Hard to assess, since we don’t know how much was blown.

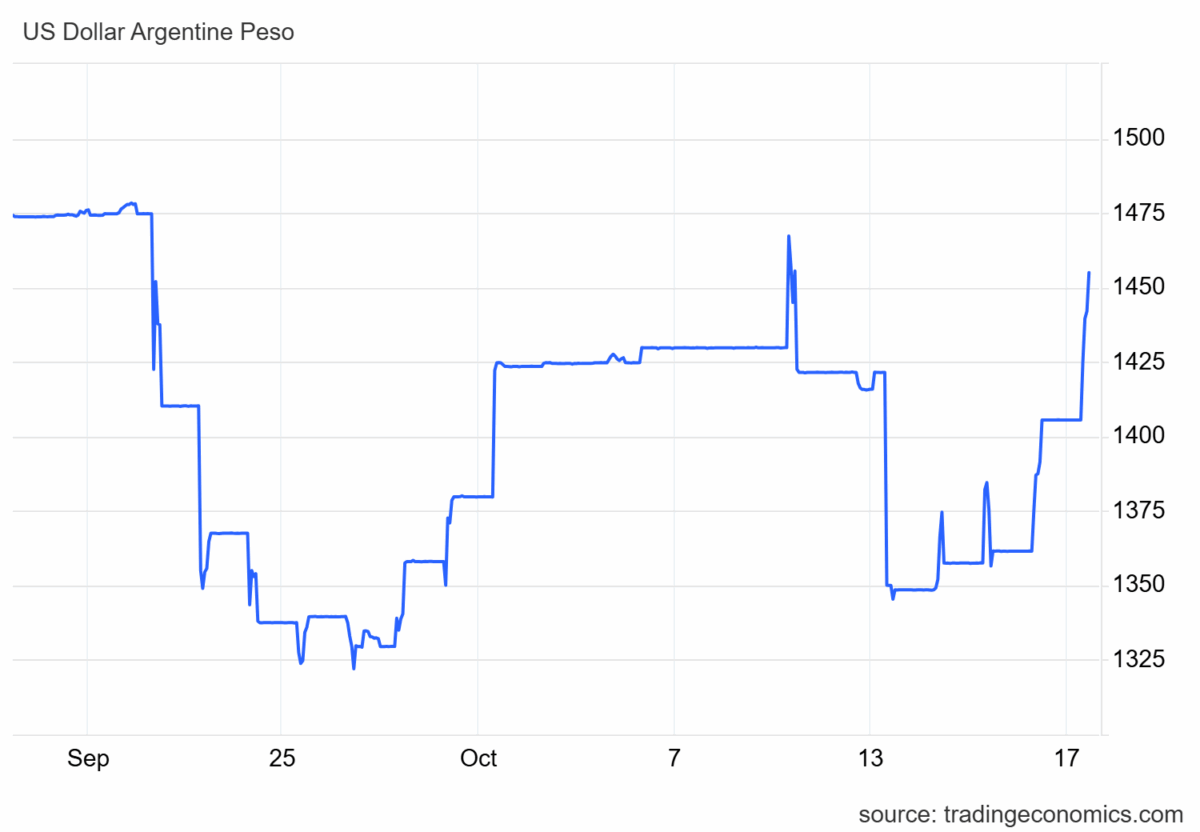

Data as of noon (CT) 17 Oct 2025.Up is a depreciation.

Against a backdrop of Bessent arranging additional $20bn private funding (window dressing?), one wants to know how much of the US ESF is going to disappear. Mark Sobel has some views on the possible outcomes (and notes that the purported $20bn “swap” is not a swap in the commonly understood parlance).

My last question: Is Bessent the only person in the world who thinks the peso is undervalued?

CPI deflated real value of the trade weighted Argentine peso; up is an appreciation. The peso has appreciated by 29% (log terms) since January 2024. As WSJ noted, most private sector economists view the peso as 20-35% overvalued.

Sobel: “First, ‘swap’ is a misnomer. It involves a reversible transaction, exchanging one asset (dollars) for another (pesos). That tells one nothing about the terms and conditions of transactions.”

He’s saying what many of us were thinking.

In any effort to prevent peso sales, there are a couple of important issues. One, short-term, is ending a one-way bet. Speculators and panicked investors need to learn that abandoning the peso is not a certain way to make (save) money. The other important issue, is to change the underlying problem, medium to ling term, which undermined confidence to begin with.

The felon-in-chief and his loyal mouthpiece, Bessent, claim that this month’s election is the cause of the loss if confidence. Only if that’s true does Treasury’s intervention have much chance of working – and how often do either if them say anything that’s true?

Argentina under Milei is a textbook example of the trilemma. That’s not a problem that an election can solve unless the election changes Milei’s policies; Milei is not up for election.

Following his meeting with Argentina’s President Javier Milei on Tuesday, President Donald Trump said of Milei, “If he wins, we’re staying with him, and if he doesn’t win, we’re gone”.

How do you think that threat goes over with investors as well as voters? Given that the polls don’t look so good for Milei, it seems best to get out sooner rather than later.

So U.S. intervention serves the interest of those who need access to US$s now, before the election. An intervention which won’t persist if Milei’s allies lose this month, and which won’t cure the underlying policy problem, isn’t designed to boost confidence. It’s designed to make Treasury cash available to private financial interests.

Bessent is using Argentina to loot the Treasury. The felon-in-chief gets to signal his support for Milei, who has kissed up to him, and to help his rich supporters, so he lets Bessent loot the Treasury.

Bessent was already hinting on Wednesday he was going to double it with a “facility” (closer to approximating a “pure” loan??) of $20 billion which would obviously make it $40 billion total.