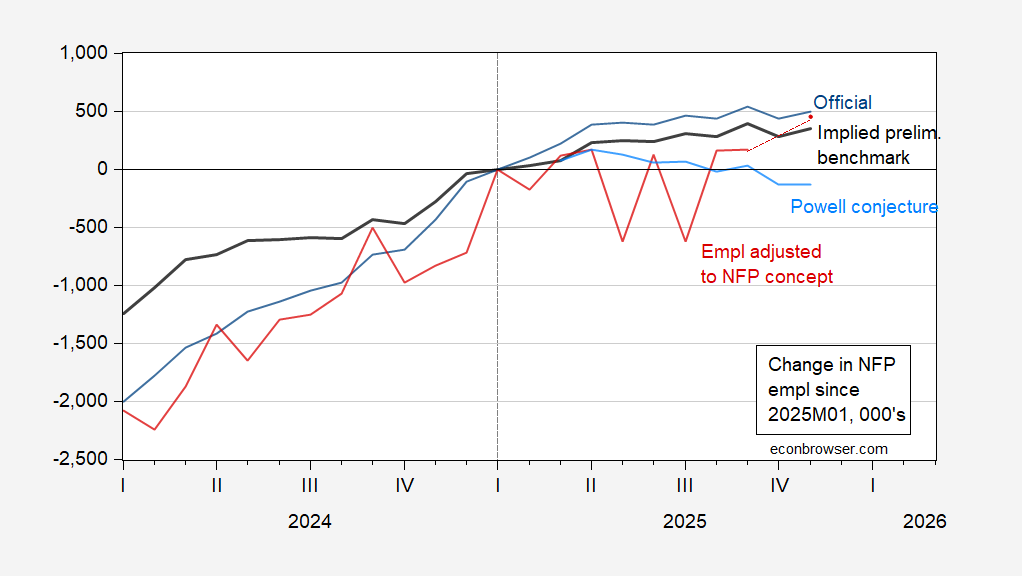

NFP and private NFP upside surprise +64K v +50K Bloomberg, +69K v +45K Bloomberg. According to official data as well as implied benchmark revision data, NFP is treading water. According to the Powell conjecture that the current BLS series has been overstating employment growth by 60K/month, we are well past NFP peak.

Figure 1: Official CES nonfarm payroll employment (blue), implied benchmark revision (bold black), Powell conjecture based on implied benchmark revision (sky blue), and CPS employment adjusted to NFP concept, smoothed population controls (red), change since January 2025, in 000’s. Source: BLS via FRED, BLS, and author’s calculations.

August and September employment were revised down by 22K and 33K respectively.

My nowcasts (taking account of the downward revision in August and September) were too high by 22.4K and 98.8K. These nowcasts were calculated using ADP estimates of private NFP. Goldman Sachs overestimated by about 200K each month.

October government employment fell in part because of the Federal Deferred Furlough Program, which should have been resulted in an approximately 150K drop; the actual drop in government (Federal, State, Local) employment was 162K.

It’s interesting to note that the difference between growth in ADP NFP and BLS NFP over the April to September is about 40K, not far from the Powell conjecture of 60K.

One positive piece of news is that the CPS employment series adjusted to the NFP concept rose markedly, potentially marking a break from the downward trend recently observed. That being said, the standard errors associated with the CPS estimates are likely larger than usual, due to the missing data for October.

The Sept jobs were adjusted downward. Thus, Powell is correct. When the BLS adjust downward, then we know that the econ is in recession. Also, the consumer confidence took a hit in the summer just as jobs started to disappear. Thus, the “soft data” was correct this time. Next up, the QWES bench marching survey will show more job losses.

I will make a bold Nate Silver-esque claim* that there is a 50/50 chance that there was a cycle peak in September, and the government shutdown tipped the economy into recession.

Evidence:

1. housing has been recessionary long enough to be recessionary.

2. Heavy truck sales have also turned recessionary

3. Light vehicle sales, although within the range of noise, are also consistent with a recession outset.

4. Consumption leads employment, and neither real retail sales nor real spending on goods have meaningfully exceeded their December 2024 levels (although their 3 month moving averages continued to increase through September, the last – stale – month of data reported).

5. The jobs reports are now consistent with either a slow expansion or the onset of recessions, depending upon revisions.

6. Withholding tax payment growth slowed down dramatically beginning in mid-September, as is now reflected in the delayed publicly available graph from the Daily Jobs Update: https://www.dailyjobsupdate.com/public/withholding-tax-charts/daily-growth-recent

7. Gasoline consumption also headed lower YoY for most weeks beginning in September.

The big contrary indicator is real aggregate nonsupervisory payrolls growth, which on the back of sharp wage gains as indicated in yesterday’s jobs report made new highs. Additionally, weekly consumer retail spending as reported by Redbook continues to show robust growth (but I believe this survey is weighted towards non-durables and services purchases).

The delay in reporting data means that, except for jobs, the crucial information for October and November has not been reported yet, including consumer spending, production, durable goods orders, and real sales.

(*because regardless of which way the result ultimately turns out, I can claim my forecast was correct)

my electricity prices in texas are up about 40% compared to last year, with no slow down expected in the coming year. this price increase has occurred while abbott and trump have cut back on renewable and battery production in texas, while forcing the state to build out very expensive natural gas units that are used only a fraction of the time. just a preview for the rest of the country as the trump energy policy goes national. everything is expensive under trump.

I’ve seen several suggestions (not here, by the way) that our recent slow pace of job gain may persist, allowing us to avoid recession. That’s not what the record shows. Here’s y/y % change in private employment:

https://fred.stlouisfed.org/graph/?g=1OUzC

Any time job growth falls below 1% y/y, a sharp deceleration has followed. The latest reading is 0.8%. That’s without the Powell conjecture. It’s possible that this time will be different, but these “maybe we’ll muddle along” ideas are ahistorical.