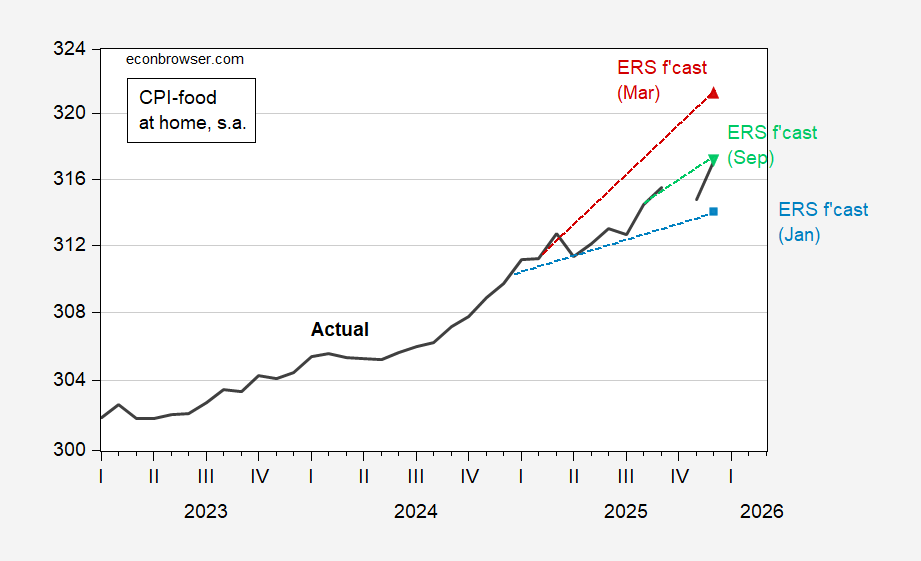

Reported hits the September USDA Economic Research Service forecast. Figure 1 displays the food-at-home component of the CPI, along with ERS forecasts:

Figure 1: CPI-food at home (bold black), January 2025 forecats (light blue square), March forecast (red triangle), and September (inverted light green triangle), all s.a. Source: BLS via FRED, ERS, and author’s calculations.

Given the distortions in the reported CPI arising from the government shutdown, one shouldn’t overstress the month-on-month figures. Looking over the longer term, grocery prices rose 2.4% y/y through December 2025. In contrast, they rose only 1.7% y/y through December 2024. So much for bringing down grocery prices.

September 2025 was the last ERS forecast, given the government shutdown and lapse in data collection. USDA indicates forecasts will resume publication on 1/22/2026.

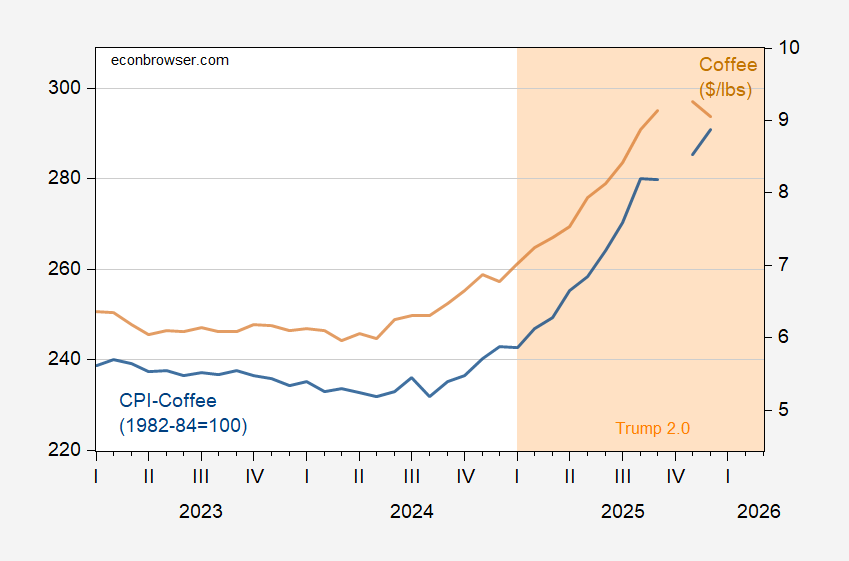

I add one more graph of a component of food of particular interest to me: coffee!

Figure 2: CPI – coffee (blue, left log scale), and coffee price per pound in $ (tan, right log scale), both s.a. Source: BLS via FRED.

Off topic – The Daily Mail reports that the felon-in-chief has ordered U.S. special forces to draw up plans to invade Greenland:

https://www.dailymail.co.uk/news/article-15452323/Donald-Trump-orders-army-chiefs-plan-invade-Greenland-President.html

The Daily Mail also reports that U.S. military leaders are resisting the order.

