The Bureau of Economic Analysis announced yesterday that U.S. real GDP grew at a 2.1% annual rate in the fourth quarter of 2019. That’s slightly below the 2.3% average rate since the recovery from the Great Recession began in 2009:Q3.

Continue reading

Author Archives: James_Hamilton

The return of the Fed’s balance-sheet policies

The Federal Reserve has increased the size of its balance sheet by a third of a trillion dollars over the last 15 weeks, returning to tools that a short while ago we thought it had abandoned. But the Fed’s current goal in these operations is quite different from what we had seen earlier.

Continue reading

Growing a little more slowly

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 1.9% annual rate in the third quarter of 2019. That’s a little below the 2.3% average rate since the recovery from the Great Recession began in 2009:Q3.

Continue reading

John Williams on monetary policy and the current economic outlook

I moderated a discussion this morning with John Williams, president of the Federal Reserve Bank of New York, in which John shared his perspectives on monetary policy and the current economic outlook. You can watch on Youtube (conversation begins at 44 minutes in).

Economy still growing, but…

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 2.1% annual rate in the second quarter of 2019. That’s pretty near the 2.2% average rate since the recovery from the Great Recession began in 2009:Q3.

Continue reading

Comparing shipping costs and industrial production as measures of world economic activity

That’s the title of my latest contribution at Vox CEPR Policy Portal.

Libra: economics of Facebook’s cryptocurrency

Facebook last week announced plans for Libra, a new global cryptocurrency. The name seems to be a marriage of the words “livre”, the French currency throughout the Middle Ages based on a pound of silver, and “liber,” which is Latin for “free.” Facebook claims that Libra will give the freedom to easily transmit funds across borders to the 1.7 billion adults in the world without access to traditional banks.

Continue reading

Yield curve inversion

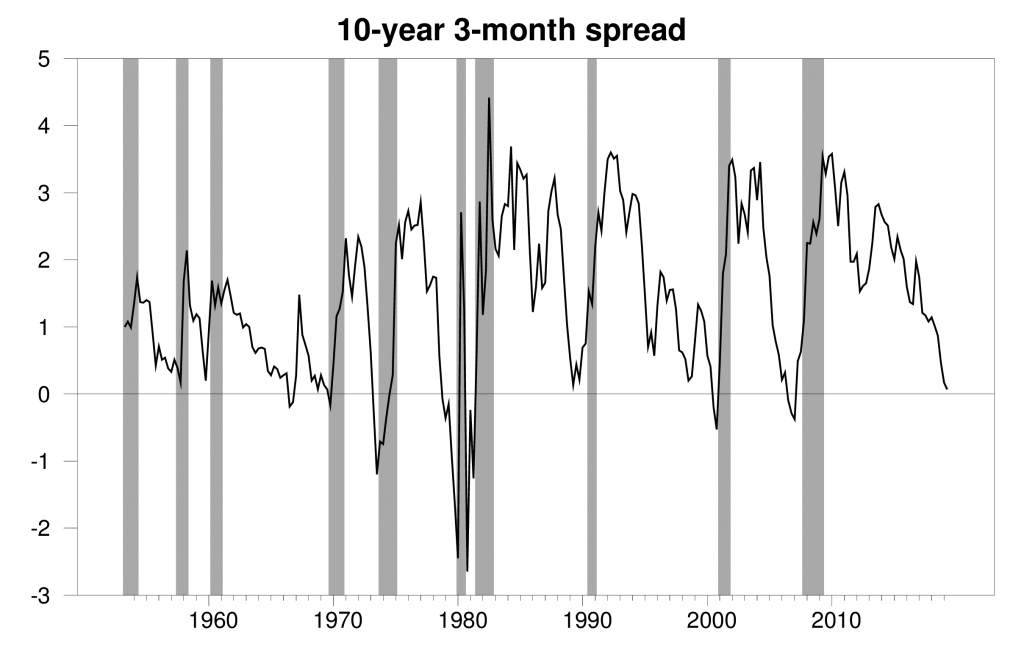

The gap between long-term and short-term interest rates has narrowed sharply over the last year and is now dipping into negative territory. Historically that’s often been a signal that slower economic growth or even an economic recession could lie ahead.

Gap between average interest rate on 10-year Treasury bond and 3-month Treasury bill during the last month of the quarter (1953:Q2 to 2019:Q1) and May 1-24 for 2019:Q2. NBER dates for U.S. recessions shown as shaded regions.

Continue reading

Tools of monetary policy

I just finished a new paper on current U.S. monetary policy operating procedures. Here’s the abstract:

The Federal Reserve characterizes its current policy decisions in terms of targets for the fed funds rate and the size of its balance sheet. The fed funds rate today is essentially an administered rate that is heavily influenced by regulatory arbitrage and divorced from its traditional role as a signal of liquidity in the banking system. The size of the Fed’s balance sheet is at best a very blunt instrument for influencing interest rates. In this paper I compare the current operating system with the historical U.S. system and the procedures of other central banks. I then examine strategies for transitioning from the current system to one that would give the Federal Reserve better tools with which to achieve its strategic objective of influencing inflation and output.

Here’s a link to a video of my presentation of the paper at a conference at Stanford last week.

U.S. economy keeps growing

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 3.2% annual rate in the first quarter of 2019. That’s better than the 2.2% average rate since the recovery from the Great Recession began in 2009:Q3, and even a little better than the average 3.1% growth over the last 70 years.

Continue reading