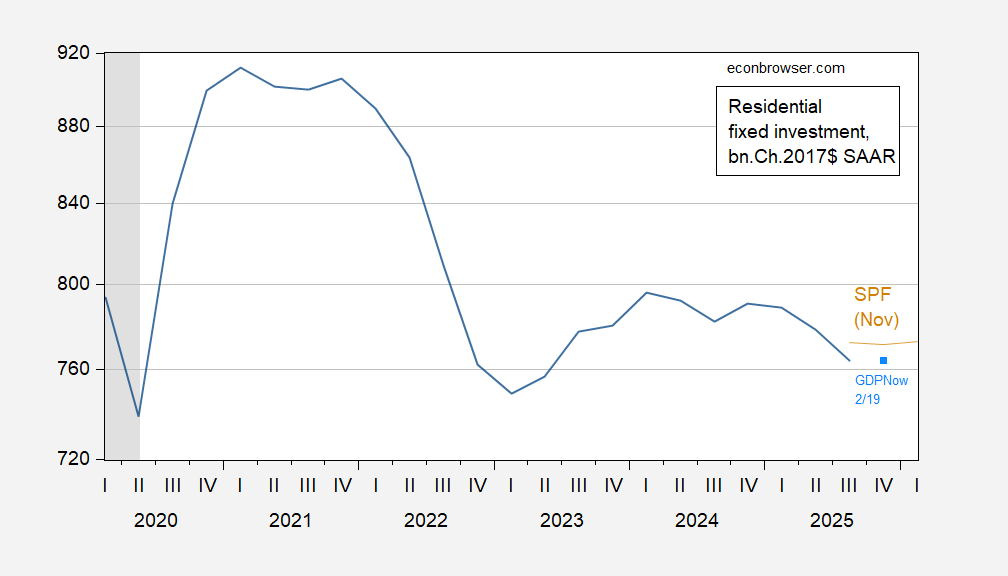

Most indicators suggest growth in output, spending aggregates (while employment is trending sideways). Housing is suggested as a leading indicator by Leamer (2007, 2015), but less a leading indicator recently (Green, 2022). Here’s a picture of residential fixed investment, which on average leads economic activity by approximately 7 quarters:

Figure 1: Nonresidential fixed investment (blue), Survey of Professional Forecasters November forecast (brown), GDPNow 2/19 nowcast (sky blue square), all in bn.Ch.2017$, SAAR. NBER defined peak to trough recession dates shaded gray. Source: BEA, Philadelphia Fed, Atlanta Fed, and NBER.

GDPNow has residential investment as flat in Q4, and below the November SPF trajectory.

On the other hand, some people claim “AI is the new housing” (here). I will note that over the 1986-2025 period (omitting the pandemic period, 2020-2022), residential investment appears to Granger cause GDP, while the reverse does not appear to be the case (at 5% msl).