China-based International Business Times has picked up the story, as have a lot of also-ran news services:

https://www.msn.com/en-gb/news/world/trumps-greenland-invasion-plot-sparks-pentagon-revolt-as-senior-military-chiefs-resist-orders/ar-AA1U0yuX

What I have so far been unable to find is any mention of this story by mainstream U.S. news outlets. Make of that what you will.

By the way, there is another story making the rounds about the felon’s nutso obsession with Greenland. It sounds like something Glenn Beck would concoct if a Democrat were in the White House, but with the felon running the madhouse, Beck-style connect-the-dots crazy talk is a regular element of policy decisions now, so here goes…

Back in 2021, Australia’s Energy Transition Minerals (ETM) lost its mining rights in Iceland as the result of a referendum. Late last year, an Icelandic court ruled against EMT in a case seeking 10 billion Euros in damages:

https://www.greenleft.org.au/2025/1442/world/australian-mining-companys-eu10-billion-claim-against-greenland-suffers-setback

ETM has hired Ballard Partners as a “strategic advisor”:

https://www.heraldsun.com.au/business/stockhead/energy-transition-minerals-appoints-ballard-partners-as-us-strategic-advisor/news-story/2f4d09f7e12d0d591bd70606081fae0f

Ballard was Pam Bondi’s employer when she represented Qatar as a registered foreign agent. Ballard also brought in Suzy Wiles as co-CEO before she became White House chief of staff.

So the idea is that ETM is using insider influence to pressure Greenland to allow uranium and heavy metals mining. ETM is looki gfora U.S. “engagement” and has expertise in rare earth mining which U.S. furms have lost over time.

The pressure takes the form of felon-level craziness that puts NATO at risk. The felon’s grab for Venezuelan oil is pointed to as a model for trying to grab Greenland’s mineral wealth. All very Smedley Butler.

Of course, another idea being circulated is that the felon wants out of NATO, but can’t rely on the Senate to go along. Attacking Greenland would cause European NATO members to withdraw from NATO, making Senate opposition to U.S. withdrawal irrelevant.

Such a selection of juvenile ideas! But so plausible! And they are not mutually exclusive.

You never know, what with all the tough-guy preening from the felon-in-chief, but signs the U.S. is near to doing bad stuff to Iran continue to pile up.

The felon called off talks with Iranian officials today and told Iranian protesters that “help is on the way”:

https://www.cnbc.com/2026/01/13/oil-prices-today-trump-iran-protests.html

Urging protesters to stay in the streets could, of course, be a purely cynical effort to risk their lives to serve the felon’s ends.

The U.S. has also urged U.S. citizens to leave Iran, not long after India and Australia did the same. The fact that this sort of warning is common when there is widespread unrest makes this a not-so-clear indication that we are about to make things worse in Iran.

WTI rose to a 6-week high today, while the WTI/Brent spread hit its widest point in 8 months – the combined effect of some additional Venezuelan crude reaching the U.S. and increased risks to Iran’s oil exports.

Food prices from supermarket and dining out have continued to increase throughout the trump presidency. Inflation is still hurting the average taxpayer. Tariffs and uncertainty are creating problems for our economy, and trump wont fix either issue soon. Taking greenland and starting wars in Venezuela and iran wont help.

and I just got my electricity and gas bills. which are significantly higher than they were last year. affordability is becoming a crisis. people are spending hundreds of dollars per month more this year than last year. and you still cannot refinance into an affordable mortgage. inflation is still raging at 35% higher than target levels. the middle class is getting crushed in America today.

The consumer price index rose a modest 0.3% in December from a month earlier, and the “core” prices up just 0.2% – however “Food at home” saw its biggest increase since July 2022 increasing 1.6%, and items such as spices, seasonings, sauces and condiments – saw large increases – Spices and seasonings were most likely tariff related increases.

Just a math point; that 0.3% rise annualizes to something like 3.7%, depending on what’s happening at the 2nd and 3rd decimal place.

Even the 0.2% core rise annualizes to 2.4%, above the Fed’s target, kinda, ’cause the Fed targets PCE inflation. I saw a recent estimate, don’t remember where, that only half of the infationary effect of tariffs has shown up so far in consumer price inflation, because of delayed implementation, front-running and so forth. Absent tight monetary policy (which would work with a lag) or recession, that means another inflationary overshoot this year roughly as large as last year. If immigration policy and climate continue to drive up prices, we can look for additional inflation from those causes, too.

Was a number of items in the CPI estimated because of ‘labour problems. Was it the normal CPI or not?

The White House has a $3 meal deal which includes a piece of brocolli, one corn tortilla, and a piece of chicken. Great way to lose weight.

And here is a picture for you:

https://shorturl.at/03hHt