In the FT today:

The dollar’s dominance was built on the foundation of America’s many strengths. But like termites eating away at a house’s woodwork, Trump’s dysfunctional policies are eating away at its support and rendering the US currency acutely vulnerable to future shocks.

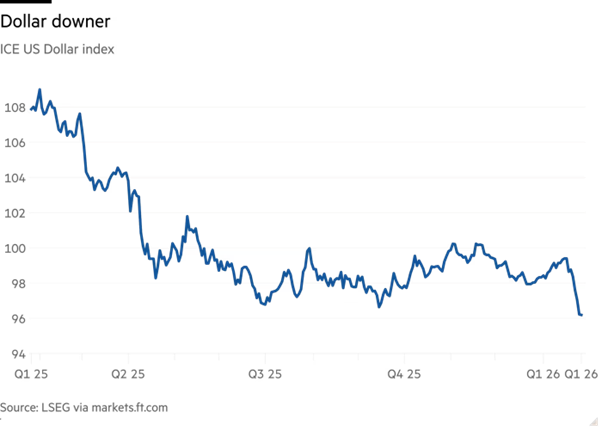

This remarkable newfound weakness was on full display this week, after President Donald Trump reality-divorced insistence that “the dollar is doing great”. Traders responded by sending it even lower:

Kamin and Sobel identify where the termites are gnawing away:

— The status of the US as a trusted ally and partner has eroded further, weakening a key pillar of the dollar’s global stature. …

— The soundness of US macro policy has come into question. …

— Mounting budget deficits and debt threaten the future solvency of the federal government and the safety and liquidity of US Treasuries. …

— The rule of law is being weakened. Global investors may not be concerned by ICE’s behaviour or the weaponisation of the Department of Justice by the While House. But the administration’s intrusions into private business — as well as the taxes on capital flows that nearly made it into the OBBB — should lead them to hesitate before committing long-term investments into the US.

I think that the stunning drop in the dollar is consistent with a loss of credibility driven by the termites progress, as discussed here.

More from Steve Kamin on the dollar during and post-“Liberation Day” here.

Odd thing. Though still low relative to just after the Liberation Day (sic) surge, Treasury credit default swaps have been climbing this month:

https://www.worldgovernmentbonds.com/cds-historical-data/united-states/5-years/

Meanwhile, corporate spreads have been narrowing:

https://fred.stlouisfed.org/graph/?g=1QZzP

So there’s something going on which is making Treasuries riskier, but not corporate debt. Hmmm…what could do that?

The US$ has primarily slid after T—-p has engaged in sabre rattling that overseas investors took seriously. In general, they could care less if the US were to slide into authoritarian fascism, so long as its international posture were unchanged. The US$ actually rallied in autumn 2024 as traders thought that a Wall Street friendly T—-p would mean “happy days are here again” for them. But it began its big slide a couple of weeks before T—-p’s inauguration when it became clear that his 2nd Administration would be filled with neophytes and bootlickers. It continued its slide through “Liberation Day,” when T—-p upended the global trade order in a major way, and bottomed at the end of June last year right after T—-p’s military strike against Iran (which luckily did not result in a Middle East conflagration).

Interestingly, the $ was generally stable from then until T—-p’s strike against Venezuela. Killing fishermen in the Caribbean and some 3rd class humans in Nigeria passed without notice, but once T—-p followed up the successful decapitation raid in Venezuela with renewed and more direct threats particularly against Greenland, traders got concerned again (and we all know that, once T—-p finds a lever that works, like a rabid lab rat he presses the lever again and again). The latest big slide coincided with the Davos meeting, where T—-p rattled his sabre right in the faces of the European elite, and following the lead of Canada, Europe decided it had Had Enough.

So, if T—-p strikes Iran again, based on the above I would expect a further slide. If on the other hand he focuses his “ordinary” chaos domestically, I would expect the US$ to stabilize again.

Another point: Weighed against commodities, it is not only the US$ which has hit the skids. For example, while the Euro is up 14.8% against the US$ in the past year, industrial commodities are up 29.2%, and commodities including precious metals are up 23.4%. In other words, commodities have firmed against other major currencies as well. This could reflect a “demand side” shock of a global economic boom, which does not seem to be the case; or it could be a “supply side” shock in which traders are seeking safe havens outside of all government securities.

Two things:

– Not to defend the investor class, but they are pretty good at answering “How does this affect future net revenue?” If the answer is “It probably doesn’t”, then there’s no price reaction. If the anser is “I am not cinfident that I understand implications for future net revenue”, they demand a higher risk premium. Liberation Day was, “It’s bad, but I don’t know how bad” – worst answer possible.

I digress. My point is, localized, peaceful domestic protest not that bad for net revenue. A reduction in foreign demand for U.S. assets is bad, because of higher borrowing costs.

Uncle Milton taught us that morality has no place in business decisions, and you know how popular Uncle Milton is with investors.

– As to grabbing commodities, or claims on commodities – Yeah, you betcha! The felon-in-chief has repeatedly put access to critical inputs, and the pricing of critical inputs, at risk. Get ’em while you can.

Taking your dichotomy – the felon’s domestic thuggery doesn’t change financial prices, but his international thuggery does – these are some of today’s headlines:

“U.S. Weighs Military Action Against Iran”

https://foreignpolicy.com/2026/01/29/trump-military-action-iran-protests-eu-irgc-foreign-terrorist-organization-sanctions/

“Iran puts ‘fingers on trigger’ as US armada arrives in Middle East”

https://www.yahoo.com/news/articles/iran-puts-fingers-trigger-us-234116076.html

Plenty more where those came from. To the extent that access to financial reserves and access to economic inputs are among the big worries during the felon presidency, another attack on Iran could have an impact on markets. Iran is the poster child for denial of access to financial resources and interruption of the flow of economic inputs.

Punching Iran seems to have had diminished effects on financial market and energy prices in recent years, but conditions have changed. We have entered a period when “flight to safety” no longer automatically means “buy U.S.” A reminder that the U.S. now does what the felon damned well pleases might up the price of punching Iran.