the goal is to encourage domestic rare earth production by assuring a lower bound to domestic prices. Fine, but why expand the use of tariffs to the point that the felon-in-chief has, and then decide against using tariffs for their intended purpose?

What other “strategic industries” might get price floors? Bessent hasn’t said, but just like tariffs, price floors are inflationary. And competition is good.

By the way, we have a vaguely similar system of price supports for that very strategically important industry, sugar:

https://www.gao.gov/products/gao-24-106144

Obesity is an epidemic, and instead of taxing sugar, we subsidize it. I dunno, maybe there’s a causal relationship in there. There is clearly a political quid pro quo at work, just as there will be with all thos “strategic industries”.

You simply set a demand that government products have be be sources domestically. That becomes a steady customer for domestic suppliers (investors).

Off topic – India may be cutting back on Russian oil imports, or not:

https://indianexpress.com/article/world/trump-claims-pm-modi-agreed-india-to-stop-buying-russian-oil-10309583/

Some reporting in India suggests that imports for government agencies have been cut, but that private brokers have not had any instructions regarding oil trade with Russia. Orders for December are in process now, orders for January about to start.

“Wealthy Americans Are Spending. People With Less Are Struggling…

“This isn’t just an inequality story — it’s a macroeconomic story,” said Lindsay Owens, executive director of the Groundwork Collaborative, a progressive policy group. “As the wealthy continue to consume, that’s masking more and more insecurity and instability in the economy under the hood.”.

https://www.nytimes.com/2025/10/19/business/economic-divide-spending-inflation-jobs.html

Even the NY Times gets this! But the real question is whether macroeconomists take note? Will they regularly report on the dual track of national income instead of just focusing on the aggregates?

DAndersen: See https://econbrowser.com/archives/2024/01/re-post-distributional-data-from-the-national-income-and-product-accounts

You raise a good point but to be fair there are economists who do report on this.

Bruce Hall started one of his patented stupid rants the other day with this MAGA dishonesty:

‘This situation didn’t happen overnight. Back 50-years ago, there were plenty of migrant workers who followed the planting and harvesting and then went south for the winter.’

Brucie boy as usual had no source for his rant. His rant showed his usual total lack of understanding of anything. Par for the course for our MAGA moron. I tried to provide this history of U.S. farm worker policy that goes back not 50 years but a couple of centuries. Of course our favorite racist clone of Stephen Miller has not read this or anything else with an ounce of value or veracity!

A Timeline of Immigration and Farm Worker Policy in the U.S.

nfwm.org/wp-content/uploads/2024/02/Updated-Immigration-FWI-Timeline.pdf

Alas little EJ Antoni is back to lying on the Twitter. HIs latest said those 7 million NO KINGS protestors did so only because they were paid by George Soros to do so.

You mean I protested for free? What is this, America or something?

Let’s say Soros has (had) a net worth of $7.2 billion:

https://en.wikipedia.org/wiki/George_Soros

That comes out to about $1000 per protestor. If Soros liquidated his entire estate in order to pay protestors (having previously given roughly 64% of his estate to charity, the bastard!, and as a champion of democracy, I suppose it makes sense to suspect him), that would probably generate quite a turnout.

One problem: Damn it, George, where’s my money! If my friends and I didn’t get paid, who did, you @#$%%??? C’mon, it was,…well, it was a lovely day, but that’s not the point! Where’s my cash, George?

By the way, isn’t little Antoni screwing things up for the next right-wing freak who wants to blame Soros? If we accept that Soros blew his wad on getting 7 million of us to turn out, doesn’t that disqualify Soros in the future as a money-bags boogey-man?

I saw a few sign at our protest that said some variation of “I was not paid – I do it for the pleasure”.